Pre 8 a.m. comments

Another contract win for a widely-followed company, Lo-Q (LON:LOQ) has been announced today, this time for a theme park in Turkey. No financial details are given, but it's a 2-year contract, with an option to extend for another two years, to provide the Q-bot virtual queuing system for eight of the park's largest rides.

The shares recently peaked at a pretty bonkers price of around 670p (which was a forward PER of about 40!), but have since come off to a perhaps more reasonable 537p. The forward PER of 32 doesn't tempt me I'm afraid, still much too warm for my tastes. Although as supporters point out, each contract won is a stream of recurring revenues, so earnings will lag behind the valuation, which is an argument that has some merit to it.

EPS will surely need to come in a long way ahead of broker consensus of 16.2p and 17.6p this year and next year, to justify the current rating? I can get to a price of about 400p at a stretch, but a more reasonable price looks to me around 300p based on existing forecasts. But if you think they will out-perform forecasts, then it's worth more! You pays your money, and all that.

They should start paying dividends now too, in my opinion. I notice that the Beneish M-Score throws up a warning flag over possible "earnings management". Don't shoot the messenger, I'm just pointing it out as an area that investors might want to look at, and gain reassurance about.

I like the look of results from Getech (LON:GTC). This is a specialist consultancy in the resources sector, which owns a database of global garavity and magnetic information, which is licensed to oil exploration companies.

At 65p the market cap is £19m.

Interim results to 31 Jan 2013 show a very successful half year, with turnover of £4m delivering a profit before tax of £1.4m (up a whopping 290% on the equivalent prior year period), although the increase against last year's H2 is less pronounced.

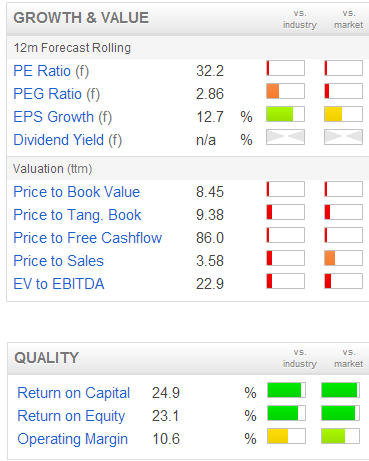

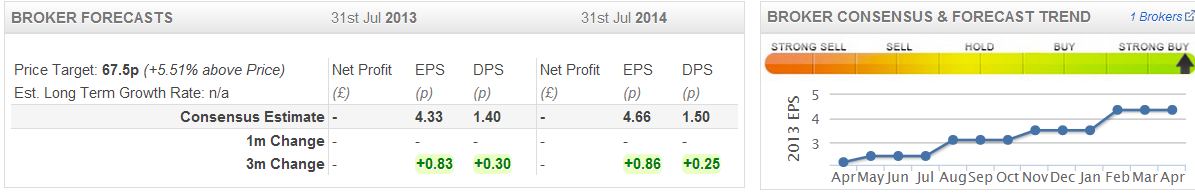

Diluted EPS is 3.328p, so if we double that (assuming no seasonality from H1 to H2) then it's about 6.7p annualised, so a PER just under 10. Looks pretty good value, if those sort of figures are sustainable (or better still can be beaten in future). That seems to be a long way ahead of broker forecasts for this year:

The interim dividend has been doubled to 0.4p, although that's only 0.6% yield for the interim dividend, plus whatever the final dividend will be on top. So not exciting for yield, but it's growing.

The balance sheet also looks pretty good. Gross cash of £5.6m contains an element of advance payments from customers, although I can't see a breakdown of that, but it will be part of the £3.7m trade payables figure (it's called deferred income, where customers have paid up-front, so should be netted off against cash to arrive at a cash balance which is the company's own funds).

The outlook statement sounds pretty positive too, but with a word of caution about full year results being dependent on "finalising a number of deals". So overall, I can see justification for the price being perhaps 20-30% higher on the back of these figures. Looks as interesting niche company with high profit margins, and such pricing power can go hand in hand with growth, as it means the product/service is in demand.

Post 8 a.m. comments

Shares in Driver (LON:DRV) are strongly up this morning on the back of a positive trading update. I am not familiar with this company, which seems to be a specialised global construction consultancy. Their historic growth figures are very impressive. They indicate the company will exceed management expectations for this year (ending 30 Sep 2013). Could be worth a look.

Interactive gambling company, NetPlay TV (LON:NPT) has had a somewhat erratic performance in the past, but seems to be firing on all cylinders at the moment. Their trading update today shows strong growth in Q1, with mobile & tablet being the "star performers". Having just bought myself an iPad, I can fully appreciate why tablets are such a growth area, so from now on when researching consumer-facing companies, I shall be searching for their iPad/iPhone App and judging them partly on how good or bad it is.

Interesting to note that Netplay say they are "confident of meeting full year market expectations", which is a bold statement to make only 4 months into your financial year, so that probably means they are likely to exceed the 1.13p broker consensus forecast. At 18p the shares look fully valued to me for now, and I don't really like investing in the gambling sector anyway.

I've been highly critical of the misleading accounting treatment for their pension deficit used by Nationwide Accident Repair Services (LON:NARS) in the past, which in my opinion resulted in a material mis-statement of the company's financial position on the balance sheet. Incredibly, the old rules on accounting for pension deficits allowed them to hide an unfunded pension fund deficit of £26.1m off balance sheet altogether, and instead they reported a fictitious pension asset of £11.4m! It just beggars belief that the auditors signed off accounts which therefore materially overstated net assets by an amount which was similar to the company's entire market cap!!

Anyway, these disgraceful accounting rules have been changed, and NARS now have to report the true position on their balance sheet, and sure enough net assets have dropped from £26m to just £697k. Bit of a difference! Strip out goodwill, and net assets becomes negative to the tune of ££5.6m.

I don't think I could bring myself to invest in a company which reported such misleading accounts in the past, even if it was within the existing rules at the time, someone should have stopped and said, "this just isn't right", to report an £11.4m asset which didn't exist, and to hide a huge pension deficit (although it was reported in the notes to their accounts, but many people don't read those, and just look at the headline figures).

Anyway, turning to the figures reported today, for the year ended 31 Dec 2012, NARS saw LFL turnover down 3%, due to a reduction in insurance repair work (they operate car repair centres). However, underlying operating profit was resilient, and actually rose to £6.8m.

The final dividend of 3.6p was maintained, giving a full year dividend of 5.5p, which gives a pretty spectacular 8.5% yield at this morning's 65p mid-price. However, there must be a high risk of the dividend being cut, as the high dividend (costing £2.4m), and funding the pension deficit (£2.6m p.a.), uses up all of the business's post-tax profits, by my calculations.

So I think buying the shares purely for the dividends is a bit risky, as it could back-fire, and a dividend cut would probably knock an instant 20-30% off the share price. Not worth the risk in my opinion.

Regulars will know that I view property REIT Newriver Retail (LON:NRR) positively. They own secondary retail space, and hence stock market sentiment is pretty down on them. However, their strategy of targeting value-orientated tenants such as Poundland, Primark, etc, is good. Plus they actively manage their properties to create letting opportunities, which is a sign of good management. I know this area quite well, having been a former retailer FD, so know it more from the tenants side of things.

Their portfolio update today is very impressive, in terms of the many actions taken to drive value from their portfolio. I don't yet have any shares in NRR, but it's high on my watch list, and might buy a few at some point.

New River's main attraction is the 8.3% dividend yield, which pays out all earnings effectively. But there is also longer term portfolio appreciation potential. Whilst rents are under pressure now, the inevitable outcome of QE is higher inflation at some point, so with a (say) 10 year view, rents will be dragged up by inflation in my opinion. So having a high yielding, and well managed REIT in commercial property is probably a good thing for a very long term portfolio such as a pension fund, and should provide a nice degree of inflation protection.

Right that's me done for today. There are some other results out today, but nothing which caught my eye. As usual, if there's something which I've missed, which fits the value investing small cap approach of this column, then do feel free to add your own summary in the comments section below. We like comments, it's good to make it interactive.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.