Good morning! I've been racking my brains to come up with an elaborate, RNS-related April Fools, but can't think of anything sufficiently funny, so will have to pass on that opportunity until next year. Although I would have assumed that Rob Terry buying 7% of Daniel Stewart was an April Fool, if the news had been issued today instead of yesterday!

I had a second wind last night, and added some more company sections to yesterday's report, so the full report is here.

Real Good Food (LON:RGD)

Share price: 36p (down 16.7% today)

No. shares: 69.6m

Market Cap: £25.1m

Profit warning - the company has issued a trading update the day after its 31 Mar 2015 year end. It's quite a bad profit warning too, so I'm surprised the shares haven't gone a lot lower - a 16.7% fall seems mild considering;

The largest subsidiary, Napier Brown, which represented just over 60% of group turnover for the last interim accounts, is up for sale;

My opinion - regulars might recall that this is one of my least favourite companies - it has everything I try to avoid - high debt, pension deficit, low margins, supplying supermarkets, it's capital intensive, has a legal dispute, subject to volatile raw materials prices, doesn't pay divis, etc. It's a complete mystery to me why anyone would want to own these shares.

Putting its biggest division up for sale suggests to me that the bank might be getting jittery & want to reduce their exposure, perhaps? Although a smaller, but less indebted group, would make a less unattractive investment proposition, so I shall await developments. In the meantime, I'm putting it on my bargepole list, as it's too high risk to consider as investable, in my opinion.

Global Lock Safety International Co (LON:GLOK)

Suspension - Allenby Capital has resigned (so things must be really bad!) as NOMAD to this tiny Chinese AIM-listed stock. So the company has one month to find another NOMAD, otherwise its listing will be cancelled. Let's hope they are unsuccessful in that endeavour, as waving goodbye to Chinese AIM stocks is something that should very much be celebrated.

Wincanton (LON:WIN)

Share price: 157.5p

No. shares: 121.7m

Market Cap: £191.7m

Trading update - there is a brief statement today, saying the company continues to trade in line with expectations.

Caveat emptor here, as this company has one of the worst balance sheets I've ever seen, hence this share is also on my bargepole list. The upward price momentum seemed to run out of steam at about 175p, and it's come off about 20p from the peak, for no apparent reason. I wonder if a Placing is on the cards?

They need to fix their balance sheet anyway, so until that is done I wouldn't consider this share as investable - it's far too risky. Just because banks are docile at the moment, doesn't mean that will always remain the case - especially when interest rates begin rising.

Quindell (LON:QPP)

Share price: 135.4p

No. shares: 440.9m

Market Cap: £597.0m

(at the time of writing I hold a long position in this share)

Disposal of division - Quindell shares are currently suspended, on publication of a circular concerning the disposal of its Personal Services Division to Australian lawyers, Slater + Gordon (who you might recognise from TV ads running at the moment).

Today's circular (link above) gives more detail on the proposed disposal (which has to be authorised by QPP shareholders, which should just be a formality) which was announced in an RNS two days ago. I can't see anything new of any major significance in today's circular, which I've just finished reading.

Key terms are;

- Quindell will receive £637m cash proceeds on completion

- deferred cash for 50% of the net profits from settlement of NIHL (hearing loss) claims over the next two years

- Quindell intends returning c.£500m (113p per share) to shareholders, with further distributions possible

- The smaller group will continue with a focus on insurance-related technology activities (e.g. telematics)

- £50m proceeds will be held back in escrow for 18 months, to settle any disputes

My opinion - I am absolutely staggered that this deal is going ahead, and that SGH are willing to pay such a high price for a business that is on its knees. I got this completely wrong, as I didn't think there was any chance this deal would happen, but it is. SGH has very highly rated shares in Australia, and apparently its shareholders are pushing it to grow aggressively, so it has raised fresh cash from its shareholders to go ahead with this deal.

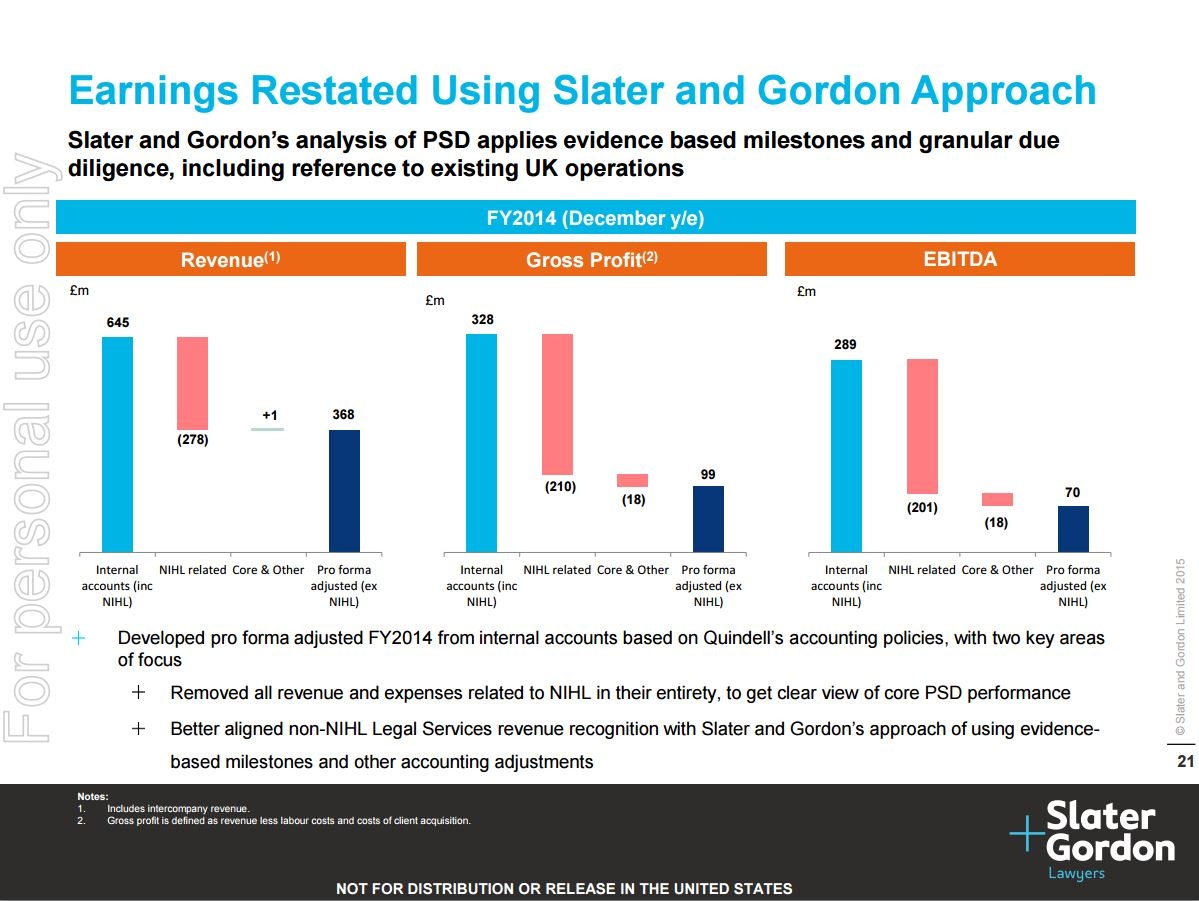

There was a very interesting presentation pack on SGH's own website giving its rationale for the deal, click here to view that. What I find most interesting, is slide 21, where SGH restates Quindell's 2014 earnings using SGH's more conservative accounting treatment, and this has the result of reducing 2014 EBITDA from £289m to just £70m! So in other words, SGH is saying that almost 76% of Quindell's 2014 profits are bogus! So this very much supports the bear case, which has been based on the theory that Quindell wildly overstated its profits. That has now been shown to be correct.

However, what some bears got wrong, was that there was considerable value in the business, even after the accounts have been corrected to a more conservative basis. That said, with the shares currently at just over 135p, they are down almost 80% from the peak of 656p about a year ago, so the bear case has been proven more right than wrong.

The eagle eyed amongst you might have noticed that I disclosed a long position in this share at the top of this section. Have I taken leave of my senses?! Not really. It looks as if this deal will go ahead, and the company intends paying a distribution to shareholders of c.113p per share (£500m). So at 135p that makes the shares about 84% backed by just the first distribution (depending on the tax treatment of the distribution, but I hold these shares in a tax-exempt account, so am not worried about that).

What is the balance worth? Who knows, but after the £50m escrow monies are released, there could be scope for another distribution of say 10-20p. Plus there will be some potentially interesting technology businesses left behind. Estimates of what they are worth vary wildly, and in all honesty, I don't have much of an idea on that.

It's not a high conviction hold for me at this level, but I like that the downside should now be underpinned by cash, so any possible upside looks to be in for free.

Note in the circular today, it says that if the deal were not to go ahead, then QPP would need to raise more funding, and that the PSD would take two years to reach an acceptable level of cashflow generation. That's really shocking, and makes it all the more perplexing why SGH have been so generous in their offer. Hats off to the QPP negotiation team, who've pulled off a blinder here!

The way I look at it, the bears have been mostly proven correct about this company, but under-estimated the potential value in the shares once the dust had settled. The bulls have, in my view, been very lucky, at being thrown a gold-plated Get Out of Jail Free card by Slater & Gordon. Without the SGH offer, the outcome could have been very much worse - an emergency fundraising at pence, and massive dilution for existing holders. Which probably explains why the founder, Rob Terry, was so keen to dump his stock as low as c.40p late last year.

Anyway, a fascinating situation which now appears to be drawing to a conclusion. The big lesson to be learned here I think is, if the accounts don't look right, that's probably because they aren't right! Also that aggressively hyped companies which grow at breakneck speed through multiple acquisitions, nearly always fall apart. Oh, and the most important lesson of all - cash is king - if a company is incapable of generating positive cashflow, then sooner or later it's going to run out of money.

There were so many red flags with this company, that it was obvious the wheels were going to come off at some point. The move into NIHL cases was the real killer, as that turned a poor cashflow business into a disastrous cashflow business, and of course they then ran out of cash in late 2014, hence ending up in the current situation. Thank goodness SGH came along as a white knight, and saved the day.

Nationwide Accident Repair Services (LON:NARS)

Takeover bid - there's a 100p cash bid for this chain of car repair centres. The bidder is asset manager Carlyle Group. This looks a fairly good deal for shareholders, at a reasonable premium price, and it looks a done deal, with 60.6% of shareholders having already agreed.

I am surprised at this bid, because the company has a big pension deficit, which I had thought normally acts as an impediment to such a deal. So it would be interesting to find out how this issue was dealt with here, as that might mean other bids could appear for companies with pension deficits.

Accsys Technologies (LON:AXS)

(at the time of writing I hold a long position in this share)

Update - a positive-sounding update today, which says that the company has replaced its JV partner with a "large international chemical group", with which it has signed a memorandum of understanding, with full agreements likely to follow later in 2015.

The aim is to get a production plant up and running by end 2017, to increase supply of its Tricoya wood product. Sales grew 70% in 2014.

In my view this looks a very interesting growth company, which has a product that is clearly in demand. Producing it in sufficient quantity has been the problem so far, but it sounds as if progress is being made to resolve future supply.

My track record on more speculative stocks has been fairly poor lately, so let's hope this might be one that works out a bit better! I went long about 60p a few months ago, and so far so good (30% up at 78p).

Although it is still currently loss-making, and the £69m market cap may not look an obvious bargain, but you're paying up-front for some of the future potential.

James Latham (LON:LTHM)

(at the time of writing, I hold a long position in this share)

Trading update - this sounds OK, but suggests margins might have come under pressure, or maybe some additional costs? The main thing though is that profits are in line.

Valuation - EPS is forecast to dip slightly to 39.5p, so that puts it on a PER of 15.4, which sounds about right to me.

Pernsion deficit - an update is given on this, and is very surprising. The 2014 actuarial valuation has come down sharply, from £9.0m in 2011, to only £1.5m now. I can't understand that at all, since pension deficits are generally shooting up at the moment, not down.

A deficit recovery payment of £1,155k is being paid for y/e 31 Mar 2015, dropping to just £420k the following year. So it looks as if the pension scheme will then be fully funded, which is great news, if I've understood this correctly.

Checking back, I see the company said this about its pension deficit with its interim results published on 27 Nov 2014, which confirms that this issue has been largely resolved. That's great for shareholders, as it opens the door to potentially good increases in future divis.

My opinion - whilst the PER may now look up with events at 15.4, personally I am not inclined to sell my shares, because the macro backdrop (esp. housebuilding) is very positive for a wood supplier like Latham. So I am hoping for decent increases in future earnings.

Also, bear in mind that this company has a terrific balance sheet, so there are surplus assets thrown in for free, which always gives me a warm glow. The current ratio is 2.90 for example, and I reckon surplus working capital is probably worth around 25% of the market cap, giving management scope to do acquisitions or make a capital return to shareholders at some point. So hidden upside potential in for free basically.

Stockopedia's algorithms like it too, as the StockRank is 99.

All done for today.

Regards, Paul.

(as mentioned above, Paul has long positions in QPP, AXS, LTHM, and has no short positions in the companies mentioned today. A fund management company with which Paul is associated may also hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.