Good morning!

April Fool's Day today, and my favourite article is this corker from the Guardian, which had me in stitches once I realised it was not serious, about half way through.

Best Tweet of the day (well from last night, to be completely accurate) so far comes from the utterly brilliant (get this woman into Parliament) Julia Hartley-Brewer;

Lakehouse (LON:LAKE)

(at the time of writing, I hold a long position in this share)

Slater/Rawlings EGM statement - I was rather hoping that this announcement was also an April Fool, but sadly it appears not. As a LAKE shareholder myself, I'm getting increasingly perplexed and annoyed by the mud-slinging in public going on between the Slater/Rawlings team, and the incumbent management of LAKE.

This is just not the way things should be done. If they think management are no good, then Slater/Rawlings should have called an EGM to replace the executive Directors. Instead they have gone down the bizarre route of wanting to evict the NEDs, and put in Rawlings himself (the founder), and 2 other people they think would be good NEDs.

The company's response was to reject this - mainly on the grounds that the new NEDs would not be independent, which is a fair point. Although I think the company was foolish to then publicly slate the 3 suggested new NEDs, undermining their credentials in this announcement, which seems to have burned their bridges towards a compromise - not a good negotiation stance.

All in all, it's ludicrous situation that needs to be sorted out asap, as the company is just racking up unnecessary costs on numerous consultants, not to mention management time wasted, on this issue.

I can't help feeling that it's a bit of petulance on the part of Slater. They overpaid in a bad IPO, and are now throwing their toys out of the pram. If they're serious about changing management, then they should have just spoken to management, and if not possible to get the changes they want, then call an EGM to unseat the executive Directors, and put in new management. That's the way it should be done. Changing the NEDs but leaving in place the execs that they say have done a bad job, seems daft to me.

Anyway, the current situation is not showing anybody in a good light, so they need to be locked in a room, and not let out until all the issues have been resolved one way or another.

EDIT: I've just been emailed the official response today from Lakehouse to Slater/Rawlings announcement above. It says:

The board of Lakehouse notes the statement lodged by the Requisitionists this morning and will respond in more detail on Monday 4th April, 2016.

While the board is considering the Requisitionists' statement, it notes the reference to private noises made by Slater Investments. As you know, the Board announced its intention to seek a fourth independent Non-Executive Director.

The Board, reflecting on the views expressed by some Lakehouse Shareholders, did meet with Slater Investments on Tuesday 22 March 2016 to discuss the possibility of appointing a fourth Non-Executive Director.

Your Board considered this action sensible and appropriate in order to avoid further adverse disruption, and unnecessary cost, that the Company has now suffered.The Lakehouse Board urges all shareholders to vote against the resolutions put forward by the Requisitionists.

It's encouraging to see that the two sides have met, and that the company has offered to compromise. All the shareholders I've spoken to are unhappy with both sides, and want this issue put to bed immediately, leaving management (however structured) to get on with restoring shareholder value.

Note that the current CEO, Stuart Black, is also a substantial shareholder, owning 5.5m shares. So his interests are very much aligned with ours, as well as the founder, Steven Rawlings (who owns 24.4m shares), and Slater Investments (c.6% I think).

On reflection, I don't like this comment from the Slater statement today, which says;

Lakehouse's history as a public company is short and disappointing. Lakehouse listed on 23rd March 2015 at a price of 89p per ordinary share. On 10th December 2015, Stuart Black, at the time the Company's Executive Chairman, reported that "the Board remains confident for the current financial year." Only eight weeks later, on 1stFebruary 2016, the same Board issued a major profit warning. The share price fell 58% from 84p to 35p. Since we requisitioned this General Meeting the shares have rallied a little. We do not believe that the Board has a firm grip on the Company and its prospects.

The share price has actually rallied 44% since the low point of 35p which they mention above. I don't call that a little! Also, I don't think the rally was driven by their EGM requisition, as they imply. It was an oversold rally which would have happened anyway. Actually, I think the EGM requisition is holding back the price, by creating uncertainty, and recall that when the EGM requisition came out, the share price fell sharply, but has since rebounded.

Finally, if the last sentence above is true, then why on earth are Slater/Rawlings not trying to remove the Execs? The company pointed out that at the AGM, Slater & Rawlings actually voted in favour of the Directors, but then shortly afterwards requisitioned this EGM. So at the moment I'm leaning towards supporting the incumbent Board in the EGM vote.

Buy & build

Lakehouse (LON:LAKE) is a buy & build group, and that is the theme of today's report. For anyone not familiar with the term, buy & build is where a group is built fairly rapidly, by starting with a core management & company, then bolting on multiple other acquired companies usually in the same sector. Trying to improve profitability through using the expertise, IT, and sales/marketing capabilities of the core company is usually key to this strategy.

Generally, investors are wary of groups which aim to grow through a buy & build strategy, because this approach often goes badly wrong in the long run, if too much debt is accumulated, and if management are incompetent and buy lots of duds, or overpay for not very good companies.

Although it can be done well - it's all down to good management, with a disciplined approach to buying the right companies at the right price. Look what a spectacular success David Cicurel has made of Judges Scientific (LON:JDG) - which incidentally announces another small, but profitable acquisition today. Interestingly, Cicurel's strategy has been to largely ignore synergies, but to just buy good businesses on attractive multiples. The group is valued on a higher earnings multiple than the companies it buys, so it instantly creates shareholder value every time he makes another acquisition.

Another example is John McArthur at Tracsis (LON:TRCS) who has also created considerable shareholder value from a similarly disciplined approach to buying target companies - he sets out the specific acquisition strategy, and a worked example on valuation, on Tracsis's website here. Other company CEOs should read that website page, as it's a masterclass on how to make decent acquisitions!

Norcros (LON:NXR)

Share price: 169p (up 1.7% today)

No. shares: 61.0m

Market cap: £103.1m

(at the time of writing, I hold a long position in this company)

Acquisition - This is another group which is executing well with a buy & build strategy. The share price at Norcros seems astonishingly depressed, despite Gervais Williams' Miton Group having hoovered up 17% of the company. The shares look remarkably good value, although bear in mind the large pension fund is an ongoing issue.

Today Norcros announces another sensible-looking acquisition, of a bathroom products company called Abode Home Products Ltd, its website is here. Although a small deal, costing just £3.9m initially, with a potential £0.9m earn-out, this looks a cracking deal.

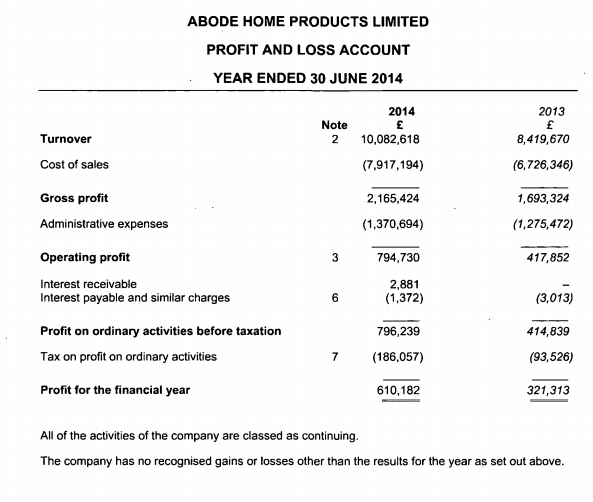

Here is the P&L from Abode, from its most recently filed accounts - which are for y/e 30 Jun 2014. Note that the company seems to have been late filing its 2015 accounts, which should have been filed by yesterday, 9 months after the year end. Perhaps they are being processed by Companies House still? This is perplexing - a financially sound company should always file its accounts promptly, not leave it until the last minute. After all, if I were a prospective supplier to Abode, I wouldn't be very happy about only being able to look up financial information about the company which is now nearly 2 years' old.

Here is Abode's P&L;

One point to note is that Abode's CEO pays himself in dividends, with only a de minimis salary. So this increases reported profitability. Therefore the above profits would need to be reduced by, perhaps £200k p.a., to include a normalised salary for the CEO. It's still a nice bit of additional profit to bolt onto Norcros's group figures.

Also, I like the fact that Norcros has a large, international sales & distribution network. So it can feed Abode's products into that network, and hence leverage greater sales from the acquired company. So this acquisition makes a lot of sense, and I hope in due course should provide a catalyst for Norcros shares to re-rate. I believe that patience will eventually pay off with this share.

Cantors helpfully point out in a note this morning that a new FD is starting next week at Norcros. He was previously FD at AGA - which of course also had a big pension fund, but despite this was acquired by a larger American group.

They estimate that the acquisition announced today will add c.5% to both revenues & profits. Not bad for an outlay of just £3.9m, using cheap debt.

Back to buy & build generally

The other thing with buy & build, is that it creates the illusion of growth, especially when financed by debt. That's fine when debt is cheap, and providing the multiple of debt to cashflow doesn't become too stretched. So investors are more likely to rate the group shares on a higher PER than the acquired companies are bought for. If all goes well, this can create a virtuous circle where each cheap acquisition bolts on more earnings, and thus creates instant shareholder value as the earnings are re-rated onto a higher multiple. The cashflows generated can then repay the debt, over a number of years.

It's worked amazingly well for Judges Scientific (LON:JDG) so let's hope Norcros can execute similarly well. So far, so good, as the acquisitions made by Norcros in the last couple of years seem to have done well. The beauty is that Mom & Pop type businesses can often be picked up cheaply, if the founders want to exit for retirement. Plus profits can be greatly increased if the products are sold aggressively through the acquiring group's much stronger sales network.

All interesting stuff! The absolutely vital factor for a buy & build strategy to work, is that management must be absolutely top notch. The worst think that can happen with buy & build is if you have a clueless or delusional CEO trying to execute that strategy - examples include that clown at Silverdell, and of course the maniac Rob Terry formerly at Innovation Group & then Quindell. So if you have even the slightest doubt about the competence, or integrity, of management - then keep a wide berth, as chances are that it will end in disaster sooner or later.

CML Microsystems (LON:CML)

Share price: 391p

No. shares: 16.2m

Market cap: £63.3m

Trading update - this was issued yesterday, and relates to H2, the 6 months ending 31 Mar 2015. Things sound on track:

The Group's operating results are on course to meet market expectations conveyed at the time of the half yearly results in November 2015, which were for a second half sequential revenue improvement and a full year advance in profitability.

New order bookings firmed as the period progressed and it is noteworthy that orders were received relating to the one or two customer product launches that had previously been delayed.

In terms of outlook, this introduces a small note of caution, but overall sounds fairly optimistic:

Customer demand from the end markets in which the Group operates continues to be difficult to predict however, the Board currently expects that the business strategy being followed will uphold expectations for a further trading improvement over the year ahead.

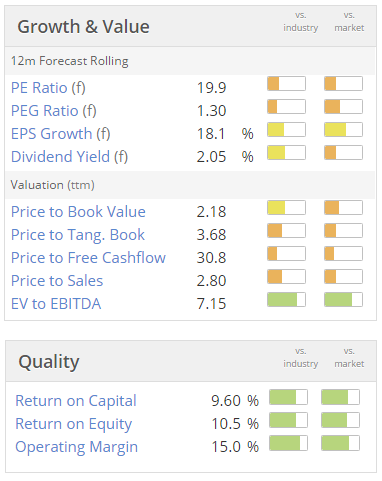

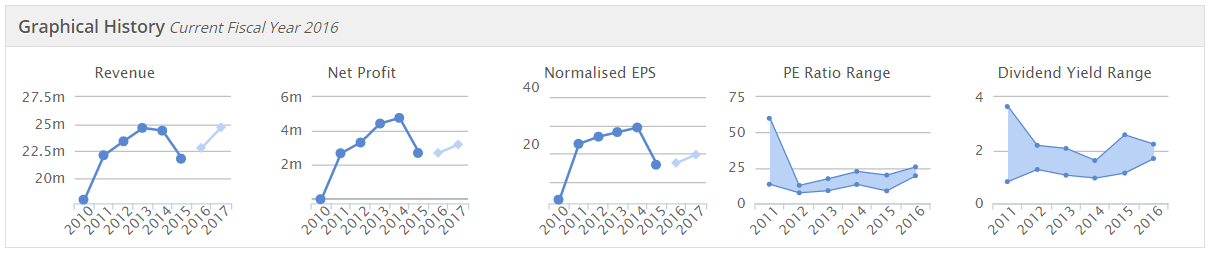

Valuation - here is the usual Stockopedia graphic:

Looks a bit pricey to me, but remember to adjust the PER down to take into account the decent amount of cash on the balance sheet.

Another issue is that the company seems to have gone ex-growth. So although it's operating in a sector that is perceived as sexy, will that remain the case if it's not delivering growth?

Boohoo.Com (LON:BOO)

(at the time of writing, I hold a long position in this share)

Menswear growth - when I visited BooHoo's Manchester HQ last year, the business was clearly almost completely focussed on ladieswear. There is a menswear department too, but it's tiny compared with ladieswear. So there's a good growth opportunity if menswear can also be grown.

Therefore, I was pleased to pick up this morning that Scotty T from Geordie Shore, and winner of the most recent Celebrity Big Brother, has been appointed as a model & brand promoter for BooHoo Men. I think this is a really good choice for the target market. For those not aware of this gent's credentials, he's an affable chap, whose life largely revolves around, to use the geordie vernacular, getting smashed & banging girls. Why not?!

He'll be wearing BooHoo clothes on Geordie Shore apparently - well, wearing them briefly anyway, before embarking on his next conquest.

EDIT: Here is the new specific menswear website just launched - BooHooMan.

BooHoo has proved itself adept at marketing using social media, Vloggers, etc. The shares look expensive, and are expensive, but that's because it's a strong organic growth company. Underlying profitability is much higher than the reported figures, because it's spending so much on marketing to drive growth. Around 13% of turnover is spent on marketing - that creates a big moat which smaller competitors just can't match.

Menswear will never match ladieswear, because men just spend less on clothes than women - that's why the prime ground floor retail space in the High Street is almost all targeting women. What menswear there is, will be in much cheaper basement or first floor locations usually, or right at the back, where the rent per square foot is a lot lower. So the lower sales psf from menswear can only work in low rent locations. Apart from high end stuff of course. I'm just talking about mainstream clothing.

I'd say there's probably an opportunity for, over time, BOO to add maybe another 10-20% of incremental sales by ramping up sales of menswear. However, that will come at a cost, in marketing spend. All good for the share price though - as the market laps up growth stories, so another growth avenue will be looked on favourably by the City I think.

Also, I do hope BOO brings PrettyLittleThing.com in-house. It's got a £5m call option over the company, which really I think it will be obliged to exercise, given the strong growth that PLT has produced recently.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.