Good morning!

I continued working throughout yesterday afternoon. Prompted by a reader, I had a look at software group Kainos (LON:KNOS). What a fascinating company! If you missed that section, click here to revisit yesterday's complete SCVR.

The organic growth at Kainos from 2013-2016 has been remarkable. Thank you to the reader who pointed out there were many, generally favourable reviews, from its employees on Glassdoor. This website should I think become an automatic checklist item for me to research, from now on. It gives a glimpse into a company's culture, and flags potential strengths and weaknesses.

The internet is full of interesting nuggets of information about companies. So it's vital to dig around for them, rather than just relying on the airbrushed versions of events coming from companies themselves. Peter Lynch emphasised the importance of picking up such "scuttlebutt" in his books. It's never been easier now that we have so much information out there, and Google to rummage through it for us.

Anyway, I potentially like Kainos, but need more comfort on whether its stellar growth, and profitability, are sustainable in the long term. So it's gone on my watchlist, to be researched in more detail one rainy weekend - i.e. probably this coming weekend!

Total voting rights

There seems to have been a proliferation of these announcements from companies, often at month end. It's been bugging me as to why they are issued. So I googled it! This article came up.

If I understand the rules correctly, then companies need to issue an update at the end of each month, if there has been a change in the number of shares in issue. On top of that obligation, companies also have to make an immediate announcement if any material change occurs at any other time.

This is helpful to investors, in that we can quickly check whether a market cap figure is correct and up-to-date. All we have to do is look to the most recent "Total Voting Rights" RNS, for the total number of shares in issue, and multiply it by the current share price. It's worth checking, as occasionally data sources can overlook recent Placings, for small companies.

Primary Bid

I'm watching the development of PrimaryBid with great interest. This is a new venture, to allow private investors to offer funding for companies which are considering doing a Placing. Wouldn't it be great, if we could have access to Placings, on the same terms as Institutions? So I really hope this project is successful.

A deal is announced today - PrimaryBid has raised £500k for Ascent Resources.

At the moment, the PrimaryBid deals are very small, and mainly for seemingly basket case junior resource sector companies, and the like. Still, I suppose they have to start somewhere. It would be great to see larger amounts being raised for decent companies.

Pennant International (LON:PEN)

Share price: 48p (up 40% today)

No. shares: 26.5m

Market cap: £12.7m

(at the time of writing, I hold a long position in this share)

New contract awards worth in excess of £13 million - I like the way the company has got the contract value into the RNS title! Why not? If something good happens, then it makes sense to shout about it. Especially when your share price is bombed out.

Pennant makes simulators and other training systems, for military and other purposes. The new contracts are with 2 Middle Eastern customers. More details are given, but the only bit that particularly interests me is this conclusion:

"These new orders provide the Board with a good degree of confidence that revenues and earnings for the current financial year ending 31 December 2016 are likely to significantly exceed current market expectations."

So clearly very good news.

In my report of 11 Dec 2015, with the shares down 15% to 41p, I pondered:

"My opinion - clearly the company has had a lousy 2015, but is looking forward to somewhat better 2016 & 2017, based on a firm order book, not just hope. Maybe this could be a good time to buy, in anticipation of the share price recovering?"

I like situations like this, where there's been a gap in the order book, and lousy results have been published, but where there's a strong sales pipeline.

Valuation - the house broker has this morning issued revised forecasts. It's striking how bad 2015 was - but this is looking like a one-off bad year, with good years either side.

2016 has been raised from a £1.5m profit before tax, to a forecast £2.0m PBT.

This translates into EPS of 7.1p for 2016, and 7.8p for 2017.

Therefore even after today's big rise in share price to 48p, the PER is still low, at 6.8 this year, falling to 6.2 next year. That looks excellent value to me. Although a company of this kind, with lumpy order intake, probably should not be rated on a PER of over about 10. So still some good upside, in my view.

Dividends - there should be scope to reinstate the divi - as the final divi was suspended (sensibly) after a very poor performance in 2015. Mind you, bear in mind that working capital could come under short term strain, as turnover is going to rise very rapidly, from £9.9m in 2015, to forecast £16.2m in 2016.

My opinion - it's very pleasing to see this company recover. I was reasonably confident that the company would recover, as it had already reported a strong sales pipeline. Also its history is fairly good.

This situation perfectly illustrates the importance of a strong balance sheet, especially for a small company with a lumpy order book. The company had a terrible year in 2015, but at no point was it under financial strain. This means that shareholder value is, in the long run, protected. Sure the share price crashed, but the company was not forced to raise new equity funding, thus diluting existing holders. Instead its strong balance sheet protected it, and now it's coming out of the problem patch, and shareholder value is rising again.

It's a pity this share is so horribly illiquid - I only managed to buy a couple of tiny scraps of stock. There were no big sellers during the downturn, which in itself is encouraging. Although frustrating of course, when you spot the potential value, but can't actually buy in any size.

Anyhow, well done to management & staff at Pennant, for turning things around successfully.

Flowtech Fluidpower (LON:FLO)

Share price: 140p (down 3.4% today)

No. shares: 43.1m

Market cap: £60.3m

AGM trading update - a reassuring update today, which concludes:

"In summary, therefore, we fully anticipate that Group trading for the 2016 financial year will meet market expectations and we remain optimistic about the future of the Group."

That sounds fine to me.

A note of caution is included re the Brexit vote:

"Turning to our markets, we remain vigilant and ever aware of the more challenging conditions being experienced across the majority of industrial sectors, particularly in the UK.

Also, consideration has to be given to the current BREXIT campaign and the uncertainty surrounding its outcome. Whilst this factor is causing a degree of constraint in some of our markets, the Directors believe this to be a short term influence.

My opinion - If you invest in equity markets, then you have to accept volatility - driven by numerous geo-political issues. It's all too easy to "not see the wood for the trees", if you constantly let external factors frighten you out of good companies.

This company is on my watchlist. I think it's a nice business, with a good niche position, and the shares look reasonably-priced.

StockRank is 91 - very strong.

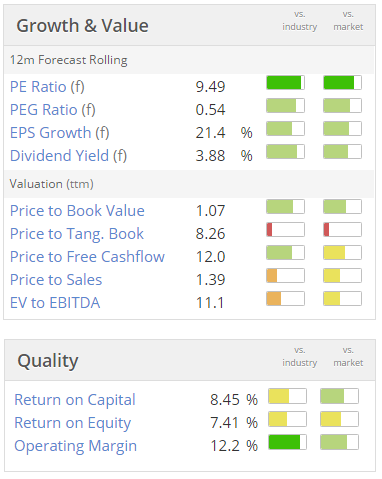

Note also that the valuation graphics look very positive:

I like the combination of low PER, with a high operating margin. Plus a fairly good dividend yield too.

Whatever you do, don't get the ticker wrong! This is FLO, and definitely not FLOW (which looks a basket case to me). I know someone who accidentally bought the wrong one, so it's a serious risk.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.