Good morning!

Sorry there was no report yesterday - I've been in bed for the last 36 hours, with a high temperature. There seem to be a lot of lurgy around at the moment. Anyway, thought I'd better drag myself out of my pit so as not to miss the email deadline of 1pm two days on the trot.

Somero Enterprises Inc (LON:SOM)

Share price: 148p (up 10% today)

No. shares: 56.1m

Market cap: £83.0m

(at the time of writing, I hold a long position in this share)

Results y/e 31 Dec 2015 - this company is the global market leader for laser-guided concrete screeding machines. There was a lot of useful information in my interview with the CEO on 20 Jan 2016, here.

Good results were expected, as the company has issued several upbeat trading statements, including this one on 7 Jan 2016, indicating that EBITDA would be "materially ahead" of market expectations, following a strong Q4.

These numbers look terrific, a few highlights & comments;

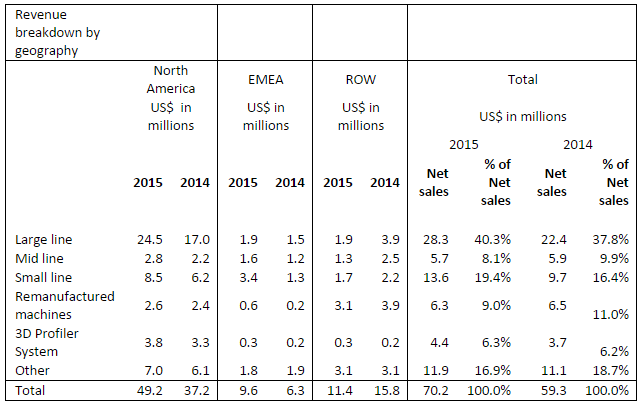

Revenue rose 18% to $70.2m - note that sales in the US did the heavy lifting, with sales to RoW actually falling:

A friend emailed me this morning about Somero's results, saying, "Forget China, this is a simple all out play on the US economy – yee haw!" He's hit the nail on the head. With US sales now representing 70% of the total, and growing the most in absolute terms (although EMEA grew more in percentage terms, from a low base), then it's the state of the US economy which matters most.

Somero management told me that the US economy was strong, in our interview, and today's commentary from the company reiterates this;

Healthy trading momentum in the US has carried forward into 2016 from the strong finish to 2015. The momentum is driven by demand for replacement equipment, fleet additions, technology upgrades and new products. The underlying non-residential construction market fundamentals in the US remain strong, evidenced by lengthy project backlogs for our customers that extend well into 2016. This gives us confidence in our growth prospects for 2016.

I'm somewhat confused, as we seem to be getting highly contradictory signals about what's going on in the US economy. Manufacturing is apparently in recession, yet Somero are reporting boom-like conditions in their sector - which is primarily related to the building of warehouses, surely a good forward-looking indicator for economic expansion? So perhaps worries about a US recession are overblown?

Pre-tax profit rose 40% to $17.4m, a really excellent result.

Corporation tax is much higher in the US than UK, so that needs to be adjusted for if you use valuation measures like EV/EBITDA. I tend to focus mainly on PER, which is after tax, so requires no adjustment.

Note also that in 2014, Somero benefited from a negative tax charge, which inflated its earnings. Therefore the adjusted EPS figures are the ones to use, stripping out this factor, and this saw an increase from $0.18 to $0.23.

Valuation - taking the $0.23 adj EPS figure for 2015 (the adjustments are bona fide), translating at £1=$1.38 (note how much sterling has depreciated agains the dollar, which of course is good news for Somero shareholders, as earnings in dollars are now worth more in sterling terms) it comes out at 16.7p.

With the share price at 148p, this means the PER is only 8.9! That seems remarkably cheap to me. There are only two explanations - either the market has just priced it wrong, and the shares will go up. Or, the market is factoring in a US recession, and a drop in earnings - but there's no sign of that happening so far.

Balance sheet - is in great shape. I can't see any "funnies" in the accounts at all, everything seems absolutely fine. Net cash was $12.6m at year end. Note that company also has an unused bank facility, which has recently been renewed for another 5 years.

Debtors and inventories seem to be well-controlled.

Note that fixed assets are increasing, due to building new/expanded headquarters. The cost doesn't look excessive.

All in all, this is a financially strong company, which would be in good shape to withstand any economic downturn, when the next one inevitably comes along.

Dividends - a final divi of $0.05 has been declared, which together with the smaller interim divi gives $0.069 for the year, up 25% against last year. In sterling that is 5p per share total divis for 2015, giving a divi yield of 3.4%.

Management - as Warren Buffett always stresses, when you buy shares in a company, you are really backing a management team. So you have to be comfortable with management, in terms of their integrity (above all else), but also their competence, commitment, etc.

Having met Somero's management at a FinnCap presentation, I have to say they are one of my favourites. Everyone I have spoken to about the company, be they fellow investors, and its advisers, have also commented highly favourably on management.

You couldn't ask for a more open, and straightforward management team, who are always courteous and patient, and happy to give up their time to answer any questions that investors have.

UK Listing - why is an American company listed on AIM? Isn't this a red flag? In this case, no it is not a concern to me. The company listed on AIM because its former owner, a VC, wanted to maximise the sale price, and at the time it floated in 2006, AIM was the best bet.

Since then, management have been very happy with AIM (in particular the support given to the company by its shareholders in the dark days of 2008-9), so they don't see any reason to change the listing arrangements.

The only slight problem is that some brokers seem to require UK investors to fill out a complicated US tax form, which puts off some investors from investing. I hold some in my SIPP, and I don't recall having to fill in any forms. Also, there is no requirement to fill in a form if you hold them on a spread bet.

My opinion - this is one of my favourite companies, and if business continues to boom, then the shares look astonishingly cheap.

Before we get too carried away though, this is a highly cyclical company. It makes expensive items of capital equipment for the construction industry, so when the economy goes into recession, demand tends to fall off a cliff.

Therefore, there is a valid reason for making a cyclical adjustment in the rating you put on the shares. So I wouldn't be valuing it now on a PER of say 15 or 20, as if it were a growth company. However, a PER of 8.9 times 2015 earnings really does seem low. FinnCap suggest a PER of 11 is more appropriate, which drives their price target of 185p.

It depends on where you see the US economy going. Are we at the top of the cycle, about to go into recession? Or is there just a minor blip in an ongoing economic recovery? Who knows?!

Another key point for me, is that Somero's markets are very much larger now, than they were a few years ago. This is because so many more warehouses are being automated, and using high racking, so the floor being almost perfectly flat actually matters a lot more now, than it did in the past. Therefore my belief is that the top of the cycle this time, should see Somero making very much more profit, than the top of the last cycle.

When you look at its international sales too, really they're only scratching the surface of what should be possible. So much greater penetration of international markets is another key driver for the shares, long-term.

The main question I'm asking myself today, is why I'm not holding more Somero shares, when it has already been well trailed that the results today were going to be great, and that the valuation is so cheap? I see upside here to 200p+, providing the US economy doesn't go into a proper recession.

EDIT: I note that economic data released in the USA this evening has been considerably stronger than expected, for the construction sector. This is positive for Somero.

Tribal (LON:TRB)

Share price: 52.5p (up 33% today)

No. shares: 94.8m

Market cap: £49.8m

Disposal - this is excellent news for Tribal shareholders, since the group is financially distressed, and planning a Rights Issue. Therefore, selling a non-core subsidiary called Synergy, for £20.25m in cash, is very helpful.

Previously the company had said that its Rights Issue would be up to £35m. Today the company says it will be up to £21m, which combined with the share price rise, means dramatically reduced potential dilution for existing holders who choose not to take up their Rights.

My opinion - Tribal was a good falling knife to catch, as I pointed out on 14 Dec 2015 (when the shares were 29p) because the fundraising was specifically stated to be a Rights Issue - therefore existing holders would not be diluted, providing they took up their rights. Also, the new issue was underwritten up to £30m, thereby guaranteeing it would complete.

The adjusted EBITDA of Synergy was £2.3m for 2015, so it looks as if the sale price of £20.25m is a decent outcome for Tribal, and of course now greatly reduces the pressure on the company, given that the refinancing is now basically half-done. A smaller Rights Issue than originally planned will complete the other half, and should go through without any problems now, I imagine.

I thought it was a bit funny that the share price of Tribal began shooting up a few weeks ago, and whilst some of that is probably due to trend-following traders jumping in when the price began moving up, there can be little doubt that another part of the buying almost certainly came from persons unknown trading on insider information, knowing about the disposal, which of course is illegal.

I'm annoyed about this, because I sold my shares at 44p, into a strongly rising price, but I didn't know about the disposal. Whereas the person who bought my shares possibly did know? So they have essentially stolen some of my money, by trading on inside information - as I never would have sold my shares, had I known that this deal was about to happen.

Perhaps the company should have released an RNS earlier, saying that it was in negotiations to sell a subsidiary, rather than allowing the share price to roughly double from the recent lows before updating the market on the reason why the share price was zooming up?

Johnson Service (LON:JSG)

Share price: 90.25p (down 0.6% today)

No. shares: 330.6m

Market cap: £298.4m

Results y/e 31 Dec 2015 - I hadn't realised just how dramatically this business has changed. The original dry cleaning business is now only a relatively small part of the group, at 19.7% of turnover (£46.2m out of a 2015 total group turnover of £234.4m), and adjusted operating profit is only £2.0m - which is only 7.2% of total group adjusted operating profit of £27.9m.

The bulk of the group is now textile rental, through 5 brands (Apparelmaster, Stalbridge, London Linen, Bourne, and Zip), judging from the pictures on the websites, the focus seems to be on hospitality & hotel sectors. Although other workwear is also shown (e.g. overalls for warehouse staff, mechanics, etc).

The group has been growing through mainly debt-funded acquisitions. This presents two problems. Firstly, it creates the illusion of strongly growing profitability, when actually the profit growth is mainly coming from acquisitions. It's quite difficult to work out how much of the profit growth is organic, and how much has come from acquisitions. So you can end up over-paying for the shares if you (wrongly) attribute a higher growth company rating to a group that is actually buying in its growth (and should therefore be valued on a lower PER).

Secondly, the balance sheet becomes increasingly risky, the more acquisitions are made, if they are funded through debt. JSG did raise some equity, but the bulk of its acquisition spree has been debt-fuelled. That's great when debt is dirt cheap (as it is now of course), and the economic situation is relatively stable. However, when the next recession bites, customers go bust, or cut back on things like rented uniforms, and demand falls back, pushing companies like this into a difficult hole.

JSG got into a mess with debt in the past, so it's surprising to see them going down the same road again. Memories fade after a while, I suppose?

Net debt has shot up from £28.5m a year ago, to £71.2m at 31 Dec 2015. In my view, that's starting to get a little uncomfortable. Although I very much like the interest rate swaps entered into by the company for some of its debt, which provides a good degree of comfort;

A new bank facility, which currently comprises a £100.0 million revolving credit facility, was agreed in April 2015 and runs to April 2020.

Interest payable on bank borrowings is based upon LIBOR plus a margin which is linked to gearing levels. The applicable margin during 2015 was, on average, 1.61% and will be 1.75% for at least the first quarter of 2016. We have mitigated our exposure to increases in LIBOR rates through the use of interest rate hedging. Two interest rate hedging arrangements, each for £15.0 million of borrowings, have been entered into whereby LIBOR is replaced by a fixed rate of 1.4725% for the period January 2016 to January 2019 and 1.665% for the period January 2016 to January 2020.

These numbers are so low by historical standards, that you have to pinch yourself to believe it - a company borrowing at a fixed rate of about 2% for 4 years - astounding. So maybe this is the time to be pushing out the boat on borrowings, providing you protect yourself in this way?

Pension deficit - the balance sheet liability has fallen from £14.8m to £13.0m in the last year, but of more importance is the annual deficit recovery payments, which are now £1.9m p.a. - not a trivial sum, as pension fund cash injections from any company are effectively financed by reduced dividends.

Outlook - sounds alright;

The strong performance of Textile Rental in 2015 has continued into the early part of 2016. We have maintained our strategy of identifying businesses which complement our existing operations and which will add value, as demonstrated by the acquisition of Zip in January 2016. The refocus of our Drycleaning business will help us drive improving performance.

The Board expects that the Group will continue to deliver a strong performance and successfully implement its strategy for 2016.

Valuation - adjusted, fully diluted EPS was 6.3p in 2015. Assuming they're calculated on the same basis, then that seems to have beaten broker consensus of 6.05p.

I haven't seen any updated broker notes for 2016 yet, but I imagine the current consensus of 6.51p might be increased to perhaps c.7p. That puts the shares on a PER of 12.9, which isn't too bad. Although if you adjust for net debt, and the pension deficit, then the underlying PER is a fair bit higher, in the mid teens.

Balance sheet - for me, this is the deal-breaker. I just prefer companies to be more conservatively financed than this, because then they can cope with a downturn, or anything else going wrong.

In this case, NAV has risen to £106.8, but closer inspection shows that it's the intangibles which are going through the roof. Goodwill rose from £56.2m to £93.5m, and (other) intangible assets also rose, from £11.7m to £36.6m. In total that makes intangibles £130.1m. If you deduct that from NAV, the result is NTAV of negative £23.3m. I don't normally invest in companies with negative NTAV. It's risky, as there's no safety buffer for the hard times.

Cashflow - note that cashflow is greatly boosted by textile rentals being classified as fixed assets (and not inventories). This means that the depreciation charge is very large (£33.0m in 2015), but so too is capex on textile rental items (£27.5m). Since the numbers are similar, this suggests to me that the items hired out have a lifespan of only just over a year. That makes EBITDA a nonsense number, because you couldn't switch off capex - it's a continuous requirement for the business to just stand still.

Yet I bet the bank are using EBITDA as a key measure. Which they really should not be, but that's their call! I've been saying for a while that, I suspect at some point in the future, banks might tighten up on EBITDA multiples as a criteria for setting borrowing facilities. EBITDA works well in some sectors, but is a nonsense concept for a business like this which has very short-life fixed assets, which really should be seen as revolving inventories, not capex at all.

Dividends - don't expect particularly generous divis, as it's growing by acquisition, and has debt, plus a pension deficit. So the yield is not exciting, at 2.4%.

My opinion - overall, management have done an impressive re-engineering of the business, disposing of many of the legacy dry cleaning sites (note the large exceptional charges again this year), and bolting on apparently good textile hire businesses. This brings risk of course - often acquired companies turn out to be inferior to what the acquirer thought he was buying! So time will tell on that score.

I feel that debt is getting too high now, and the textile hire sector can be a real can of worms when the economy turns down - big write-downs on inventories are usually needed, e.g. when customer-branded linen becomes worthless when the customer goes bust. You can also find that depreciation & impairment policies can be wrong, which stores up trouble for the future.

Overall, I wouldn't say that the shares are bad, just that for the risks involved, I don't see the current price as being particularly attractive.

MySale (LON:MYSL)

Share price: 44.5p (up 1.1% today)

No. shares: 151.3m

Market cap: £67.3m

(at the time of writing, I hold a long position in this share)

Interim results 6m to 31 Dec 2015 - this is an interesting turnaround situation. For background, here is a link to my previous 8 articles on the company over the last 15 months. It's a turnaround basically - the company tried to grow too fast, racked up hefty overheads, then slashed cost to prioritise slower, but profitable, growth.

Turnarounds don't happen overnight, but this one seems pretty credible to me. The company is now only marginally loss-making, by £256k in H1 (using an exchange rate of £1 = A$1.91), on turnover of £67.1m in H1. So as near as dammit to breakeven.

Therefore, there's no issue with solvency, or needing to raise more cash - because it's eliminated the heavy losses, and still has a sound balance sheet, with £15.7m of cash (A$30.0m) - a material figure, which is over 23% of the market cap.

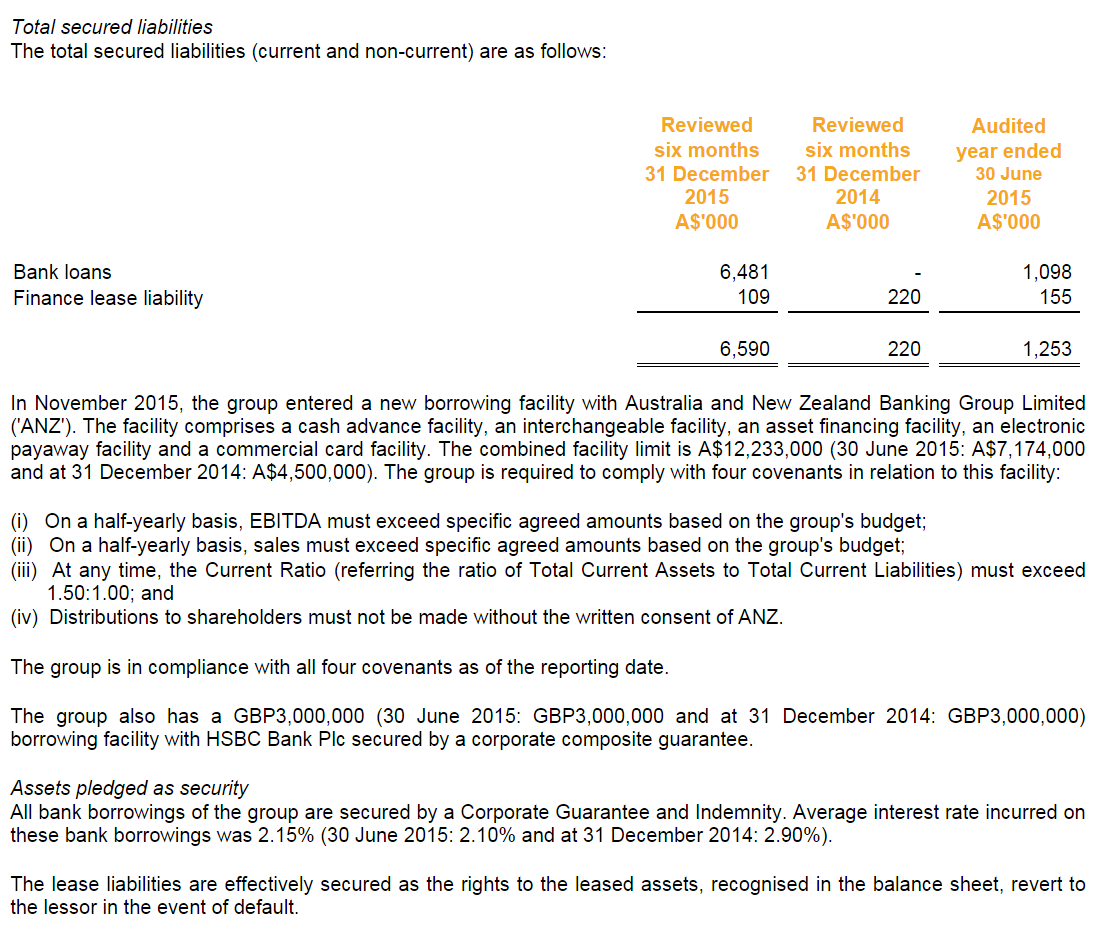

However, note that there is also £3.4m in bank loans on the balance sheet, which strikes me as odd. More details are given in note 12 to today's accounts;

I'd like to understand why the company is simultaneously running a large cash balance, and a bank facility. That's usually a red flag - so it needs investigating.

Gross margin - this is key to the turnaround. The original business plan was for MYSL to clear stock on behalf of big brands, in flash sales. So the stock would still belong to the original brand, until it was sold. This method of selling (so-called consignment stock) is great in theory, in that MYSL doesn't have the cost or commercial risk of owning the stock. However, it is negative, in that sales are low margin, and the stock can often be dead stock, that will sell very slowly, if at all.

To recognise this, MYSL is now buying in more of its own stock. Hence inventories on the balance sheet has shot up from A$14.0m a year ago, to A$35.1m at end Dec 2015.

Gross margin has correspondingly risen, to (a still very low) 25.5%, from 23.0% a year previously. There should be tons of scope to raise that gross margin further (a normal gross margin for this type of business is c.50%). That is when the shares could suddenly get a lot more interesting, if gross margin is raised considerably, with a leveraged impact on the bottom line, if overheads remain unchanged. If the top line can be pushed harder too, then it could all suddenly drop into place. Those are big "ifs" though.

Outlook - fairly encouraging;

The group had a good start to FY2016 as the planned strategic initiatives have delivered both improved financial performance and positioned the group for further, profitable, growth.

In the first half improved trading in all our territories is testimony to the focus and hard work of all the teams over the last 12 months. That our South-East Asian operation saw such strong growth in revenue and gross profit is evidence that our strategy is working in this market and we aim to develop this significant market opportunity to further diversify the group's future income streams.

The positive momentum of first half trading has carried into the opening months of the second half with double digit revenue growth to date. The Board is confident the group is on track to meet its expectations for the financial year as a whole and will continue to focus on driving profitable growth.

The acquisition of the online retail business in Australia from Grays eCommerce is a great opportunity to add customers, scale and efficiency to the business and the integration will be completed during the second half of the financial year.

Our focus for the second half is to deliver on the strategic aims; grow the active customer base, increase activation levels and continue increasing gross margins.

My opinion - it's not an online fashion star like Boohoo.Com (LON:BOO) (I hold a long position in BOO), but neither is it a basket-case like Koovs (LON:KOOV) . MYSL is somewhere between the two! We'll have to see how things pan out, but to me, there are positive signs of progress here, and stable finances.

Also don't discount the fact that MYSL has management which is experienced in the sector, and heavyweight backing from Sir Philip Green (owner of fashion group Arcadia) who owns 22% of MYSL, through his Shelton Capital vehicle.

Arcadia is also now supplying stock to MYSL;

Many new brands, including a number from Arcadia, have joined our roster, attracted by the group's excellence in inventory management and our ability to efficiently dispose of their surplus products. The group's unique international distribution capability is a particular point of difference for European and USA brands.

This article today from Retail Week gives more colour. Philip Green is a close adviser of the MYSL management, and supplying stock - it's not a guarantee of success, but it skews the odds very heavily in our favour, for MYSL shareholders.

Overall, I'm positive about MYSL. With a say 2 year view, I think there's a good chance of the shares being usefully higher, if the turnaround continues, and decent profits emerge. I like fallen angels which then go through a long bottoming out pattern, whilst the fundamentals gradually improve. You can find that this lays the ground for a big move upwards at some point in the future. That's why I hold some stock personally.

The big downside with online fashion retailing, and what makes it a lot harder than people initially think to succeed in this sector, is that companies have a large, and continuous marketing spend requirement.

Also the customer returns rate is typically c.30% in this sector, which puts a big dent in profitability, and is a logistical nightmare, having to process, and re-sell so many returned items.

STM (LON:STM)

Share price: 55.5p (up 12.1% today)

No. shares: 58.9m

Market cap: £32.7m

(at the time of writing, I hold a long position in this share)

Results for y/e 31 Dec 2015 - I don't normally cover the financials sector, but make occasional exceptions if something interesting crops up. The opportunity arose to meet management of this company last year, and I was impressed. Having said that, I have a number of worries about the business model, and sustainability of profits, so only took a modest-sized position personally.

In particular, most of the new business comes from one referral partner. Also, the profit really all comes from one product - QROPS pensions administration. Add in regulatory risk, and it's not difficult to imagine that something might go wrong, at some point.

That said, the results today really sparkle. Whilst turnover is only up 2% to £16.2m, profit before tax has risen 59% to £2.7m.

EPS is up even more, a rise of 103.%, due to the tax charge dropping sharply in 2015 vs 2014.

Diluted EPS of 3.79p puts the share on a PER of 14.6. Since a lot of revenue is recurring in nature, and very sticky, the bull case for this share is that earnings should continue rising. Broker consensus is EPS of 5.0p in 2016, which would drop the PER to about 11.

Balance sheet - looks very good. £8m of cash, very nice - that's about a quarter of the market cap.

Dividends - are being reintroduced after a 4-year absence. A 0.9p final divi is nice.

My opinion - if I could get more comfort on the potential downside risk, then I'd really load up with these shares, as there are a lot of things which look very positive, and there's no denying that today's figures look superb.

Note that the CEO of 8 years has recently tendered his resignation.

Hydro International (LON:HYD)

Share price: 177.5p (up 4.7% today)

No. shares: 14.4m

Market cap: £25.6m

Results y/e 31 Dec 2015 - Just quickly, as time is running short.

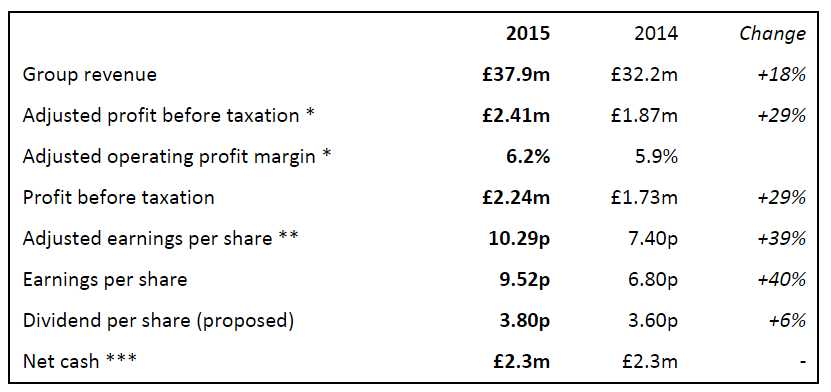

The highlights look good;

Although it's important to recognise that the share price has risen 57% in the last year, so you have to decide to what extent the improvement in trading has already been priced-in?

The group looks to have been acquisitive, with intangibles rising (note also that it capitalises some expenditure into intangibles assets - e.g. patents & trademarks £121k, software assets £398k, product development £197k).

My opinion - I haven't looked into it in enough detail, but based on 2016 forecast EPS of 12.3p, then the PER drops to 14.4, which doesn't seem unreasonable, but doesn't scream bargain either. Might be worth a closer look perhaps?

All done for today.

Project catch-up starts tomorrow, as I try to do Monday's report as well as Wednesday's!

Best wishes, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.