Good morning!

It's a quiet day for news today, which is handy as I have a lunch appointment with some investor friends, so just a brief report today.

RNWH

Share price: 330p (up 1.4% today)

No. shares: 61.5m

Market cap: £ 203.0 m

Trading update - a reassuring update today:

The Board expects the Group's results for the year to 30 September 2015 to be in line with market expectations with growth in both revenue and operating profit continuing in the second half.

Cash generation continues to be good resulting in a further reduction in net debt.

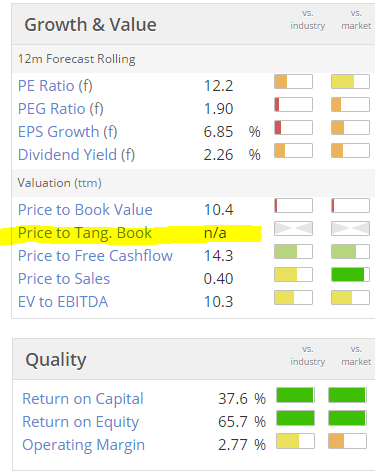

The valuation looks reasonable at first sight, given that this is a low margin contracting business (so won't ever command a premium rating):

Balance sheet issues - I won't go over all the detail again, but suffice it to say that (for me anyway) this share remains uninvestable, due to it having an extremely weak balance sheet.

I have highlighted above the "Price to Tang. Book" line on the StockReport. This is a very quick way to check if the balance sheet is weak - if this line says "n/a", then that means that the company has negative net tangible assets, as in this case. So when looking at companies, I always glance at this line, as "n/a" is a red flag for me, meaning that more work is needed to check out the balance sheet.

The last reported balance sheet showed a deficit on NTAV of £40.2m, clearly a very weak position.

My opinion - the business is financed by customer deposits, and money owed to subcontractors, so there is a lot of hidden debt, over and above the bank debt. If you ignore this issue, then you're paying too much for the shares, simple as that.

On the positive side, the business seems to be trading well, and has delivered a much improved performance in recent years, growing its operating margin, winning good business from the rail sector in particular, and adding bolt-on acquisitions.

Although when you look at the individual subsidiary accounts, they're really very ordinary businesses, so packaging them together doesn't really add any value. Would you pay a PER of 12 for any of them individually? I very much doubt it. So it's difficult to see why a group of unexciting companies put together should command a PER of 12.

Acquisitions can however create the illusion of growth, although that comes at a cost - of a weaker balance sheet, that becomes increasingly top-heavy with goodwill & other intangible assets.

Anyway, so far so good, but this is definitely not a sleep soundly at night share. It's high risk, due to the very weak balance sheet. Although as you can see from the chart, holders have done very well in the last couple of years - which can make people complacent about risk.

Daniel Stewart Securities (LON:DAN)

Share price: 1.63p (shares suspended)

No. shares: 932.3m

Market cap: £15.2m

Shares suspended - this is a joke company in my view. How can a financial adviser/broker, be so repeatedly inept, and still be allowed to remain in business?

The shares have been suspended again today, due to non-publication of its accounts for 31 Mar 2015 - so the shares have to be suspended under the six months rule.

The company says that a refinancing package is imminent, and that it can then publish the accounts (since auditors require that a company is a going concern - in practice, having enough cash to last another 12 months).

Rob Terry (formerly of Quindell) is involved with this company, and is up to his usual financial shenanigans, trying to pump up the value of what is clearly a completely worthless, and reputationally tarnished firm. Peas in a pod, is the phrase that springs to mind.

Nothing else of interest to report today, so I'll leave it there.

See you tomorrow morning!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions.

A fund management company with which Paul is associated may hold positions in companies mentioned.

NB these reports are just Paul's personal opinions, and are never advice nor recommendations)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.