Good morning folks,

A couple of updates today and possibly I will return to something we missed from yesterday.

Thanks,

Graham

Ramsdens Holdings (LON:RFX)

- Share price: 163p (+14%)

- No. of shares: 30.8 million

- Market cap: £50 million

This pawnbroking/financial services chain is guiding for results significantly ahead of market expectations.

Ramsdens Holdings PLC, the diversified financial services provider and retailer, is pleased to announce that the strong foreign exchange results in the early summer months gained additional momentum through the traditional peak period of July and August. In addition, the Group is benefiting from its jewellery retail initiatives and these, along with the continued strong gold price, has helped the precious metals buying and pawnbroking segments.

I've suspected for a while that the foreign exchange market is rather uncompetitive (possibly due to customers not being interested enough to try to get the best rates). Well done to Ramsdens for making headway in this segment.

The other factors cited, jewellery retail and the price of gold, are also very relevant for H & T (LON:HAT) (in which I continue to hold a long position).

I think the sector as a whole is primed to do very well. Their jewellery retailing activities offer people bargains on high-end items, and so should be robust regardless of overall consumer sentiment. But the financial services side, especially pawnbroking and personal loans, is counter-cyclical versus the rest of the high street.

Ramsdens shares aren't the apparent bargain they were at IPO any more, and my instinctive scepticism toward new issues has cost me a bit here in terms of missing out on the opportunity!

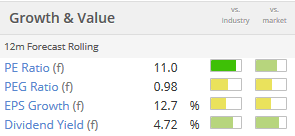

Since forecasts will need to be updated for today's guidance, the shares aren't particularly expensive now either:

Avingtrans (LON:AVG)

- Share price: 256p (unch.)

- No. of shares: 30.7 million

- Market cap: £79 million

It's easy to make a mistake calculating the market cap here, as the number of shares outstanding has increased by 11.5 million, and these have only been admitted to trading today.

This was a reverse takeover such that shareholders in the target (£HAYT) now own nearly 38% of the combined entity.

This can cause an overhang if disgruntled former shareholders of the target don't want to stick around, but trading has been orderly today.

Paul has written before about Avingtrans management being canny operators.

I see that Hayward Tyler (LON:HAYT) had only recently got into a bit of financial trouble, its net debt rising from £9 million to £22 million over the most recent fiscal year. That resulted in protracted negotiations with bankers over repayments and covenants.

So there is definitely a sense in which the bid for Hayward was opportunistic, though a healthy premium to the prevailing share price was paid.

Today's update explains how the new group is going to be organised:

Energy Division - focusing on nuclear. Nuclear waste storage containers and other niche markets. But lots of other sectors involved too.

Medical Division - components and systems for equipment manufacturers.

Having paid for the acquisition in shares, Avingtrans should continue to have a huge cash pile and all the flexibility that goes with that.

Now they will need to return Hayward to profitability, and integrate it with the rest of the group.

Overall, it sounds like it has potential, albeit a rather complicated story!

Everyman Media (LON:EMAN)

- Share price: 164,5p (+4.4%)

- No. of shares: 60 million

- Market cap: £99 million

This premium cinema chain provides results to June and also informs us that trading since then has been in line with expectations, for a "reasonable overall summer" in the cinema market.

Revenues are up 55%, which seems to be just about satisfactory according to the tone of the report:

For the 26 weeks ended 29 June 2017, the Group's box office revenue was up 51.9% on the previous period, reflecting favourably compared to a market movement of 10.3%. This resulted in the Group's market share increasing to 1.98% for the period (30 June 2016: 1.46%, 29 December 2016: 1.64%) (Source: Comscore).

It would be more helpful if a simple "like-for-like" figure was given for sales growth in the screens which were also operating last year, but we have to make do with what's given.

Last year, for the period to June 2016, revenues rose to £12 million with 19 cinemas in the estate.

The estate is now 21 cinemas, and one of the new additions was added during the most recent six-month period. So the vast majority of the growth is from cinemas which were also operating last year.

There are ten more venues in the works, and it sounds like the differentiated offer of full-service hospitality is a formula that works.

With so many video streaming options at home, including new releases, it makes sense to me that a cinema which went the extra mile in terms of hospitality would outperform.

The PE ratio is c. 30x but given that the number of venues is set to grow by 10 in the short-term, plus the potential long-term runway, I don't think that should be a barrier to investing here,

Vertu Motors (LON:VTU)

- Share price: 44p (+1%)

- No. of shares: 395.3 million

- Market cap: £174 million

The update from this car retailer is in line so I won't dwell on it too long.

There is a sale-and-leaseback of some freehold property at a nice 40% uplift compared to book value, the difference to be recorded as an exceptional gain.

The CEO takes the opportunity to remind us that the Vertu balance sheet includes £182 million in book value related to the property, suggesting that more value can be unlocked in this way over time.

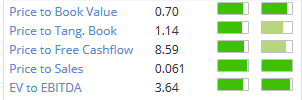

We have discussed at length in these reports the overt cheapness of the car retailing sector in relation to earnings. But maybe there are also book value reasons to consider a purchase of Vertu in particular? Stockopedia metrics suggest it is currently trading at only a modest premium to tangible book (that tangible book value perhaps being understated in the accounts, in the same way that the value of the property sold in this deal was understated).

Satellite Solutions Worldwide (LON:SAT)

- Share price: 7.75p (+5%)

- No. of shares: 682.6 million

- Market cap: £53 million

I promised I would include this in yesterday's SCVR, but didn't get around to it. Apologies!

Satellite Solutions provides "last mile and last resort connectivity".

Taking a look at its UK subsidiary Quickline (link) which it recently purchased for £8 million, the main services it advertises to businesses are "100% uptime ultrafast multipath connections", "remote monitoring of distant plant" and "international links to overseas operations".

For home users, it advertises "superfast connections even to areas poorly served by traditional technologies".

It does this via relationships with 3rd-party satellite owners including Avanti Communications (LON:AVN).

Stockopedia ranks this as a Sucker Stock and it's not hard to see why it would do that: it has never made a profit.

However, it's a young business (founded in 2008) and is still ramping up. The two co-founders are still at the helm and own about 12% of the shares between them.

Yesterday's interim report show it moving into profitability at the underlying EBITDA level, with a £2 million result.

Ignoring amortisation (the "A" in EBITDA) is arguably fair, but I would be reluctant to accept that the £1.2 million depreciation cost should be adjusted out. Putting the share-based payments back in as well since they are just another name for staff compensation, the underlying EBITA profit which I would accept is c. £700k.

Like-for-like revenue growth was helpfully provided, treating the existing and acquired businesses as if they had been owned last year, too. On that basis, revenue growth was 13%.

Total revenue was £20.6 million and therefore the failure to produce a meaningful profit figure looks a bit disappointing.

The CEO includes in his comments the following:

We are continuing to evaluate all operational aspects of our businesses, particularly in driving improvements in gross margins and overhead efficiencies in the short to medium term.

This does indeed seem like it should be a priority now, given the modest EBITDA margin.

Net debt has increased to £13 million thanks to a debt-and-equity-fueled acquisition strategy which has also seen the share count increase considerably over the past few years.

There is £12 million in subordinated debt, some of which is convertible at 9p per share, and there are also 74 million share options held by the debt investor, at a strike price of 7.5p per share.

Meanwhile, the stated headroom in its HSBC borrowing facility of £1.5 million doesn't sound very comforting to me (along with a £2 million cash balance). Is £3.5 million the entire spending headroom available to it at the moment?

The CEO says "we are now ready to consider further acquisitions in the second half of the year and beyond", which means more equity dilution should be on the way.

It's well outside of my risk tolerance, I'm afraid. The StockRank is 4, and since this report is called the Small Cap Value Report, you probably won't be surprised if this isn't something I'd be interested to invest in just yet!

That's all for now. I hope your month got off to a good start. Enjoy the weekend!

Cheers

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.