Good morning!

Mothercare (LON:MTC)

As you can see from the chart below, Mothercare has had an awful year so far in 2014, with the shares really plummeting. I last reviewed them on the big profit warning on 8 Jan 2014, where I came to the conclusion that with a weak Balance Sheet, and probably now trading at a loss, the shares if anything looked like a good short at 295p. As the chart shows, that was a very good call, even if I do say so myself!

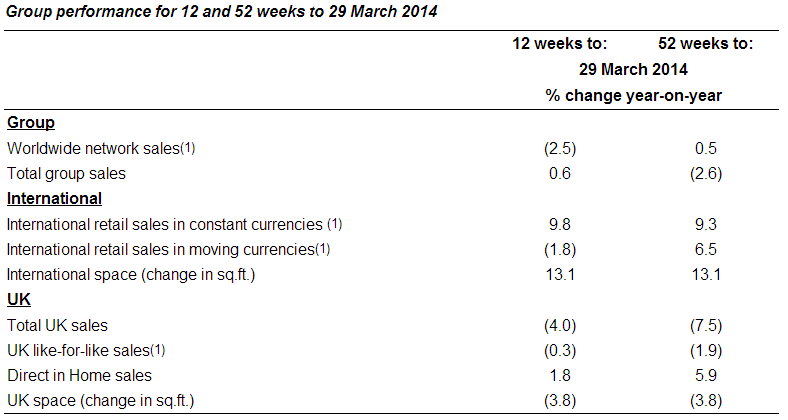

A trading update this morning indicates that tradnig in Q4 has improved somewhat. Various sales data is given in a table, for the UK, International, in constant & moving currencies, for Q4, and the full year, etc. It's probably easier if I just copy/paste the table here:

As you can see, there's quite a big adverse currency effect, as overseas sales are translated into (stronger) sterling. Their overseas business is actually very good, and decently profitable. However, the problem is the UK business, which is heavily loss-making, and needs to be drastically down-sized or even closed down altogether.

I just can't get my head round why Moterhcare works overseas, but doesn't work in its home market. That is such an unusual situation, usually it's the exact opposite with UK retailers.

We remain profitable at Group level and are focused on eliminating UK losses whilst also continuing to exploit our growth potential across our International markets.

I reckon they can only be (at best) marginally profitable, and when I last crunched the figures it looked like they would make a loss for year ending 29 Mar 2014, so the statement above today surprises me. It depends how you measure profit though, so perhaps the company has managed to classify enough costs as non-recurring so as to eke out a paper profit? I'd like to see the full accounts before even considering a purchase here.

The other key issue to research is what their leasehold terms are in the problem UK division. If the bulk of those leases are going to expire fairly soon, then it might be the case that UK losses could be stemmed at a sufficiently brisk pace as to save the group from going bust. However, if they are stuck in many loss-making stores with no exit possible in the medium term, then it might be best for them to do a pre-pack administration, or a CVA on the UK business to get out of the loss-making shops.

Anyway, for the moment the market is happy, and has marked up the shares 14% this morning to 186p at the time of writing. That's a market cap of about £165m. If it had a stronger Balance Sheet, I might be tempted to have a punt, but a weak Balance Sheet, and trading probably not much above breakeven, with lots of ongoing problems, doesn't interest me at this point. It's on the watch list though, as the overseas business does look to be successful - although I wonder if that is sustainable? If competitors have crushed Mothercare in the UK, what's to stop them doing that overseas in due course too?

It's another reminder that UK rent & business rates are just far too high. With more & more business moving onto the internet, it's difficult to see how current levels of retail rents & business rates can possibly be sustainable in the long run.

Norcros (LON:NXR)

The rather muted market response to a reassuring trading update this morning from bathroom fittings group Norcros, surprised me. There were very few trades early on, so I re-read the statement to make sure I hadn't overlooked anything negative. Having read it twice, it all looks pretty good to me.

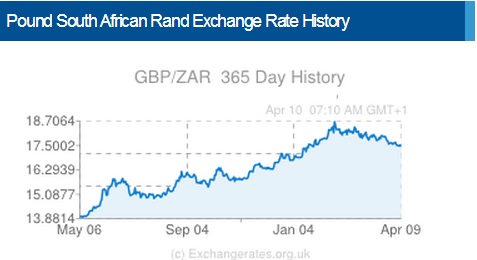

Remember that about 40% of Norcros turnover is from its South African subsidiaries, so there is a significant impact from translating those figures into sterling, as the exchange rate has moved a lot in the last year, see the exchange rate chart for GBP:ZAR on the left.

However, this shouldn't have too great an impact on Norcros, because it's only the translation of the S.African division's profits that sees the main impact of exchange rate movements. There would also be an impact on higher imported raw materials prices, but that would offset by higher demand, so quite a lot of moving parts.

Anyway, this is all waffle really, because the bottom line (literally!) is that Norcros today say;

The financial year ended in line with market expectations.

Group revenue for the year is expected to be in the region of £229m (2013: £210.7m) which represents year on year growth of 16.4% on a constant currency basis and 8.7% on a reported basis. Group underlying operating profit1 is expected to be 25% higher than prior year at approximately £16.3m (2013: £13.0m) despite a 20% weaker South African Rand costing £0.4m on translation of South African profits. Group underlying profit before taxation2 is expected to be 26% higher at approximately £14.7m (2013: £11.7m).

There are a couple of things to say about that. Firstly, I am impressed with the precision of today's trading update - giving precise figures for profit. Also I am impressed with the timeliness of giving this information - just 10 days after the year end date of 31 Mar 2014. That demonstrates tight financial controls are in place here - which matters, because it lowers the risk of unexpected bad news, bad debts, fraud, etc.

Note that the turnover & profit growth has come from the successful acquisition of Vado. Without that, the figures would probably have been quite disappointing. Having said that, a turnover table also in today's announcement shows an improving trend in the last 8 weeks of the financial year just ended, which is positive.

Various other infomation is given, which to my mind has a generally positive tone, although perhaps I'm unwittingly seeking confirmation bias (as I hold the shares)? The psychology of investment is a fascinating topic, and it never ceases to amaze me how many bulletin board posters try to interpret positively even statements that are glaringly negative! So it's important to be self-critical in how we all interpret trading updates & results, and not just look for positives, and mentally block negatives.

Moving to the outlook, today's update sounds mixed to me, but concluding on a reassuring note. So overall I would say this is satisfactory to mildly positive;

UK construction activity and an improving housing market has driven trade sector recovery during the year but the UK retail sector, as expected, is taking longer to benefit, although there have been some encouraging signs more recently. Whilst the medium term outlook in South Africa is positive, the weakening Rand continues to have an adverse effect on Rand profit translation to Sterling.

Nevertheless, with our strong brands, leading market positions and continued self-help initiatives focused on market share gain, the Board remains confident that the Group should continue to make progress in line with market expectations for the year to 31 March 2015.

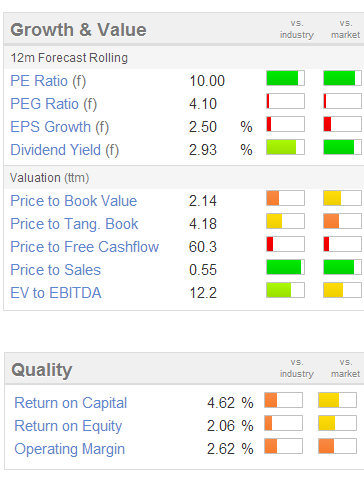

That's all great, but it boils down to valuation. If this stock was on a PER of say 16, then I would say that it's probably priced about right.

If it was on a PER of 20 or more, I'd say it was expensive. However, the interesting thing is that it's actually on a forward (i.e. based on broker consensus estimates) PER of just over 10.

I think that's cheap, but as always please Do Your Own Research ("DYOR"). These reports just give one personal opinion, and are never, ever recommendations.

Note also the useful dividend yield of just under 3% - always nice to be paid whilst you wait for a capital gain.

Critics might point to the low "quality" scores - indicating that this is quite a capital-intensive business that doesn't make much of a return on those assets.

Critics should also point out the enormous pension fund here, although in percentage terms it's quite well-funded (about 95% last time I looked). My view on that is that the key number is the agreed deficit recovery overpayments, and in this case from memory I think they are just over £2m p.a.. So the pension fund is really a drain on cashflow somewhere in the ballpark of 10%, so I adjust for it in my head by trimming back the PER I am prepared to pay by about 10%.

Accumuli (LON:ACM)

I've only very briefly touched on Accumuli before in these reports, so it's not a company I know at all really, having just commented in the past on its in line trading statements, and that the valuation looked reasonable. Several readers have asked me to look at it, in the comments below, so here we go.

The trading update this morning reads well, in my opinion. The company describes itself as an "independent specialist in IT Security & Risk Management" - certainly an area that immediately appeals from an investment perspective.

Here are the headline bullet points from today's announcement;

· Trading for the year ended 31 March 2014 in line with expectations, with Group EBITDA* expected to be around £2.9m (2013: £2.1m), 38% up on last year

· Gross Profit generated from recurring revenues¹ was £5.9m (2013:£3.8m) representing over 60% of Gross Profit

· Two acquisitions made during the financial year, Signify Solutions Limited ("Signify") and Eqalis Limited ("Eqalis"); both performing well

· Cash Balances at 31 March 2014 of £3.5m (2013: £7.2m), after funding of two acquisitions referred to above, settlement of deferred consideration for EdgeSeven and payment of our maiden dividend

The word "Maiden" only arouses any interest from me if it is preceded by the word "Iron", or alternatively has the word "dividend" after it! In this case the forecast dividend yield is shown on Stockopedia at 3.1%, and the policy is to pay out "up to 30% of pre-tax group EBITDA via dividend". I'm not keen on the "up to" bit, as that means technically paying out nothing would fit that policy!

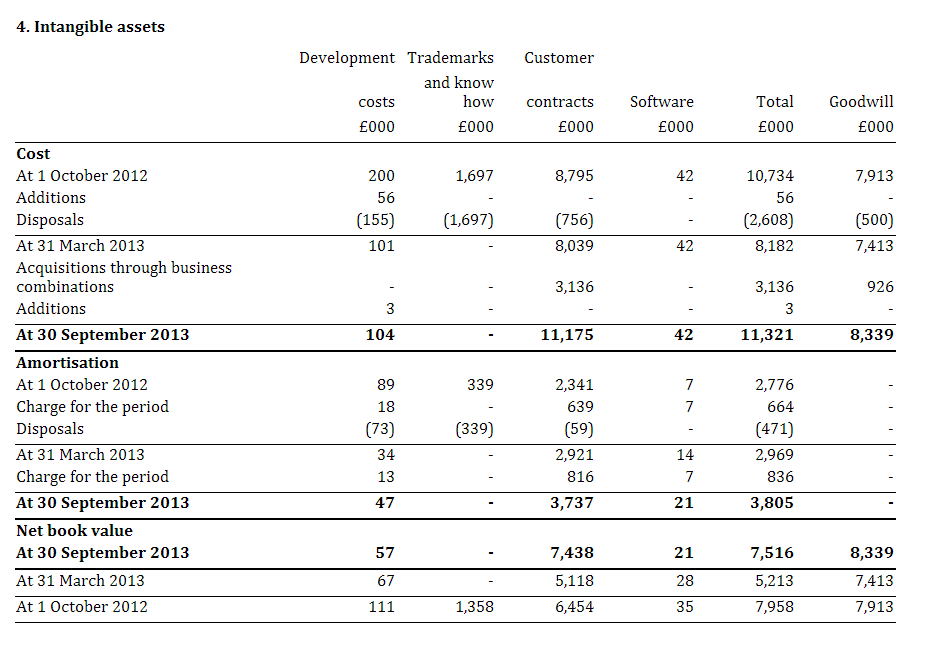

I also dislike EBITDA, as it is usually quoted to inflate profit perceptions, and ignore a whole load of capitalised costs. So checking the figures here, I was pleasantly suprised. Yes there is a large amortisation charge of £664k for the last 6 month period account, but it almost all relates to acquired customer contracts - i.e. it's stuff they have bought up-front, but is not an ongoing cash cost.

Capitalised development spending is minimal, with a NBV of only £57k at 30 Sep 2013.

So in other words, it seems to me that EBITDA is actually a good approximation to genuine cashflow in this case. See note 4 from their last interims (below), for more detail;

As a business that is generating £2.9m of apparently genuine cashflow, and paying a reasonable dividend, I quite like the look of it.

I also like that 60% of gross profit is classified as coming from recurring revenues.

The Balance Sheet looks satisfactory to me, although the cash probably comes from deferred income I imagine (there's no breakdown in the interims).

Anyway, there's enough positive stuff in there for me to have bought a little stock this morning, as a starting point. Then I'll be incentivised to do some more in-depth research, and only increase my position to a more meaningful level if it passes a more in depth research process.

That's it for today. Same time tomorrow morning.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in NXR and ACM, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.