Good morning!

Very quiet for results today, but there are always a few other topical things for me to rattle on about here.

In case you missed it, I updated yesterday's article later in the day, it covered BOO & QRT. Plus also later sections on STM and SCS - both of which look quite interesting actually.

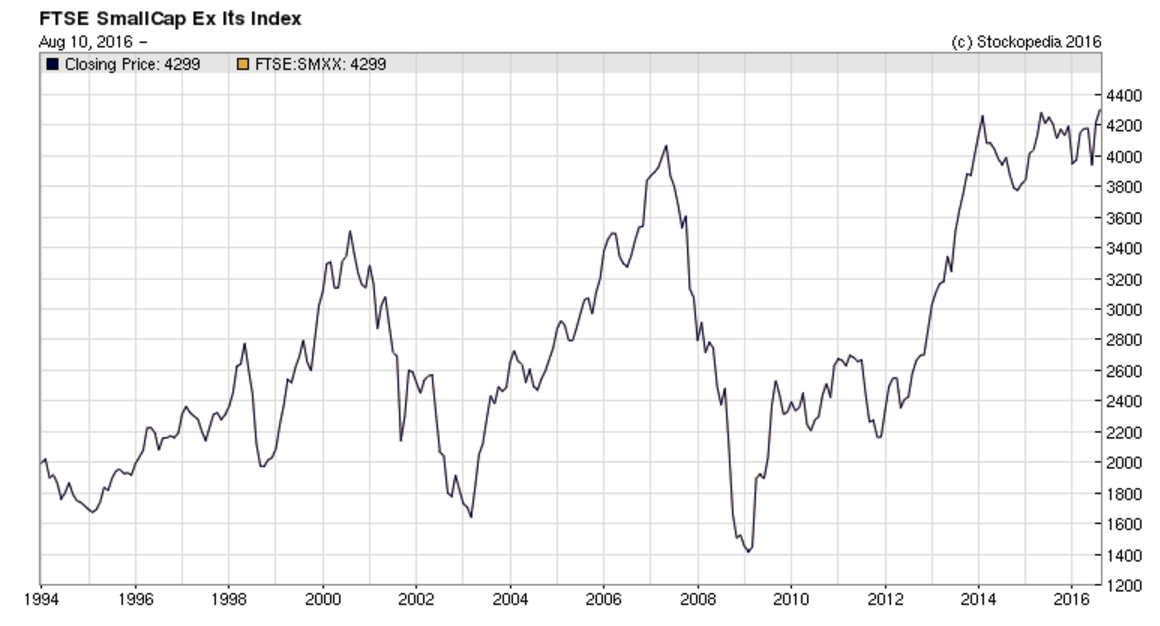

I was surprised to read a Tweet yesterday from Richard Crow, pointing out that the Small Caps Index had hit a new high. It's almost as if Brexit never happened - why did we all get so stressed about it?! Or, are we being lulled into a false sense of security now, before earnings disappoint later this year? Who knows.

Looking at the chart below of SMXX, it looks like this;

Glass half full person - we're breaking out to a new all time high!

Glass half empty person - it took 7 years (until 2014) to regain the losses after the peak in 2007, and we've traded sideways since 2014!

Both views are true, but just place a different emphasis on things.

I reckon that a lot of money was probably taken out of the market before, and immediately after Brexit. So some of that is probably sheepishly coming back into the room! Hence prices in a lot of smaller caps rising at the moment.

If you're a subscriber (and I hope everyone is, as that pays my wages for writing these reports!) then you can click on this link SMXX to analyse the constituent companies within each Index.

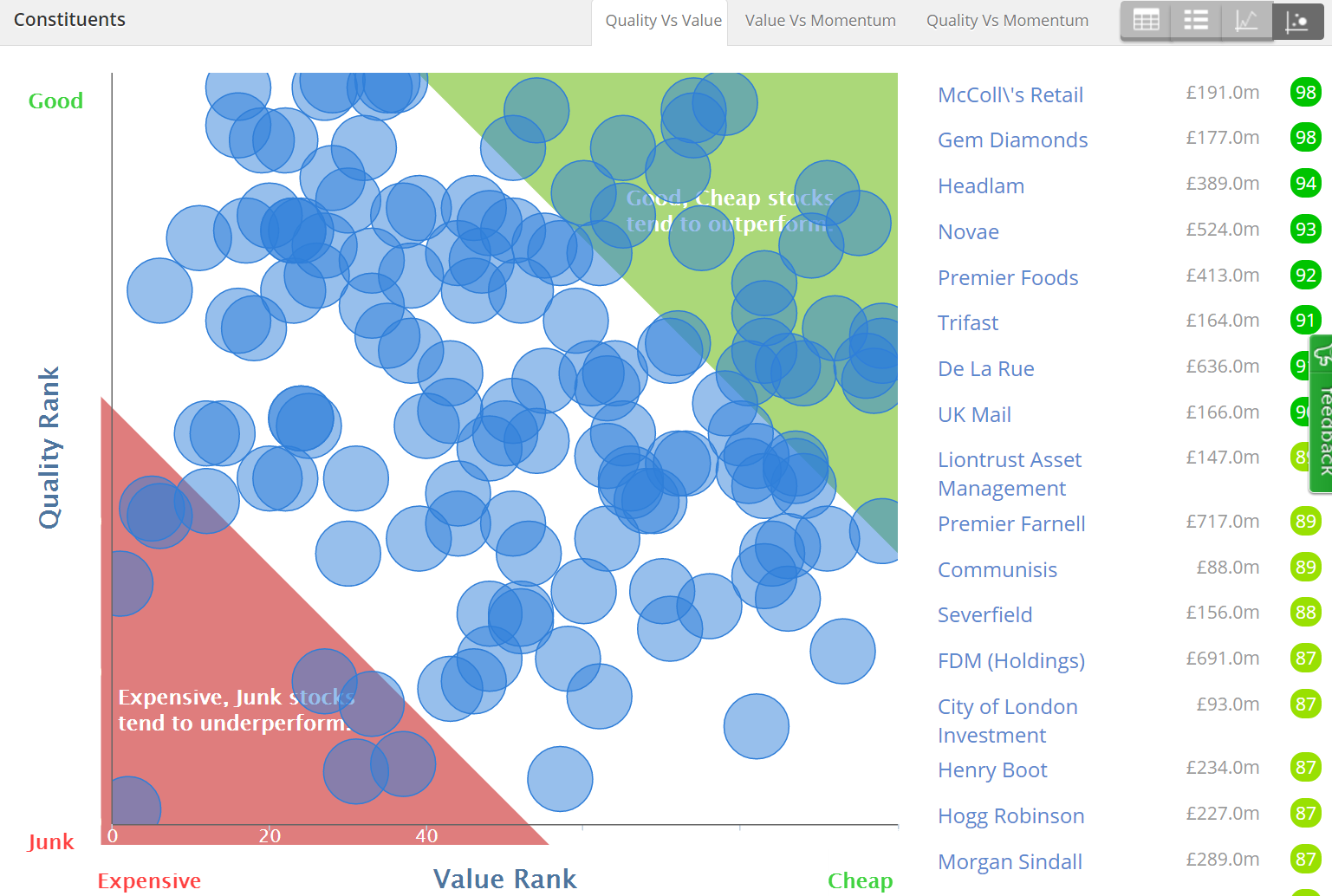

I particularly like the scatter chart, showing a blob for each constituent in the index, analysing where it sits, based on the Stockopedia Quality & Value ranks. So we should generally be aiming for stocks in the top RHS green segment, and avoiding ones in the lower LHS. Hovering over each blob reveals the name of the company (but won't on the screenshot below, unfortunately);

Some people, like Ed, use the StockRanks to "farm" for a portfolio of stocks, which as a portfolio have statistically out-performed. Whereas I'm more of a "hunter", so I like to pick my own stocks, and then use StockRanks as a sense check. For example, only one stock in my personal portfolio is in the red zone - Speedy Hire (LON:SDY) - which I must admit, has been a lamentable company - but that's why I bought it, for a turnaround.

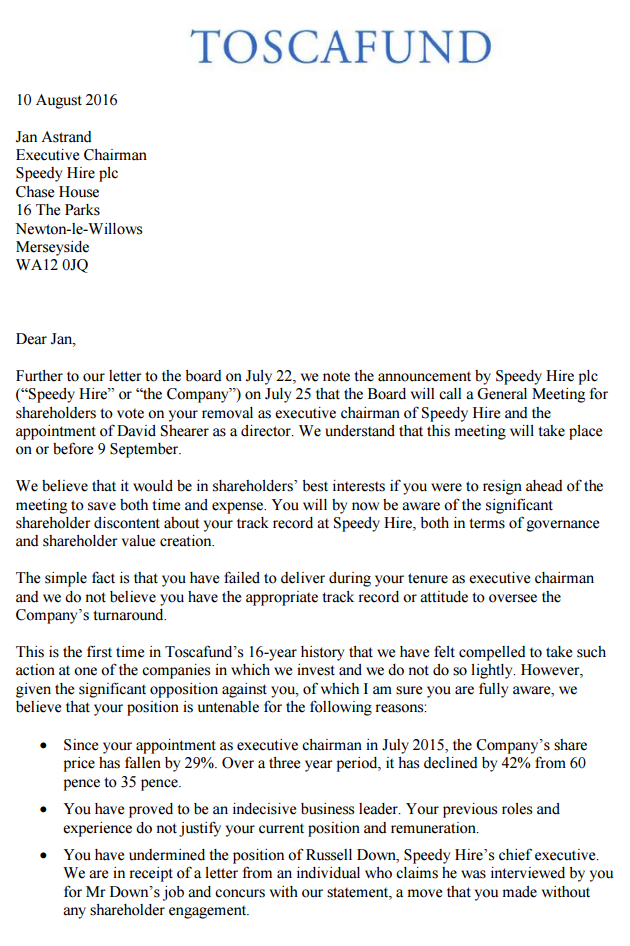

Talking of which, what a coincidence - my phone has just pinged to say there's an RNS out from SDY. It's a brief response by the company to another exocet missile fired at its Exec. Chairman by Toscafund, the largest shareholder. It's clear from Toscafund's latest open letter (issued today) that they really want the Chairman out.

Here's page 1 of the 2 page open letter, which is as direct as it's possible to get:

In reply, SDY today says that it will convene an EGM for 9 Sep 2016. Prior to that, on Friday this week, SDY says it will issue a circular, with their full response. Should make interesting reading. I quite enjoy these occasional situations where dirty laundry is aired in public, a bit of a guilty pleasure. It's good to see Institutions thinking & acting like owners, not just short term speculators. If management are useless, it's really only the Instis who can kick them out - private investors can't usually do anything.

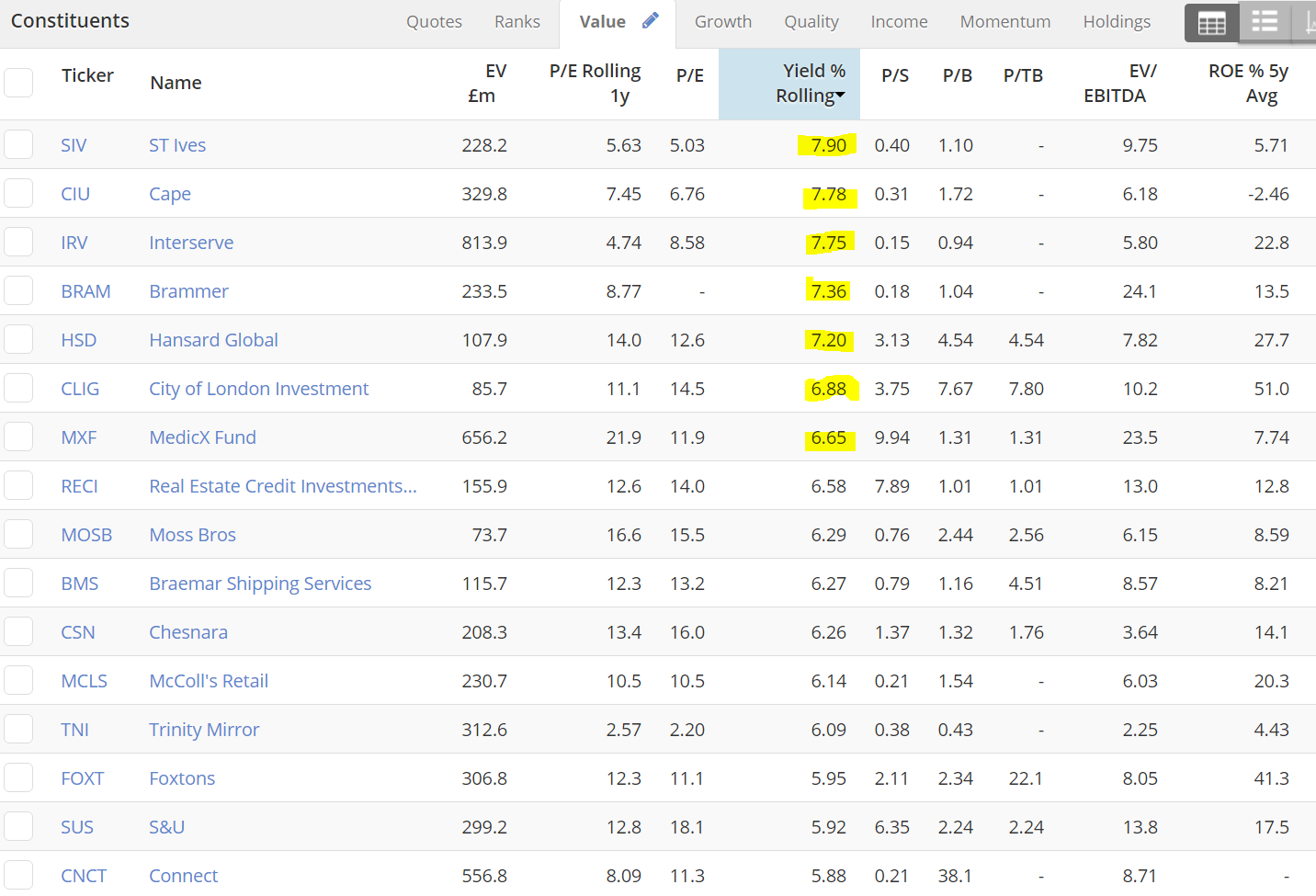

Going back to using Stockopedia as a tool for searching through the indices for interesting companies, you can sort in all sorts of ways. Here's the SMXX sorted by highest dividend yields, by way of an example;

I note that Interserve (LON:IRV) reported this morning - and looked quite interesting on a very quick skim of the numbers I did earlier. Might write a section on them later today, if there's time.

Lookers (LON:LOOK)

Share price: 112.75p (up 4.4% today)

No. shares: 396.2m

Market cap: £446.7m

(at the time of writing, I hold a long position in this share)

Proposed disposal of Parts Division - this announcement caught my eye at 7am this morning, as there were so few results to look at. Lookers is a car dealership chain, and has agreed to sell its parts division for £120m cash. That's more than a quarter of its market cap, so it's a big deal.

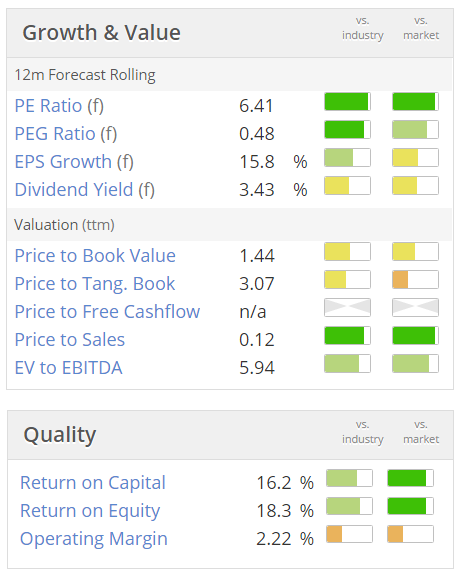

I crunched the numbers, and based on the figures below, it looks as if the deal values its parts division at a PER of about 12 (calculated as £12.6m operating profit turning into c.£10m post-tax earnings, and a disposal price of £120m).

At first that looks good, since the forward PER for the whole group is only about 6.4. So selling at a higher PER looks positive for shareholder value. Trouble is, the company then points out that this disposal will be earnings dilutive, as the cash received will generate a negligible return due to interest rates being so low.

So this is a classic situation where we have to make up our minds between 7-8am whether an announcement is good, or bad. After some pondering, I decided it was probably good - since the £120m won't be left on deposit for long - it will be deployed to buy up more car dealerships, which will boost earnings providing they are acquired on a PER of less than 12.

For this reason, I decided to buy a few shares first thing, but waited to see what the market reaction was. Initially it was poor, with the share price dropping on a few small trades. Maybe one or two PIs had been spooked by the earnings dilution comment? Anyway, as the price began firming up, I jumped in and picked up a few, as an opening position.

I've mentioned recently here that the car dealership sector is one of my favourites at the moment, as it looks oversold. Several dealers have given fairly solid trading updates recently, saying that nothing much has changed post-Brexit, and that manufacturers are going to absorb the forex hit rather than raise prices in future.

In terms of valuation, most of the car dealers look much of a muchness to me. I hold quite a lot of Vertu Motors (LON:VTU) already, so don't want to go overboard, hence only picked up a few LOOK this morning. It's not good to get over-exposed to one sector, in case my sanguine view of the future turns out to be wrong - which could easily be the case.

RTC (LON:RTC)

Share price: 58p (down 11.5% today)

No. shares: 14.3m

Market cap: £8.3m

Interim results to 30 Jun 2016 - I had a quick look at the figures here at 7am, and wrote "OK-ish" in my notes. This is a tiny staffing group, which is heavily reliant on several key framework contracts, e.g. with Network Rail. So it's too small, and risky, and illiquid, for my liking. The trouble with things this size, is that if you buy a decent chunk, and something goes wrong, you can't get out. So risk:reward is quite a lot worse than for more liquid stocks, and that should be reflected in a lower PER in my view.

The opposite can also be true though - on good news, there can be a disproportionately large increase in valuation at tiny companies, as happened here a couple of years ago.

Revenue up 16% to £34.1m - most of this is "pass through" revenue, I think, for contractors' wages.

Profit before tax of £447k - up from £398k in H1 last year.

There was a strong H2 bias to profits last year, so looks as if H1 is the seasonally slower half.

Gross margin has slipped quite a bit - from 21% to 18% - reflecting a change in mix from perm to temp.

Outlook - seems a bit ambiguous to me;

During the second half of the year we expect Ganymede to perform in a consistent manner to the first half and whilst unsettled political and economic conditions may impact on certain sectors of the recruitment industry, we remain optimistic of the long-term opportunities in the infrastructure sectors we support.

Does this mean that no H2 uplift is expected? I'm not sure.

Dividends - the forecast divi yield is good, at 4.86%, which will have risen, due to the share price fall today. A 1p & 2p interim & final divis were paid last year, so 3p in total.

Today an increase to 1.1p for the interim divi is announced. So it looks as if the 3p forecast total divi for this year might be a whisker too low perhaps?

I'm not sure how secure the divis are though, given a fairly weak balance sheet, which relies on a big invoice discounting facility.

Derby Conference Centre - where David Stredder held a memorable "Mello" conference a couple of years ago, looks like a distraction. Also it's cash hungry, with £1m capex incurred in H1 2016. It's a lovely historic art deco building, but seemed to me probably a commercial white elephant.

My opinion - overall, I can't get excited about this company. It's too small. If you think that they can grow profits substantially, then it would be worth a punt perhaps. For me, I'd rather move a bit higher up the food chain, and pick one of the several bargain, but much larger, staffing companies. There's less risk of something going wrong with them, in my view. Also you can sell larger shares, if the economy really does start to tank.

Some friends hold this one, so they'll probably hate me now!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.