Good afternoon!

I'm running late today, so will be updating this report until mid to late afternoon.

Synectics (LON:SNX)

Share price: 123.75p (up 17.9% today)

No. shares: 17.8m

Market cap: £22.0m

Year end trading update - this CCTV company has an unusual 30 Nov year end, so it updates today on the full year that has just finished.

key points;

Consolidated revenues for the year just ended are estimated to have been approximately £68 million, compared with £64.6 million in the previous year. Underlying results are expected to be in line with market expectations.

In recognition of Synectics' return to profitability (subject to audit), the Board intends to recommend a modest resumed final dividend in respect of the 2015 financial year.

Net cash at the year end was approximately £0.3 million, a substantial improvement from net debt of £(6.1) million at the prior year end. This cash inflow reflects primarily the unwinding of abnormally high working capital balances caused by project delays and disruptions in the oil and gas sector during 2014.

This is all very encouraging in my opinion, as the company was looking close to a basket case, and had a distinctly stretched balance sheet a while ago - in particular, alarmingly high debtors, and mounting bank debt.

It seems as if the company has now fixed those issues, and got its balance sheet back under control. A resumption of divis is also very encouraging, even if only a modest amount.

So the sharp rise in share price today looks fully justified.

The perception is that Synectics has big exposure to the oil & gas sector, but the company comments today that it was just under 20% of 2015 revenues, so not as big an exposure as I thought.

My opinion - it's probably not a share that I would rush out to buy, as the outlook comments don't sound particularly encouraging. Also, it's only operating slightly above breakeven at the moment, so it remains to be seen if a more robustly profitable business can be created, or not.

However, it's apparently no longer a dangerously risky share, so I'm today taking it off my Bargepole List (it was added at 335p on 29 Jul 2014, so has since dropped 63%, so that was a good call). It's pleasing to see companies remedy significant problems, and return to better financial health, without diluting existing shareholders.

Although I'd still rather see the actual figures, as trading updates can sometimes be rather selective in their portrayal of the facts!

If the company is able to achieve broker forecast for the new financial year, then the forward PER would be attractively low. However, I think it's dangerous to assume that companies will be able to more than double profits year-on-year, and then value the company on that basis. So it's safest to be cautious with this type of company, in my view, as companies in this sector very often miss forecasts.

For the moment though, it looks like a low has been put in, and who knows, it could be a good trading share for a short term bounce?

Lakehouse (LON:LAKE)

Share price: 93p (down 1.8% today)

No. shares: 157.5m

Market cap: £146.5m

Results y/e 30 Sep 2015 - today is the first time I've looked at this company, which is a group of support services companies, focussed on public sector, social housing maintenance, a small construction division, etc. So it's basically a group of low margin contracting & outsourcing businesses.

I usually try to avoid this type of sector, as it's only a matter of time before a major contract goes wrong, and the shares crash. A good recent example of that is ISG (LON:ISG) and of course it wasn't that long ago that ROK and (another one whose name escapes me) went bust.

Another negative factor with Lakehouse is that's it's a recent float, having a full UK listing since Mar 2015. So many new listings aren't what they seem, and something goes badly wrong in the first year or two, that I now treat all new listings as highly suspect, and try to avoid them altogether. The Prospectus for Lakehouse is here.

The IPO was at 89p, and half the shares were fresh money for the company, and the other half being existing shareholders partially cashing out. I always feel that if existing shareholders are happy to bank their gains, and sell, that's telling me I probably shouldn't be buying! Although on the other hand, you could argue that people top-slicing their holding isn't necessarily untoward.

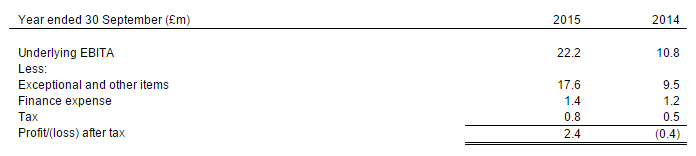

Adjusted earnings - the crux here is whether you are prepared to accept the company's definition of adjusted earnings. It strips out acquisition-related amortisation, which is fair enough. However, there are also a lot of exceptional items, which can hide a multitude of sins. I prefer clean numbers, with little to no adjustments. The adjustments here are highly material;

Valuation - if you accept the adjustments, then the shares are cheap. Adjusted EPS is 13.7p, so that puts the shares on a very reasonable PER of just 6.8. This figure seems to have come in ahead of broker forecast (assuming they are calculated on the same basis) of 11.8p.

There's a fair bit of potential dilution from share options, because the diluted adjusted EPS figure is 12.3p, so that raises the PER to 7.6 - still cheap though.

Balance sheet - being on such a low PER, is it loaded with debt then? Actually, no it's not. The only interest-bearing debt seems to be £743k of finance leases. There is £6.9m of cash, so the cash position looks fine.

Overall though, the balance sheet is weak. NAV of £85.5m is dominated by intangibles totalling £83.5m, leaving just a sliver, at £2.0m of tangible asset value. Companies in this space often operate with dangerously weak balance sheets, relying on juggling cashflow between customers and suppliers/subcontractors, with bank debt often plugging any gaps. This is inherently risky though, as are large value contracts, hence why I much prefer a strong balance sheet in this sector - which is lacking here.

Bear in mind the £9.2m deferred consideration creditor too, which will be a cash outflow presumably (unless paid in new shares). That should really be treated as debt, which would more than wipe out all the cash balance.

Cashflow - looks good, with the business generating a strong operating cashflow both this year, and last. So if they can avoid contract risk pitfalls, then perhaps everything might be fine?

Dividends - a 1.9p final divi is fairly decent, equating to a 2.0% yield. Broker forecast is for the divi to more than double next year, to 4.2p, so if all goes to plan, then the yield would look good next year.

Although relying on expectations for big divi increases is quite risky, as we've seen with several recently floated companies, e.g. Entu (UK) (LON:ENTU) and DX (Group) (LON:DX.) where one of the key attractions for the IPO was the high forecast yield, but then of course the wheels either came off, or at least got a puncture, resulting in the big yield not actually happening as planned. Therefore caution is necessary in my view with all forecasts, especially where only one, or few, brokers are forecasting (especially if one of those was the company that did the IPO!).

My opinion - it looks good value, if things proceed to plan. The trouble is, this sector is fraught with risk, so there is quite a high possibility that things won't proceed to plan.

Also, the chart looks funny to me. It's as if someone is trickling out shares into the market, preventing the share price from going up.

On balance, it's not for me, but if things do go well, then I could foresee these shares being usefully higher in future. I see that Slater Funds are involved here, with 6.0% holding, and I respect their judgement a lot, which reassures.

Plexus Holdings (LON:POS)

(at the time of writing, I hold a long position in this company)

AGM statement - I really like this company, but can't stand their unbelievably long-winded shareholder communications. I simply haven't got time to read/digest them! I appreciate that some shareholders may want a highly detailed essay all about the company several times a year, but surely many others just want a concise update on what is going on.

Therefore I plead with the company to produce an executive summary with all of its updates, for time-pressured people.

Anyway, I've run out of time, as hospital visiting is my afternoon role at the moment, so will try to circle back to this later, as I gave up half way through today's rambling update statement. I still haven't read the last full results statement, it was about 29 pages of narrative alone! Ridiculous - when you hold 40-60 positions, it's just not possible to plough through all that detail. I'd rather just have a one-pager, like Castings (LON:CGS) produce.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.