Good morning!

There are 3 profit warnings I want to comment on today. Is this a sign of a worsening economy? Not really, as all 3 are companies with existing or previous problems, so for the time being anyway I'm still fairly sanguine on the outlook for the UK economy (not sure about overseas though).

So let's take a look, in order of magnitude of today's share price falls.

Hornby (LON:HRN)

Share price: 39.6p (down 51.1% today)

No. shares: 55.0m

Market cap: £21.8m

Just a bit of catch-up first;

I reported here on 18 Jun 2015 about Hornby's £15m equity fundraising at 95p, and how amazed I was that it had been possible to raise fresh funding in what was effectively a rescue refinancing, to get the bank off the hook. Sure enough, the investors who backed that 95p fundraising are looking unwise now, and indeed looked unwise at the time too.

In my report of 12 Aug 2015 I noted the non-specific but generally positive-sounding trading update, and the move from the main listing, to AIM (a sensible move for a company of this size, in my view), concluding that the shares (at 107.7p) were too high, given that the turnaround was not cemented yet. Risk:reward was all wrong at that price - with shareholders being asked to pay up-front for what was then only a tentative turnaround.

Interim results on 8 Dec 2015 look pretty awful, I didn't report on them at the time, but am just looking at them now. It was clear from the interim numbers that the turnaround plan was not working, and once again Hornby slipped into losses - £3.4m for H1, and that's before adjustments, exceptionals, etc. Once again however, management peppered the narrative with optimistic noises about the outlook.

Profit warning - here we are today, and it's clear the wheels are coming off. Clearly a serious profit warning, to have triggered a fall in share price of over 50% today, on top of the drift downwards in price since Aug 2015.

UK sales performance seems to have fallen off a cliff in Jan 2016, which looks very strange to me;

In the UK the Group saw a strong sales performance in the key November and December period as sales opportunities were maximised in the run up to Christmas. Like for like sales in this period were up 17% overall year on year, though this masks some volatility within the period. However, subsequent trading since the start of the New Year has been in stark contrast, with a disappointing response to January product promotions combined with poor underlying sales resulting in negative year on year revenue growth and sales for the month being substantially below expectations. While we are expecting performance in February and March to improve on January, it will not reach previously anticipated levels.

Something just doesn't stack up here, to my mind. I can't recall ever coming across a company that is achieving +17% LFL sales, and then suddenly plunges into negative sales the following month. One explanation might be if some exceptional one-off sales were achieved in Nov-Dec. I think the company needs to elaborate on this, because it looks very odd indeed to me - there must be some other factor to cause such a plunge in sales, which is not being disclosed (yet).

International trading has also had continued disruption, although they are trying to make it sound as if the worst is behind them (reassurances which we've heard quite a lot in the past too);

As disclosed at our interims, there has been a significant reorganisation of the management and distribution operations of the European subsidiaries. The impact of this has been that trading in the international businesses was disrupted last autumn as the restructuring took place. Hornby is now through the main period of major disruption. Improved sales in the last two months have reflected the changes that have been made to the logistics, stock handling and distribution operations and like-for-like sales across December and January combined were up 5%. Despite this being the first positive like for like sales performance this financial year, this is still significantly behind the Board's previous expectations.

The key sentence above is the last one.

Guidance on loss for this year - helpfully the company does give some figures to enable shareholders assess the damage;

In total the Group is now expecting to report an underlying loss before tax in the range of £5.5m - £6.0m, which represents a substantial setback in our recovery plan for the business.

With a £3.4m H1 underlying loss, this means that H2 is also loss-making, to the tune of £2.1m to £2.6m. Plus there will be all sorts of exceptionals on top of that. Looks pretty grim to me. As an aside, I think companies that make a great song & dance about having a turnaround plan, and give it a silly name, as if it were some kind of separate entity, often seem to come unstuck. When actually, turning a business around is all about starting to manage it well, instead of badly.

Bank covenants - these are under pressure again, despite the £15m equity fundraising in Jun 2015. With one failed attempt at turning the company around already in place, I imagine that the conversations with the bank will probably have a much harder edge this time.

As a result the Directors consider there to be a risk that the Group will breach a covenant of their banking facility in March 2016. The Group has enjoyed a long and supportive relationship with its lender, with whom it is currently in discussions.

Having a long and supportive relationship with a bank means precisely nothing. It only takes someone at regional office to get a fright on, and over-rule (and replace) the friendly local manager, and all of a sudden your banking relationship has gone out of the window. I've experienced that situation personally whilst an FD in the 1990s, so ever since have never relied on any banking relationship.

Outlook - this sounds like a management team who are not in control of the business, and don't really know what's going on (which reinforces what I already thought);

The Directors are continuing to execute the Group's turnaround strategy. At the same time, the Board is now analysing the causes and consequences arising from this poor start to the new calendar year. We will update the market on the Board's progress and our revised expectations for the financial outlook for the business in due course.

My opinion - if I held shares in this, I'd have sold with the lousy interim results in Dec 2015, at over double the current price. If I'd somehow missed the obvious need to sell in Dec 15, then I would definitely sell this morning.

Bank covenants in danger of being breached just 7 months after a substantial rescue fundraising, is a complete disaster. I know it's easy to criticise, but management really don't seem to know what they're doing, and don't seem to have basic control over the business, and its supply chain.

It's still heavily loss-making, has problem bank debt, and no doubt a shareholder register who must be asking themselves whether it's time to just pull out, rather than throwing more good money after bad?

As things stand right now, I'd say this share is uninvestable, so it's gone onto the Bargepole List, as being too high risk. The trouble is, after making positive noises for some time now, about the turnaround, yet delivering dismal results (and publicly saying that they don't really know why current trading is so poor!), then who would have confidence in management to continue their attempts to turn around the business?

So the danger is that the next fundraising could be at a massive discount, hence diluting away existing holders. Even if I did think the turnaround looks promising (which I don't), then I would wait for someone else to refinance the company first, and only invest once the banking covenants were sorted, etc. Why take the risk of being heavily diluted in the next fundraising? It wouldn't surprise me if the next equity fundraising has to be done at say 10-15p. Or below, who knows? When a company runs out of money, and has its bank breathing down its neck, then you could argue that the existing equity has nil value. The company will only survive if new finance is raised, and it's then up to the new financiers to name their price (which if they have any sense, will be as low as possible).

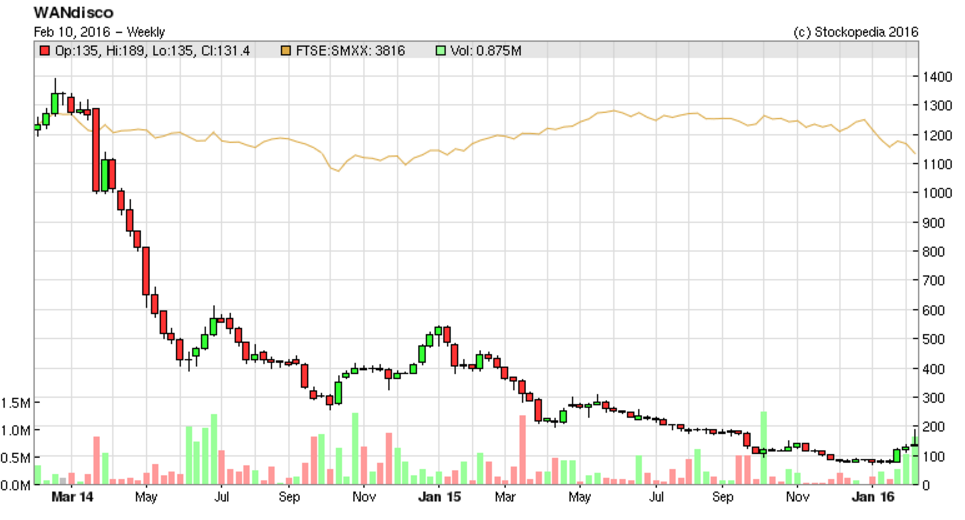

WANdisco (LON:WAND)

Share price: 134p (down 28% today)

No. shares: 29.6m

Market cap: £39.7m

2015 year end update - this is the company which seems to think that repeatedly saying the words "Big Data" in its RNSs will be a satisfactory substitute for making profits. It seems that shareholders may be tiring of that wheeze.

Key points in today's update;

- 2015 revenues slightly below expectations

- Cost cutting has resulted in adj. EBITDA loss being better than expected (or not quite so bad, perhaps?)

- Cash consumption reduced in H2 (good thing too, as it burned $13.4m in operating cashflow + capitalised development costs in H1)

That all sounds reasonable, doesn't it? So why the 28% fall in share price today? Because it's run out of cash! Consider this;

Principally as a result of reductions in cash overheads, our net consumption of cash was significantly reduced in the second half, resulting in a net cash balance of approximately $3m at the close of the year. With strong cash collection and further cost reductions so far in 2016, we have moved significantly closer to cash break-even.

Our $10m credit facility with HSBC remained undrawn at the close of the year.

Let me translate that for you: We've almost completely run out of money. There was only $3m left at the end of 2015, which is probably only enough to keep the lights on until March or April. We're nowhere near breakeven, and are desperate to get more cash from anyone who will give it to us.

So it's only a matter of days, or weeks, before the next Placing is announced. After stumping up $26.1m in fresh equity funding just a year ago, in Jan 2015, that has nearly all gone now. Analysts were only forecasting a revenue increase of 11.6% in 2015, to $12.5m, and the company hasn't even managed to achieve that! The forecast loss for 2015 is $27.1m!

My opinion - this company is a complete joke, and anyone putting fresh money into it needs to be relieved of their duties, and not let anywhere near other people's money ever again.

Sometimes one can accept heavy initial losses, if turnover is rapidly rising, with high margin additional sales being booked - thus giving a clear path to profitability in the foreseeable future. However, WANdisco just talks in grand terms, but delivers nothing, other than catastrophic cash consumption. It has no demonstrable path to anything other than continued catastrophic losses.

This share is a great example of how fund managers can be hoodwinked by exciting-sounding technology, into completely suspending their critical faculties - buying into a story rather than a credible business plan, and pouring huge amounts of other people's money down the toilet. It's certainly not just private investors that fall for story stocks - Institutions are just as bad, in my experience.

Let's see if they can get another placing away, and at what price? The usual pattern is that the placings get smaller & smaller, at a lower & lower price, with conditions being attached - such as drastic cuts in overheads, management salaries, etc.

The brutal truth is that, so far anyway, management have dismally failed to execute, the business remains chronically cash consumptive, and hence it really should be put out of its misery.

It's already on the Bargepole List - it went on there in Jul 2014 at 480p, when it was already obvious that things were not working out.

The 2-year chart below speaks for itself. I question what caused the sudden spike up to nearly 200p recently? Looks like share price manipulation by person(s) unknown, to get the share price up ahead of a placing, but that's just a guess.

Maybe existing shareholders might chuck in another 6-months cash, in a new placing, to defer the day of reckoning when they have to 'fess up to having made a duff investment, and to temporarily prop up the share price, and hence the value of their existing holding?

Let's have an interlude in all this unremitting doom!

Tangent Communications (LON:TNG) shareholders are being put out of their misery by management, who are proposing to take the company private, with a cash offer priced at 2.25p in cash. This may look a disappointing price, compared with when management were doing the rounds telling shareholders about their exciting growth plans (when the shares were c. 8-10p), but basically it hasn't worked. That's been obvious from the figures for a while, and with a £3.8m market cap last night, I think management are right that it's too small to justify the costs of maintaining a listing.

The price being offered is a 63.6% premium to last night's close, although percentages lose their meaning when you're dealing with such de minimis sums.

Overall, I can't work myself up into a rant on this one - de-listing it, and paying a fair price, seems the sensible exit route. It's a done deal, with over 50% acceptances already.

So that's the end of that one.

Back to the doom & gloom, here's another profit warning!...

Renold (LON:RNO)

Share price: 30.1p (down 29.5% today)

No. shares: 223.1m

Market cap: £67.2m

(at the time of writing, I hold a long position in the company)

Checking back to my previous notes, I last looked at this industrial chains manufacturer here on 9 Apr 2015, when it had just reported an upbeat trading statement for y/e 31 Mar 2015. My conclusion was that, whilst trading was improving nicely, the weak Bal Sheet (especially the pension deficit) prevented the company from paying meaningful dividends, hence it wasn't attractive at the prevailing price then of 56p.

Interim results to 30 Sep 2015 slipped through my net (it's not possible to report on everything, every day), but looking at them now, turnover was down 6.8%, but profits remained robust, due to cost-cutting. The outlook statement at the time warned of weakening market conditions, and lowered guidance.

An update on the pension deficit is worth reading here, in that Renold has de-risked some of its pension liabilities, which has been a material, ongoing problem on the group's balance sheet.

Profit warning today - seen in the context above, Renold seems to have already managed down expectations, so this isn't a bolt from the blue, it's really just a continuation (and worsening) of negative trends that were already in place.

Underlying1 sales for the full year are therefore expected to be around 10% lower than the prior year. The Chain division is expected to finish the year down approximately 8% and Torque Transmission down around 14%.

The sustained delivery of self-help measures has led to a further lowering of our break-even point. As a result, the Board now expects that the impact of the reduction in sales on adjusted2 operating profit will be limited to a decrease of around £2.0m (or 13%) compared to the prior year. In the Chain division, efficiency gains will deliver adjusted operating profit similar to the prior year, despite the forecast fall in underlying sales. The smaller Torque Transmission division has also made efficiency gains but its scale means it is less able to absorb the impact of the forecast fall in underlying sales.

Since we already know that underlying H1 sales were down 6.7%, then the full year (to 31 Mar 2016) expected to be down 10%, implies (assuming no material H1:H2 seasonality) a fall in H2 of about 13.3%, so quite a significant deterioration.

A fall of £2.0m (13%) in adjusted operating profit actually isn't that bad at all, considering the fall in turnover. I suppose the key question is, how much worse is it going to get? Also, is this a temporary blip in demand, or a more serious long-term downturn?

Valuation - last year's adjusted EPS was 5.0p, so if we assume 13% below for this year, then that comes out at 4.35p. The shares are currently 30.1p, so that's a PER of 6.9.

Sure there is some debt, and the pension deficit, to take into account, so I'll need to do some more work on that. I've just had a quick look at the last Annual Report, and the pension fund deficit is a big issue, so that's definitely the area that I need to do more work on. Although the de-risking of about half of it, mentioned above, sounds encouraging.

My opinion - in my report of 9 Apr 2015 I concluded that, due to the balance sheet issues, I would want a PER of 6-7 to get me interested in buying these shares. That's happened today, hence I've bought an opening size (i.e. small) initial position, with a view to doing more detailed work on the balance sheet over the weekend.

It seems to me that the company has managed investor expectations well - being open about the downturn in its markets, and how costs & efficiency gains are mitigating the fall in turnover. Combine that with a fairly good operating profit margin for an engineering company, and this suggests to me that Renold might be a reasonably good quality business.

Also, chains wear out, and need servicing, so even if new build machinery is on the wane in current economic conditions, then presumably there will be repair & maintenance work for existing clients. I need to find out more about the business model, and form a view on whether the business is just going through a soft patch, or whether it is in overall decline due to competitive pressures?

At this valuation though, at just over 30p, I think risk:reward is starting to look potentially interesting, with a longer-term view - i.e. being prepared to ride out any further downturns in business for say the next year or two.

In terms of Directorspeak, today's comments sound very sensible (below). Sensible management is what comes across from previous announcements too, in stark contrast to a couple of other companies in today's report.

"The fact that international industrial end markets are volatile has been widely reported. We are continuing to do the right things to protect capital and revenue investment in projects to support the medium term delivery of the STEP 2020 Strategic Plan rather than simply cost cutting to deliver short term gains at the expense of the Group's future development. Our focus remains on getting the business into the right shape to withstand the current volatility and to deliver growth in the longer term."

The long term chart shows how savage the recent sell-off has been - Renold shares are now back down to roughly the average price during the period 2010-13, yet a lot of restructuring has been done since then, putting the business in arguably better shape now, than it was then.

It depends how bad the downturn in its markets get. If we're going into another 2008 type scenario, then the share price went down as low as about 12p then. The prices don't look directly comparable though, as the no. of shares in issue seems to have jumped from about 120m to about 220m in 2011, so clearly a fundraising must have been done then to repair the balance sheet.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.