Good morning,

It looks like a quiet news day in terms of the universe of stocks we usually cover here. I'll see what I can come up with - or let me know if you have any suggestions.

Cheers,

Graham

Electrocomponents (LON:ECM)

Share price: 499p (-1%)

No. shares: 441m

Market cap: £2,200m

Trading Update (for the four month period ending to 31 January 2017)

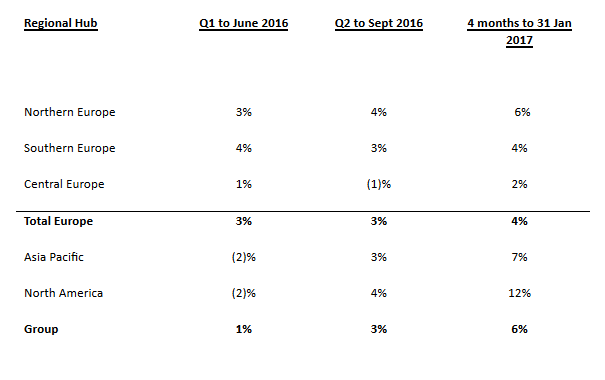

Revenue growth looks like this:

This company has always seemed to have a bit of a low profile among investors, but it's a really good distributor - "the world's leading high-service distributor for engineers", dealing in over half a million products.

The shares have gone on a tear higher this year (they started January around 220p) so it's not in the bargain bucket by any means, but it claims to be the leading distributor in the UK, Europe and Asia-Pac. That's a position which is worth a premium rating, in my book.

Non-GBP income means that this is one of the stocks which has provided fantastic GBP devaluation protection for investors:

We continue to expect FY 2017 revenue and profits to see a significant benefit from foreign exchange(2) and additional trading days(3).

Checking the footnotes in today's statement:

Our profits remain sensitive to movements in exchange

rates on translation of overseas profits. Positive currency movements

increased H1 profit before tax by around £7 million. Assuming current

(31st January) rates persist for the rest of the year, the

full year currency benefit will be around £18 million. Every 1 cent

movement in the Euro will have a circa £0.9 million impact on profits.

Every 1 cent movement in US $ will have a circa £0.3 million impact on

profits

So that's a huge FX benefit, and the final footnote tells us that there will be a £10 million benefit to revenues from additional trading days in this financial year.

So the results are a bit messy but ECM has "typically" earned at least £60 million per year in net income, and Stocko suggests that the forecast for 2017 is £82 million.

No matter which way you look at it, it's on an above-average PE rating, but it's a very solid business which should hopefully continue to trade well for many years to come.

Greene King (LON:GNK)

Share price: 683p (-2.6%)

No. shares: 309.8m

Market cap: £2,116m

This pub, restaurant and hotel manager seems happy with its Christmas performance, but the numbers overall seem fairly tepid:

In the first 40 weeks of the year, Pub Company achieved like-for-like (LFL) sales growth of 1.1%. Excluding Fayre & Square, LFL sales were +1.6%...

LFL net income in Pub Partners was up 3.5% after 40 weeks, maintaining its strong performance this year. In a cask ale market down 3.8%, own-brewed volume (OBV) in Brewing & Brands was down 4.2%.In terms of the estate, 59 pubs were sold and another 50-60 are set to be disposed.

Outlook:

Looking ahead, despite continued economic uncertainty and

significant cost pressures, we will remain focused on building our

retail pub brands, delivering great experiences to our guests and

completing the Spirit integration. We are confident that the

combined strength of our brands, pubs, people and cash generation leaves

us well placed to deliver another year of progress, value creation and

returns for our shareholders.

That said, the company looks big enough to weather the storm, and there will doubtless be some mitigation strategies. Maybe fewer over-25s will be hired or retained (which was not the intention of the policy of course, but perhaps that it is how it will work in practice).

My opinion: I haven't studied this in enough detail yet to have a very strong opinion, but for what it's worth, this is trading at a nice low PE rating (c. 10x) and is yielding c. 5%, so it's certainly in "value" territory.

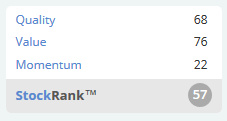

Stockopedia gives it a good Value Rank. Momentum is weak, as the shares have been drifting lower for some time:

I've just checked the interim results for this year: net debt was at £2.2 billion, versus operating profit before exceptional items for the half-year period of £204 million.

So at first glance, the financial risk doesn't look too bad to me, and this might be worth a look.

Just Eat (LON:JE.)

Share price: 510p (-8%)

No. shares: 678.5m

Market cap: £3,460m

I didn't bother reading this announcement first thing this morning, as "Director Change" usually means some non-Exec or other has been added or removed.

But in fact, this concerns the CEO:

The Board of Just Eat plc (LSE: JE.) announces that, due to urgent family matters, David Buttress has informed it of his intention to step down from his role as Chief Executive Officer. David will work full time in the Company until the end of the first quarter, at which time John Hughes, who has been Chairman of the Board for almost six years, will assume the role of Executive Chairman. John will work closely with David and Chief Financial Officer Paul Harrison to ensure a smooth and orderly handover.

The Board is commencing an immediate search to find a replacement for David. David has agreed to serve a minimum one-year term as a non-executive director.

The fairly innocuous-sounding RNS has resulted in value destruction of almost £300 million to the company's share price.

Mr. Buttress has been at the company since 2006, and was appointed CEO in January 2013.

I'm sure investors will be wishing him and his family the best. It sounds completely unplanned and inevitably rather disruptive. I would instinctively mark down a share price by c. 10% on news such as this, especially for fast-growing and high-tech companies which can't just run themselves on auto-pilot.

Reckitt Benckiser (LON:RB.)

Share price: 7025p (-3%)

No. shares: 700m

Market cap: £49.2 billion

Reckitt Benckiser to acquire Mead Johnson

There's an absolutely huge acquisition to go with the full-year results.

Reckitt Benckiser Group plc to acquire Mead Johnson Nutrition Company RB to acquire Mead Johnson for $90 per share in cash, valuing Mead Johnson's equity at $16.6 billion

Total value of the transaction is $17.9 billion including Mead Johnson's net debt

Significant step forward in RB's journey as a global leader in consumer health

The rationale includes £200 million in annual cost savings by the third full year.

Debt financing is said to be in place and RB excepts to keep a "strong investment grade credit rating" - it currently has stable A1 and A+ ratings from Moody's and S&P respectively, which are unchanged since 2007.

(Note that it would remain at investment grade even if it was cut to a BBB rating.)

Reckitt is one of the world's biggest "House of Brands", and it says that the Enfa franchise owned by Mead Johnson will now become the largest "Powerbrand" in its portfolio. You can read about Enfa at this link.

The offer is at a 30% premium to Mead's share price before speculation began about a possible transaction.

In PE ratio terms it's far from cheap, at about 26x. Shareholders from both companies will need to vote it through.

My opinion:

Mead Johnson looks like a superb fit. The price is unfortunately rather eye-watering but I think that is just a reflection of interest rates and general market levels in the current environment.

Consumer staples aren't cheap these days - in the US, trading at 19x earnings, or 21x for the personal products sub-category. And of course you need a premium to get an acquisition through.

It looks like good news for RB for the long-term. Some share price weakness in the short-term is to be expected - that usually happens for the acquiring company, as its risk profile and economic characteristics are about to change, which some existing shareholders may be uncomfortable with.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.