Good morning! Churchill China (LON:CHH) issues a positive trading update today, saying that strong trading in Nov & Dec means that its operating performance for calendar 2013 will be "significantly ahead" of 2012, and will exceed current market expectations. It's a pity they have not quantified by how much they are likely to exceed expectations, as they have now created uncertainty. I would have much preferred if they gave an approximate percentage by which profits are likely to exceed the prior year, which should be possible if they have decent financial controls & reporting.

EPS for 2012 was 19.5p, and current broker consensus is for 23.2p EPS for 2013. So if they are likely to significantly exceed that, then I would imagine we're probably looking at somewhere in the 25-30p range? Maybe more, who knows? That's the problem now, we're being forced to guess what their performance might have been, which I don't like. They should have been more specific in the announcement, giving clear guidance by quantifying likely EPS, even if that means giving a range, rather than an exact figure.

I've re-written this section to reflect the big share price rise this morning:

The shares are currently 465p to buy, so a 25-30p EPS range means a PER between 15.5 to 18.6, probably towards the lower end of that range I would guess. The company also has net cash, and pays a decent dividend, which was held at 14p per share between 2008-2011, and started rising (slightly) in 2012. So a payout of 14.5p is forecast for this year, maybe they will pay 15p or more, as they have out-performed for the year? That equates to a dividend yield of 3.2% at the current buying price of 465p per share, which is fairly respectable.

The spread is very wide here, and it's a pretty horribly illiquid share. The three largest holders hold 50% of the shares, so that means the free float is quite small, and not many shares are traded on most days.

This one might make a good longer term investment though, as you would imagine that with many signs of the economy recovering, the hospitality sector is likely to be buying more crockery than in the last few years, indeed there is probably pent-up demand. So things are looking good for the company, well done to holders of the shares.

Please bear in mind that, in common with other financial websites, Stockopedia's data is updated overnight. So when a share price rises a lot, remember that the company data on the StockReport will relate to last night's closing share price. So things like the PER and dividend yield will NOT reflect today's big price rise, until tomorrow. That's important when making decisions - i.e. you need to adjust the figures manually on days when the share price has moved a lot.

As an afterthought, I am wondering if there is any read-across to a pottery share I hold, Portmeirion (LON:PMP) ? It's in a different segment, as Portmeirion is more ornamental, collectable crockery. But the valuation looks similar to Churchill China before their recent rise.

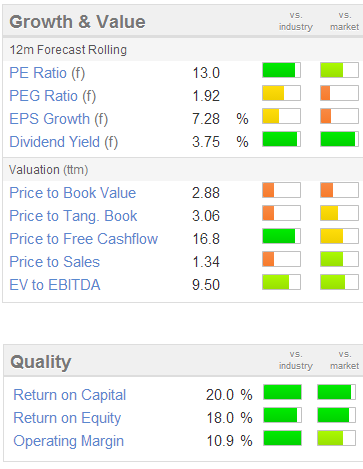

Portmeirion is currently showing (see graphics on the right) a forecast PER of 13, and forecast dividend yield of 3.75%, quite good value.

It also has net cash (although some was spent on buying out the freehold of their H.O. lease). I wouldn't be surprised if this one puts on another upward leg, if they are also trading well, but we'll have to wait and see. Last year they gave a trading update on 21 January, so not long to wait.

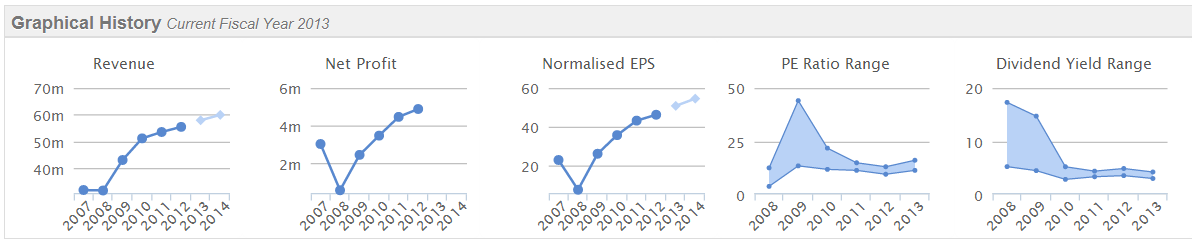

It also has an excellent track record of growing profits & EPS in recent years, which is not bad at all considering how the economy has been in their main markets (UK, USA & S.Korea). So now economic growth is emerging, there could be scope for profits growth to accelerate, which would in my opinion justify a share price nearer £10 than the current £7. Here is the Stockopedia graphical history to illustrate my points:

This brings me onto strategy at the moment. The trouble is, especially in small to mid caps, all the low hanging fruit (i.e. bargains) are gone now. So the place to be looking for value is by researching companies in more depth, and anticipating which ones will out-perform against broker forecasts.

We're increasingly seeing how operational gearing can be transformative for a company's profits once they start to decently grow sales - and often higher sales go hand in hand with higher gross margins, because products or services that are in demand can command price rises by the supplier.

Broker forecasts tend to lag behind reality, both in an economic downturn (when brokers remain too optimistic, and over-estimate profits), and in an economic recovery they tend to be too pessimistic, and in particular they tend to inadequately forecast for operational gearing. So you often see forecasts where 10% sales growth is predicted, and profits will also be up 10%. Yet operational gearing means that a 10% rise in sales will drive a very much higher rise in profits, as I demonstrated in this Tuesday's report using Topps Tiles (LON:TPT) as an example.

So I need to remember that broker forecasts are often wrong, and often wrong by a lot, because of operational gearing. So on reflection I've been treating forecasts with too much certainty, and the investment winners of the next year will be the people who can identify companies in advance which are going to greatly beat their broker forecasts.

So in my view 2014 will be the year of the investor who can get under the bonnet of companies in detail, and pick up on situations where there are early signs of sales & profits rising strongly, and spot the significance of that before the rest of the market does. So it's not going to be easy, as in most cases share prices are up with events now, or even too high. Plus of course if you pay up-front for growth, and it doesn't materialise, then you're going to suffer a nasty loss on that share.

The alternative of course is to just sit in cash and wait for the bargains to come to you. That's very often what the most successful investors do. There is no rule that we have to be 100% invested all the time. Indeed a lot of the shrewdest people I know are currently at least 40% in cash. Sure as night follows day, sooner or later the market will have a panic, and throw some bargains at us, and you can only buy the dips if you have some cash on the sidelines.

It must be pretty galling to be the founder/CEO of a group for 12 years, and then when you announce your retirement the share price shoots up. That's exactly what's happened at Creston (LON:CRE) today. Their shares have risen a remarkable 10% this morning to 103.5p, which reinforces extremely negative bulletin board comments last year about management which I noticed. There seem to be significant concerns with Creston shareholders about excessive Director remuneration packages, and in particular overly generous share options schemes. The disclosures on share options in their Annual Report were so complicated & confusing, that in the end I gave up trying to understand the full picture.

This is a much wider issue - in my view the managerial class draw far too much in remuneration out of most companies, and this situation has arisen largely because so much of the shareholder base is non-voting. What I mean by that is that Directors have cottoned on to the fact that many, even most shares will not be voted at general meetings, because those shares are held in Nominee accounts - not just private shareholders who usually hold shares in this way, but also the CFD & Spread Bet holdings will almost always be held in a non-voting form too.

This effectively leaves many management teams in complete control, able to do whatever they like, including setting their own pay (through the thin veil of supposedly independent Non-Execs). The only brake on them are the Institutional shareholders, who are part of the same managerial class! So what we have seen over the past couple of decades is a ratcheting up of executive remuneration to levels that cannot possibly be justified, especially with some smaller caps where Directors are being paid £400k+ packages in some cases, which can be wildly out of kilter with their ability, and the value they add.

The closer you get to London, the more excessive remuneration becomes. Which is why I like investing in companies in the Midland, and North of England, and Scotland. You tend to find much more grounded management, who are not greedy, and have a better work ethic - the type of people who just get on with the job, rather than schmoozing people with slick powerpoint presentations.

Sometimes I like to compare the total cost of the Board of Directors with the annual profits of the company, and it's not at all uncommon to find situations where Director remuneration is 25%+ of profits. You then have to ask exactly for whose benefit is the company being run? Especially if there is little or no dividend, the answer must be that it's being run for the benefit of the management, not the shareholders.

What we need is a revamp of the system, to empower shareholders, and a change in the rules so that remuneration is set by a shareholder committee. Or at the very least, for Director remuneration to be proposed to shareholders in advance, and be subject to a binding vote.

Also, all shareholders should be allowed to vote directly, with the nominee system scrapped. It's way past its sell-by date, and we already have the technology to just have an electronic shareholder register where all shareholders can vote directly via the internet. Incidentally, it is already possible to have a personal CREST account for individuals, and ShareSoc have been suggesting that private investors take up this facility.

The current situation where often greedy Directors line their own pockets at the expense of shareholders, whilst driving up profits through very often forcing down wages of the lowest level staff, is not only immoral, but is also economically counter-productive - to have a healthy economy we need the benefits of economic growth filtering down to everyone, not just a privileged elite. To hear myself saying these things, having been true blue all my life, is surprising, so there is clearly a major problem here that needs addressing.

Board room pay needs to come down - I would say by roughly half, and pay for the people at the bottom needs to increase considerably. So as shareholders we should be campaigning for these changes, and going to AGMs to challenge Director pay. If they get a barrage of indignation at the AGM from angry shareholders, then they will think twice before plundering the coffers. If nobody turns up, then they will carry on ratcheting up their pay. Everyone else will benchmark to the highest level (when has a company ever said their Directors are in the bottom quartile? But 25% of them must be!), and so the process of ripping off shareholders carries on. Things have to change.

I'm not saying all companies are like this, but many are. There are also some shining examples of sensible Director pay, such as Spaceandpeople (LON:SAL) and Zytronic (LON:ZYT) which is one of the reasons why I like those companies - good management who work hard, and pay themselves sensibly.

Another positive change would be to restore tax breaks for long-term shareholding. That would bring back more shareholder oversight, whereas at the moment the Stock Market is just a casino, where most shares are traded in such short time frames that the holders don't give a damn about corporate governance or executive pay. So bring back incentives for long-term share ownership, and that will all change for the better - as shareholders will begin to think & act like owners again, instead of speculators.

Going back to company news, there is a trading update from TT electronics (LON:TTG). I'm not sure what they do, something to do with electronics, so am only looking at the numbers, to see if it might be of further interest to do more research on. For the avoidance of doubt, that's the thrust of these reports generally - I just have a quick skim of the day's results and trading statements, to see if anything of potential interest crops up. As I cover about 500 shares, there isn't time to go into things in any great detail - that's up to readers, to DYOR on any initial ideas that I throw up here that sound interesting.

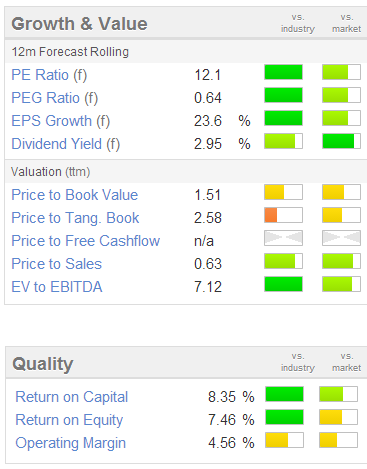

TTG say that trading for 2013 was in line with expectations, and that the order book "continued to show a positive trend ...". Strong cashflows resulted in a net cash position of £26m at 31 Dec 2013. They intend using the Balance Sheet strength to drive organic growth, and selected acquisitions.

TTG say that trading for 2013 was in line with expectations, and that the order book "continued to show a positive trend ...". Strong cashflows resulted in a net cash position of £26m at 31 Dec 2013. They intend using the Balance Sheet strength to drive organic growth, and selected acquisitions.

I like the sound of this one, as it's on a reasonable valuation - check out the mainly green (i.e. good) valuation measures on the right.

That seems to me a pretty good starting point, especially as earnings could surprise on the upside in a recovering economic situation across Western economies.

So based on a fairly attractive valuation, and positive-sounding trading statement, I think this one is worth of some further work. A good start would probably be for me to find out what they actually do! I shall report back if it looks interesting, this might be one of my research jobs for the weekend. But there are enough positive indicators to make it worth investigating further as a possible value situation.

I almost forgot to mention, the company has also announced in today's statement that it is relocating its operations in Wene, Germany, to lower cost areas. They say this will have an exceptional cost of £30m, which looks an awful lot, it's about 10% of their entire market cap. However this will deliver "efficiency benefits" of around £8m from H2 of 2015. That's almost a four year payback period, which strikes me as a bit questionable. They say it will also hold back profitability in 2014, so perhaps this might just be a share to put on the watch list instead? Major restructuring can go wrong, so this increases the risks of a profit warning in 2014, so I might hold back, and buy on a profits warning instead (if one happens).

Even though I published a positive write-up on XP Power (LON:XPP) when they were 1304p on 9 Jul 2013, unfortunately I omitted to buy any shares myself, thinking that there was no rush. That caused me to miss a nice rise in the share price in the last six months. They are now 33% higher at 1728p.

Their 2013 year end trading update today sounds positive, with sales up 8% for the year. They also make positive noises about the outlook, talking of "encouraging signs of recovering global demand for the capital equipment manufactured by our customers". Margins also improved, so this sounds good.

Net debt has come down to just £3.7m at 31 Dec 2013. They seem to pay dividends quarterly, and a total of 53p will be paid for 2013, giving a yield of 3.1%, and it's worth noting the strong growth in dividends in the last six years, up from 20p in 2007.

Also noteworthy is a very strong operating profit margin, of 22.4% for 2012, which indicates considerable pricing power, a positive indicator of competitive strength.

That is confirmed by these interesting comments in the outlook statement (my bolding);

XP Power has a long-established strategy of targeting blue chip customers with strong leadership positions in their respective markets, and whose insistence on vetting their suppliers' design and manufacturing facilities acts as a significant barrier to entry to many of the Group's potential competitors.

This strategy remained successful in 2013 and we believe that we continued to take market share as a result. Furthermore, the macro-economic outlook for our customers appears to have slightly improved during the second half of 2013 and we consider that we are well placed to benefit from this improvement.

The rest of the outlook statement is positive, but not strongly so, saying;

Orders received in 2013 were £103.7 million compared to £96.6 million in 2012. We enter 2014 with positive momentum and we therefore expect that we should be able to show further modest growth in revenues in 2014.

With the forward PER now about 17, it looks priced about right to me, hence is not of interest to me. As a long term holding though, I can see the attractions, but personally I would want a cheaper entry point than now, and think I missed the boat when the opportunity presented itself six months ago.

OK, that's it for today, and the week. I hope you enjoy the weekend, and please keep the comments coming, the idea is for these reports to be interactive, so I particularly like comments from people who flesh out things I have commented on with more details, especially where you think I'm wrong, or have missed something important.

Regards, Paul.

(of the companies mentioned today, Paul has long positions in PMP & SAL, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.