Good morning!

Feel free to send in your requests and I'll work through them.

Cheers

Graham

Stadium (LON:SDM)

- Share price: 131p (-1.5%)

- No. of shares: 38.2 million

- Market cap: £50 million

Trading Update and Notice of Results

Checking the archives, I see that myself (one time) and Paul (several times) have refused to criticise this wireless/power/electronics business very much. It had a nasty profit warning last year which gave the share price a big shock, but it has recovered well and the shares have re-rated since then.

This short update confirms that things are back on an even keel, as trading is in line with expectations and ahead of the equivalent period last year.

Encouragingly during this period the Company's order book has continued to grow to above £28m, up from £25.8m at the year end. Consequently, the Board remains confident about delivering further positive progress in the current year.

The quality statistics shown below don't inspire me to to look into it in great detail but the StockRank is 93 and it's been a solid performer over the years, and the rating is still not terribly high. So it's a reasonable contender for a value portfolio.

Accrol Group (LON:ACRL)

- Share price: 149.5p (-4%)

- No. of shares: 93 million

- Market cap: £139 million

Preliminary Results for the Year ended 30 April 2017

This loo roll manufacturer / tissue converter joined the market in June of last year, so this is its first set of results for performance as a listed entity.

Worth mentioning that it's an example of a successful IPO, at least over the short timeframe of one year. The IPO placing was at 100p.

Solid headline results, with the following selected highlights:

- Revenue increased 14.2% to £135.1m (FY16: £118.2m)

- Gross Profit increased 9.3% to £37.7m (FY16: £34.5m)

- Adjusted profit after tax(1) increased 57.3% to £11.0m (FY16: £7.0m)

- Profit after tax increased 29.3% to £7.4m (FY16: £5.7m)

And elsewhere (in my own words):

Net debt is reduced to £19 million, so the debt multiples look very safe now.

Market share is a very impressive 50% in the "Discount Sector".

New and expanding manufacturing facilities in Leyland, Lancashire.

Worth noting that Accrol is a tissue convertor - it's not actually manufacturing reels of paper. It's buying in the tissue and then cutting and preparing it for distribution to retailers. The company describes this as a source of competitive advantage. Whether that's true or not, it's important to see that the scope of Accol's activities is narrower than might otherwise be assumed.

Dividend is not bad at all - 4p for the final, on top of 2p for the interim.

My opinion: I note that the founding family have moved on and that their remaining shareholdings are not terribly large in comparison to the institutions which have piled into these shares.

I don't see this as particularly positive. I'd be more interested if the founding family was still running it and owned most of the shares.

Given that they've moved on, the shares are of course still worth looking at. The CEO makes a good argument about the value of the discount sector for tissues being on the rise (10% per annum), as stretched consumers don't see the point of paying up for branded products. Accrol is embedded in the big supermarkets and discounters (relationships with Booker and Lidl both mentioned in the blurb).

Outlook is good though it seems to rely on macro conditions improving, which can't really be counted on:

Despite the exchange rate driven inflationary pressures and the slower than expected consumer price increases which the whole industry faces into, the Directors remain confident that when price increases do come though, our sourcing policy and investment in capacity, supply chain efficiency and people has positioned Accrol to take advantage of the marketplace dynamics.

Overall, it's another reasonable and inoffensive holding! StockRanks agree, with a rating of 62. Will probably get more interesting when something goes wrong and the shares can be bought for a recovery!

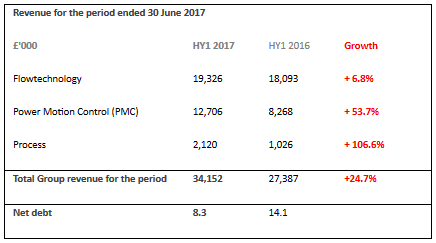

Flowtech Fluidpower (LON:FLO)

- Share price: 143.25p (+2%)

- No. of shares: 51.7 million

- Market cap: £74 million

This is the UK's leading supplier of technical fluid power products. Fluid power means hydraulics (fluids under pressure) and pneumatics (gas under pressure).

I went off these shares recently when I read about the company's plans for acquisitive growth. I'm just not interested in acquisitive strategies any more, too many costs and poorly executed plans.

Revenues are up and debt is still at a workable level:

Net Debt continues to be well within available facilities and covenants providing further scope for the Company to utilise its own resources to fund accretive acquisitions in H2.

Separately today, there is the announcement of an acquisition of a company in a related space for £1.5 million plus extra payments of c. £2.1 million (max payable is £9 million) on an ex-cash basis. It's the third acquisition so far this year.

Outlook sounds fine:

The Group's current underlying performance will deliveranother year of solid progress. As a business, we are confident in our strategy, commercial opportunities and the prospects of the Group and, the business remains on track to meet current market expectations for the year ending 31 December 2017.

I wish the company the best but this is not really my type of investment.

Having said that, if I was ignoring specific company strategy and using a more quantitative approach, I would probably include this stock within a large portfolio. Greenblatt's Magic Formula is my favourite quantitative approach and this scores really well on that front:

Carillion (LON:CLLN)

- Share price: 117p (-39%)

- No. of shares: 430 million

- Market cap: £503 million

This building support services group is (still) over our market cap limit, despite today's fall. But it has been widely discussed in the comment, and could potentially fall within our limits?

25% of shares outstanding have been shorted, which is huge by UK standards. Indeed, it is our most shorted stock.

Today's update is grim. H1 operating profit is lower than expected due to timing of disposals in certain PPP interests, and furthermore:

· Deterioration in cash flows on a select number of construction contracts led the Board to undertake an enhanced review of all of the Group's material contracts, with the support of KPMG and its contracts specialists, as part of the new Group Finance Director's wider balance sheet review.

Result: contract provisions of £845 million, having associated net cash outflows from these projects of £100 - £150 million.

And: revised full year guidance. Revenue between £4.8 - £5.0 billion, overall performance below previous expectations.

It's widely known (not least by the shorters) that Carillion carries plenty of debt, and average borrowing over this interim period is now expected to £695 million.

As a general rule of thumb, when debt is bigger than the market cap, you need to be extremely careful. Most of Carillion's "Enterprise Value" is now in the debt load.

So it has accelerated its debt reduction plan, with more/faster disposals, cost savings, receivables recovery and with no dividends this year.

An interim CEO has been hired from the Board. Unstable management is of course another red flag.

The Board announces today that it is undertaking a comprehensive review of the business and the capital structure, with all options to optimise value for the benefit of shareholders under consideration. An update on the Board's review of the business and capital structure will be provided at the Group's interim results, in September.

"All options" - sounds like a capital raise might be up for discussion.

It was helpfully pointed out in the comments that similar business Costain (LON:COST) raised a lot of money for its balance sheet, which it then used simply to look stronger when it bid for contracts. Nobody wants their support services provider to go bust mid-contract.

Though I found it strange that Costain (LON:COST) raised so much money and then didn't actually use it, maybe it was the correct strategy after all. Maybe potential Carillion (LON:CLLN) customers are turned off by the company's debt load?

Either way, things are definitely looking creaky here now. Operating margins have been c. 5% over the past several years and it looks like they could be severely under pressure with these contract provisions. Carillion will be generating a lot of "empty revenues" this year.

As regular readers are aware, I'm allergic to dilution, so could not be tempted into this.

Impax Asset Management (LON:IPX)

- Share price: 98p (+4%)

- No. of shares: 128 million

- Market cap: £125 million

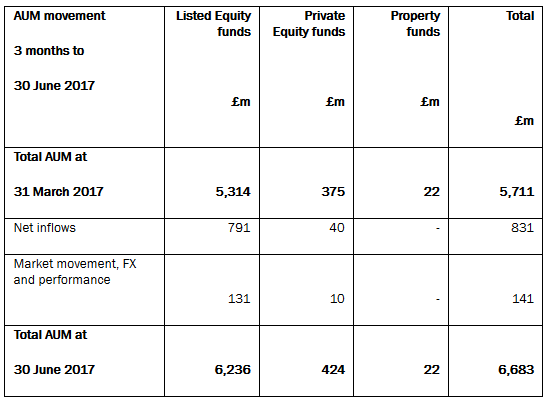

Regular quarterly update from this environmental-focused asset manager.

Net inflows were 15% of the starting amount and that's just over the quarter.

Asset management companies generate a lot of operating leverage, as their platforms can often manage vastly increased amounts of capital once they've been set up, hiring very few additional staff to do it.

The market cap is now just shy of 1.9% of AuM, much lower than the equivalent ratios for larger asset managers. If the AuM keeps growing, I'd expect to see an improvement in the share price not just directly from the improved AuM but also from an improved rating assigned to that AuM.

That makes this one to watch.

That's all for today, sorry if I didn't get to the stock you recommended!

Best wishes

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.