APOLOGIES - I'VE MESSED UP THE FORMATTING.

It took ages to get it back, so I daren't tinker with it any more & lose everything again.

Good

morning! Apologies for my outage yesterday - I wrote up a report

yesterday evening, so here

is the link for

that, where I reported on news

from: Tungsten (LON:TUNG), Maintel

Holdings (LON:MAI), Transense

Technologies (LON:TRT), Escher

Group (LON:ESCH), Clarkson (LON:CKN)

Lots

of results today, so this report will probably take me most of today,

therefore please refresh the page every now & then.

John

Menzies (LON:MNZS)

Share

price: 388p

No. shares: 61.3m

Market

Cap: £237.8m

Final

results -

for calendar 2014 are out today. They're not very good, although that

was expected since the company issued a profit warning on 5 Nov 2014,

which I

reported on here,

when problems arose at its aviation division.

Then

on 16 Jan 2015 the company put out an in line with (reduced)

expectations trading statement.

Here

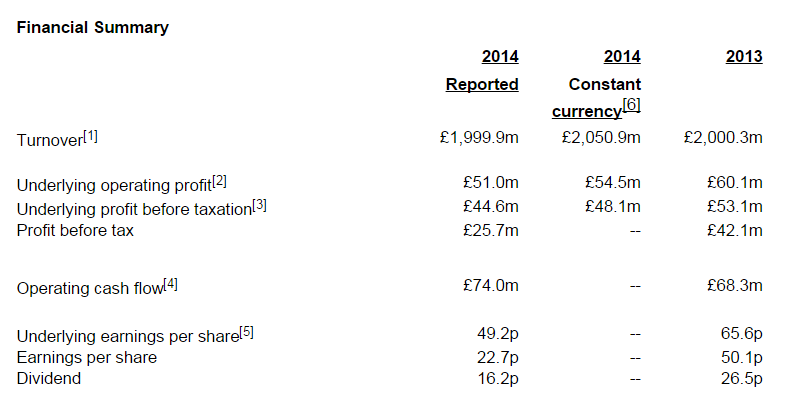

are the financial highlights for the 2014 results;

Points

to note;

It's

a high turnover, low margin business (operating margin only 2.6%),

so should be cheap.

Underlying

EPS of 49.2p is a whisker below forecast of 49.9p, so that's OK.

Dividend

cut - as I predicted in my last two reports, the dividends looked

unsustainable, and have (sensibly) been cut by 39% to 16.2p for the

year - a yield of 4.2% now.

Balance

Sheet -

there are a number of issues, and overall I describe the balance

sheet as weak. The company claims to have a strong financial

position, which just isn't true, so it's really annoying to see them

repeating that claim today. If the financial position was strong,

they wouldn't have cut the dividend, would they?!

Net

assets of £69.7m become -£46.4m when you write off the £116.1m

intangible assets. Anything below zero NTAV is a red flag for me.

Current

ratio is 1.0, which is low (I look for at least 1.2, and preferably

1.5+)

Debt

is a little higher than I am comfortable with, at £143.6m, although

this is partially offset by cash of £32.8m, giving net debt of

£110.8m.

Capex

- the business looks fairly capital-intensive, with £28.1m being

spent on capex in 2014, and total property, plant & equipment

having a NBV of £120.1m.

Pension

deficit - as you would expect, this has got worse, with £59.0m

showing on the balance sheet, although the imminent triennial

actuarial valuation for 31 Mar 2015 will no doubt be considerably

worse. The overpayments are considerable, at c.£13-14m p.a.

Outlook -

the H2-weighted year comments for 2015 worry me - that's usually a

deferred profit warning;

My

opinion -

at 388p per share, with 2015 EPS forecast at 50.8p, the current year

estimated PER is 7.6. Whilst that might look cheap at first sight,

once you factor in the pension deficit payments, and consider net

debt, together with lacklustre performance in low margin and

ex-growth activities, it's difficult to see much appeal here.

The

dividend was yielding about 7%, but that was clearly unsustainable

(anything over 6% usually is), and with the divis now cut to an

unremarkable yield of 4.2%, it has less appeal for income seekers

too.

Overall,

I can't see anything appealing here.

Synectics (LON:SNX)

Share

price: 138p

No. shares: 17.8m

Market

Cap: £24.6m

Final

results -

for the year ended 30 Nov 2014. As expected, these are bad - the

company warned on profits last year, due to its biggest sector being

selling CCTV systems to the oil & gas sector, which has obviously

seen big cutbacks when the price of oil plunged.

The

company put out a profit warning on 27 Oct 2014, which I

reported on here.

Although without wishing to sound too smug, I also warned readers

earlier than that, on 29 Jul 2014 that the interim figures didn't

look right - in particular the very large debtor balance was a

big red flag. So it went on my bargepole

list on

that day at 335p per share. It's down 59% since then, which just

shows that checking the balance sheet for reasonableness is

worthwhile.

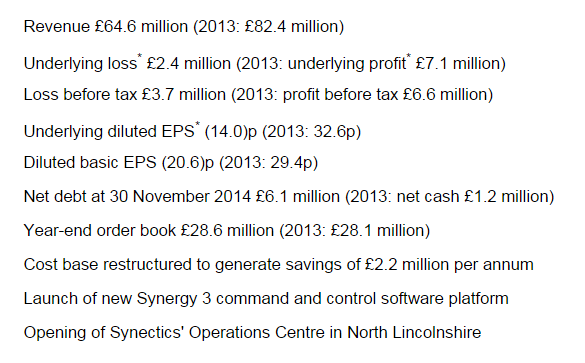

Here

are the highlights from today's results;

The

swing from net cash to net debt particularly worries me. Banks don't

like funding losses, so things could get sticky there if the company

cannot fairly quickly demonstrate an improvement in trading.

It

looks like they are roughly at breakeven on an underlying basis,

after reducing the cost base by £2.2m p.a.

Balance

Sheet -

this is still a big area of concern to me, and I'm seeing red flags

within current assets. In particular, whilst turnover has fallen from

£82.4m in 2013 to £64.6m in 2014, the debtors figure on the balance

sheet has only dropped a little, from £27.7m to £25.6m. That looks

way too high to me. To my mind, an acceptable level of debtors would

be about two months turnover, maybe three months at a push (to allow

for VAT). So three months turnover is £16.2m. The actual debtors

figure is £25.6m, so £9.4m more than what I consider to be

reasonable. Therefore getting a breakdown of what is in debtors, and

what the aging of those debtors is, would be imperative.

Similarly,

inventories should have gone down, but has actually gone up from

£9.7m last year, to £12.6m this year. Again, that doesn't make

sense, when turnover has fallen considerably, to be holding more

inventories.

It

all suggests to me that there could possibly be lots of junk on

the balance sheet, which might need to be written off, giving rise to

a further (and large) potential loss. These seem to be

preliminary, rather than audited results, so I hope the auditors have

spotted the red flags of high inventories & debtors, and will be

looking closely at those areas.

My

opinion -

if the figures don't look right, then I don't invest. These figures

don't look right, so it's staying on my bargepole list. It's high

risk, with bank debt having shot up, and the company being

loss-making. On the other hand, if they can recover to previous

levels of sales & profits, then all would be well. Shareholders

should probably be prepared for being asked to stump up more cash, as

the bank may not be prepared to continue funding any further losses.

Interquest (LON:ITQ)

Share

price: 96.5p

No. shares: 35.2m

Market

Cap: £34.0m

Audited

results -

for calendar 2014 are out today. They look strikingly good, with

adjusted PBT up 96% to £4.5m. However, checking back to my

notes here from 8 Jan 2015,

that is in line with the trading statement released on that day. So

no surprises here, just in line results.

The

big jump in profitability seems to have come from an acquisition made

in late 2013.

My

opinion -

overall it looks OK. The PER is just under 11, which is about

right for a staffing company, there are lots on AIM at valuations

typically of a PER between 8 and 12.

The

balance sheet isn't great, relying on bank debt to part-finance the

debtor book, but again that's normal in this sector.

Net

tangible assets work out at only £2.6m, rather weak.

If

you recall, this is the group that put itself up for sale last year,

but nothing came of it. It's probably priced about right for the time

being.

Begbies

Traynor (LON:BEG)

Q3

trading update -

profitability, and net debt, are said to be in line with

expectations.

Goals

Soccer Centres (LON:GOAL)

Final

results -

for calendar 2014, show flat operating profit, but an improvement in

profit before tax due to a lower financing charge. It's a nice enough

business, but where's the growth? A 1% increase in underlying EPS to

14.5p is hardly worth writing home about. At 226p, the shares don't

look good value on a PER of 15.6, given the lack of growth, and the

still significant level of debt (although that looks under control

now, having been excessive in the past).

Overall,

I'd say the price is a tad on the high side. Current trading so far

in 2015 has been flat against last year.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.