Good morning!

I'm starting to notice patterns in market behaviour in these more nervous/volatile conditions of late. Whenever there is a large sell-off in the USA, then the Futures seem to gradually recover the following day. Also, you see very little selling in UK small caps - no sign of panic at all today for example, even though the Dow dropped 465 points from its peak yesterday.

I find that rather encouraging - it suggests to me that UK small cap investors are committed to their shares, and not easily panicked. Although I have noticed very low volumes being traded in small caps on days like today - so it seems that buyers go on strike, rather than there being any meaningful selling on days like today. You can't dip in & out of small caps anyway, as the bid/offer spread will destroy your returns.

With a lot of positive newsflow and results being issued at the moment, this still feels like a bull market in small caps, even if the big Indices are struggling - a lot of which is due to particular sectors, such as oil/resources, and banks. So I think it's best to sometimes detach from looking at Indices, and focus on which sectors are under pressure, or doing well.

Overall, with the economic situation looking fairly positive here in the UK, and in America, and with signs of recovery in Europe, this doesn't strike me as a time to be particularly worried about macroeconomic things, any more than usual anyway. Cheaper oil is great news for most people, and most companies...

Petrol - disposable income

Some interesting read-across from big cap results today. WM Morrison Supermarkets (LON:MRW) interim results are not great, as expected, but I note that fuel sales are down 16.8% to £1.6bn. That is mostly due to the lower price of oil feeding through to the pump. So if we assume say 2% is due to lower footfall (carfall?!) and the remaining 14.8% is price deflation, then I make that a £278m "tax cut" for people who bought fuel at Morrisons in H1, or £556m p.a. I've no idea what market share Morrisons has for fuel, but for the entire market we must be looking at multiple £billions in extra disposable income in the pockets of the UK consumer. This has to be positive for consumer cyclical shares generally, and reinforces my view that this area is the best hunting ground for good shares at the moment.

Living Wage

Next (LON:NXT) is the latest company to comment on the impact of Minimum Wage increases, there's an article on CityAM here summarising it. Worst case scenario is they have to put up prices across the board by 1% - hardly a disaster, although mildly inflationary (good time to do it, when inflation is low). Although productivity gains should mitigate.

It's becoming increasingly clear that Living Wage shouldn't have much impact for investors, other than for marginal businesses which cannot pass on any price increases without losing business. Other companies will just hike prices a bit, trim staff rotas a bit, and profits should not be affected that much.

Another point to consider is the new pension arrangements coming in, I think in 2017? I've just been reading up on "auto-enrolment", and it seems to require employers to contribute up to 3% of employee wages into a pension scheme. What's the betting that, over the long-term, successive Governments will gradually increase employer obligations to fund pensions?

So it seems to me that investors need to think about these two headwinds, and ask companies how they will cope.

Ricardo (LON:RCDO)

Share price: 880p (down 1.5% today)

No. shares: 52.4m

Market cap: £461.1m

Results y/e 30 Jun 2015 - this is an engineering group, which I've not reviewed here before, but seeing as it's a quiet day for small caps results, let's check it out.

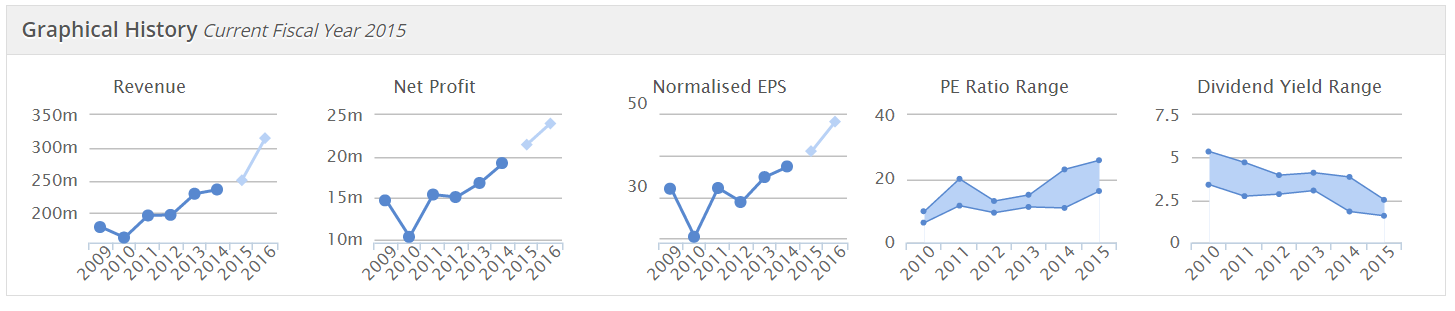

The Stockopedia graphical history shows a good trend of growing turnover and profits, forecast to continue. However, it also shows that the shares have been getting more expensive, with the PER range rising, and the divi yield range falling. That's not necessarily a bad thing, if the future potential of the business has been improving, but a higher rating eats into your margin of safety as an investor - you can't afford to get your research wrong, if you buy stocks on a PER of 20 or more!

Acquisitions - four have been completed in y/e 30 Jun 2015. Investors need to be careful not to over-value acquisitive companies - it's easy to mistake the step changes in profit from acquisitions for organic growth, and hence end up paying too high a PER for a business which might actually have little organic growth going on. You also have to watch the balance sheet, as it can rapidly fill up goodwill and bank debt. If you don't adjust the valuation for that, then you'll over-pay again, potentially.

Underlying EPS 42.4p (up 9.6%) - that doesn't seem much of an increase, so the acquisitions must have been quite small, and/or near the end of the financial year. The PER is 20.8 - rather lofty. Note the PEG will be expensive, unless more growth is feeding through into 2015/16.

The 42.4p EPS achieved is a beat against broker consensus of 41.2p (corrected from earlier typo - my apologies), which is encouraging - as it shows a company which is managing investor expectations well, and keeping a little bit back to out-perform on results day.

Dividends - total for the year is 16.6p (up 9.2%, similar to the rise in earnings). The company has established a good track record of progressive dividends, more than twice covered. The yield is an unexciting 1.9%. Still, that's better than cash in the bank, and it's rising a lot faster than inflation, so not to be sniffed at for long-term investors.

Net cash/(debt) - pleasing to see the company has net cash overall, not net debt. The figure is £14.3m. Although this net figure is split £59.7m cash, less £45.4m debt.

Ah, hang on a minute! Note that £40.6m was paid out the day after the year end, to complete an acquisition, and a further £3.2m paid for a smaller acquisition in Aug 2015, so the real position is now pro forma net debt of £29.5m, which looks fine given the size & profitability of the group.

Balance sheet - this looks solid to me. Net assets are £116m, take off intangibles and NTAV is £71.1m. The current ratio is healthy, at 2.12, but that will drop a fair bit post year-end due to the acquisition payments, but will still be healthy at 1.49 (calculated by reducing cash by £43.8m for the acquisition payments mentioned in the paragraph immediately above this one).

Note there is a pension deficit of £20.7m.

You have to think about the balance sheet in the context of how profitable & cash generative a company is, and in this case everything looks fine to me - this is a sleep fairly soundly at night type of stock.

Outlook - sounds pretty upbeat to me, although it's lacking any financial specifics;

Market conditions remain positive in the UK and Asia, with a good pipeline of defence vehicle activity in the US and recent secured wins in the motorcycle sector in Germany. We enter the new financial year with a good order book and pipeline across the Group, together with large, long-term assembly contracts and the addition of four new businesses, which all provide confidence in the further development of the Group. As we celebrate our centenary year, our order book and financial position provide a good platform for future growth and we continue to actively look for opportunities to expand and enhance our business.

Valuation - this seems to be a good quality business, which is performing well, and that is reflected in the valuation:

My opinion - based purely on a quick review of the figures, this share looks priced about right to me. I don't know anything much about the company, or its prospects - that's the research that other people need to do before buying the shares.

The market looks to have priced it about right, based on the facts as they stand today, which is good because that's what markets are supposed to do! The opportunity with this type of share, is to find companies which are likely to significantly beat market expectations, as that will then trigger a re-rating. I don't know anywhere near enough to make a judgment on that, so for the time being my view is that it looks a nice company, probably priced about right, based on the current forecasts for this year, and the historic numbers.

Bear in mind also that the shares have had a lovely re-rating in the last two years, so might be at the top end of what is reasonable for the time being perhaps? It looks the type of business that might get a takeover bid from the USA at some point too, so that could be a joker in the pack here possibly?

Haynes Publishing (LON:HYNS)

Share price: 112p (down 8.6% today)

No. shares: 15.1m

Market cap: £16.9m

Trading update - the company says it is required to make a "material non-cash impairment of goodwill", relating to its US operations. I don't care about writing off goodwill, because I always do that anyway, but the concern is that it is being done because their US operations are trading badly.

Overall though, group performance is in line;

The Group now expects to report a material non-cash loss after tax as a result of the impairment. Pre-exceptional items, the Group expects to report results in line with expectations.

Year to date operating performance within HaynesPro and Haynes UK is satisfactory whilst the US business is trading below expectations. The board of Haynes intends to launch an operational and cost review of the wider Group and will report to shareholders as the process progresses.

The trouble is, there don't seem to be any market forecasts, so in line with expectations could mean anything! Checking back, the last set of interims were pretty bad - turnover down 20%, and PBT only a whisker above breakeven.

The balance sheet looks superficially quite strong, but it contains very high inventories. There could be a need for a substantial write-down there at some point in future. Note also a hefty £14.9m pension deficit. It also had £1.0m in net debt.

My opinion - this is looking high risk now to me. The company is clearly going to have to strip out a lot of costs, in order to remain profitable at all, and keep the bank onside.

I suspect the divis are likely to be cut completely here at some stage, since cash will need to be preserved to repay bank debt, and keep topping up the pension fund.

Sadly, there's not much call for car repair manuals these days, so it's difficult to see much of a long term future for this company that I'm sure many fellow petrol-heads have fond memories of clambouring underneath my old car years ago, covered in oil, and constantly referring to my Haynes manual!

The best case scenario now is probably that management can successfully manage the decline, but I doubt there will be any value for shareholders, so with a heavy heart, sadly I'm putting the shares on my bargepole list.

Cambridge Cognition Holdings (LON:COG)

Share price: 75p (down 6.3% today)

No. shares: 17.0m

Market cap: £12.8m

Interim results - this is a very interesting little company, which has long-established computerised tests for detecting and monitoring dementia.

I'm a little disappointed with today's interim results. Although turnover rose 17.7% to £2.93m, the company reported a loss before tax of £0.28m - improved from the £0.47m loss in H1 last year, but I was hoping to see profitability, because it made a maiden profit of £0.18m in H2 of last year. So sequentially, this is a step backwards.

Although it's fair to say that at this stage of its development, the cashflow from profitable activities is being reinvested in growth. So as long as losses don't spiral, then breakeven or small losses are tolerable.

The company only has £1.26m cash in the bank, so not much headroom there, although no immediate cause for alarm either.

My opinion - I'll keep a watching brief on this one, as I like the company, its products, and think there is considerable long-term potential here. The CEO, Nick Kerton, who I met earlier this year at an investor event, has been seriously unwell, and receiving intensive treatment. May I take this opportunity to send him my best wishes for a full recovery. The COO, Steven Powell, is standing in as Acting CEO.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.