Good morning!

China fell again overnight, but the US futures seem to be firming up, at least for now anyway. Doing a lot of reading over the weekend, it seems to me that the US markets are pricing-in a soft patch in the US economy, and possible spillover from the Chinese economy also slowing. Therefore, unless the forward-looking economic data improves, then this time "buying the dip" would possibly be the wrong thing to do.

Combine that with main US Index charts which look very much like they have topped out, and are now in a bear market. So my conclusion is that this is probably a time to be relatively cautious - it's not a good time to be using gearing, and probably sensible to get rid of low conviction positions, to raise cash for better bargains that might appear if people start throwing out the babies with the bathwater.

Although as most of my positions are reasonably priced things that I have confidence in, my long term portfolio remains unchanged.

CEO Interviews

I've just published the transcript of my interview with the CEO of Brady (LON:BRY) (I hold a long position in this share) on my website here. Reading it again, I think the CEO gave reasonable answers to my questions, and took the criticism (of the profit warning) on the chin. It's good to find a CEO who is prepared to face the music after a disappointment, and doesn't just want to talk to investors in the good times. That particular interview was done because the company approached me, and asked for a "right to reply", following my sharply critical comments in these reports.

People seem to like these interviews, so I'm doing more. Later this week there are 2 new interviews lined up, so please submit your questions using the links below (as that collates the questions into one place). Please don't put questions in the comments section below this article, as they just get lost.

Proactis Holdings (LON:PHD) interview, morning of 14 Jan 2016 - an interesting & growing group, specialising in cost control software. Your questions here please.

Best Of Best (LON:BOTB) interview, afternoon of 15 Jan 2016 - long-established supercar competition company - originally in airports, but now increasingly via internet - questions here please.

(I hold long positions in both these companies)

Home Retail (LON:HOME)

(at the time of writing, I hold a long position in this share)

Sainsburys deal? - I've been amazed/dismayed at the generally short-sighted, and ill-researched commentary on this company in the blogosphere, mainstream press, and from city analysts, re the potential takeover from J Sainsbury (LON:SBRY) . Unlike most, I immediately saw the logic of such a business combination, and it's clear from the SBRY announcement that they are committed to doing a deal if they can.

Retailing is changing rapidly, and it's now all about combining conventional stores with efficient internet selling & logistics - in particular (see John Lewis's last update) the crucial importance of click & collect, and Argos is also trying to establish a ground-breaking national same-day delivery service. Customers are tired of poor delivery, with those annoying cards put through the letterbox, with all the associated hassle. Things are moving on, and Argos is up there in the right place with click & collect, and same-day delivery.

Argos is turning into a hybrid retailer & logistics company - e.g. Ebay sellers can use Argos stores (at no extra charge) as a collection point. The idea is to focus consumers on using Argos stores as their main local hub to collect items from. Combining that with Sainsburys stores, which already have high footfall, is a brilliant idea - using surplus space, and there will be numerous cost and efficiency gains. I seem to be one of very few commentators/analysts who actually "gets it".

An article in the Sunday Mail yesterday suggested that a deal is likely to go ahead, at 155p+.

Personally I've banked most of my gains, as risk:reward is now looking finely balanced. I'd rather reassess after the trading update this Thursday. If that means missing out on some of the gains, so be it. The downside risk is that the TU is a stinker, and potential bidders walk away. Downside risk in that scenario is a share price of probably about half the current level - not a risk worth taking, in my view, for relatively modest upside.

Balance sheet - the other absolutely key point about Home Retail (LON:HOME) which almost all commentators have completely overlooked, is its enormous balance sheet strength. This was core to my bullish view of the company, indeed I saw takeover approaches coming, and flagged the likelihood of bid(s) for HOME late last year.

HOME has net cash, and a huge (over £500m) storecard debtor book, with no associated debt. These are forecast (combined) to be c.£800m. So a bid at say £1.2bn for the group, would actually only have a cash outlay for the bidder of £400m! It's an absolute steal at that price, for the UK's 2nd or 3rd largest internet retailer, and with Homebase thrown in for free, which could be sold on to PE.

Sure, Argos has problems, but nothing that can't be fixed. It's digitally focussed, and doing all the right things, in terms of where retailing is going in the future. In my view a combination of Sainsburys and Argos is a very good proposition, and would, given time, enhance the value of both businesses.

In particular, Argos stores have relatively short leases remaining - apparently half of its stores have leases up for expiry (or break clauses) in the next 5 years. So there is a big opportunity to relocate some Argos branches into the largest SBRY stores, thus cutting costs. Also SBRY could do all its non-food buying through Argos's existing buying department.

Although it's Argos's logistics and IT capabilities that SBRY wants the most. I've heard that from a senior former employee at SBRY's HQ.

Shorters - HOME was one of the most heavily shorted shares in the UK market, with about 8.5% of the company having been shorted. This made me salivate, when going long of the share, because I knew my analysis was correct, so having a large group of forced buyers would catapult the share price higher once bidding interest in the company emerged. That's exactly what happened.

It's been glorious to see shorters, who got it completely wrong, running for cover - in particular after Crispin Odey's haughty & snobbish comments last year about Argos being no good, because it was too working-class! How ridiculous. So karma has taught him a lesson hopefully, with a multi-million loss.

Most of the time shorters do better research, and are very often right about bad companies, but they also sometimes get it wrong. When they are wrong, shorters are the investor's best friend, as they become forced buyers to cover their shorts once the newsflow has turned positive. So you can just sit back, relax, and watch the money roll in to you, as they drive the share price back up again. They have to keep buying even if they don't want to. Very enjoyable.

Let's turn to today's company news next.

SkyePharma (LON:SKP)

Share price: 408p (up 4% today)

No. shares: 104.8m

Market cap: £427.6m

(at the time of writing, I hold a long position in this share)

Trading update - relating to the year ended 31 Dec 2015. This reads positively;

Full year revenues for 2015 are anticipated to be ahead of the Board's previous expectations announced on 26 November 2015, primarily because the Group's license partner, Mundipharma, has agreed that the first flutiform® sales milestone of €10 million (£7.4 million) will now be recorded in 2015. This will be through the release of deferred income and no cash will be received as it will be used to meet a large part of the balance of Mundipharma's right to recover up to €25 million (£17.6 million) of previous development costs, as already disclosed.

The Group's cash and cash equivalents as at 31 December 2015 was approximately £41 million and net cash was approximately £35 million. Cash generation in the second half of the year benefited from both a robust operating performance and the later timing of payments for capex projects, which remain on track.

The above only mentions sales being ahead of expectations, but no mention of profits.

FinnCap have said this morning that their forecasts are likely to be on the low side, and are being reviewed. So it looks as if earnings estimates are more likely to go up than down.

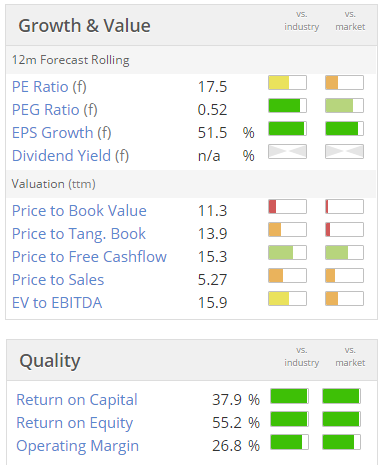

Valuation - with a strong balance sheet, and good growth, the valuation doesn't look particularly demanding to me, despite the strong share price rises recently. Note the excellent quality scores below too. I wonder if my friend Leon Boros would see this as a QARP.

Note also that Stockopedia's black boxes like it too, with a StockRank of 85.

My opinion - obviously I like it, having a long position in the share. I wonder if a takeover bid might be the eventual outcome here, as tends to be the case with successful drug companies. It's not a sector I know or understand, but SKP is relatively easy to research, since you can value it on a conventional basis, on an earnings multiple.

So it gets a thumbs up from me.

GVC Holdings (LON:GVC)

Share price: 470p (up 0.1% today)

No. shares: 61.3m

Market cap: £288.1m

Trading update - this gambling company reports what look like strong figures for Q4. Of particular note is that the 10% rise in Net Gaming Revenue ("NGR") was despite a big currency headwind - the figure in constant currency was up 21.3%.

I am assuming these increases are organic, because no mention is made of acquisitions, but that is worth double-checking.

The Directorspeak sounds upbeat;

"I am delighted to report yet another set of strong numbers as 2015 year ended very positively for GVC. The Board and I would like to thank all our staff for their hard work and continued focus. With the shareholders of both GVC and bwin.party digital entertainment plc ("bwin.party") having voted overwhelmingly for the acquisition of bwin.party on 15 December 2015 and with completion expected on 1 February 2016, and the enlarged GVC Group expected to be admitted to the Main Market on 2 February 2016, we are enthusiastic to commence the integration of the businesses and to continue to drive shareholder value for investors in the enlarged Group."

Annoyingly though, no mention is made of profits versus market expectations - which is a glaring omission, as that's the most important aspect of trading updates. So we can only assume that the results will be in line, or perhaps a bit ahead?

My opinion - I don't really have one, as am not up to speed on the numbers for this company. Any meaningful analysis would need to look into the acquisition of bwin.party in detail, as this is a highly material acquisition, which will make the group much larger.

So far, so good though - the shares have 4-5 bagged in the last 5 years, and paid juicy dividends on top. There used to be a huge dividend yield here, but this is now showing as down to 3.1%.

Also, just to flag that you have to be very careful about regulatory and tax issues, with this type of company, which is why these days I tend to steer clear of the online gaming sector. Why complicate life?

Laura Ashley Holdings (LON:ALY)

Share price: 26.25p (down 1.9% today)

No. shares: 727.8m

Market cap: £191.0m

(at the time of writing, I hold a long position in this share)

Laura Ashley Australia - I'm surprised the listed company has been so slow to announce this news to the market, even though it's not material to results overall, and will probably be presented as an exceptional item.

The Australian franchisee has gone bust;

The Company has been made aware that its license partner in Australia has been placed into voluntary administration. Laura Ashley has an exposure of circa. £1.2 million and is continuing its discussions with the administrator regarding the future of the Australian operations.

There is no effect on the rest of the Laura Ashley business.

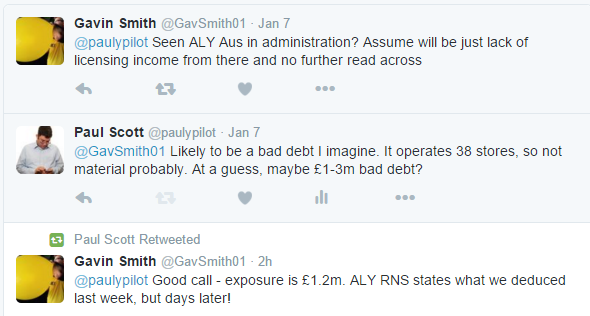

What is surprising is that it has taken several days for the company to announce this, as it was in the press in the middle of last week. Indeed, 4 days ago the following Twitter exchange began, where I correctly estimated the likely range of the bad debt, after several of us had picked up from the Australian press that Laura Ashley Australia had gone bust;

This is an interesting point - that as investors, we can get ahead of market announcements simply by monitoring the press, and the internet generally. Automatic Google searches are useful for this - I have several set up for companies which are my biggest holdings, and I get an email every morning showing anything relating to that company that Google has found.

If it's publicly available information, out there on the internet, then you're not insider trading, you've just got hold of useful information from an alternative public source than the company itself.

In this case, this information really shouldn't affect the overall valuation of the company very much at all, indeed any move should have happened last week. When you're sharing a profit margin with a licensing or franchisee partner, unfortunately there will be the occasional bad debt.

Generally speaking, I try to widen my sources of information, and not just rely on company announcements. Third party information is often more useful than what the company itself tells us (which will nearly always be skewed to the positive).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.