Hi everyone,

I'm back after a busy few days in London.

This report will cover Foxtons (LON:FOXT), McBride (LON:MCB) and Sigma Capital (LON:SGM).

Today's Part 1 by Paul is here, where he is covering Shoe Zone (LON:SHOE) and Joules (LON:JOUL).

Foxtons (LON:FOXT)

Share price: 95p (-4%)

No. shares: 275.1m

Market cap: £261m

Trading Update (for the year ended 31 December 2016)

Remarkably weak against comparatives:

Total group revenue for the year was

circa £133m (2015: £150m), with revenue for the quarter ended 31

December 2016 totalling circa £26m (2015: £35m).

As might be expected, the more cyclical, sales-driven revenue stream is responsible for the weakness, not lettings:

The reduction in Group revenue for the year reflects

the significant fall in sales volumes immediately following the first

quarter of 2016. In the final quarter of 2016, sales revenues were circa

£12m (2015: £20m) as volumes remained subdued. Lettings revenues in Q4

were circa £13m (2015: £13m) and have remained more resilient,

benefitting from our high levels of renewals despite lower levels of new

tenant activity and some downward pressure on rents arising from

increased stock availability.

The outlook statement for 2017 is quite bland, saying that at the current rate of sales activity, "it is likely that 2017 volumes will be below those in 2016". Indeed!

From the previous trading update, I note that Q3 sales revenues were down 34% on the previous year, whereas Q4 sales revenues are down 40%. So perhaps full-year 2017 sales revenues might end up c. 40% down on 2015, unless something changes?

The previous update remarked that the company remained "highly cash generative with no debt". Today's update changes the focus a little bit, mentioning EBITDA margin instead of cash generation. Although it again emphasises that the company remains debt-free.

My opinion: This is a great stock for a pub debate, if you're interested in the London property market (which quite a few people are, unsurprisingly!).

Something which I still find rather unsettling is how the company spent over £28 million on dividends and buybacks in H1 (more than 10% of the current market cap), just as conditions were deteriorating.

It's of course very difficult to predict the property market, but that was a rather significant mistiming from a company which should have an excellent vantage point from which to detect trends.

Worse still, the share buybacks were executed at an average price of 169p. My rule of thumb is that if the share price ever halves after a buyback, it was definitely a mistake. Let's see if we get there!

Sales were responsible for £23.5 million (about half) of Foxtons' profitability (adjusted EBITDA) last year. Assuming very tough conditions in that segment for the short-term (or the foreseeable future), which the company was not expecting, I would remain uncomfortable with the current market cap, as I was at the interims in July. Flexible costs will cushion the blow, at least.

McBride (LON:MCB)

No. shares: 182m

Market cap: £327m

Trading Update (for the six months ended 31 December 2016)

I will try to keep this brief, as the trading update is in-line:

The Group's first half year financial performance has been encouraging, with quality of earnings continuing to improve from further positive progress on margins and costs. As a result the Board remains comfortable that the business is on track to deliver its full year expectations for adjusted operating profit.

The company has sought to reduce complexity, and therefore deliberately reduce customers, to enable an increase in margins. In other words, it is behaving rationally!

So the 7% constant-currency revenue decline in this latest period has not spooked the market too much, since 2.5% of this is deliberate.

My opinion:

I always want to take a second look when I see a company acting responsibly and in the interests of shareholders - turning down business to improve margins and efficiency is often one of those actions. Too many management teams prioritise sales (vanity) instead of more important objectives.

So when I read the management discussing a much-improved adjusted ROCE in their executive review of last year's results (to June 2016), I tend to think that it's probably an above-average management team. And with that measure rising to 24%, I tend to think that it's probably a better-than-average company, too.

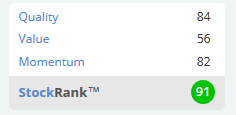

The StockRank tends to agree with my suspicions:

I will stay reticent on the question of valuation, since net debt of £91 million, as of last year, looks rather on the high side.

Still, this could fit nicely within a portfolio of high-Stockrank shares (although please always remember to do your own research - as this is just my opinion, not investment advice).

Sigma Capital (LON:SGM)

Share price: 84.5p (+0.6%)No. shares: 88.7m

Market cap: £75m

Trading Update (for the year ended 31 December 2016)

A first look from the SCVR at this property and regeneration specialist, with focus on rental properties for families.

"Broadly in line" results are expected (this is sometimes interpreted as a slight miss, but the shares are up today regardless):

The Company continues to make encouraging progress

and results for the year are expected to be broadly in line with current

market expectations. This has been achieved without the benefit of the

launch of an additional phase of managed PRS before the year end and

reflects a better than expected performance from both Sigma's own

self-funded activities and its regeneration projects with local

authorities.

Outlook is good:

Prospects for the new financial year remain positive, with a substantial pipeline of qualified development opportunities and strong rental demand across the portfolios.

I see there was a sharp correction on September 30th, when the H1 report was released (on the last day permissible). This was due to the delays hinted at in the first paragraph above, leading to the company "materially rebasing management expectations

in the near term".

My opinion:

I'm not sure yet what the investment case is here. Net assets at June were reported to be £33.1 million, or 37.3p per share, though investors were willing to pay 75p per share in 2015 for the launch of the company's own PRS (private rental sector) portfolio.

PBT is forecast at £3.9 million this year. A few regeneration/development projects could see this figure multiply in 2017.

As I said with Watkin Jones (LON:WJG), there is a lot of variance when there are just a few projects - and the valuation needs to reflect this.

Therefore, adjusting for risk, the current share price might be annoyingly accurate.

On the subject of sectors, Paul and I may become more clearly-defined in terms of which ones we are each covering (although there will continue to be a strong element of overlap).

Paul is obviously very strong on retailers, while I am quite happy covering financials, insurers and property. So we might divide our coverage along broad lines such as this in future.

If you feel there are sectors or stocks which lack coverage, or if you have any other ideas, please don't hesitate to leave a message or send a comment!

Regards

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.