Good morning.

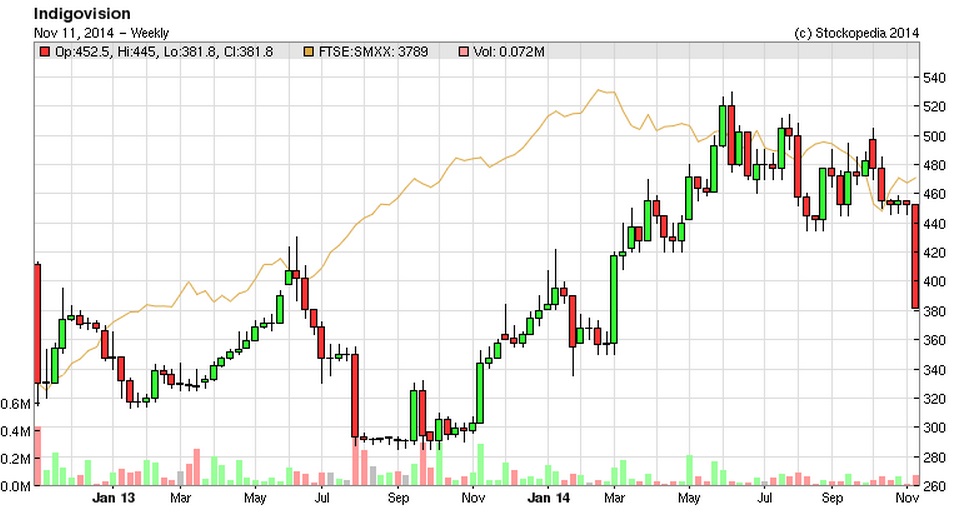

As Lord Lee described at Mello Derby, every now and then you wake up and look at your screen, and get that sick feeling when you see something in your portfolio has plunged, therefore there must have been a profit warning. Scanning the prices on my iPhone, one jumped out at me - IndigoVision - it should have started with a 4, but today it starts with a 3, which only means one thing - either gremlins have seized the controls at the software company providing the prices, or there's been a profit warning.

Indigovision (LON:IND)

Share price: 381p

No. shares: 7.6m

Market Cap: £29.0m

It's a profit warning I'm afraid. The first step is to shake off the emotional response of disappointment/despair- that just clouds your judgment. The task at hand is to reassess the valuation & prospects of the company, based on the new information available, and make a considered decision on whether to sell, hold, or buy more.

First I check whether the price has stabilised, and what price change & volume has occurred so far today - yes it has stabilised, and the price is currently down about 16% at 381p mid-price. That tells me that the market considers the news today to be bad, but not a disaster. A typical profit warning, where trading has badly deteriorated, can be expected to instantly scrub off 30% of the market cap, so a 16% drop here suggests to me that the company has announced disappointing, but not disastrous news.

The market quickly adjusts the price of any share that puts out fresh information, so unless something has structurally changed at the company (i.e. things are going to get much worse in future), then the price will have already corrected to a new level which by and large reflects the new information. There may be a buying opportunity if leveraged positions are being dumped at any price by the spread betting companies, but that's clearly not the case here. Total volume reported so far is 69,952 shares, about £273k-worth, based on an average price of about 390p.

Looking at the reported trades, a flurry of small retail sells in the first 8 minutes of trading this morning took the price down to the current level, so anyone with any decent-sized holding would not have been able to sell anyway. That's the way it is with micro caps - the lack of liquidity is such that you place your bets, and then have to live with the outcome. There could also be larger, delayed trades of course - the prints you see straight away are only the small trades, and if you can't work out why the price is falling/rising against the tide of reported trades, then that's because a bigger seller/buyer is in the background, and will be reported on a delayed basis sometimes an hour later, or at the end of the day, or not for a few days, depending on the size of the order being worked. That's why it's meaningless to look at the reported trades, and try to interpret whether they are buys or sells. ALL transactions are by definition, both a buy and a sell. If the price is going up, then buyers are engulfing sellers, and vice versa. Price is all that matters.

Profit warning - for the avoidance of doubt, anything in blue text here means I've inserted a link to the documentation, so you can click through to the original source of information.

This is an unscheduled update, based on the fifth quarter to 31 Oct 2014. Has he gone mad, I hear you cry? There are only four quarters in anything. Not in this case - the company is currently in a one-off 17-month period, since it has changed its year end from 31 Jul to 31 Dec. We already knew the company's performance for the year to 31 Jul 2014, which was good - turnover up 16% to a record £37.2m, and operating profit up 20% to £2.5m.

So today we have an update from 1 Aug to 31 Oct 2014, and the 15-month period to date. This is what the company says;

Group sales for the fifteen months ending 31 October 2014 were £43.4m, 9% ahead of the 15 month comparative period to 31 October 2013. In the fifth quarter, covering August to October of the current 17 month financial period to 31 December 2014, good rates of sales growth continued both in North America and in Europe, Middle East and Africa, but this was offset by lower sales in Latin America and Asia Pacific. As a result, overall Group sales for the fifth quarter were below expectations. Gross margin percentage for the fifteen months remained in line with that reported for the 12 months to 31 July 2014, and in line with expectations.

Outlook - this bit is a bit more encouraging;

Although overall Group sales for the fifth quarter were disappointing, the Group continues to expect double digit sales growth for the 17 months to 31 December 2014, and the medium term outlook for IndigoVision remains favourable. As a result of the lower than expected sales in the fifth quarter, the Group currently anticipates that operating profits before foreign exchange movements for the 17 month period to 31 December 2014 will fall short of existing market forecasts.

Given that sales are up 9% in the 15 months to 31 Oct 2014, then expecting "double digit" (i..e over 10%) sales growth for the 17 months, suggests that the order book is good for Nov & Dec. The company has a track record of being very straightforward in how it reports things - although it has little visibility on orders beyond about 6 weeks ahead.

Forecasts - at the moment the house broker suggests turnover of £54.0m and profit of £3.8m for the 17-month period to 31 Dec 2014. The company says it will "fall short" of profit forecasts. Not materially below, or any other wording to suggest a disaster. So based on the update today, I reckon that we're probably looking at a lower profit in the £2-3m range.

My opinion - it's yet another disappointment, but the trouble is the lumpy & high margin nature of orders, means that profits are inherently erratic with this company & others like it.

In the past, the company has always recovered from profit warnings, and it you had bought after profit warnings, then you would have done well overall.

It has a particularly strong Balance Sheet, and pays good dividends, so that will support the share price.

The company does zero financial PR, so it is always relatively cheap compared with other more promotional small cap shares. That is frustrating at times, but also means there is not so far to fall when something goes wrong - as there aren't really any speculative holders of the shares who bought on it being pumped up in the press & elsewhere.

I feel that it's wrong for the broker to publish a single profit forecast. The business is inherently unpredictable, so they should instead move to publishing a range of forecasts, which in this case I think would be quite wide. So for next year, the base case might be say £1m profit, with upside to say £5m if they land a handful of big contract wins. If shareholders understand that the range of possible outcomes is wide, then expectations are suitably grounded. That is far preferable to latching onto a £3m forecast, and everyone moving in waves of excitement, followed by despair, when the company over or under performs.

The £29.0m market cap looks about right to me, given this latest disappointment. Therefore I'm neither a buyer nor a seller. The picture could quickly change for the positive, if they land one or two big deals before the year-end - this stock is totally unpredictable.

Are things going badly wrong? No - they have disappointed in two regions (Latin America, which has been very strong in the past due to a roll-out of Colombian town centre CCTV projects, and Asia Pacific);

...good rates of sales growth continued both in North America and in Europe, Middle East and Africa, but this was offset by lower sales in Latin America and Asia Pacific.

So it's mixed. The company is financially strong, so can ride out bumps in the road like this.

It's frustrating that this company comes so close to great things, but always seems to stumble just as sales & profit growth are taking off. That said, the market cap is cheap, the Balance Sheet is bulletproof, margins are high, it's selling globally in competition with the major players in the sector, so I'd rather sit tight here than buy into some ramped up story stock that has never made a profit - which is the alternative on AIM, often at considerably higher valuations.

(updating every few minutes, please refresh page periodically)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.