Good morning!

I'll make this an earlier, but shorter report than usual, as I have a working lunch in London to discuss the future of stockbroking. So I'll be mainly listening, but chucking in a few points of my own which may not make me very popular - e.g. why do we need stockbrokers and market makers at all? All that's really needed is an electronic order book for every stock, with individual membership for investors within a central clearing house, to do all the admin.

Anyway, before I start WWIII over lunch, let's have a look at a few results & trading statements.

Spaceandpeople (LON:SAL)

Here is the latest in my series of CEO interviews. Yesterday I chatted to Matthew Bending, CEO of Spaceandpeople (LON:SAL) . I think his answers were very open, and interesting. See what you think - the audio is here.

Fishing Republic (LON:FISH)

Share price: 30p (down 6.3% today)

No. shares: 26.9m

Market cap: £8.1m

Results y/e 31 Dec 2015 - this is a small chain (7 shops in N.England) selling fishing tackle & equipment (55% of turnover), and a website (45% of turnover). It floated in Jun 2015, and this is given as a reason why profits barely increased - up from £295k in 2014 to £305k in 2015 on a pre-exceptional basis. £299k of exceptional costs took it down to a whisker above breakeven for calendar 2015.

As a retail roll-out, with online growth too, it looks superficially interesting. However, the glaring anomaly in the accounts is the extremely slow stock turn. In my retail days, we tried to turn (i.e. sell all, and replace with new) stock about every 6 weeks. In the case of FISH, its stock turn is more than a year!

So the P&L shows revenue of £4.1m, with a cost of sales of £2.2m. So the £2.2m figure is the stock (at cost) which was sold in the year. This figure is comparable with the stock at cost figure on the balance sheet, which should be no more than a quarter of that - i.e. c.£550k or below.

Stock on the balance sheet is actually a gigantic (in this context) £2.4m. That's bonkers! Basically this company is just buying warehouses & shops full of stock, which then sits there gathering dust (and probably being pilfered slowly too).

The auditors should be banging the table here, to write-down slow-moving stock. The rules (which I think are still in force) are that slow-moving stock has to be written down to the lower of cost or net realisable value. The auditors are meant to review stock on a line-by-line basis, and insist on the client making a provision against slow-moving stock. Has that happened here? I'm sceptical that it's been done properly.

The trouble is, if you're valuing dead stock at cost, then your profit figure is over-stated. So at some point, this company really should take a hefty provision to write-down the value of its dead stock. If the average is taking over a year to sell, then there must be within that items which are slower-moving still.

The narrative does however state that the inventories figure includes stocking up for 3 new shops, but it doesn't quantify this. Key figures for me, would be what value of inventories are needed for each new shop, and what profit contribution each new shop makes. That would give me an idea whether a roll-out into many more shops would be self-funding or not.

My opinion - a business model which relies on holding an enormous, slow-moving inventory, is very inefficient. Expansion into more sites is likely to require large inventories for those too, which means that expansion might involve taking on more debt, instead of the ideal retail roll-out situation, where inventories are light, and hence expansion becomes self-funding.

I couldn't invest in something with such a wildly inefficient, even bizarre, balance sheet. The inventories issue needs to be sorted out first.

Universe (LON:UNG)

Share price: 8.9p (down 10.2% today)

No. shares: 231.3m

Market cap: £20.6m

Results y/e 31 Dec 2015 - these figures look okay to me - although the market cap looks up with events now, after a very strong run since 2012.

Operating profit is impressive, up 18% to £2.0m.

The company says it let some low margin work go, hence revenues being slightly down to £20.3m. That's fine by me - it's profit that matters, not revenues.

A healthy 10% operating profit margin target has been achieved in 2015, which is good news. Again, I like management that are focussed on margins & profits, rather than chasing revenue growth for the sake of it.

Finance expense of £373k struck me as odd, as the company doesn't have much debt, so rummaging through the narrative, this is explained by what look like one-off factors:

Net finance costs increased by £0.39m to £0.36m (2014: income of £0.03m). This increase reflected a revision to the estimated contingent consideration due in 2016 to the vendors of Indigo (which was acquired in 2013), and results from our success in the convenience store market. Consequently, a provision of £0.22m released in 2014 was largely reversed in 2015. As a result of these movements, profit before tax decreased by 4% to £1.68m (2014: £1.75m).

This has had the effect of depressing growth in profit before tax (which of course is stated after finance costs, whereas operating profit is before finance costs). In fact PBT fell slightly, from £1.75m in 2014, to £1.68m in 2015. We can safely look through this as an anomaly I think, due to the unusual nature of the finance cost above.

Major contract win - previously announced, with Conviviality Retail is rolling out in 2016. So whilst this should be good news for Universe, there's always the risk of a major contract going wrong in some way. So let's wait to see how this progresses.

Outlook - the Chairman sounds optimistic:

Universe remains well placed for further progress in 2016. We will continue to develop our established position in the petrol forecourt market and seek to achieve further strong growth in the convenience store sector. At the same time, we will look for opportunities to enter additional retail verticals. We will continue to invest in the expansion of our product range and services so as to further enhance our offering. We also expect to tender for contracts with major new customers".

Balance sheet - looks fine to me.

Cashflow - much better than most software companies. They're not doing anything silly in terms of capitalising costs, keeping that modest. The cashflows look real, and quite strong.

Dividends - it doesn't pay divis. That seems a bit odd to me. I think it's a good discipline for companies to pay a divi each year - it reminds management who they are working for. If I were a shareholder here, I would be pushing hard for divis to start. There's enough money in the kitty to pay a say 2-3% divi yield.

My opinion - I wasn't expecting to like it, but I do.

Stockopedia's number-crunching likes it too - the StockRank is 83. Anything over 80 is statistically more likely to do well. Or rather, a basket of them will, anyway.

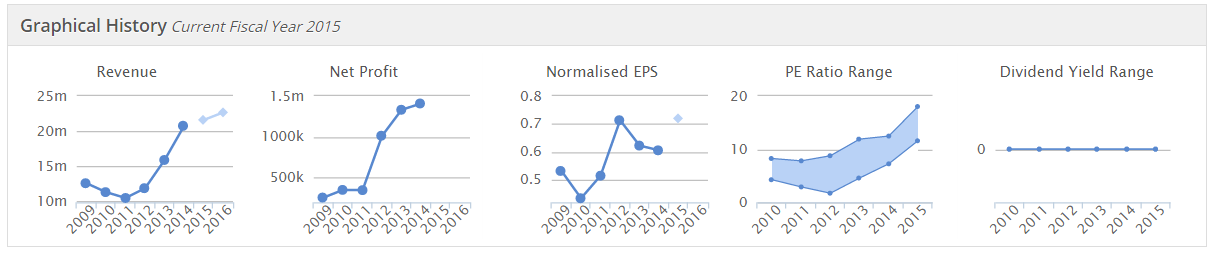

Note how the Stockopedia graphics above show the good profit growth, but subdued EPS growth because the number of shares in issue more than doubled from 2011 to 2014.

Also note how the shares have got progressively more expensive from the "P/E Ratio Range" graph - this used to be a low PER stock, but it's not any more.

Finally, note the lack of divis from the final chart.

I find these 5 little graphs contain a wealth of info, once you learn how to interpret & compare them. Info that can be absorbed in a literally a few seconds, since it's presented graphically.

Software Radio Technology (LON:SRT)

Share price: 33.2p (up 3.7% today)

No. shares: 127.5m

Market cap: £42.3m

(at the time of writing, I hold a long position in this share)

Trading update - for the year ended 31 Mar 2016. The key part says:

Subject to audit, for the year ended 31 March 2016, the Company expects to report results ahead of market expectations with revenue of £10.6 million, a 24% increase on the prior year, and profit before tax of £0.2 million, compared to break even in the prior year. As at the year end, gross cash balances were £1.8 million.

Now clearly a £0.2m profit isn't anywhere near enough to sustain a market cap of £42.3m. That's because the market cap is largely resting on expectations for much better results in future. Therefore it's the order book, and sales pipeline which really matter.

Directorspeak - the CEO tells us about the pipeline:

Simon Tucker, CEO of SRT said: "With a 24% increase in revenue these are another solid set of figures. However, the most significant progress has been made in market development and sales opportunity conversion. As a result, we enter the new financial year with a £70 million forward contract order book, and a validated sales pipeline worth over £200 million, both of which are growing. We therefore expect an exciting year ahead."

Given that turnover in recent years has been around £6-10m p.a., then the above figures are pretty huge. That said, sceptics point out that SRT has bandied around huge pipeline numbers for a long time, with large prospects apparently slipping away, or receding into the future.

As you can see from the chart, the recently announced 3 year deal of up to $100m caused a big jump, which has held so far. I think the house broker is assuming that revenues from this deal will be very heavily back-end loaded, so something like 3:7:90 for the 3 years, from memory.

My opinion - I'll try to get the CEO, Simon Tucker, back on the blower, for a recorded chat. Although it will have to wait until the results are published on 6 Jun 2016, because only then will he be allowed to chat openly.

My feeling is that, if the company does deliver on the $100m contract, then the numbers could be fantastic - it's something like 50% gross margin, so that would be transformational for the company's results. Profits would go through the roof. However, will it actually happen, that's the big unknown?

These graphs nicely show the good year:bad year cycle which has happened in recent years. Also you can see that there are no divis (as expected from a small tech co). PER doesn't really work when profitability it erratic.

This share is all about future potential, which seems tantalisingly close to working out well. Time will tell.

A few quickies before I sign off & head into town.

Lakehouse (LON:LAKE)

(at the time of writing, I have a long position in this share)

Trading update - Encouragingly, the company again reiterates that it's on track to meet full year guidance. It spoils it by then saying that the year will be heavily H2-weighted. As we know, that often actually results in a profit warning in H2, as actual performance fails to live up to hope.

Half of the £50m bank facility has been utilised as at 31 Mar 2016.

I like this bit:

The integration of the acquisitions made in 2015 remains well advanced and all are performing in line with our expectations.

As regards the battle for control of the Board Room, this should be resolved next week. Here are the timings:

I have to dash now. See you tomorrow!

Regards, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.