Molins (LON:MLIN)

Molins (LON:MLIN)

No. shares: 20.2m

Market cap: £10m

Profit warning:

Trading to date in the final quarter has been materially lower than expected, partially due to an unfavourable sales mix and a number of deliveries delayed into the early part of 2017. As a result the Board is revising downwards its expectation of full year performance

As experienced investors will know, most delays aren't fully recovered in subsequent periods.

Shareholders are given a silver lining:

...order intake in the last three months has been

positive, at an increase of 80% over the same period last year, with the

Packaging Machinery businesses in particular benefiting from a strong

period of conversion of prospects. The consequence of this recent order

activity is that the Group is expected to enter 2017 with a

significantly higher order book than it had entering 2016.

So the shares are down by 7.5%, as the reality of a weak year now is offset by the prospect of a good one next time around. That seems to be a fair reaction, as results now are worth more than results later!

Pension: Paul has previously argued, and I agree, that the performance of this business (a good-quality business in its own right, in my opinion) is of secondary importance to investors, relative to the pension fund.

At June, falling interest rates resulted in an accounting pension obligation of £373 million (up from £336 million) against assets of £371 million (also up, from £347 million).

UK Treasury yields may have recovered a little bit since then, but the shares remain effectively call options on the pension fund - the upside is potentially huge, while the downside is that the shares may well turn out to be worthless.

For what it's worth, commissioned research forecasts now suggest that the company will achieve PBT in the current year of £0.8 million, and £3.2 million in 2017.

Share price: 382p (-7%)

No. shares: 41m

Market cap: £157m

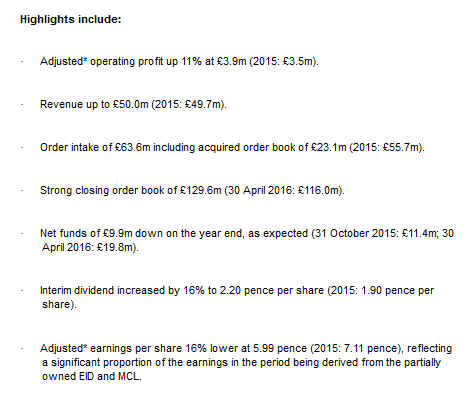

Half Year Results (for the six months ended 31 October 2016)

The market is also a little disappointed with results from this group of four technology companies:

Excluding the beneficial impact of EID ownership, "revenue is down 12% and trading profit down 29%".

Deteriorating performance at the two previously-owned businesses is to blame for this weaker result.

But it's not all doom and gloom. H1 is traditionally weaker than H2, and brokers have been forecasting a big ramp-up in full-year performance this year.

Outlook:

The Group's closing order book of £129.6m (30 April

2016: £116.0m) and recent order wins provide a good level of

underpinning to the second half of the year. We therefore expect, as

seen in the last few years, a much stronger performance in the second

half...

Overall, Cohort's order book and pipeline, market

positions, capabilities and strong funding position provide confidence

that we will make further progress in 2016/17, and we maintain our

expectations for the full year.

My opinion: I believe this is a very professionally managed company. One of the reasons for the forecast improvement in H2 is that a loss-making subsidiary (SCS) has been swiftly restructured and split up between the group's other subsidiaries. While this has unfortunately led to redundancies, the overhead cost savings are c. £1.6 million annually.

However, despite my positive impression of management action, it's not clear that the shares represent good value. The majority share in EID cost only £5.2 million. Even if it has a large order book (£23 million), will it really move the needle in terms of profitability? I tend to assume that sellers in corporate transactions (in this case, the Portuguese government), do not make serious financial blunders.

Anyway, the company appears confident that recent order wins, including £16 million since period-end from clients such as TfL and the Royal Navy, will help it to reach financial targets this year. Those targets provide for a forecast PE of 16x.

Dividends have been rising steadily for at least a decade, and the interim dividend was boosted again today. So perhaps, on that basis alone and in the absence of any major red flags, the company deserves the benefit of the doubt.

Share price: 517.5p (+1.5%)

No. shares: 65m

Market cap: £331m

Half Year Results (for the six months ended 30 September 2016)

I've removed the picture of the results, as there were slightly too many highlights!

The key numbers are:

- 25% increase in revenue to £26.9 million (2015: £21.5 million)

- 43% increase in gross profit to £12.8 million (2015: £8.9 million)

- 97% increase in pre-tax profit to £5.3 million (2015: £2.7 million)

- 61% increase in earnings per share to 5.68 pence (2015:3.52 pence)

Amazingly, this share price has trebled in a year.

Only 3% of sales are in sterling, and that will have been one small factor in the rally. The company previously noted (AR 2016) that "virtually all our sales and majority of costs arise locally in dollars, RMB, or the euro".

The company spent many years (and about £60 million) developing its flagship antibiotic, Aivlosin® , which treats a range of common diseases in pigs and poultry. It is now aggressively exploiting this prior investment and ramping up international sales, as can be seen in the numbers.

The gross profit margin is less than 50%; I would be interested to know if or when 60%+ can be achieved (as is common for pharmaceuticals). Is it particularly expensive to produce their applications - granules, premix, etc?

I cant say too much without specific insight into the addressable market of their antibiotic, but the signs are positive that it is being rapidly accepted by consumers. As a patent-protected molecule, competition should be slim to non-existent for the foreseeable future.

The full-year PBT result is forecast at c. £12.5 million by Peel Hunt. In the context of valuations generally, I can understand why some investors would be willing to pay a high multiple for a good-quality pharma company in the growing animal sector.

But would I chase this any higher? Probably not, at this point. I'd need to understand how big the market for this antibiotic could potentially be.

Petards (LON:PEG)

Share price: 24.75p (+13%)

No. shares: 34.9m

Market cap: £9m

I've been prompted to comment on this small contract win with Siemens, a longstanding customer of Petards:

The equipment to be supplied provides the trains and their drivers with enhanced capability in the areas of security and surveillance through CCTV coverage, both internal and external, of saloon areas combined with pantograph, forward facing and track debris monitoring

The order is worth approximately £2 million. Engineering activities will commence immediately with the first equipment deliveries to be made at the end of the first quarter 2017 and it is anticipated that the project will be completed during 2018.

It's the third contract win announcement from Petards since October, all coming on the back of a promising interim report which showed continuing PBT of £526k. The shares have picked up quite a bit of momentum, doubling since July.

Perhaps if the market cap can break through £10 million, it might show up on the radar screen for a few more investors?

It's probably worth researching in more detail. I tried studying it a couple of years ago, but realised that I would have a lot of difficulty predicting its lumpy contract wins. So in the end I waited for an exceptionally cheap share price, and never quite pulled the trigger on it

Maybe someone is out there with a keener insight into the demand for these products: train CCTV systems, passenger counting systems, etc.

Please note that I updated Friday's SCVR with a comment on Fairpoint (LON:FRP), which issued a very troubling, late-afternoon profit warning.

Paul has extended his relaxation period but will be back soon - no need to worry!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.