Good morning!

Volex (LON:VLX)

My view on this one might be tarnished by my having sold out on the last set of results, which I thought were poor, and the outlook also poor. Debt had risen too high for comfort, and despite the company telling everyone that the level of debt was absolutely fine, they immediately afterwards did an $11m Placing in Dec 2013, having kept the share price up by doing a bullish roadshow about the recovery potential.

So they really do need to deliver the planned turnaround, as the market price is already factoring in improved results. Today's IMS is for the three months to 31 Dec 2013 (which is their Q3, as It's a 31 Mar 2014 year end). The key sentence says;

The Board is pleased to report that there are some clear, but early signs that the implementation of the Volex Transformation Plan announced in November is on track and beginning to deliver results. Group trading stabilised through the final quarter of 2013 and the Board anticipates full year results will be in line with expectations.

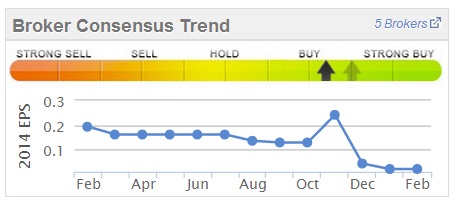

That might sound OK, but bear in mind that broker consensus forecast has been in decline for the last year, as the company has managed down expectations, and is now only a little above breakeven for 2013/14, at a forecast of about 1.5p EPS (remermber that Volex reports in $US so its figures need to be converted into sterling. See the useful Stockopedia graphic on the right, which shows how far broker forecasts have fallen this year.

That might sound OK, but bear in mind that broker consensus forecast has been in decline for the last year, as the company has managed down expectations, and is now only a little above breakeven for 2013/14, at a forecast of about 1.5p EPS (remermber that Volex reports in $US so its figures need to be converted into sterling. See the useful Stockopedia graphic on the right, which shows how far broker forecasts have fallen this year.

Broker consensus is for a strong recovery in profits to about 7.2p next year, so even then the forward PER would be 16.5, so bear in mind that the share price here has already factored in a strong recover in trading, where in reality there are only tentative signs of recovery, as the company admits. I cannot see the logic for paying up-front for a recovery that may or may not happen - that seems like lop-sided risk:reward to me, but skewed against me.

There's nothing in the current update, nor the valuation, that changes my mind on this one - at the moment the turnaround is already priced in, and far from certain to actually happen. It's too much of a leap of faith for me - I prefer to have far more certainty about a positive outcome where possible.

What I suppose the bulls on this share are anticipating, is that Volex might be able to return to peak levels of profitability, which seems quite a tall order. The company's previous strategy of centralising production seems to have been wrong, and they are now making their operations more locally focussed. So I would imagine there are likely to be further restructuring costs. You do wonder after a while whether company profits are real at all, since many companies seem to be permanently in a state of reorganisation, and arguably don't make any money at all overall throughout the whole economic cycle, once you offset restructuring "exceptionals" in the bad years against bumper profits in the good years.

Mello Investor Evening - Chinese companies

A key topic of discussion between investors lately has been about Chinese companies Listed on AIM. They have reached extraordinarily low valuations, if you believe the figures. Clearly most investors don't believe the figures, and who can blame us when so many Chinese companies Listing abroad have turned out to be fraudulent in some way - try Googling it, and you'll come up with all sorts of problems with Chinese companies that Listed in the USA for example.

I'm probably at the most extreme cautious end of the spectrum on this front, in that I believe AIM attracts wrong-uns, because it really has little to no effective corporate governance, and nobody seems to suffer any punishment when they do something wrong - be it just incompetence or outright fraud. So whilst there are many excellent companies on AIM, the overseas ones should be treated with a bargepole in my view. Whenever I have invested in overseas AIM companies, it's been a disaster, and I can only think of one case (£PGB) where I actually made money on an overseas AIM Listed company.

However, others take a view that with the valuation of supposedly cash-rich Chinese companies now in the low single digits on a PER basis, then they could be multi-baggers from here if they turn out to be bona fide companies. Very few pay dividends, which adds to the sense that something isn't quite right, although I note that Naibu Global International (LON:NBU) did recent pay some dividends, which strengthens their case.

Naibu and Camkids have also had a recent artificial boost from being tipped in Simon Thompson's annual bargain shares column in Investors Chronicle. Although heavy selling by insiders has made previous share price rises short-lived in Naibu shares.

Anyway, the organiser of Mello events, David Stredder, has booked in three speakers from Chinese companies Naibu Global International (LON:NBU), Camkids (LON:CAMK), and China Chaintek United Co (LON:CTEK), who will all talk to investors on Monday coming, the 17th Feb. Full details are here about the evening, and how to book a place with David. Numbers are already tight, and this looks to be the best attended Mello event to date. It should be fascinating, as there are a lot of very smart investors at these evenings, and no punches are pulled by Mello regulars in the Q&A!

So perhaps this evening will reinforce, or dispel our prejudices about Chinese companies Listed on AIM? At the very least it should be an interesting & enjoyable evening, so do come along if you wish - as everyone has a common interest in the market, conversation over dinner and drinks flows very easily, there's no need to be shy!

Accsys Technologies (LON:AXS)

A positive-sounding trading update has been issued by this company, which makes the "Accoya" treated wood product. Revenue is up an impressive 71% to E23m for the nine months to 31 Dec 2013. I can't find anything about profitability in today's statement, so based on the net cash figures falling, I presume it must still be loss-making?

The share price has almost doubled in the last two months, and the market cap is now pretty hot at about £100m. There again, they do seem to have a product which is taking off strongly, so with the product apparently being made under licence by Solvay in future, the market is anticipating higher revenue streams and a move into profit. Existing broker forecasts indicate continued, but reduced losses in the current year (ending 31 Mar 2014) and the following year.

So very much a stock for growth investors. I would need to get a much better handle on the likely forecasts before paying this kind of valuation, but it certainly looks worthy of a bit more digging. I like high growth situations, but can rarely stomach the high valuations that come with the territory.

High Valuations

A friend made a very good point to me the other day over lunch, which is worth repeating here. His view (and I agree) is that the market in small to mid caps has been so buoyant in the last couple of years, that many stocks reached a sensible valuation last summer, but have since risen further to an over-valuation. So where this is the case, the price is anticipating the company at least meeting broker forecasts, or more. Therefore any trading update that is not positive will in all likelihood trigger a big sell-off, unless management can achieve what they've done at Volex (LON:VLX), and convince people that everything is fine and the figures will improve in time.

So our challenge (as I see it) as investors is to avoid the banana skins by not paying inflated prices for things, and doing our research to a sufficient depth to ensure that we anticipate problems. So in my view this year will very much be a stock-pickers market, where deeper research pays off. We probably won't get any assistance from the market generally, as how can small caps generally stage another big rise, when they are already fully priced mostly?

People who find good quality companies at reasonable prices, and research them in enough depth to be as sure as you can of them delivering decent results, should do well this year. I suspect a lot of the bubble stocks with growth stories might well pop, but that's perhaps more likely to be a stock-specific thing, when people see results and realise that the emporer has no clothese - although that didn't happen with Ocado (LON:OCDO) recently, where the bulls are still in charge of the asylum with respect to setting the price. Eventually though I think the penny will drop, that it's a badly flawed business model that probably won't ever make a decent profit. You would think ten years' losses would be enough to prove the point, but apparently not.

Hyder Consulting (LON:HYC)

This company warned on profits on Monday, and due to time constraints on the day I didn't have time to report on it, so am circling back now as today is quieter.

My initial reaction to reading the profit warning was surprise that the market had savaged the share price by 27% down on the day, as the factors mentioned all looked like things that should have been anticipated by the market - i.e. an unfavourable exchange rate movement in the $AUS and sterling, combined with a change in Govt policy in Australia. Why did investors not see those issues coming? It suggests a degree of euphoria in momentum investors taking the share price higher than was justified on fundamentals - very much a warning sign for all shares, and certainly reinforces my view that selling partially or fully before results, is not a bad idea for fully valued shares, unless you're absolutely sure they will out-perform.

Their trading statement covers the period from 1 Oct 2013 to date, with the key paragraph saying;

The Group's results for the financial year are expected to be materially below current market expectations due to delays in new contract awards in Australia following the election, and project delays in the Middle East.

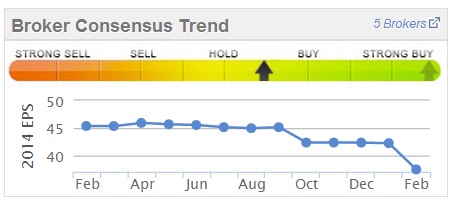

I saw that at least three brokers have downgraded Hyder following this result, and the very useful Stockopedia graphic showing changes in broker consensus over the last year is showing a recent drop, which I presume must be post Monday's profit warning;

Stockopedia is showing broker consensus of 37.4p EPS for this year (ending 31 Mar 2014), and 39.8p for next year. So at 475p per share, that price comes out at a PER of 12.7 and 11.9, which in itself looks reasonable. I double-checked on another site, and they have lower consensus EPS forecasts, at 34.2p and 34.75p for this year & next year, which would drop out at a PER of about 13.9, which doesn't look cheap considering the company is now performing poorly.

I think this one will have to fall into the category of too difficult to value at the moment. My instincts are telling me that it's probably come down from an inflated price to a reasonable price, but I'd like to see the next set of results before taking this idea any further.

Their latest outlook statement from Monday this week is really too vague to make much difference at this stage;

The trading performance in the UK is encouraging, and the level of bidding activity and opportunities in Australia and the Middle East are good. Our strong order book and positioning leave the Group well placed to take advantage of future growth opportunities over the years ahead.

So the key take-away on this share, is that if you pay a full price, and something goes wrong, then expect to be hit with a 25-30% loss. The trouble with this, is that you then need a 33-43% riser to recoup the money from a 25-30% loss, just to get back to even money, because of the way percentages work. Hence why it's so important to try to avoid losses as much as possible.

Also, remember there is a pension deficit at Hyder to consider when valuing it.

Update on lunch with Hargreaves Services (LON:HSP)

For the second time in the last six months, I attended an enjoyable lunch for analysts & brokers with the Directors of this coal distribution, mining & engineering group. I wish more companies would do lunches like this, rather than morning briefings, as it means I can do my morning report here (at a pinch) and then catch the train into London in time for lunch. Also, being fed & watered in return for listening to & reporting on the company's performance seems a fair exchange to me.

I rate the CEO highly here, Gordon Banham. He comes across as completely straightforward, knowledgeable, shrewd, and is obviously in full command of all the facts & figures. So someone I'm very happy to back, indeed I broke my golden rule of trying not to buy stock straight after a meeting, but in this case I did pick up a little stock after the meeting.

As reported here by me yesterday morning, the interim results from Hargresves Services were very good. I was a bit concerned by the comments on the future for coal, but this was all addressed over lunch. The CEO gave a detailed presentations, with numerous slides setting out chapter & verse on future likely demand for coal, and the company's plans for output, etc.

The whole tone of the meeting was dramatically more bullish than last time, about five months ago. The company had then been tidying up problems, with the closure of their last deep mine in the UK, and a fraud had been discovered within their Belgian operations. All that is now water under the bridge now, and management are focussed on their 10+ year plan for the company.

The bulk of their profits come from coal distribution in the UK, which works mainly on a fixed profit margin per tonne, so it's a predictable business, supplying coal to power stations and steel works. Demand will fall, but that has been planned in, and is due to EU rules on emissions. So one slide drilled down to the individual power station level, and showed what demand is expected. Several will close, and this is likely to lead to the lights going out in about two years time. So we are facing an energy crisis in the UK, something which the CEO here referred to cuttingly by saying that our Government doesn't actually have an energy policy at all in the UK. They just blindly follow EU directives, and a crisis is now looming. So there is a real opportunity here, and as the cheapest & most abundant source of energy, coal might well see a resurgence out of necessity in a couple of years' time. If that happens, it's a bonus, but at the moment HSP stacks up nicely without any such benefit.

The most interesting part is that the CEO's vision is for HSP to gradually morph into an international engineering services group. They recently won a contract with a Hong Kong power station, to manage their materials handling, and H+S. This could develop into much more business over time, and is an area they are keen to develop, as HSP has considerable expertise in this area.

So longer term, the UK coal production and distribution is now set up so that it's a cash cow, with little risk, and that will fund both a strongly rising dividend, and the international growth. The CEO did not strike me as given to hyperbole - in fact at our lunch in Sep 2013 he seemed quite dour. However, this time he spoke about now being, "the most exciting time ever for the group, which is there for the taking", and seemed really fired up by the international growth opportunities, to leverage HSP's expertise in coal & steel engineering support services. As he pointed out, the EU may be trying to strangle coal here, preferring cleaner energy, but in Asia they are building many more coal-fired stations. So whilst the UK will never export coal again (as it's too expensive to transport), there are numerous opportunities for British engineering experience to be sold on a consultancy basis. Remember that many emerging countries have grown so fast that there are huge gaps in their expertise which British engineers built up over the last 200 years.

Overall then I think HSP looks good value on a PER of just over 6, which could I think expand to a higher multiple over time as the growth areas begin to replace the cash from coal. Although encouragingly, HSP is rapidly becoming the last man standing in UK coal, and has bought assets on favourable terms, with all legacy issues dealt with. So there should be no more nasty legacy issues, just favourable cashflow from open cast mining and distribution (including imports) for a considerable number of years yet. The cash generated will be used to pay decent divis, and to acquire further assets and finance growth opportunities overseas. All in all, it looks a good package for a long-term portfolio in my opinion.

Right, that's it for today, see you tomorrow.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in HSP and a short position in OCDO)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.