Good morning!

I'm overwhelmed with the volume of results & trading updates today, so will do my best, but this report will probably take the rest of the day to write! So I might have to cut some corners, to cover all the companies reporting today.

Reports of the death of retailers seem premature, with surprisingly upbeat statements from both Debenhams (LON:DEB) (I hold a long position in DEB) and WM Morrison Supermarkets (LON:MRW) today. It's interesting to note that, in both cases, the market did not correctly anticipate that recent trading would be alright - the pessimists were wrong. This seems a pattern at the moment - i.e. that price movements on the chart really are not proving good indicators of company performance at all, and many glaring anomalies have appeared - creating buying opportunities. I'm drawn like a moth to the dim lights of companies surrounded by investor gloom, as selectively you can find lovely bargains, if you avoid the value traps (not always successfully done, by any means, but I'm getting better!)

I've been filling my boots c.400p this morning with Sports Direct (SPD) shares - the dramatic sell-off seems greatly overdone, perhaps because tracker funds might be selling ahead of it dropping out of the FTSE 100? This has combined with a mild profit warning, and numerous press articles attacking the company's pay & working conditions, and general corporate governance issues relating to Mike Ashley's tenuous grasp of (and/or disdain for) the requirements of being a publicly listed company. Him owning 59.4% of the business creates a lot of problems. All of which is great from my point of view, as I'm only interested in it being a fantastic business, that is now very cheap in my view. As always, this is just my personal opinion, I'm not giving recommendations, just chewing the cud on things that look interesting to me. DYOR is the whole ethos of this site remember.

KBC Advanced Technologies (LON:KBC)

185p cash takeover - this looks a done deal, with 42.6% acceptances already secured from Institutional shareholders. Well done to KBC shareholders, this is an attractive exit price (a 49.2% premium to last night's closing price), and all in cash too.

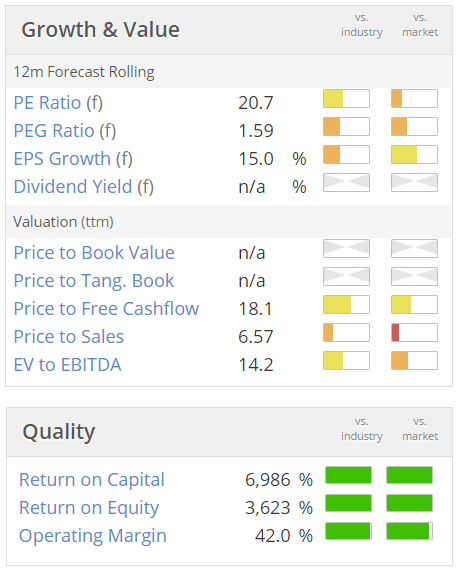

The buyer is a subsidiary of Aspen Technology Inc (NSQ:AZPN) which you can check out using the graphics we're familiar with (on the right), if you have the US edition of Stockopedia.

Aspen has a StockRank of 88, and has amazingly high quality scores, so its fwd PER of 20.7 is perhaps justified.

Note how it's another example of a larger US corporation buying a UK business, in order to drive growth. This is an established trend now, and I suspect we'll see more such takeovers happening. US corporations need to do more than just share buybacks with their surplus cash, so it seems they're exploring overseas for bolt on acquisitions.

Boohoo.Com (LON:BOO)

Share price: 39.5p (up 8.2% today)

No. shares: 1,123.1m

Market cap: £443.6m

(at the time of writing, I hold a long position in this share)

Trading update - this is the one people are really interested in! I know that a lot of readers also hold this stock, as do I - it's my favourite company on the market, as a long-term hold.

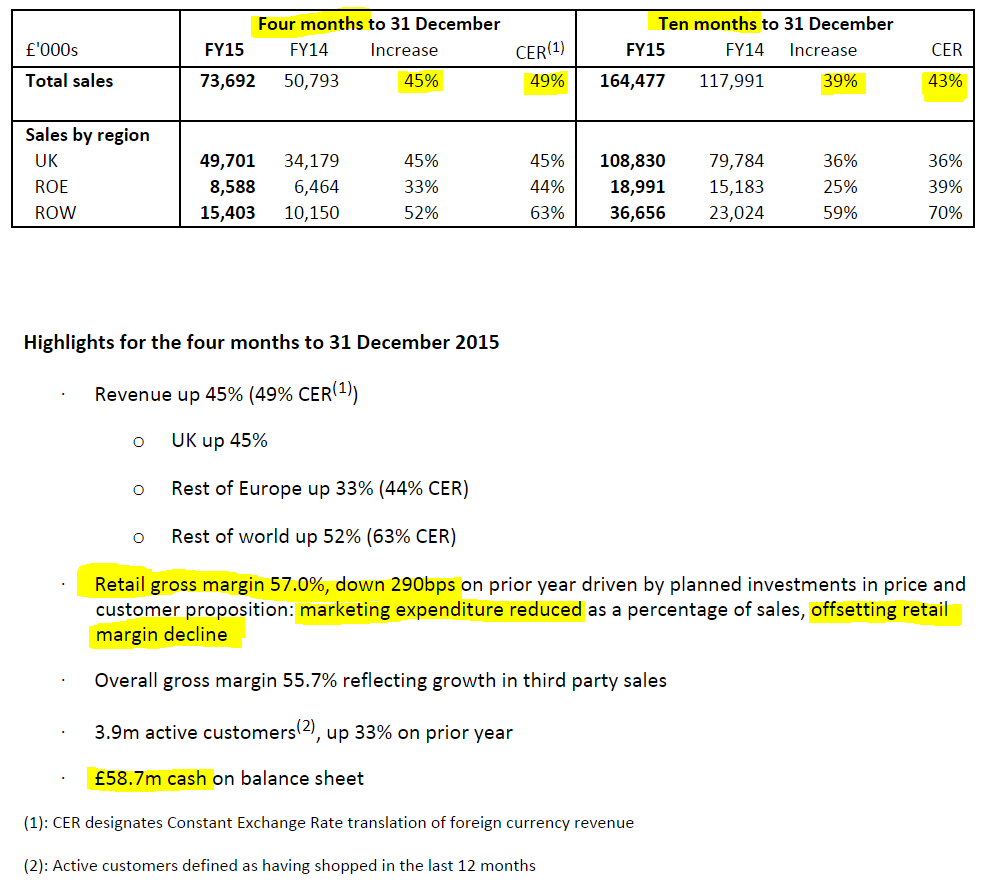

Here are the figures, with my highlighting of points drawn out below;

My comments - excellent sales growth, with the 4-month H2 sales being up 45%. That's a marked acceleration in growth, since in H1 sales growth was +35%. Blending the two together, gives 10 month YTD top line growth of 39%.

This is fantastic growth, as it's all organic. How many businesses in your portfolio are achieving this rate of organic growth? Not many, I bet. This is why the shares are on a premium rating, which they fully deserve in my opinion (and then some). Growth companies are never cheap, so it's a red herring to obsess about the PER when growth is this strong. I thought Asos looked ridiculously expensive when it was £3.50 per share, and it went on to 20-bag! (since come back somewhat, but still about 8-9 times that level. Rapid growth at good margins can transform a business in just a few years, so you have to look forwards, not backwards, when trying to value it.

Gross margin - I had a battle royale with Tom Winnifrith late last year, when he published a bearish note on BOO. So I felt compelled to visit him, and give him a 3 hour lecture in person, about online retail margins (over pizzas and a bottle of prosecco). He described this the next day as akin to being waterboarded! He backed off largely to avoid another of my lectures I think, lol!

Tom's suggestion was that BOO's very high gross margins were unsustainable. So no doubt he will be claiming to have been correct all along, as BOO's margins have indeed fallen, by 290bps to a still very respectable 57.0% at the retail level, and 55.7% overall - lower because it includes wholesaling activity, which is obviously lower margin - BooHoo products are now sold online on Asos, and Next Directory, so the brand is expanding beyond its own website.

What has happened though, is that BOO has made a policy decision to give customers better value for money. This is because sales are highly elastic - you reduce the selling price, and demand greatly increases. This is 100% the right strategy. By giving away a bit of its margin to customers, BOO has achieved very high sales growth, gaining market share, and making life more difficult for competitors.

BooHoo's key competitive advantage is its long-established supply network, which is global. The business was set up by experienced rag traders, with decades of experience & contacts. So the company can source very keenly, and also has very little markdown due to its "test & repeat" business model. It therefore has a huge advantage over bricks & mortar retailers, and can undercut them on price, whilst still achieving a very respectable margin.

Marketing - I was a bit worried that BooHoo might have been spending too much on marketing. At the peak, it can hit 17% of turnover, reducing then to c.10% later in the season. That's a massive spend, and can I think be a case of reducing marginal returns. It's far better to do what they are doing now - cut the prices, and recoup that profit from reducing marketing spend. It's working, and gets a big thumbs up from me as the correct strategy.

Full year outlook - sounds confident;

We remain confident of trading in the remaining two months of the financial year and now expect revenue growth for the full year to be marginally above previous guidance of 30% to 35%. We are trading in line with current market expectations for EBITDA as we continue to invest in driving growth and building market share across our key markets."

EBITDA is a fashionable metric at the moment, but bear in mind that the warehouse facilities have been greatly expanded, so there will be a higher depreciation charge each year.

The key message however is that the business is trading in line with expectations.

My opinion - this is a reassuring update. I am pleased that the company is going for growth, and is driving this by giving customers better value for money. That is the right way to build the business.

I see this being a very much larger business in 5-years, so for me, it's a hold almost regardless of what the current PER is. PER is not a reliable way to value rapidly growing companies. In actual fact, BOO is not outrageously priced at all compared with other growth companies, especially when you deduct the nearly £60m in net cash from the market cap.

As with all growth companies, if anything serious goes wrong, then it's a long way down - as Instis who bought in the IPO discovered a year ago. In my view though, the expectations set at IPO were too aggressive, and the subsequent profit warning in Jan 2015 was a once-only reset of expectations. Since then the company has recovered well, and investors who saw the buying opportunity a year ago have been handsomely rewarded so far.

In my view this share could be above its original IPO price of 50p in the not too distant future. Note that there are no divis as yet.

I see that the StockRank, which was very low, is rising - now past the halfway cut-off, at 52. With this good update, and continued share price strength, I expect the StockRank to rise further, as the growth & momentum scores continue to offset the value score.

Avesco (LON:AVS)

Share price: 237p (up 11.5% today)

No. shares: 19.1m

Market cap: £45.3m

(at the time of writing, I hold a long position in this share)

Sale of freehold property - regulars here will know that I love freehold property. Why? Because freeholds;

- are hidden assets that can often be thrown in for free (many investors don't even notice that freeholds are owned by companies they invest in)

- can be sold when cash is needed

- go up in value over the long term usually

- banks are happy to lend against freeholds - so usually won't withdraw lending facilities even if trading is poor, if they have security over freehold property.

- can attract takeover approaches

As I pointed out in my report here of 11 Jun 2015, the company's freehold property (several acres used by its Fountain Studios subsidiary) had hidden value;

"Freehold property - this is in the books at depreciated cost, of £6.8m. I've heard that the open market value of the group's land assets could now be significantly above book value, but you would need to DYOR on that, as I have only heard it secondhand, verbally, from a friend who looked into it a few months ago. - See more at: http://www.stockopedia.com/content/small-cap-value..."

The good news is that this property has been sold, for £16m (that's 35% of the group's market cap), so £9.2m above book value - which will be booked as an exceptional profit to this year's results, no doubt.

Moreover, this will not impact trading in any way, since Fountain Studios is actually loss-making, turnover of £5.3m, and a £0.3m pre-tax loss for the year ended 30 Sep 2015. So a double benefit from this property disposal.

Net debt for the group was £17.5m at 30 Sep 2015, so this cash receipt of £16m wipes out all but £1.5m of the net debt - an astonishing transformation of the group's financial position. It will of course also wipe out a hefty interest charge from the future P&L, thus improving earnings.

So a terrific development, and I'm surprised the share price only rose 11.5% today - perhaps the news hasn't really sunk in with investors yet?

Results y/e 30 Sep 2015 - I must admit to finding these figures very confusing, not helped by the fact that the broker note uses a different calculation of EPS (adjusted, fully diluted) to the various versions given with the results.

There are large exceptional items in both years, plus profit from discontinued operations (release of provisions from the Disney litigation). Overall then, I'm going to have to spend more time dissecting the numbers properly, probably over the weekend.

What Avesco calls "trading profit" rose from £6.25m last year, to £7.36m this year, so a rise of nearly 18%. The group is a bit of a sprawl of various subsidiaries in different countries, but to my mind the investment case should focus on the jewel in the crown;

CT USA - this business looks very exciting. It is the "main profit driver" in the group. CT in Europe performed better too, thanks to reduced costs in Germany (which had been heavily loss-making). I was very impressed with the contract that CT USA performed, which turned the Hoover Dam into a giant projection screen, for the launch of a new Ford truck - see this link.

Companies, events organisers, sports, and broadcasters can do so much more with audio visual displays now, and clearly great expertise & experience, plus the right (expensive) equipment is needed. So I really like the niche that Avesco operates in, and this surely must be a good growth area, as the figures today suggest.

My opinion - with net debt now almost paid off, from the property disposal announced today, and the CT division having made a £9.1m profit in 2014/15, an "odd year" - i.e. when profits are meant to be relatively subdued, due to the timing of big sporting events falling into even years, then I am struggling to see why Avesco is only valued at £45.3m. The problem seems to be that the superb performance of CT is diluted by other marginal businesses within the group.

In an ideal world, I would like to see all other businesses divested, and the group renamed Creative Technologies. That could well trigger a decent re-rating. With Fountain Studios being closed down & sold off, that process looks well underway already.

Note that the Chairman, who is past retirement age, will want to maximise the value of his stake, so I suspect the group is being optimised to get its valuation up, which is great for all shareholders. When he sold £1m of shares last year, the whole lot was bought by other Directors - that's a remarkably bullish signal, in my view.

FinnCap says the company did 25.4p adjusted EPS in 2014/15, and strangely they are forecasting a reduction in profit this year, despite it being an even year. So I suspect the company could thrash the current forecast of 21.6p for this year. Personally I have in mind nearer 30p adjusted EPS for this year.

So I remain very keen on this share, and think long-term it could end up significantly higher than it is now, providing nothing goes wrong, and we're paid generous divis along the way too. Selling the surplus property is a great move, that unlocks a dormant asset, de-risks the shares, and will enhance earnings due to lower interest charges. What's not to like?!

Stockopedia likes it too, with a StockRank of 96.

Best Of Best (LON:BOTB)

Share price: 175p (up 1% today)

No. shares: 9.7m

Market cap: £17.0m

(at the time of writing, I hold a long position in this share)

Interims to 31 Oct 2015 - this company runs the win a supercar competitions at UK airports, but is also now becoming increasingly an online business - online now accounts for 66.5% of revenues.

Revenue growth is reported today at 30%, to £4.98m for the 6 months, which is encouraging. Although the additional gross profit of £0.5m was nearly all ploughed back into increased marketing costs, to drive new player acquisition.

Therefore profit before tax only rose from £431k in H1 LY, to £478k in H1 TY. I'm a little disappointed with that, as I was hoping for a greater increase in profits. Although if the marketing spend drives faster growth in future, then it could turn out to be money well-spent. Time will tell on that.

Valuation - it looks as if the company is heading for perhaps 8-9p EPS this year, so the shares aren't cheap on a PER of between 19-22. That's a lot for such a small company. Although bear in mind that the balance sheet is strong, holding £2.2m of net cash, or 22.7p per share.

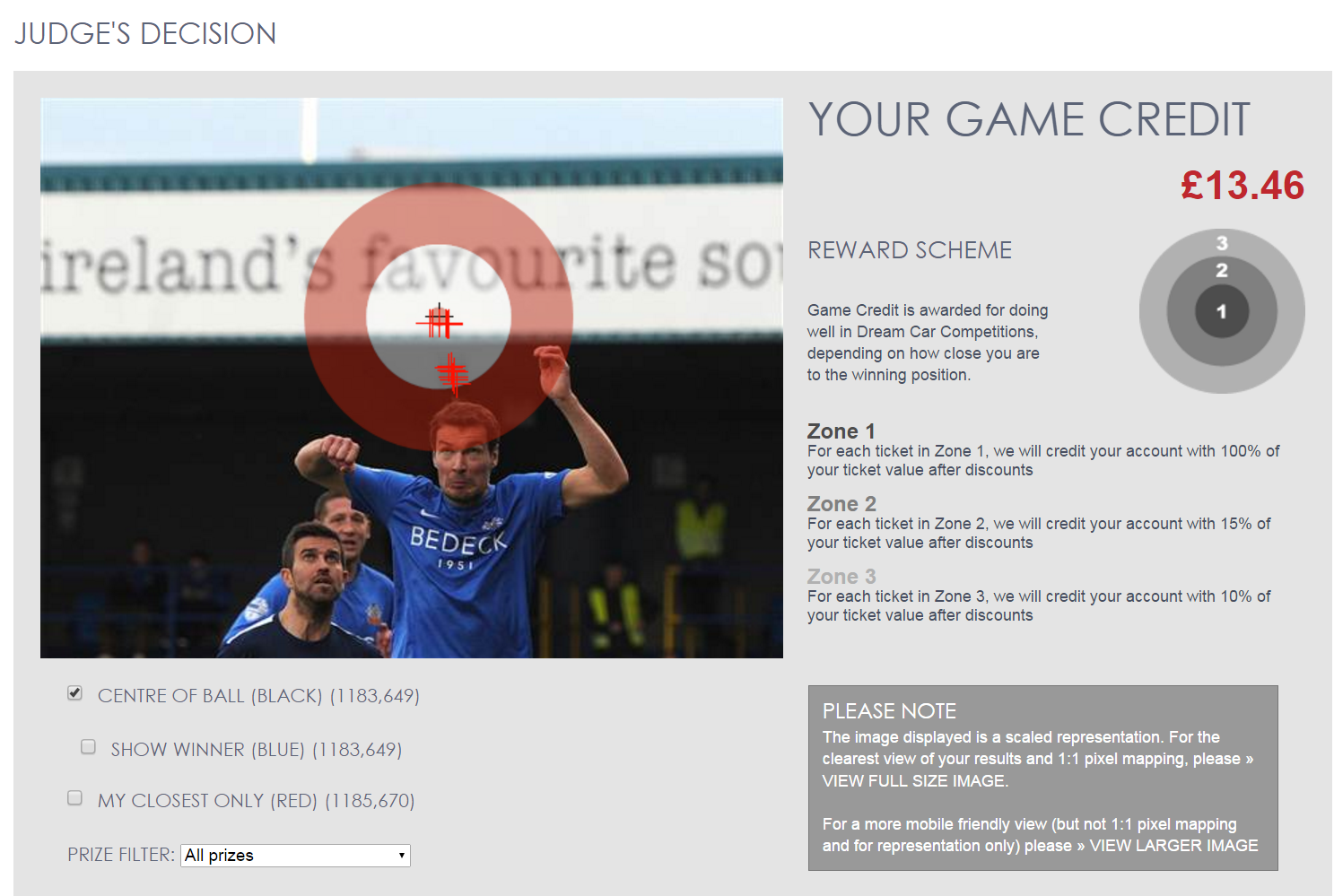

My opinion - I am a keen customer, and I play the online competition every week. It's enormous fun, as the concept is a spot the ball competition. I seem to get very close almost every week (see my result today, below), and a good proportion of my ticket cost is rebated in consolation prizes - I won £13.46 this week. This keeps you playing, as winning seems a realistic possibility, and you don't want to see your game credit consolation prize going to waste. There are also lots of special offers to keep things interesting. It's a genuinely interesting & fun competition, with real winners each week.

I am hopeful that the company might at some point really step up a gear, and see faster growth, e.g. with international expansion. It has done very well so far, in about 15 years of operating, and I see considerable potential here for a much bigger, international business. So far though, only small Indian franchises set up. Imagine if international growth, through franchisees really took off.

Even if overseas customers are playing via the UK website - I see this week's winner is a lady in St. Petersburg - although maybe she bought a ticket at Gatwick Airport?

Note that this share is thinly traded, as the free float is only 14% (about 1.36m shares, according to Thomson Reuters). So it can be very difficult to pick up (or sell) shares in it, which will rule it out for many people. I spent several months building up my holding here, very slowly, picking up scraps of shares as and when they became available.

CEO interview - I am interviewing William Hindmarch, the CEO and majority shareholder, on Friday this week. So if you would like to submit any questions to him, please use this link (NB please don't add any questions below here, in the comments section, as I may miss them).

William visits the competition winner every week (there is a guaranteed supercar to be won every week), and puts the videos on BOTB's website. This particular video is hilarious - where he accidentally detonated the firework the wrong way around - straight into his own meat & 2 veg! (from 2:35 onwards).

McBride (LON:MCB)

Share price: 160p (up 6.8% today)

No. shares: 182.2m

Market cap: £291.5m

Trading update - this maker of household & personal care goods has a 30 Jun year end, so it reports today on H1, being the 6 months to 31 Dec 2015.

Instead of telling us what we need to know - how the company is performing compared with market expectations - this update goes round the houses.

Group revenues increased by 0.4% on a constant currency basis when compared to the first half of last financial year.

Profits are benefiting from actions associated with business simplification, streamlining and cost initiatives, as outlined in the Group's new strategy. As a consequence, first half year underlying trading results will show further overall progress, in particular when compared to the first half of last financial year.

So here is my RNS translation service - turnover is down in sterling terms, but slightly positive when adverse forex movements are stripped out. Profit has risen compared with last year, due to cost cutting. We don't want to tell you how we are performing against management or market expectations, but leave you to assume that we're in line.

Valuation - broker consensus is for 9.91p EPS this year, putting the shares on a rather warm PER of 16.1. That seems a lot for a not particularly good, low margin business, supplying supermarkets which are in a cut-throat price war.

Balance sheet - note that Mcbride has a geared balance sheet, with quite a lot of debt, and a pension deficit. Although I see from the last Annual Report (note 15) that it has land & buildings on the balance sheet at depreciated cost, of £50.1m, presumably freehold property, which would make me much more comfortable about the bank debt.

The business is also quite capex-intensive, but this means that before capex, it is decently cash generative.

My opinion - the company has undergone a good turnaround, but the shares look up with events now, or even perhaps a tad too high? The trouble is that cost-cutting can only go so far. With not top line growth, and margin pressure from customers, it's difficult to see much scope for further profit growth.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.