Good morning!

Graham is also writing today, his report is gradually taking shape here.

I'm aiming to report today on;

- AO World - only modest growth, and cautious outlook. Not good enough, I'm bearish.

- JD Sports - a barn-storming trading update!

- Debenhams - perhaps better than expected Xmas performance? (sorry, I ran out of time, so didn't cover this one in the end)

- Moss Bros - in line trading update. Looks pricey to me.

- Mothercare - in line trading update. Potential turnaround?

- Robinson - mild profit warning, but upbeat outlook. Property angle too.

You might have noticed that I've strayed into several mid & large cap stocks in the list above. I always agonise over what to report on at this time of year. The retail sector is my sector specialism, due to having been an FD for 8 years for a ladieswear chain. So naturally I'm drawn to RNSs from retailers.

However, you can get reporting & analysis on larger caps from numerous other sources. So there's little value added from me just replicating here what others report on. Hence I'll just cover retailers which particularly interest me, for whatever reason.

Other retailers which also reported today, include: Tesco, Marks & Spencer, Asos (excellent international growth), ABF (Primark), and Dunelm. I'm not going to report on them here.

Graham intends reporting today on;

- STM - in line update, and optimistic outlook.

- Stadium - broadly in line.

- Gym Group - self-funding roll-out of low cost gyms.

- Premier Oil - trading update. Oil? Oil!! {{shudders}}

- SuperGroup - interim results.

So let's hope we can successfully get through all of that lot.

IG small caps wrap

I have a quarterly chat on video with Jeremy Naylor at IG, about my favourite small caps.

We recorded the latest edition yesterday afternoon, the link is here - it's about 15 minutes long.

Regulars here will recognise all the stocks as my favourites. As always, they're not buy or sell recommendations - that's for you to decide! They're just my favourite current stock ideas, some of which will work, and some won't.

Growth vs Value?

Generally, most Christmas trading updates for retailers are coming through fairly well. So it looks as if the first one to report, Next (LON:NXT) probably had more company-specific issues for its lacklustre performance. Mind you, Next's figures weren't actually that bad at all. Everyone's talking about it as if it had a disastrous Xmas, but it remains a remarkably profitable, high quality business, with sector-leading net profit margins.

Although I think Next is probably destined to remain on a PER of around 10 for the foreseeable future. That may seem cheap, but where's the growth going to come from? Also, the juicy net profit margin is surely now a target for more aggressive competition to chip away at? Plus of course all retailers are facing considerable cost headwinds now.

I have a broader concern that we're very much in a bull market where investors want growth, and are prepared to pay up for it. This leaves mature, or declining businesses looking unattractive investments. What's the point in buying a mature business, even if it's cheap, only to see it get cheaper still? That worried me with Shoe Zone (LON:SHOE) yesterday. I like the company, and the results were good. It's paying lovely divis too. Trouble is, where's the upside going to come from? Hence I only bought a few shares, just for the divis.

I recall back in the heat of the TMT boom from 1998-2000, a strange phenomenon occurred, which perplexed & annoyed me at the time. It was that good companies, with decent profits, cashflow & divis, on low valuations, just got cheaper & cheaper. Eventually the penny dropped - people were selling their falling value shares in despair, and instead recycling their money into high momentum technology stocks, which got more & more wildly over-valued.

Eventually of course the bubble burst, in Mar 2000, and the process then reversed - with value stocks doing quite well, and overpriced tech stuff collapsing over the next 2 years.

That's not to say all the fashionable tech stocks at the time were rubbish. One or two were very good companies (e.g. ARM). The vast majority were rubbish though.

Things are a bit different now. Valuations for growth stocks are nowhere near as stretched as they were back in 1998-2000. Also, what I'm seeing is that most of the growth companies that are zooming up in price now are decently profitable businesses. So it's not about blue sky this time, it's more a question of multiple expansion - i.e. as the bull market progresses, investors are becoming more willing to cough up a high PER.

I feel quite surprised to see myself participating in this mood too. However, it's based on pretty solid foundations. Boohoo.Com (LON:BOO) is one example of where the soaring share price has been justified by better & better fundamentals. The market was correctly anticipating superb, forecast-busting performance. Same with Fevertree Drinks (LON:FEVR) - it looked expensive all the way up, but the forecasts have been continuously increased.

So my conclusion is that, if I find a genuinely exciting growth company, which is repeatedly busting through forecasts, then I should not rule out paying quite a high earnings multiple for it. For me though, the key is strong organic growth. So I don't mind paying up for Gear4Music, because it's delivering superb organic growth (last reported at +55% YoY).

I've been thinking about a set of criteria for growth stocks, and mine is currently this;

- Exceptional organic growth (both top, and bottom line)

- Must be profitable (or very near)

- Fully funded - so no significant future dilution will be necessary

- Entrepreneurial & honest management - preferably led by the founder, with meaningful shareholdings

- Repeated broker forecast increases

- Some sort of competitive advantage - better than the competition

- Executing well, operationally

- Focused on: effective marketing, logistics, IT, and customer service

- Valuation - I will look through a high PER, if the PEG is reasonable, and the above factors are present.

I think that's quite a good list. What do you think? Are there any items that I've missed which could be added to this checklist? I'm trying to focus more on creating investing checklists. Up until now, I do everything in my head, but this is a somewhat chaotic approach. One of my aims for this year is to formalise my process using checklists.

AO World (LON:AO.)

Share price: 170p (down 7.9% today)

No. shares: 421.1m

Market cap: £715.9m

Q3 results - this doesn't read at all well, for a highly rated growth stock.

The company is an internet retailer of electrical goods. Its main market is the UK, but expansion into Europe is also underway.

Comments today on the UK market are;

Our UK business continued to grow: ao.com revenue increased by 10.3% year on year and our overall UK revenue by 8.9%, against tough comparators from the same period last year.

Internet retailers shouldn't be talking about "tough comparators"! That's the sort of language I would expect from struggling bricks & mortar retailers. Also, 10% growth is nowhere near good enough to justify a premium rating. Internet retailers should be growing at 30%+, like BooHoo, Asos, and G4M are. Even Debenhams managed better online sales growth (at 13.9%, reported today) than AO. So this is a poor update in my view.

European performance - better, but coming from a lower base;

In Europe revenue for the period was up 28.4% year on year, on a constant currency basis, reflecting a period of focus on building our logistics capabilities, capacity and a solid base for the business.

Overall top line growth looks underwhelming to me. It's not clear whether this includes the forex benefit of translating European sales into sterling, or not;

Overall Group Revenue was up 12.3% for the quarter, year on year.

Bear in mind that overheads are increasing, to drive expansion in Europe, so there's not likely to be much progress in overall profitability.

Profitability - this sounds OK, but growth companies need to out-perform, to justify a growth rating;

We expect the Group's performance for the full year to fall within the guidance previously given1 ...

Hoorah, they've included a footnote to give us the figures for previous guidance - well done! This saves everyone the time & effort of having to search back to see what the figures are.

1 Our previous guidance for Group Revenue (using the exchange rate applicable at the time) was £700.3m-£735.9m with Group Adjusted EBITDA of £2.4m losses to £4.7m for the full year.

Hmmm, not great though is it? It's still loss-making at the EBITDA level.

Outlook - this sounds decidedly wobbly to me, again not what you want for a highly rated growth stock;

...but remain cautious about the final quarter given the uncertain UK economic outlook, currency impacts on supplier pricing and the possible effect on consumer demand.

My opinion - I've been bearish on this stock since it came to the market. I'm considering whether to put on a short position again. Although current market conditions are not really conducive to shorting anything, so I might not.

The problem is this - the business model doesn't make sense. What AO is trying to do, is to provide outstanding customer service - a great idea. However, it's chosen the wrong sector - electricals - where the gross margins are wafer thin. Providing great customer service, such as fast delivery, and a pleasant, well-trained, smartly dressed person to deliver & install your new washing machine, and take away the old one, all costs money. If you're starting with a wafer-thin gross margin, there's nothing in that to pay for the great customer service.

Also, not having physical presence in retail parks or High Streets, AO has to instead spend heavily on marketing, to get noticed. The company hopes that it can build repeat business from its exceptional customer service, which I'm sure is correct. However, its fairly modest Q3 growth suggests that this is going to be a long haul.

I very much like the CEO here. He's got some excellent ideas on customer service, and other things. However, he's in the wrong sector. If you could put this CEO into a company where the gross margins are high, then I think he would excel.

Overall though, I think AO World is hugely overvalued right now. I wouldn't be interested in buying the shares even if they fell by 90%. It would still be expensive at that level. It doesn't make any profit, and it's very difficult to see how it's going to change that in the future.

If you can't make any money on a turnover of over £700m, then something is badly wrong, in my view. So a bargepole job for me, at this valuation I'm afraid. I think the story is getting stale, so once the market as a whole rolls over, I'm probably going to put on a short position here. So let's hope the shares rise strongly in the meantime!

This stock reminds me very much of Ocado (LON:OCDO) - not making much money, on huge turnover, yet still inexplicably valued on a very high growth company rating.

EDIT: I wondered what the AO World StockRank would be on Stockopedia, and it very much surprised me (i.e. better than I expected);

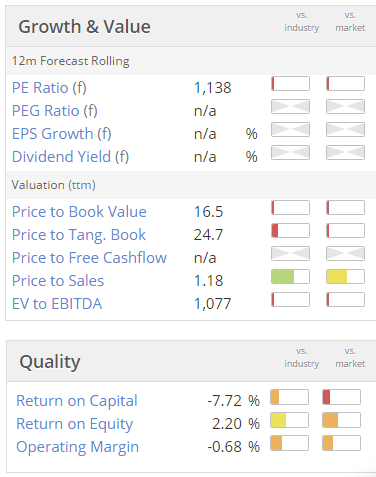

I've highlighted the Quality score, which seems incongruous, when compared with the individual quality scores on the StockReport, which are poor, as you can see below;

As you can see, the Quality scores are poor. The Growth & Value scores are diabolical, as you might expect.

So I queried with Stockopedia HQ, why is the quality score within the StockRank so high, at 85? Alex kindly replied very quickly, as this is his reply, which I thought was worthy of a bigger audience, as it might be something you've wondered about before too;

Hi Paul, Thanks for this. I think its worth remembering that the QualityRank is of course constructed using metrics that are not in the Quality Box shown on the StockReport. For example, it uses the Piotroski Score (where AO. has 7/9) and long-term sales growth (where AO. has grown sales consistently year after year). We've got the full list here - http://bit.ly/2iKMu1j . I hope this clarifies. Just drop me a line if I've missed something. Best, Alex Naamani

So this explains why there might sometimes be an apparently mismatch between the quality scores on the StockReport, and the Quality score within StockRanks.

JD Sports Fashion (LON:JD.)

Trading update - a quick mention here for this large cap retailer. Amazingly, the group has managed to maintain its stellar LFL sales growth of 10% in H1, into the (almost) full year.

This has resulted in significant out-performance of profitability;

Notwithstanding the requirement for ongoing investment in the operational infrastructure to support an increasingly complex and international Group, the Board expects that the headline profit before tax and exceptional items for the current financial year will exceed current consensus market expectations of £200m by up to 15%.

That's a really decent profit beat, to make an additional £30m profit.

Also another hoorah for this company, for them inserting the figure for market expectations into the narrative. That's even better than a footnote! Terrific clarity, well done JD Sports & its advisers. Everyone should do this.

Outlook - the Chairman is trying to rein in expectations, understandably;

I am delighted to report that we have maintained our excellent momentum from the first half of the year. Whilst we acknowledge that it would be unreasonable to expect like for like sales growth to be maintained at recent levels for a fifth consecutive year, we are confident that both domestically and internationally, our unique and often exclusive sports fashion premium brand offer provides a solid foundation for future development.

My opinion - I think there's actually quite a strong case for buying this, even at current high levels. The business is massively out-performing its rivals. I didn't think that JD's approach of trying to market sportswear & trainers as fashion items would work, or be sustainable. That was a complete misjudgement, as it appears to be working brilliantly!

Sports Direct has become a complete shambles, with arguably an arrogant fool at the helm, who's doing a great job of destroying the company's reputation. JD has differentiated itself as being a much more upmarket setting for selling very high margin sports products, and has thereby won the hearts & minds of the best brands - who don't want their kit selling in the downmarket Sports Direct stores, nor being tainted by association with Mike Ashley.

Sports Direct is trying to move upmarket, but I don't think they stand a chance, and will have to spend vast amounts to bring their stores up to a standard where the best brands would want to put their product.

So I can only see more upside for JD. Am considering taking a decent sized position here. I shall give it more thought. The StockRank system likes it too, and nearly encapsulates that this share is all about Quality & Momentum, rather than Value:

Well done to people who spotted this trend & acted on it in the past. I'm very late to the party here, but once the latest forecast upgrades have gone through, the valuation here may not be unreasonable. So maybe even more upside is possible?

It just goes to show, reports of the death of the High Street seem very much premature! Companies which have the right products, at the right price, can still make a mint from High Street retailing. I think the key driver for profitability is having differentiated product - i.e. own brand, and/or exclusive products that customers covet highly.

Moss Bros (LON:MOSB)

Share price: 102.75p (up 3.5% today)

No. shares: 100.8m

Market cap: £103.6m

Trading update - this covers the 23 weeks to 7 Jan 2017. This is the lion's share of H2, since the company has an end Jan year end.

The summary is short & sweet:

The Group has continued to make good progress and is trading in line with market expectations.

LFL sales growth looks excellent, at +6.1%. However, I seem to recall that LFLs are not really LFLs with this company, because they include the beneficial impact of refurbishing a lot of the shops. So I would take this figure with a pinch of salt.

Also, I think LFL sales is becoming a less reliable indicator these days, because there's no standard definition. So different retailers make up their own, with a natural tendency to push the boundaries. Some retailers seem to be including online sales within their LFL figures. Since that channel is generally growing fast, the danger is that it may be masking a more serious deterioration in the physical shops' trading.

So really I think it pays to focus on overall profitability, rather than obsessing over generally quite unreliable reporting of LFL sales. This is a general point, not specific to MOSB.

Ecommerce - good growth, it's up 24.9% Y-on-Y. It's vital for most retailers to have a decent online offering now as well, I think. This makes up 11% of total sales, so quite handy.

The beauty of having a decent ecommerce offering, is that it enables 100% geographic coverage for retailers with a smaller footprint on the ground. Also, the weaker pound means that many UK ecommerce sites are now picking up more international business.

Gross margin is up 1.4% against last year. Although I wouldn't expect that to necessarily be maintained, due to weak sterling meaning more costly stock will feed through at some point, once forex hedges have expired. It will be interesting to see which retailers manage to pass on higher prices to customers, and maintain their gross margins.

Cash - there's plenty of it, this is a well-financed business. Up £2.2m from a year earlier to £19.5m - this being an expected year end balance (at 31 Jan 2017). Note that is usually a seasonal peak for cash, for most fashion retailers. It's still very good though. In uncertain market conditions, it's usually best to congregate in shares which have strong balance sheets.

Outlook comments - very confident for the current year, as it's nearly finished that's not surprising. For the new year though sounds more cautious, understandably;

In common with many UK retailers, the year ahead looks set to be a challenging one, not least the uncertain consumer environment, wider political backdrop and higher input costs; in product from a weaker pound, business rates and employee costs; we are therefore preparing the company for a more competitive trading environment and we are planning and deploying our resources accordingly, ensuring that we continue to protect the investment we are making in building and sustaining growth."

My opinion - with little growth potential, and uncertain market conditions ahead, I think this share looks significantly over-priced. The fwd PER is about 16. I think the right price is nearer 10, which is what Shoe Zone (LON:SHOE) is rated at.

The divis are nice here at about 6%. As they are also at Shoe Zone (in fact the yield there is higher, once you include special divis).

SHOE may feel grubby, and downmarket, but it looks a much better value share to me than this one. Please note that I hold a long position in SHOE. Actually, both shares have a very high StockRank - 92 for MOSB and 94 for SHOE.

Robinson (LON:RBN)

Share price: 145p (up 3.2% today)

No. shares: 16.4m

Market cap: £23.8m

Trading statement & planning approval - this share is so illiquid, and with such a wide spread that it's barely worth me covering. However, I know several readers who hold the stock, and like to get my view on it, so here goes.

It's a mild profit warning for 2016;

Revenues are anticipated to be £27.5m for the year, which represents overall a 5.6% decrease on last year. The primary reasons for this are the previously reported lost business and lower demand for certain categories of branded goods. New business that had been planned for the second half of 2016 has been delayed but will benefit 2017.

The movement in average exchange rates has added £0.8m to reported Group revenues in 2016. The directors anticipate trading profits for 2016 will be slightly below market expectations, as a consequence of the fall in sales.

Not a disaster then, just "slightly below".

Outlook - a bit more positive for 2017;

In 2017 with significant new business already confirmed plus the full year impact of recently commenced new business from 2016, the directors expect to deliver revenue and earnings growth.

Sounds OK.

Property - now this is the more interesting bit;

On 9th January 2017, the Chesterfield Borough Council Planning Committee approved outline plans to develop the surplus 15 acre Boythorpe Works and 8 acre Walton Works sites in Chesterfield for residential and retail/commercial uses. This will allow the Company to work with partners to find prospective tenants, develop detailed plans and sell the sites.

I've mentioned the upside from surplus property here before, quite a few times, so this is not new. However, it is clearly good news that things are progressing.

How much is this land worth then? Unfortunately the company doesn't say. However, the house broker did include it in a note this morning, saying;

In our view, this lifts the value of the land from £5m to, conservatively, £10m (60p per share)

That's clearly a big chunk of the market cap, with the shares having closed the day up nearly 10% to 154p. It's not often a mild profit warning results in the shares going up 10%, but obviously the good news on property has outweighed any disappointment about 2016 trading.

My opinion - bear in mind that, when last reported (interims), net debt was £4.6m. So the sale of the surplus land should easily clear the net debt, and maybe leave some spare for a special dividend?

So the property is a nice bonus. Trouble is, the core business isn't madly exciting. There's little to no organic growth, and it's under constant pricing pressure from customers.

There's been a smashing progression of dividends paid over the last 6 years, but this has not been matched by corresponding increases in earnings.

Also, this share is so illiquid, with a ludicrous bid/offer spread, that it's almost impossible to trade. Therefore it's the type of share that, a bit like pets, is not just for Christmas! It's not worth buying unless you're prepared to stick with it, in my view.

That said, existing holders are better off now the planning permissions has been granted.

Mothercare (LON:MTC)

Share price: 120p (up 5.7% today)

No. shares: 170.9m

Market cap: £205.1m

Trading statement - this company has an end Mar year end, so it's nearing the end of 2016/17. The key statement today is this;

Overall Group performance in line with expectations

I've just been reviewing my notes here from 24 Nov 2016, when interim results came out. That report covered the main issues.

My opinion - This is looking tempting, if you believe the turnaround story. Things certainly seem to have stabilised. It's priced at about 12 times earnings, which could turn out to be cheap, if this is the low point for earnings.

The key point of difference here, is that Mothercare has a very nicely profitable overseas business. That is translating into higher sterling earnings.

It's worth a closer look I think, if you like turnarounds. I'm not convinced enough to buy any yet, but it's going on the watch list. There have been high hopes for a turnaround before though, which has stalled. So will it work this time?

All done for today. Graham's covering tomorrow, as I'm having a day off.

So I'll see you back here on Monday!

Best wishes, Paul.

(usual disclaimer apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.