Good morning! A jolly time was had by all at last night's ED Investor Forum, kindly hosted as usual by lawyers Fasken Martineau in Hanover Square. I enjoyed all three company presentations, brief impressions as follows;

Tristel (LON:TSTL) - Several shrewd investors have urged me to look at this company in recent weeks, so I always sit up and take notice when highly successful investors begin to mention the same company. Checking back on my notes here, it's always looked a tad expensive, but broker forecasts keep going up. In the last year consensus forecast EPS has doubled from 2p to 4p. With another outperformance RNS just a few days ago, I think this company deserves its forward PER of just over 15. One attendee put it politely by suggesting to me that the CEO & FD of Tristel would benefit from going on a presentations skills course! It was a rather peculiar, wooden, scripted presentation, with awkward pauses and almost robotic delivery. Although in a way I find that quite encouraging - if management are hopeless at ramping the share price, then you're more likely to get a bargain! The content of the presentation is what counts, and Tristel are clearly on a roll with their innovative products, which are now being put through an international roll-out.

Regenersis (LON:RGS) - The complete opposite in terms of delivery, which was a super-confident presentation from this electronics repair company. Mind you, the presentations should be slick by now, as they seem to appear at virtually every investor event going! I spotted the value here at 90p, but sold too early at 150p. The shares are now 390p, and growth is being achieved on many fronts, mainly from acquisitions in emerging markets. A fairly large acquisition has been made of a data erasure company, and a very convincing case was explained for this deal. I'm not tempted to buy back after such a big rise in price, but was discussing the company with a large shareholder afterwards, and completely understood his decision to hold for more gains.

Sinclair IS Pharma (LON:SPH) - This was a new company to me. It mainly does cosmetic creams and other treatments for skin. The charismatic CEO gave us a master class in the sector, including some vivid examples of treatments such as a suture with little cones attached, which scoops away wrinkles and lasts about two years. Useful for wrinkles, saggy bottoms, and other areas of sagginess where apparently excellent results have been reported! Why people cannot just accept that the ageing process is natural, I have no idea. Narcissism knows no bounds apparently, and the financial results of this company do look pretty remarkable, especially if forecasts are achieved. There were some more worthwhile products such as a foam to help serious burns victims survive. Also a potential new product for the millions of Indians with blotchy skin pigmentation issues. A bit like the skin whitening condition that Michael Jackson had? Which reminds me, a good suggestion to perfect your Michael Jackson singing impressions, is to practice your dance moves barefoot with Lego scattered over the floor!

Vianet (LON:VNET)

Generally I try to have several meetings in London on the same day, to make a more efficient use of the time, so I put together an investor meeting with the Directors of VNET, kindly hosted for us by MHP Communications.

In my opinion the recent results were not bad, considering they have had major distraction/disruption from the Government's Statutory Code for tenanted Pubs. As is so often the case with clumsy action by Government, their concern for tied Pub tenants actually backfired in some ways, since it created uncertainty into which Pub groups accelerated their disposal programmes. That obviously reduced Vianet's client installations for the core beer flow monitoring equipment.

They have made good progress with their vending telemetry division, and that's starting to look like an interesting business. The fuel division is holding its own, with further improvements in trading expected, and I got the impression that the dividend is reasonably safe. That's worth noting, since the yield is an appealing 7%.

Volex (LON:VLX)

It's best to take everything this company says with a huge pinch of salt. They are masters of spin, and just talk nonsense in their trading statements, in my opinion - there's a complete disconnect between the bullish narrative and the poor figures. Today's results for the year ended 31 Mar 2014 are headed up,

'The Volex Transformation Plan is beginning to deliver results'

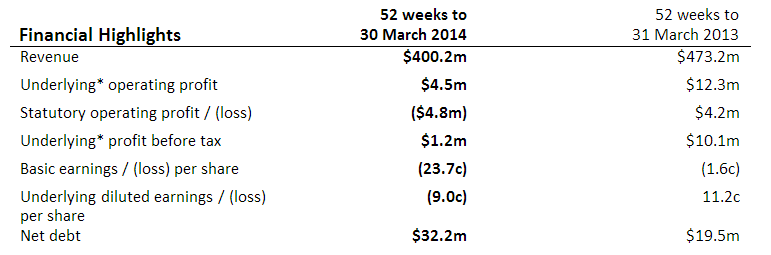

The figures immediately below that statement then make it clear that the company has not made progress at all, in fact trading has got worse. Here are the highlights, and remember that these will be best things they can report;

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.