Good morning,

Ed completed his incredible charity cycle challenge from London to Paris, and apparently did so with ease. Congrats! Details are available at this link.

It was an eventful election and parliamentary outcome, and brings with it some shivers of uncertainty given the lack of a decisive result, but the FTSE is only down by 0.35% so far today. EURGBP is unchanged versus when I mentioned it on Friday.

So let's put all that to one side and stick to companies for now.

Graham

Stanley Gibbons (LON:SGI)

- Share price: 11.125p (-15%)

- No. of shares: 178.9 million

- Market cap: £20 million

Strategic Review and Formal Sales Process

Response to Stanley Gibbons Statement

As you can see, a string of updates from this stamp collectibles company and its potential bidder.

For those who aren't familiar with the history, this company has undergone a massive restructuring exercise to try to pay down bank debt and control costs after massive write-downs in 2015/2016.

Checking back to last month's trading update, I see that bank facilities with £18.3 million capacity were being utilised to an extent of £17.2 million. It was truly remarkable that even after a large fundraising and all the restructuring efforts, the debt level remained so high.

A sale of assets worth £2.4 million was announced with that update. A further £1.4 million disposal was announced later in the month, as the company attempted to control the debt level and return to core activities.

And that brings us to last Friday, when it confirmed "it has received an unsolicited approach from Disruptive Capital ("Disruptive") regarding a possible offer by Disruptive for Stanley Gibbons."

Disruptive is an investment vehicle chaired by Edi Truell; youcan browse its website here.

The bid approach by Disruptive has apparently triggered the Board of Stanley Gibbons into initiating the Strategic Review/Formal Sales Process:

The Board's success in achieving divestments from non-core assets to generate investment capital for the Group and the recent approach from Disruptive Capital, leaves the Board determined to ensure that the underlying strength of the core business is fully reflected in shareholder value.

The Directors believe that Stanley Gibbons with its heritage brands and expertise has significant strategic value not only in its existing core markets but also across the broader global collectibles market, particularly the Middle East and Asia.

Unlocking this incremental long term value is likely to require further investment and the Directors believe that it is likely therefore that such value is best delivered either within a larger group or alongside a strategic investment.

I've put the last sentence in bold because I think it's possibly a sign that the current financial structure is still far from optimal in terms of having too much bank debt - even assuming there is no threat to solvency, such a level of debt could hamper any potential growth plans.

And it also appears that relations may have soured a little between SGI and Disruptive, per Disruptive's response:

Disruptive Capital Finance LLP ("Disruptive") confirms that it is not making an offer for Stanley Gibbons Group plc.

Disruptive has been in discussions with the management of Stanley Gibbons Group plc for some time and had received, but not yet executed, a mutual non-disclosure agreement between us and them since we required sensitive information to evaluate whether or not to make an offer.

So I'm not tempted to dabble in SGI shares in these conditions. While you could argue that Disruptive have a good track record, and so there could be a good opportunity to buy the shares at this level, it's also true that Disruptive need access to "sensitive information" to make an offer.

Since I also don't have access to that sensitive information, and given the existing financial structure, I won't be getting involved here.

Motorpoint (LON:MOTR)

- Share price: 149.5p (+2%)

- No. of shares: 100.2 million

- Market Cap: £150 million

I last covered this group of independent car dealerships at the full year trading update in April, when the share price was around the current level and I reckoned that Motorpoint was worth putting on the watchlist.

There has been a slight beat against the prior range of expectations for adjusted PBT (£14.6 - £15.5 million) (we already knew the result would be around the top of expectations):

- Revenue increased 12.7% to £822.0m (FY16: £729.2m)

- Profit before tax and exceptional items of £15.7m (FY16: £18.2m)

- Profit before tax of £11.7m (FY16: £16.9m)

Note again that this is still a relatively new share, only listing in May 2016. It's down from the 200p IPO price but one thing it does have in its favour is that it has a premium listing on the LSE, so the corporate governance should be a bit stronger than your average AIM small-cap!

As a reminder, Motorpoint focuses on cars less than two years old and with less than 15,000 miles on the clock, i.e. that "nearly new" segment.

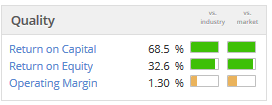

The company mentions that it earns a very high return on capital employed, and this is borne out in Stockopedia's Quality metrics (and note that low operating margins are to be expected in this industry):

Dividend: the company declares its first full-year dividend, so the dividends for the year add up to 4.23p. Not a bad yield.

Outlook is strong:

Our recent openings have built up a considerable growth opportunity for the year ahead; by building volumes in this third of our estate that is under two years old, we will achieve a rapid cash return on these investments. Supported by an expanded and strengthened management team we are well positioned to deliver the Motorpoint model across the estate.

My opinion

The glaring disappointment is that profits fell by such a large percentage this year, which is attributed to increased operating expenses at the four new sites opened since November 2015. Obviously, their expenses have not been matched by operating profits over this time period. (There are 12 sites in total.)

It would have been helpful if more information was provided to break down the results at the loss-making sites and the like-for-like results at the older sites; the like-for-like results would give us a helpful indicator of core performance and the potential results at the newer sites when they mature.

Still, I remain impressed by the company's business model, its customer reviews and the quality metrics.

It probably won't ever deserve a huge rating since this is a difficult industry to build a moat in, but it seems like a pretty reasonable stock to hold at current levels!

Northern Bear (LON:NTBR)

- Share price: 66p (+17%)

- No. of shares: 17.9 million

- Market Cap: £12 million

This Newcastle-based building services provider creeps over our £10 million market cap limit, and has been mentioned in the comments.

Services are roofing, solar panels, fire protection, forklift supply, health & safety, etc.

Originally listed in 2006, it had some lean years from 2010-2013 but has been getting stronger since then:

- "Earnings per share from continuing operations for FY2017 are ahead of FY2016 and management expectations following another strong year's trading.

- Net positive cash position at 31 March 2017 (31 March 2016: £2.5m net bank debt).

- Progressive dividend policy to continue (FY2016: 2.0p per share). "

That will be the fourth successive annual dividend payment. And see how the cash position has improved despite the dividend payments.

Under the heading Operational Matters, we get what amounts to an outlook statement:

We have experienced excellent results from continuing operations across the whole Group being roofing services, building services and materials handling. We have carried out work from the North of Scotland to Cornwall and an element of the growth that has been achieved is attributable to the geographical expansion of the Group's customer base.

We have moved into the new financial year with a particularly strong order book for the time of year which currently provides optimism for another good set of results in the year ending 31 March 2018.

My opinion

A classic micro-cap with value, it's the sort of stock I would have considered for my personal portfolio if I wasn't already 90%+ invested and accumulating cash.

K3 Business Technology (LON:KBT)

- Share price: 147.5p (-4.5%)

- No. of shares: 36 million (before Placing)

- Market cap: £53 million

Quickly highlighting this share as one where I had previously suggested the financial accounts required caution, and where Paul had specifically warned about the balance sheet's lack of tangible asset backing.

Today it faces the consequences and (conditionally) raises between £7.5 million and £1 million through a Placing and Open offer, at 140p. That's a 9.4% discount versus the closing price last week.

According to a 1pm RNS, the Placing was successful.

But dilution is generally to be avoided and the additional 5.4 million shares are material.

Needless to say, my overall impression of this company is not good so far!

Triad (LON:TRD)

- Share price: 77p (+4%)

- No. of shares: 15.5 million

- Market cap: £12 million

Mentioning this by request, final results from a small IT services company (again, just over our £10 million threshold). It includes IT consultancy/solutions and recruitment.

These are the company's strongest results in ten years:

- Revenue for the year ended 31 March 2017: £30.9m (2016: £28.3m)

- Profit before tax: £1.52m (2016: £0.86m)

- Profit after tax: £1.53m (2016: £1.21m)

The explanation is as follows:

Revenue and profit have been driven by careful management of existing key accounts, with significant growth seen across three of our four largest clients. This has been achieved as a result of the professionalism of our staff and outstanding levels of service delivered by our teams. Maintaining long-lasting relationships with our clients is a key contributor to our strengthened position, and the Group has been particularly successful in this regard despite the intense competition faced across the industry.

Clients include central government bodies, a government-owned company. and a wide variety of private entities.

It has a solid net cash position (£2.2 million), fair gross margins (16%), and hasn't issued new shares for well over ten years.

So there are plenty of things to like about this. On the other hand, recent success appears to be concentrated in growth at just a handful of clients.

That said, I would probably consider buying Triad if I was willing to break my resolution to stay away from professional services/consultancy companies for the foreseeable future.

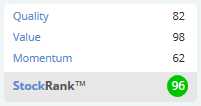

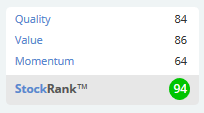

As with NTBR, it's got a massive StockRank and could easily have further to go, as the higher market cap helps to bring it onto people's screens:

That's all for today,

Thanks for reading!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.