Good morning!

French Connection (LON:FCCN)

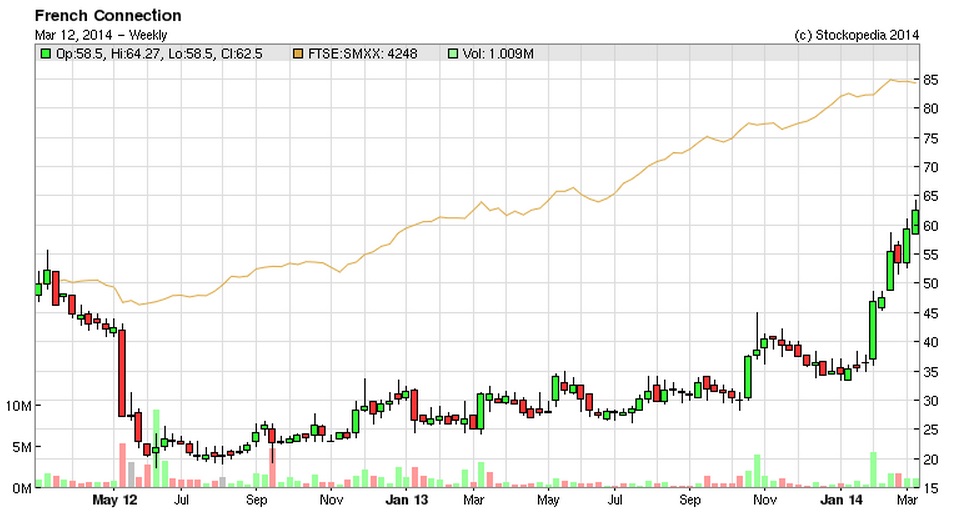

I think it was Antony Bolton who said that his best calls were often stocks that at the time felt uncomfortable to buy. That's how it felt for me with French Connection, where hardly anyone could see my logic that it was a good each way bet at about 30p (they are now 60p!). The bulletproof Balance Sheet, loaded up with cash, and no debt, plus a large wholesale debtor book on top, was sufficiently strong that the company could absorb continued losses for years to come, providing they didn't get completely out of hand. Cash gives you time to turn a business around, and founder/CEO (who still holds 42% of the shares) has been making a lot of changes on various fronts to turn the group around.

Moreover, the group results mask what is in reality two successful businesses, the wholesale and brand licensing divisions, which together made a profit of £17.8m in 2013/14 (the year end was 31 Jan 2014). This was more than enough to cover the £11.3m group overheads, and would have left a profit of £6.5m. However, the problem part of the business is the Retail division, which has a long tail of heavily loss-making shops, on leases that cannot be disposed of in the short term. This made a thumping great loss of £11.6m in 2013/14, although that is usefully improved from the appalling £15.4m loss in 2012/13.

Over time though, the retail losses will melt away, as problem leases are handed back to the landlord at the time of expiry. Typically retail shop leases are fifteen years in duration, at the time of inception. So in FCCN's case, most of the problem leases will surely be in their second half now, so perhaps 5 years left to expiry? Taking a long term view then, from now on FCCN should be experiencing a tailwind of lease expiries of loss-making shops, which will boost profitability a certain amount each year. Nine loss-making shops were closed in 2013/14, and a further 3-5 more are due for closure this year.

My initial review of the results for year ended 31 Jan 2014 published this morning has not identified anything unexpected or untoward. On 5 Feb 2014 the company said that the loss for 2013/14 would be reduced to £4.7m (2012/13: £7.2m loss). The actual figure has come in slightly better, at a loss of £4.4m, which is pleasing.

Net cash has also come in slightly better than expected, at £28.2m (barely changed from prior year of £28.5m), and a bit better than the £27m forecast on 5 Feb 2014.

Ecommerce sales are now 20% of group retail sales. So imagine what the valuation would be if it was just an eCommerce company?! The market would go nuts for it, and probably value it at about £500m!

The outlook statement is vaguely positive, saying;

We have accomplished a lot in the past year and will build on that momentum to deliver further improvements. We have seen a positive reception to our Spring range and whilst there is still much to do, I am confident that we are on the right path and have the right strategy to drive further progress.

...Orders for the Spring 2014 collections are ahead of last year.

Therefore I think it's reasonable to anticipate this year trending towards breakeven.

How you value it, depends on the way you look at it. However, in my opinion, a £59m market cap at around 61p per share could still be cheap, if the turnaround really gathers pace and the group moves into profit. It is clear from the brand licensing, Ecommerce and wholesale divisions profits, that there is considerable value here.So the way I see it, you have a profitable business that is masked by a heavily loss-making retail business. The good news though, is that the retail units can be disposed of gradually as the leases expire, so over time the problems will shrink, leaving behind the best bits.

Therefore, the question mark over whether French Connection will survive has now gone (unless they have a relapse with product design or quality, or both). We just don't yet know how big the upside will be. I'm happy to sit tight for another year, although I'll be watching the trading statements like a hawk, and would have no hesitation in hitting the sell button if they subsequently issue a poor trading update.

Cloudbuy (LON:CBUY)

Results time is usually when the market throws a bucket of cold water over blue sky companies, as investors take a gulp and realise that market caps are very high for loss-making, early stage businesses. However, that depends on how much red meat a company can put into its outlook statement. Maintaining high market caps is all about keeping investors excited about future prospects - bull markets are driven by sentiment, not facts. Once sentiment falls flat, then the share price can fall dramatically as everyone rushes for the exit at the same time.

In the case of CludBuy (formerly called @UK) it might be too early to judge it. Results for calendar 2013 are issued this morning. There is a legacy business of company formations, which only generated £773k in turnover. The new business is based around a deal with VISA, whereby CloudBuy offers a rebate to clients who pay for their purchase ledger supplies using company credit cards. That seems to be the way they promise cost savings for clients, but we're talking tiny amounts (under 1%), and of course many suppliers won't accept credit cards as a payment method.

So I'm not convinced by the business model here. The company says that it uses software to identify cost savings, but after meeting management, it seemed to me (maybe I got it wrong?) that the main saving is just the credit card payment rebate. So their software seems to cross-match clients purchase ledgers with a list of companies that accept payment by credit card.

So with turnover of only £3m for calendar 2013, and a loss about the same as last year, of just under £1m, the £50m market cap (at about 50p per share) looks very vulnerable to any disappointments. It rests entirely on investor expectations of future growth & profits.

Following a fundraising there is plenty of cash, £4.2m at the year end.

A third line of business seems to be a social care marketplace which they have launched with Northamptonshire County Council.

In all honesty, I haven't done enough work on this one to be able to judge the chances of its success. After a fairly brief presentation by the company, and Q&A, I was left unconvinced. It's the type of thing I might have had a punt on at £10-15m market cap, but at £50m market cap, it has to deliver now. So for me, risk/reward isn't attractive, given that I don't fully understand, or believe in the likely success of their business model.

Any readers who understand the company better than me, please feel free to brief us in the comments section below. It might be great, in which case let's hear the bull case!

Modern Water (LON:MWG)

I did a two sentence review of this one just over a year ago, and there's not really a lot to add to that.

It seems to be trying to commercialise a water purification technology, so could be too early to judge performance from the historic numbers. Results for calendar 2013 are issued today, and don't look good. Turnover fell slightly to £3.5m, and its operating loss reduced about 10% to £4.9m. So heavily loss-making, on very little turnover.

They did a fundraising during the year, so there was £11.4m cash in the bank at end 2013, which looks to give them just over two years cash burn if losses remain stable.

I've not looked into their technology, so have no idea whether it will work or not, nor how to value the company, but generally speaking I avoid this type of company. The company seems to be winning contracts in China, three of which were signed near the end of 2013.

Broker forecasts are for continued losses of almost £5m in 2014, so one wonders when and how it's going to start making money?

StatPro (LON:SOG)

My last report on this company was on 31 Jul 2013 following their interim results. Re-reading my notes, and looking at today's full year results for 2013, not a lot has changed. On the positive side, the company has very high levels of recurring revenue, supplying software for the fund management sector.

On the negative side, it looks a mature business, that is moving its products into the cloud, which seems to be why profit before tax fell in 2013 from £3.8m to £3.1m.

The quoted EBITDA figures are nonsense, as that ignores all the historic capitalised development spend, as well as the £3.4m of development spending that was capitalised in the year. As I repeatedly warn readers here, if you value software companies on an EBITDA basis, you will almost certainly be considerably over-paying! EBITDA greatly inflates the true underlying performance of the business in most cases.

Normal EPS is 3.1p, putting the shares on a very high PER of 27.6 times, although that falls to 19 times adjusted EPS of 4.5p for 2013. Still pretty pricey for what seems to be a mature business with little to no growth.

The total divis for 2013 are up from 2.7p to 2.8p, so a useful yield of 3.3%.

It reports net cash, but that is dwarfed by deferred income, so it isn't surplus cash, it's just money paid up-front by customers. Let's not get into that debate again, people can adjust for it if they wish, or not. With £4m cash, and £12.7m deferred income, to my mind that's a net debt position of £8.7m, it's just interest-free debt courtesy of their customers. It's also likely to be a favourable point in the cashflow cycle, as companies nearly always choose a year end date to show a positive cash position.

In this regard, I note that the P&L has an interest charge of £308k for the year, which implies that they were maybe on average £6m overdrawn throughout the year? (assuming say 5% interest rate). The existence of a bank facility is confirmed under "Cashflow and financing", although it was undrawn at the year-end.

My hunch that the company spends most of the year overdrawn is confirmed by this sentence in the financial review;

Finance income and expense

Net finance expense reduced to £0.27 million (2012: £0.49 million), and is mainly the finance costs of our currently unutilised credit facility.

So if you calculate value on Enterprise Value (i.e. market cap - net cash), then you're going to come up with an incorrect number by relying on the year end Balance Sheet both here, and at many other companies. That's why EV is a fundamentally flawed measure - because companies window-dress the cash balance for the year-end Balance Sheet. In my view companies should be obliged to report the average net debt or net cash balance, calculated daily, throughout the year.

The Balance Sheet here is weak, with £10.3m current assets, and £18.5m in current liabilities, for a very poor current ratio of about 56%. That may not be a problem considering they have a lot of recurring revenues, but it's a weak position to be in. So the dividends are really being paid out of cash that would be better kept within the business to improve financial strength, in my opinion.

Net tangible assets are negative, to the tune of £6.6m, which again is a weak position. So it's not for me, although I've seen worse, and because of their recurring revenues, software companies can run fine on stretched Balance Sheets, providing the bank manager remains supportive.

It's noon, and the sun's out, so time for a jog along the seafront I think, see you tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in FCCN, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.