Good morning.

TT electronics (LON:TTG)

Share price: 143.5p (up 8% today)

No. shares: 159.0m

Market Cap: £228.2m

I reviewed the issues facing this company here on 4 Nov 2014, when it issued a profit warning. My conclusion then was that, despite the various problems, it could make an interesting turnaround investment at some point.

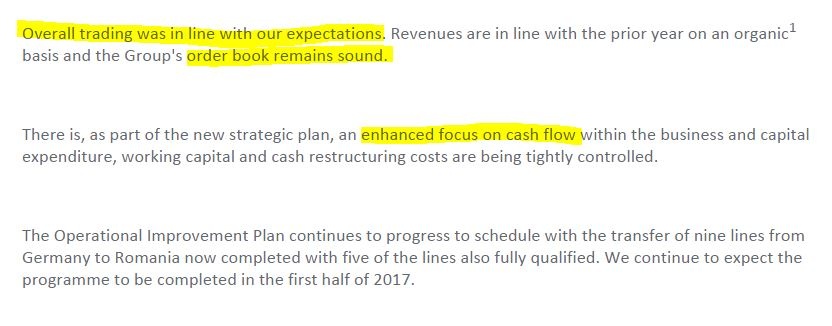

Trading update - today's update sounds generally quite positive, saying;

The comments about having an enhanced focus on cashflow are a little worrying - that implies that the cash position might be getting tight? Or that the bank might be pressing them to reduce debt - net debt was £30.7m at end Oct 2014, which doesn't seem alarming, given the size of the company. I did notice that inventories looked high in the last set of accounts, so action to reduce them is a positive.

Outlook - the Directorspeak sounds upbeat, but note that it leaves the door ajar to another profit warning, if H2 doesn't improve on H1, as expected;

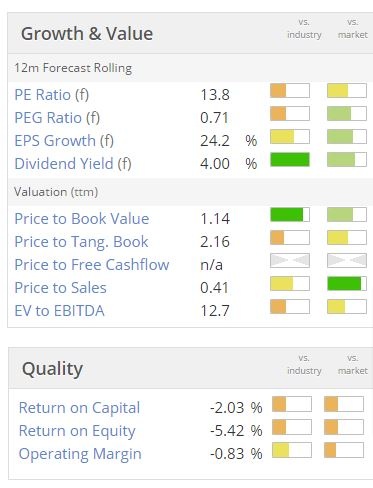

Valuation - tricky, because the company has been undergoing major restructuring, moving production from Germany to Romania. Note that the broker consensus has been steadily reducing over the last year, although seems to be bottoming out around 10p EPS;

Personally I like to see this chart going in the opposite direction! Although at some point estimates factor in all the bad news, and start rising again, we just don't know when that will be.

Assuming that broker estimates are correct, or even too cautious, then the valuation looks possibly about right, at the moment, who knows? It's impossible to say with any certainty, as we don't know how the turnaround will play out.

The divis look attractive, if they are sustainable - that's a nice 4.0% yield.

Note there is a large pension fund here, but the deficit is not too bad, but is still a cash drain of over £4m p.a. in deficit recovery payments.

My opinion - the shares have bounced nicely from the profit warning in Nov 2014.

One of the most frequent conversations I have with other investors, is when to sell - especially if there has been a profit warning.

Most people seem to think selling immediately is the best strategy, and they always say that "profit warnings come in threes!", etc. Yet I keep coming across lots of situations, like this one, where actually if you'd held your nerve, even bought more after the despondency of the profit warning (waiting a month or two for all the sellers to be flushed out), then you'd be quids in about six months later.

So I'm firmly of the view that stock market adages work, except for about half the time when they don't work! Maybe I've just created a new adage there!

In this case, I can't see any particular reason to get involved with the shares now that they've already bounced about 50% from the lows - I'd probably be taking some (or all) of my money off the table now, if I'd ridden out the Nov 2014 profit warning.

People's Operator (LON:TPOP)

Share price: 129p

No. shares: 77.1m

Market Cap: £99.5m

Final results - for 2014 are a bit of a joke considering the market cap of nearly £100m, but this company is a start-up, so I suppose it's all about growth. Even so, they have a mountain to climb. Turnover in 2014 was only £432k, and there was an operating loss of £2.3m.

The concept sounds nice, but I'm very sceptical whether it will work commercially. The company operates a virtual mobile phone network, and the idea is that customers can opt for 10% of their bill to go to their favourite charity. Then 25% of the company's profits will also go to charity.

The idea seems to be that social networks will lead to customer altruism encouraging other people to sign up, so very low customer acquisition costs - c.£7 per customer, as stated today.

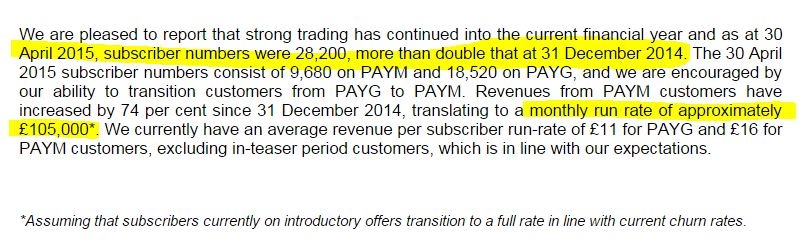

Current trading - I had to chuckle when the company says that "strong trading has continued..." - what are they smoking?! Trading is dismal, but the growth rate is high - doubling subscribers in 4 months is quite impressive;

Balance Sheet - very sensibly, the company raised a big wedge of cash, and had £18.4m in net cash at 31 Dec 2014, so there shouldn't be any worries about cash for some time.

My opinion - based on what the company has achieved so far, the valuation is completely ridiculous in my opinion. How can something that is little more than a start-up be worth £100m? I think the valuation has very much been hyped up on the name of the Chairman, Jimmy Wales of Wikipedia fame.

However, it's a company with an honourable aim, so I hope it succeeds, but personally I think people paying so much up-front for jam tomorrow are bordering on insane.

Cambria Automobiles (LON:CAMB)

Share price: 57p

No. shares: 100.0m

Market Cap: £57.0m

Interim results - for the six months ended 28 Feb 2015 look excellent, as you would expect, since car dealerships are enjoying bumper trading conditions from low interest rates (making finance deals very attractive) and a favourable move in the £:Euro exchange rate, making imported European cars cheaper.

Against this very favourable backdrop, Cambrian seems to have done particularly well, with revenue up 18.6% to £242.8m, and profit before tax up 63.8% to £3.3m - note the very thin profit margin though.

EPS for the half year was up 66% to 2.59p.

Valuation - the full year forecast is for 5.4p this year, and 6.3p next year. That makes the shares look good value at 57p, a PER of 10.6 and 9.0 respectively, although to my mind the shares should be on a lowish PER, given the huge tailwinds that car dealers are currently benefiting from. Other car dealerships are similarly cheap.

Balance sheet - not only is CAMB cheap on a PER basis, but it also has a balance sheet with lots of freehold property, and little debt. There is £13.8m of gross debt, which in itself looks modest, but also at the year end date that was almost completely offset by £13.0m in cash. That may be a favourable snapshot perhaps, on one day, but it's consistent with the last half and full year end dates too.

The P&L has £436k of interest charges in H1, so annualise that and assume an interest rate of about 5%, and this suggests perhaps £17.4m of average borrowings throughout the year. So the half year & year end net debt is probably a bit flattered, but not so much that it's a problem.

All those freeholds should mean this share is copper-bottomed, so I see CAMB as an excellent sleep at night share - this company won't be going bust.

Dividends - small, but growing. The company's stated intention is to use surplus cash to buy more car dealerships, rather than pay big divis - fair enough, everyone knows what they're getting. The interim divi was raised 50%, but it's de minimis at 0.15p per share, so the % gain is largely irrelevant.

Outlook - sounds like the good times are continuing to roll!

My opinion - there's a good investing case here, in my view - a reasonable valuation, strong balance sheet, and competent, shrewd management (in my opinion). So even though car dealers are enjoying exceptionally favourable conditions, I reckon this company is likely to continue acquiring other sites, often turning around under-performing ones.

Therefore, in my view it's a nice long term GARP share. There were some rumblings about excessive Director remuneration a while back, so that's worth checking out.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.