Happy Friday!

I usually talk about profitable rather than unprofitable companies, and Filtronic (LON:FTC) is currently the former rather than the latter:

Filtronic (LON:FTC)

Share price: 12.625p (+26%)

No. shares: 206.9m

Market cap: £26m

This company has been on the receiving end of some well-deserved scepticism on these pages in recent times, as it has a track record of losses and ended up significantly increasing its share count in fiscal 2016.

It makes radio frequency, micro-wave and millimetre-wave products for the telecoms and aerospace industries, along with other related products and services (best to take a look at its website!)

Excellent Q4 update today:

Trading during the fourth quarter of the current

financial year ("FY2017") in the Filtronic Wireless business has been

ahead of previous management expectations and despite some marginal,

short-term weakness in trading in Filtronic Broadband, the board now

expects total Group revenue of approximately £35 million in the year

ending 31 May 2017, with a commensurate increase to operating profit,

both of which are ahead of market expectations.

Checking the company's H1 report, I see that it made operating profit of £2.4 million from revenues of £21.6 million (and warned that H2 would be lower).

It's still a high-risk micro-cap, of course, and receives a "Highly Speculative" Risk Rating from Stockopedia.

The customer base is probably still rather concentrated. Last year's annual report said that "until we have expanded our product portfolio and customer base we will remain exposed to short term variations in demand patterns at our main customer". The top four customers in aggregate were responsible for a huge 74% of turnover.

Sales have much more than doubled in fiscal 2017 compared to 2016, so diversification should have improved now at least compared to that level of concentration.

Also, it has significantly strengthened its financial position after last year's placing - my initial glance at the interim balance sheet shows it has a significant excess of current assets over all liabilities (nearly all in the form of customer receivables, so it is relying on getting paid).

Anyway, I'm flagging it here as it might be worth more considered research if you have an interest in the industry and the appetite for this level of risk.

Impax Asset Management (LON:IPX)

Share price: 93p (+2%)

No. shares: 128m

Market cap: £119m

This report came out yesterday but a reader asked me to comment and since I follow the asset management industry, I thought I'd see if I could come up with a few words on it.

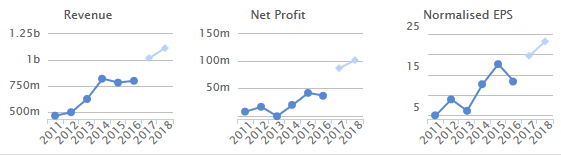

Having a listen to the company's webinar on the results, it's a simple proposition: investment focused on resource efficiency and solving environmental problems. 30 investment professionals manage £6 billion in AuM from offices in London, Hong Kong, New York and Oregon.

Food safety, air pollution and clean water are some of the big challenges and themes which the company works on.

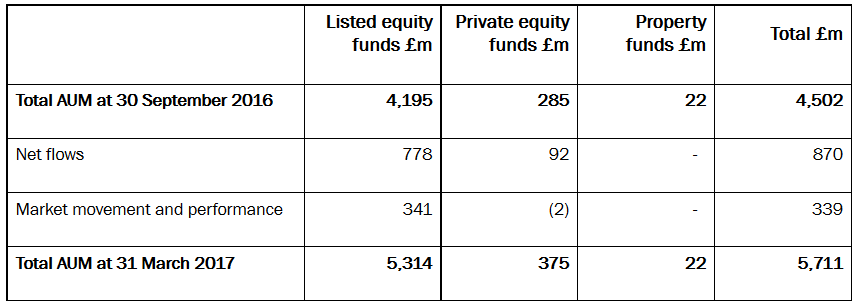

Momentum in AuM is fantastic at the moment, reporting six consecutive quarters of inflows and the following H1 movement:

Scrolling down to the income statement, I see that operating costs reduced to 77% of revenue for the period, compared to 83% in the comparable period in 2016.

There is inevitably going to be profit-sharing with employees when you have a people business such as an asset management company, and variable staff compensation will usually rise with revenues, but you should still benefit from operating leverage as an investor and that reduction in % costs is the sort of thing to look for.

Interim dividend increases 40% to 0.7p from 0.5p, and is covered three times.

Balance sheet is fine, no debt and healthy cash reserves of £13 million (of which £6 million is a necessary "risk buffer", i.e. regulatory capital plus buffer).

My opinion

Sounds interesting, with the CEO talking about the capacity for £10 billion in AuM without the need for any new products.

The current market cap is just 2% of AuM, which strikes me as rather low. Depending on their fee margins, many active asset managers trade at higher levels than that - for example, Jupiter Fund Management (LON:JUP) is currently trading at 5% of AuM.

Of course, it's possible that Jupiter Fund Management (LON:JUP) is overvalued too, but I'd be inclined to think it's more likely that Impax shares are still too cheap, despite how much they've already risen.

Entertainment One (LON:ETO)

This is beyond our upper market cap limit but is well-followed by investors so I thought I would briefly mention it.

Entertainment One is a leading independent studio which owns a wide range of intellectual property across film and music, and is the controlling shareholder of the Peppa Pig brand. It also owns the leading kids show PJ Masks. The content library has been independently valued at $1.5 billion (£1,160 million).

Today's announcement is a semi-profit warning as the company warns of £47 million in one-off costs, while maintaining that "underlying EBITDA" will be in line with expectations.

These costs are both in relation to film distribution, making a one-time payment to end a prior agreement and incurring other costs to shift toward digital distribution.

There has been no shortage of drama at E-One. Last year, the company rejected an offer from ITV (LON:ITV) at 236p/share.

It's an appealing company because despite the debt it's carrying (£260 million at the half-year report), there is some great-quality IP on its books and the cash from operating activities has been huge (and has been spent on lots of investment in new IP).

These investments are forecast to pay off and result in significant improvements in results, though it seems investors remain fairly sceptical.

TT electronics (LON:TTG)

This is an AGM statement for the four months ending April.

TT Electronics provides a range of products and services including connectors, resistors, semiconductors and sensors, for the transport, industrial, aerospace and medical industries. It has multiple offices in Europe, Asia and North America. So it's a truly international and multi-faceted business.

The statement is fairly upbeat:

Trading has been in line with our expectations overall. The Group's revenues are 10% higher than the prior year and 1% higher on an organic1 basis.

The Group's order book is strongly ahead of the prior year, giving us better visibility of the outturn for 2017 and reflecting a continuation of the momentum from the end of 2016. The development of our order book demonstrates that our strategy to position ourselves in structural growth markets where there is increasing electronic content is delivering results.

I've just checked the full-year results from March, and they were encouraging. Underlying PBT rose 20% at constant FX, or 40% at actual FX, to £26.9 million. The adjustments weren't too drastic, as reported PBT was close behind at £23.2 million.

It's one of those rare companies which reports its ROIC to investors and explicitly uses it as a KPI.

It achieved ROIC (underlying) at 10.3% in 2016, which is admittedly quite modest. Operating margin is also nothing to write home about at less than 5% at a group level.

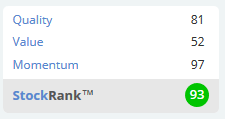

But this is one of those instances where I'd be particularly interested in the momentum of trading, as the order book grows and the company stages a turnaround from weakness in the 2013-2015 period. The Momentum Rank reflects improved fortunes and at a PE of 14x it perhaps merits a closer look.

Net debt should be manageable at £55 million, it is cash-generative and pays a dividend, and the StockRanks like it:

That's all for today, thanks for your comments and have a great weekend.

Best wishes

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.