Good morning!

Equities First Holdings

This is an American, apparently unregulated, finance company which has been doing deals with UK listed company Directors, to provide "loans" against Director shareholdings in their companies. However, a little digging online shows that EFH's modus operandi is clearly to sell the shares that are transferred to them as collateral, and that the "loan" is non-recourse - i.e. that the borrower can just walk away from it, with no penalty.

Directors at five companies appear to have used this facility - one is Quindell (which I can now mention, as I am no longer short of it, as of this morning), IQE, IGas, CloudBuy, and Angle.

It appears that the loan facilities could be used as a backdoor way of Directors selling shares, in a way which avoided having to disclose that to the market, or so they thought. It could even be used to disguise selling of shares, and make it look as if the Director is buying shares (if some new shares were simultaneously bought with the "loan" proceeds).

The whole thing has unraveled, and three of the five companies concerned have been forced to issue clarification or correction statements. It's possible that some of the Directors involved did not realise the consequences of using this arrangement, but it has reflected badly on all of them.

Shares in Quindell (LON:QPP) have been in freefall, and I expect to see the departure of the founder within days, in similar circumstances to which he was ejected from his previous listed company Innovation (LON:TIG). Good riddance quite frankly. I'm afraid that type always come unstuck eventually.

Shares in Cloudbuy (LON:CBUY) (statement today) and Angle (LON:AGL) (statement today) are also down sharply today. Although in both these cases it looks as if the Directors concerned were probably genuine, in wanting funds for a house purchase, and were probably unaware that the modus operandi of EFH appears to be that they immediately dump the transferred shares in the market.

The FCA, or whoever it is that is supposed to be regulating London markets, needs to issue some immediate instructions on this subject. Although the hot water that the above companies have got themselves into will surely deter other Directors from going down this very unwise route. I would like to see such deals banned altogether. Or at the very least, full details must be immediately disclosed to the market, making it clear that tranferring shares to EFH is actually a disposal of shares by a Director. A non-binding agreement to repurchase the shares in two or three years' time, does not negate the reality that the shares have been transferred to another party, in return for money - which to any rational person would be called a sale.

Tracsis (LON:TRCS)

Share price: 364p

No. shares: 26.4m

Market Cap: £96.1m

Please note that I am interviewing John McArthur, CEO of Tracsis, around lunchtime today, and will be publishing the interview as an audiocast on my AudioBoom channel at about 3pm today. I'd like to make the interview interactive with listeners, so if you have any questions, then please submit them before 1pm today in the comments section below this article, and I will ask John on your behalf.

Tracsis is a small group of niche companies serving mainly the rail sector, mainly in the UK, offering products & services like scheduling software, passenger counting, remote monitoring equipment, and consultancy (e.g. for franchise bids).

Final results - for the year ended 31 Jul 2014 are published today, and look very good.

Turnover is up 106% to £22.4m (some due to acquisitions), adjusted EBITDA is up 61% to £5.4m (note the high profit margin), and profit before tax up 62% to £4.2m. Earnings per share was up 53% to 12.9p. Note that the reported 12.9p is the statutory EPS, i.e. with no adjustments. So I presume the 14.9p forecast from WH Ireland must have had some adjustments in it. I'll clarify that with John McArthur in my interview shortly.

Outlook - the US potential sounds interesting, as trials have already been underway for almost a year;

We continue to benefit from transport markets that are experiencing record levels of government spending, steadily rising passenger numbers and regulatory change. This environment provides for good growth opportunities as we look to help solve the transportation problems of tomorrow. In the year ahead we intend to make further in-roads into overseas markets, most notably the US, whilst continuing to diversify our technology portfolio and UK offering through a combination of in-house development and further well placed acquisitions.

Balance Sheet - very strong, with net cash of £8.9m (up from £6.6m), which works out at 34p per share, over 9% of the market cap. So the company has enough fuel in the tank for one or two more acquisitions, which have typically been quite small, but successful.

EBITDA - I'm reassured to see that although the company has some intangible assets on the Balance Sheet, these relate to acquisitions, and it has not capitalised any other costs into intangible assets during the year. Hence EBITDA is a figure that can be taken more seriously here, than at companies which capitalise a load of developments costs during the year.

Valuation - the valuation of this share always look high, but broker forecasts were increased three times last year, so what looked expensive at the start of the year would have ended up looking good value by the end of the year. On the basic EPS of 12.9p the PER comes out at a pretty spicy 28.2. However that includes non-cash amortisation of intangibles, and various other items which you may agree are OK to adjust out, or you may not. Personally I have a problem with share-based payments, as to me that's just remuneration, so I tend to leave that in when calculating EPS to value the company on.

One should really take off the net cash from the share price too, since that cash will at some point be used to buy other businesses. I've not got the latest broker forecasts for this year, so will update this article once I have those.

My opinion - I will reserve judgment until I've interviewed the CEO shortly, but to my mind the share price is aggressively valued on the historic numbers, but that's probably because the company is trading well, and has potentially exciting upside from overseas sales of its remote condition monitoring equipment - especially in the USA where trials are ongoing. Note this comment in today's results;

North American pilot established and since extended. All indications point to a significant long term market opportunity... Our expansion plans within the US are a key driver of growth for this division and whilst the specific timing of technology uptake is difficult to predict, we see a considerable market opportunity that is many times larger than what we have achieved thus far within the UK

Therefore I think one should see the share price as a hybrid of existing earnings, plus an additional amount for anticipating sales taking off in the USA.

UPDATE: My audiocast with John McArthur of Tracsis is now live. Click here to listen, on Audioboom, or here on SoundCloud

Recap after interview- I've not managed to get hold of the revised WH Ireland forecasts yet, but should have them tomorrow. So I'll press on without them. Tracsis today reported 12.9p basic EPS, which is equivalent to about 15p adjusted EPS (which mainly strips out amortisation of intangibles, which is fine, as there is no development spend capitalised).

Therefore if we take the share price of 364p, and take off the 34p per share net cash (which will be put to use in earnings-enhancing acquisitions over time), then the Enterprise Value is 330p/share. With 15p adj EPS just reported, then the historic PER is 22, quite a punchy rating.

However, with the USA trials underway, and the potential there for orders (of the highest margin things Tracsis sells) which the company describes as "many times larger than... the UK"), it could get exciting if the potential in the USA turns into large scale orders.

What might EPS for the current year come in at? It could be anything from 15-25p in my view, depending on the scale of overseas orders. Last year broker forecasts were raised three times, and by a quite substantial amount, so if the same thing happens again this year, then I'll be kicking myself again that I didn't buy because the PER looked a bit too warm at the time, which is exactly what I decided when these shares were 130p, and again at 200p.

Overall I think the shares are probably a little too high for me at the moment, but I could easily regret not buying if & when orders are announced for overseas sales. As always, John McArthur comes over really well in my interview - telling it how it is, very open, and very much the type of management that is backable. Hence the shares deserve a management premium - as he's done 6 acquisitions, and hasn't put a foot wrong. So I remain keen on the company, and am looking for a nice spot to pick up some shares on the next decent pullback.

Flybe (LON:FLYB)

Share price: 112p

No. shares: 223.1m

Market Cap: £249.9m

Interim results - for the six months to 30 Sep 2014 were published this morning, and although I read them straight away, I didn't have time to do a write-up here, due to being so busy with other stuff. So am catching up now in the evening.

FlyBe is a turnaround situation, and my initial reaction to reading the results today was that they look disappointing. Clearly the market agrees, as the share price has dropped back to the previous support level of 110p, which was the price of the large Placing earlier this year.

However, the headline loss is explained by one-off factors;

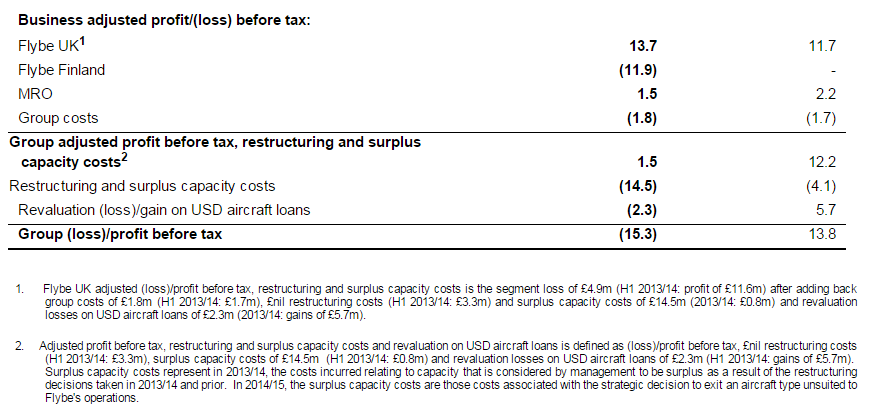

Loss after tax of £15.4m compared to profit after tax of £13.6m for the same period last year, impacted by £34.3m of one-offs and revaluations: Finland net impairment (£9.9m), EU261 flight delay catch-up provision (£6.0m), a net movement on surplus capacity and restructuring cost (£10.4m) and movement on revaluations of USD loans (£8.0m)

The Finland JV looked a millstone, so exiting from that is a positive in my opinion - FlyBe's 60% stake is being sold for a token E1 to its JV partner, Finnair. It was loss-making, so that's another problem gone.

Other legacy issues are also being dealt with;

"Our UK business performed well in the first half of the year showing the strength of the new Flybe. We delivered an increased adjusted profit before tax in the Flybe UK business and importantly became cash generative. Though our business transformation is far from complete, we are seeing the benefits of improved commercial execution with the right cost base and we now have improved operational and financial disciplines throughout our organisation.

"We are making significant progress in addressing the legacy issues within the business, which will ensure we operate with a simpler business model. We have taken decisive action in removing the overhang of the outstanding $750m order for 20 unwanted E175 aircraft, withdrawing from the Finland joint venture as well as providing for the potential costs for the arbitrary EU 261 regulation for flight delay claims in Flybe UK. We are working hard to resolve our surplus fleet issue.

The surplus fleet issue worries me a little, as it's quite a chunky item in the P&L, at £14.5m for the six months.

Although, as you can see from this table from today's results, the ongoing UK business actually showed an improvement in underlying profits from £11.7m to £13.7m;

Balance Sheet - this looks fine to me, with £167.5m net tangible assets. That includes £72.0m of net cash, and I note that 5 aircraft have been purchased outright in the period to reduce costs.

My opinion - I'm moderately disappointed with these figures, and was hoping for more progress in the turnaround. That said, new management have made dramatic progress in turning around what really was a basket case of a business a couple of years ago.

The key issue now is sorting out the surplus planes. Hopefully the new routes from London City Airport will do well - being only 20 mins by DLR from Bank station, this is a far better proposition for business travellers than Gatwick or Heathrow, and should do well in my opinion.

My personal price target on this stock is 200p+, but it might take another 6-12 months to get there perhaps?

Regards, Paul.

(of the companies mentioned today, Paul has a long position in FLYB, and no short position.

A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.