Good morning!

Groan, it's one of those days where the RNS only lists results & trading updates from companies which I find of no interest to me whatsoever. So I can't cherry-pick the interesting ones, as there aren't any.

We seem to be having something of a correction at the moment. Not before time, as the post-Brexit boom really has been remarkable, and maybe got a bit excessive perhaps?

Whenever the market goes wobbly, I have a standard procedure now - I chuck out some of my low conviction positions (especially if they've risen a lot, and look fully priced). Then I also open up some short positions on over-valued US large caps, and/or indices. That tends to act as a good shock absorber for any downturn in the rest of my portfolio.

Then when the sell-off seems to have run out of steam, I buy back the shorts, and that usually provides a little pot of extra money to grab some bargains on the long side, at or near the lows. Obviously that's all a lot easier said than done. However, it's worked for me a few times now, and as my guru says to me - "Just do more of whatever works". Some of the best advice is the simplest.

ShareSoc Brighton evening

Is tomorrow! I'm very much looking forward to this, which we're hoping to make into a monthly event. It's ShareSoc's event, but I'm just an enthusiastic helper! There are a few places left, so if you fancy coming along for what should be a fun evening, here is the booking form.

The company presenting is Palace Capital (LON:PCA) . Also, I'll be giving a 30 minute presentation on my best small cap stock ideas from the last month's reports, and which shares I've been buying/selling personally. If people like this slot, then it may become a regular monthly thing.

Of course one of the best things about these events is that we also have the whole evening to chat to each other about shares we think look interesting. So there's always a lively & friendly discussion until closing time. Everyone has a shared interest, so conversation flows easily right from the start - so nobody should ever feel intimidated or shy about coming along to investor events.

Restore (LON:RST)

Share price: 356.6p (up 0.6% today)

No. shares: 112.1m

Market cap: £399.7m

Interim results, 6m to 30 Jun 2016 - the adjusted figures look very good;

Revenue (£m) | 55.4 | 43.9 | +26 |

EBITDA (£m)* | 12.3 | 9.0 | +37 |

Operating profit (£m)* | 10.5 | 7.7 | +36 |

Profit before tax (£m) * | 9.6 | 7.1 | +35 |

EPS (p) ** | 7.9 | 6.8 | +16 |

Dividend per share (p) | 1.33 | 1.00 | +33 |

Net debt (£m) | 29.3 | 30.4 |

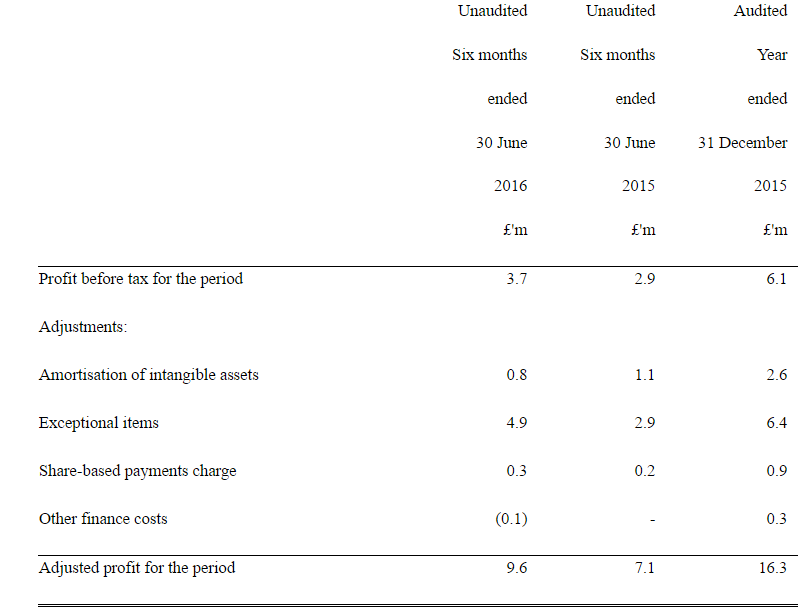

However, I note that there's a yawning gap between adjusted EPS of 7.9p for H1, and statutory EPS of 3.8p, both are for continuing operations only. So it's worth looking into what the adjustments actually are - are they reasonable or not?

There's a reconciliation in note 4 to the interim accounts today, where you can see that it's exceptional items that are doing the heavy lifting to get adjusted profit up. That worries me a bit. Personally, I like nice clean profits that don't need any adjusting.

Cash generation is also nothing to write home about here, indeed looks quite meagre for a £400m mkt cap group. That is reflected in small dividends.

Outlook - sounds solid, and in line with expectations;

The second half of the year has started well and we remain confident of making progress in the remainder of 2016 to deliver a full year performance in line with current market expectations.

Balance sheet - not great. As growth has been primarily driven by a series of acquisitions, it's the usual story of intangibles becoming an ever greater mountain at the top of the balance sheet. Strip those away, and NAV of £113.5m drops down to NTAV of minus £4.2m.

That's not necessarily a problem though, for a profitable business. Although it is important to note that there's nothing in the way of net tangible asset backing.

Net debt of £29.3m seems fairly reasonable. It makes sense for profitable businesses, with reliable income streams to use a bit of debt when it's so cheap. The trick is not becoming over-reliant on debt.

Share issuance - it's worth nothing that the average share count rises every year with this company, and has gone up from 27m in 2010 to just over 4 times that amount today. Sure, the group is now much bigger, as it's been buying up other companies. Personally I prefer companies which can grow without issuing new shares and taking on excessive debt.

Further acquisitions - note that a substantial acquisition was made post period end;

On 26 August 2016, the Company acquired PHS Data Solutions, which is the second largest provider of document shredding services in the UK, as well as having a significant records management business and a presence in document scanning, for a total consideration of £83.2m.

My opinion - this has been a fantastic investment since 2010, being a serious multibagger. However, that doesn't necessarily mean it will be a good investment in future, from today, which is all that interests me.

My main concern with this group is that there's a finite life to its main activites - document storage & shredding will probably be largely defunct in say 20 years, if not earlier. Everything will be digital by then. Sure, Restore can make money on the way, and can digitise content for its customers, etc, but what happens after that, when document storage is no longer needed?

To my mind, the current valuation of a PER of about 19 looks very warm for a business which is in this space. Also, there's no net asset backing, the divis are poor, and cashflow doesn't look great.

So for those reasons, whilst acknowledging what a terrific investment it has been to date, I wouldn't be interested in getting involved now.

Brady (LON:BRY)

Share price: 66.25p (down 2.6% today)

No. shares: 83.0m

Market cap: £55.0m

Interim results, 6m to 30 Jun 2016 - I'm scratching my head to understand why this company is valued at £55m? That seems a very warm valuation, given that it performed badly in 2015, and is now only moving into very modest profitability due to cost cutting. Plus its long-standing CEO recently decided to move on, suggesting to me that there's not a particularly exciting future ahead for the company - if there is, then people tend to stick around. That's assuming he wasn't pushed of course.

As we saw last year, revenues are fairly predictable, due to more than half being recurring in nature. However, the problem is that profit is unpredictable, because it relies so heavily on Q4 licence wins. So the company itself really has no idea what profit it's going to make from one year to another.

How on earth can investors value it then? Broker forecasts are just guesswork.

The cash position looks fine, and if Brady win some good contracts, then profit may recover. However, for me the present market cap looks wildly optimistic, so it's of no interest to me. Why pay up-front for future success which may not happen? That just strikes me as poor risk:reward.

Gable Holdings Inc (LON:GAH)

Suspension & delisting - Zeus has resigned as its NOMAD, so shares are then suspended, with one month to find a new NOMAD.

In a separate announcement, the company says it needs to cut costs to survive. It's a general tale of woe. So they won't be seeking another NOMAD, but will just be de-listing.

The writing has been on the wall here for a while. I warned readers away from this share, in the strongest terms I dared, here on 21 Dec 2015. A broker friend had strenuously warned me not to go near it, describing it simply as "a wrong 'un". The figures, and related party transactions stank too.

So there we go, that's the end of that one. I doubt very much that shareholders will see any return now, so best just write it off & put it down to experience, and of course never touch any company in future run by the same Directors.

Safestay (LON:SSTY) - as mentioned before, I like the concept here, but the figures just aren't working. Today's interim results show only an operating profit of only £191k, from fixed assets valued at £46m. That seems an extremely poor return on assets.

Moreover, the operating profit is nowhere near enough to cover the interest bill - finance costs are £789k for the half year.

Despite the upbeat commentary, I feel that this posh hostels provider is a long way from having demonstrated a viable business model yet. The aggressive property valuations make the balance sheet look OK, but I wonder how the book values would compare to an actual free market disposal price?

It clearly needs to grow more, which means more dilution for existing holders. Everyone knows that, so I can't see the shares gaining any traction for long, as rises will probably just be snuffed out by another discounted placing.

Running hostels strikes me best viewed as a lifestyle business for an owner/manager, run on a shoestring. It's difficult to see SafeStay getting very far with their business model. The sites don't generate enough profit to fund a central overhead, finances costs, let alone dividends to shareholders, in my view.

Christie (LON:CTG) - poor interim results from this services group. I can't see any appeal in this company at all. Although the shares have come down quite a lot, as they should have done.

The outlook for H2 is better though. Note that there's a hefty pension deficit on the balance sheet.

I'm losing the will to live here, so think I'll just sign off for the day now, and hope there are some more interesting companies reporting tomorrow.

Hope to see some of you in Brighton tomorrow evening!

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.