Good morning!

Quarto Inc (LON:QRT)

Share price: 210p (down 10.6% today)

No. shares: 19.7m

Market cap: £41.4m

I last reported on this "leading global illustrated book publisher and distribution group" on 9 Feb 2015 on renewal of the company's bank facilities.

Prior to that, I reported on 2 Feb 2015 covering the 2014 trading update. Those two articles are still relevant, so I won't repeat all the same detail below.

Interim results to 30 Jun 2015 - Quarto has made nearly all its profit in H2 in recent years, so the interims are not a good guide to full year performance. Accordingly today's fall in adjusted operating profit from $0.6m to $0.2m is not of enormous concern, although it would have been better to see profits improving.

Last year it made $0.6m adjusted operating profit in H1, and $14.8m in H2, so it's a very heavily H2-weighted seasonal trading pattern, which I presume is due to its illustrated books being popular items for gifts at Christmas.

Therefore it's a waste of time further analysing H1 trading, and more important to focus on the outlook comments for H2, which say;

We fully anticipate Quarto will have a strong second half of the year with good order book visibility. Quarto will develop further as a business in 2015 and continue to expand our reach in channel, territory and format. We are well-positioned, as we have shown in recent years, to grow organically, capitalising on our strengths, making long-lasting, information-rich books and selling them in as many languages and channels as possible. We also intend to develop the business by making suitable acquisitions, as we have done, that are complementary to our existing businesses and provide financial and operational synergies, taking advantage of opportunities that support the long-term growth of our business around the world.

That sounds pretty emphatic to me, and the positive comments are backed up with "good order book visibility", meaning that it's more than just hoping H2 will be strong.

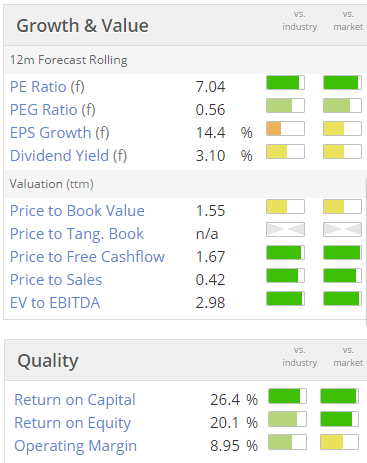

Valuation - the valuation graphics look very appealing, as do the quality scores too, so this initially looks a very good value share. Bear in mind that the graphics are based on last night's closing price, so with the shares down 10.6% today, the PER will now be nearer 6 than 7, and the dividend yield will have risen to about 3.4%.

Dividends - the interim divi this time has again been held at 3.35p (as in other recent years), with comments that the final divi will be more heavily weighted than usual compared with H1, to reflect the seasonality of trading.

Balance sheet - as I've commented before, this is where it all goes wrong. The main issue is that Quarto has way too much debt on its balance sheet, so let's focus on that.

Bank debt - net debt at 30 Jun 2015 is reported at $81.0m (only $0.5m lower than a year earlier). Note that the 31 Dec year end seems to be a seasonal low for net debt, at $66.0m on 31 Dec 2014, which shows how relying on year end Enterprise Value can be dangerous - as you might well be calculating the valuation of the business on an artificially low net debt figure, thus over-valuing the business.

So at £1 = $1.56, the net debt converts to £51.9m, which is more than the market cap of £41.4m. This drastically affects how we should value the company. If you were to reduce net debt to a modest amount of, say 1 year's profits, then that would mean you would need to do an equity fundraising at the current share price which resulted in the number of shares in issue being doubled.

That would almost halve EPS (I say almost, because interest costs would greatly reduce if debt were mostly repaid, thus partially offsetting the increased number of shares in issue, in its effect on EPS). Therefore overall, if enough equity were raised to fix the balance sheet, then the PER would rise from around 6-7, to about 11-12, which looks about the right price for this type of business.

So my point is that the high level of debt makes this share look apparently cheap, but when you theoretically strengthen the balance sheet to a point where it would be a safe investment, then the PER is no longer cheap.

I suspect that an equity fundraising here is likely to happen at some point, and is long overdue in my opinion.

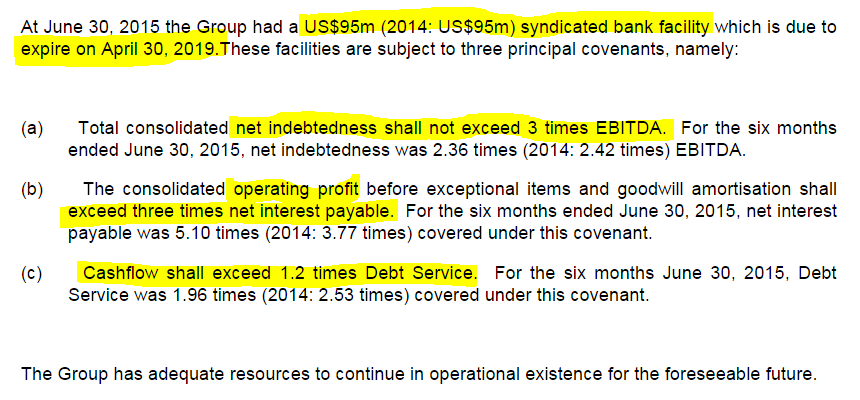

EBITDA & bank covenants - the company very helpfully publishes its bank covenants (I wish all companies would do this), and the current scores, in note 8 to today's accounts. This shows (see below) that the company is operating within its bank covenants, and has some headroom (although not enough to be really comfortable), and bear in mind this is when interest rates are at historic lows.

It's good that the banks renewed the facility, so there's no panic on that front, as the facilities run to Apr 2019.

However, what really concerns me is that the banks rely on an EBITDA covenant, listed as (a) above. The problem with this, is that Quarto's EBITDA number is a red herring. They have a large amount of costs going onto the balance sheet into "intangible costs - pre-publication costs", which is the biggest asset item on the debit side of the balance sheet, at $57.5m.

This seems to be fed into the P&L quite quickly, over about two years, so there was a massive $30.9m amortisation charge for these costs in calendar 2014 for example. The impact of this is that pre-publication costs are being deferred for about two years, using this capitalisation and amortisation method. That might be a reasonable accounting treatment, but you cannot ignore an amortisation charge that is spreading real business operating costs over just two years - this is why EBITDA is utterly meaningless at this company. Yet the worry is, EBITDA is the kingpin supporting the bank debt. The bank are working on that basis that this is a hugely cash generative business, making gigantic EBITDA. But actually, it's not.

The risk is therefore that the bank at some point recognises that relying on EBITDA is not sensible, and potentially moves the goalposts, requiring a lot of the debt to be repaid. That would then need a dilutive equity fundraising. I'm not saying that is going to happen, but it is a big risk here for investors.

What the company should be doing, in my view, is paying down bank debt as a top priority, and that would mean cancelling divis for the foreseeable future. That's what I'd do anyway. Highly indebted companies with stretched balance sheets, really should not be paying any divis at all, it's much too risky. Banks may be relaxed at the moment, but you cannot rely on that always being the case.

My opinion - it's far too risky for me to consider investing anything here. Net tangible assets are negative, and there's way too much bank debt, which relies on an EBITDA covenant which looks inappropriate to me.

On the other hand, at the moment the market is paying little attention to weak balance sheets, and seems to be assuming that interest rates will remain low forever. That's fine in the good times, but if & when something goes wrong, then a weak balance sheet is a curse, and can quickly destroy investor returns.

I'm surprised that the StockRanks gives a very high score of 97 to Quarto, but the system seems to more-or-less ignore balance sheet weakness, high debt (and pension deficits - as we've seen with Wincanton (LON:WIN) ), which I think could emerge as a flaw in the system when credit conditions tighten & interest rates rise. For the time being though, it's working brilliantly!

Although I think we might need two StockRank systems - the current one to use in benign economic & stock market conditions, and a much tougher one (emphasising balance sheet strength) to protect the downside in more bearish conditions.

Or people can just do what I do - using StockRanks to give me a shortlist, and then manually weed out the dodgy overseas AIM companies, and the companies with unacceptably weak balance sheets. All food for thought & discussion!

Stadium (LON:SDM)

Update re Open Offer - I was really pleased to see that Stadium included an Open Offer element within its recent fundraising - i.e. they gave existing shareholders (including private investors) the opportunity to buy some discounted shares at the same price & time as the Institutional Placing. Bravo!

In my view, companies should always include an Open Offer with Placings, as it can often be done relatively cheaply. and companies have a moral duty to allow existing shareholders to participate too, rather than being diluted through (often repeated) Placings.

After all, the principle of pre-emption rights for existing shareholders is a core principle in UK company law, and Placings by-pass that crucial point. This does not reflect well on a company and its advisers, if existing holders see their interests harmed by repeated discounted Placings, which is common with smaller, loss-making companies especially.

Stadium saw strong demand from its existing shareholders, with 1.577m shares being applied for, out of just under 944k available. So a successful fundraising. I think the Open Offer element should have been larger.

The danger with including a very small Open Offer alongside a Placing, is that it looks little more than a fig-leaf, or token gesture. In an ideal world, I'd like to see Open Offers be the same size as the Placing, where a discounted price is being offered.

CentralNic (LON:CNIC)

Share price movement - I don't know what to make of this statement, would any readers care to comment? Sounds potentially interesting.

The Board of CentralNic plc, (AIM:CNIC), the internet platform business which derives revenues from the global sale of domain names, believes that the recent movement in the Company's share price is related to media comment surrounding the recent announcement by Google to adopt the suffix .xyz for use by its new identity "Alphabet", the principal website of which will be abc.xyz. CentralNic is the exclusive global wholesaler for .xyz, receiving a share of revenues for all .xyz domains registered.

The Board wishes to make it clear that although the recent announcement by Google was very positive, the growing interest in .xyz was expected as awareness and usage of .xyz and CentralNic's other new Top-Level Domains continues to expand.The Company continues to trade in line with market expectations for the current year to 31st December 2015.

The shares are up 26% to 61p at the time of writing.

I don't know enough about the company to decide whether it's worth looking at or not. Have any readers looked at this one?

That's all for today!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions.

A fund management company with which Paul is associated may hold positions in companies mentioned.

NB. These reports are Paul's personal opinions only)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.