Good morning. I ditched my shares in Volex (LON:VLX) after poor recent results, but more importantly on looking at forecasts it was obvious that the company would be running short of cash in 2014, since even on Edison's forecasts it would have hit a level of net debt to EBITDA of over 3.5 (where a level most Banks are comfortable with is nearer 1.5). So I sensibly sold, only to see a flurry of PR, including 2 commissioned research notes in the same week (a sure sign that they want to raise some money!), and sure enough a small Placing has been announced today at 116p. The only surprise is that they haven't raised more, so I suspect this won't be the last time they come back for more money.

In normal circumstances poor results, and a fundraising would have been a disaster for the share price, but in this case the price has bounced back and simply shrugged off the problems. Although I hear that management have been telling a convincing story on the rounds of broker/Institutional meetings, so for the time being the market is giving new management the benefit of the doubt on a turnaround story that hasn't yet delivered anything convincing. So I'm much more sceptical on this one now, and don't plan on revisiting it - the market could be a lot less forgiving the next time they disappoint perhaps?

The announcement today also indicates the the Volex Employees' Share Trust has sold 3.4m shares, of a total of 4m. Seems odd. I thought the purpose of such a Trust was to award shares to employees on predetermined performance measures? So it looks as if they are giving them cash instead perhaps?

It's absolutely extraordinary the amount, and frequency of fundraisings going on at the moment - literally every day there are Placings and/or IPOs, of increasingly dubious quality/value. So on this measure we're very much in late stage bull market territory. Sooner or later the market's appetite for new issues and Placings will be satisfied, but in the meantime on we go.

The danger of over-paying for a growth story was very much in evidence yesterday when shares in Perform (LON:PER) were absolutely crushed by a profit warning - down 60% in one day! This won't be the last example I'm sure, of momentum and wild optimism taking a share way beyond a reasonable valuation. The market is littered with examples of this right now, and I reckon a lot of frothy share prices could come down to earth with a bump on publication of results & trading statements where wacky growth assumptions come under closer scrutiny. So very much a time to be careful I think, and not get carried away with valuations, especially on growth stocks.

Several people have told me I'm being far too cautious at the moment, which might well be true, but the good thing about playing it safe is that you can just stay focussed on the underlying value in companies, and ignore market fluctuations as background noise. In the long run the portfolio should perform well, and drawdowns of say 10% along the way are perfectly normal, and nothing to worry about.

Torotrak (LON:TRK) has also announced a fundraising, and quite a big one, to finance the acquisition of the remaining 80% of an associate company, Flybrid Automotive. The deal is at 18p per share, and has three elements - a firm Placing of 54m shares, an additional 22.2m shares by Placing/Open Offer, and 12.7m shares being bought by Allison Transmission. A further 7.8m shares are part of the consideration. So new shares are being thrown around like confetti here, totalling a pleasing to the eye 88,888,888 new shares raising £16m. That is an enlargement of the share capital by 50%.

In my view it's another tacit admission that the original gearbox technology isn't really going anywhere much in commercial terms, so they're trying a few other things too. It's a very stale story though, having been on the Stock Market for over 15 years, with no sign of a breakthrough into sustainable profit. So perhaps trying something new is a good idea in order to preserve everyone's jobs? Whether it will provide a return for shareholders is another matter. Bear in mind that Torotrak has accumulated losses of almost £60m, although these losses were recently netted off against the Share Premium account, to wipe the slate clean.

We've been discussing Vislink (LON:VLK) on Twitter, and on bulletin boards quite a bit. The share price has been hit hard by recent news that the company is ditching its full Listing and moving to AIM. Frankly there's been a lot of nonsense talked about this. AIM is the right place for a small, acquisitive technology company, and it was an anomaly that it had a full listing in the first place. The market cap is only £46m after all.

However, moving to AIM was always likely to cause some short term market disclocation, as some shareholders exit (e.g. some Funds are not permitted under their own rules to hold AIM-Listed shares). So a process is underway whereby they exit the shares, and the market absorbs the overhang. That's caused short-term price weakness, but has nothing whatsoever to do with the fundamental performance of the company - indeed they issued an in line with expectations trading statement less than a month ago, on 18 Nov 2013.

In my opinion (and please remember I'm only ever expressing an opinion here, not making any kind of recommendations) this type of situation, where a technical factor alone has triggered a fall in share price, can be an excellent buying opportunity.

In the long run, being on AIM is likely to lead to a higher share price, because AIM has (and will soon have more) excellent tax advantages - e.g. the 2-year qualifying exemption for Inheritance Tax is a phenomenal tax break, and more people are realising this is a remarkable way to shelter assets from the taxman. Plus there is now ISA money coming into AIM, which will be an ongoing benefit, and from April AIM shares will be exempt from Stamp Duty too.

Sure there are some less than perfect management teams at some AIM companies, but there are also several hundred excellent companies on AIM, which should not be tarnished by association with some of the dross on the market. Corporate governance is lighter, but it all boils down to whether you trust management and their track record. In the case of Vislink, the only issue is arguably over-generous management bonus/option schemes, but on the other hand if they deliver on the plan then why shouldn't they share in the gains?

Anyway it's a time to remain focussed on the fundamentals in my opinion, and I'm treating everything else as simply background noise. Value always outs in the long run.

An RNS entitled "Accounting Treatments" is never going to be good news. So it is with today's announcement from Office2office (LON:OFF), detailing their adoption of more conservative accounting policies concerning supplier rebates, and other purchasing agreements. This will result in the company re-stating last year's accounts, reducing profit by £1.5m for calendar 2012.

That will reduce what they define as underlying profit before tax from £6.5m to £5.0m. It will reduce overall profit before tax from £0.7m profit to a loss of £0.8m. As you would expect, the market doesn't like this news, and their shares are down 12% today to 32p.

I last reviewed OFF on 15 Nov, and deployed my bargepole, due to the extremely weak Balance Sheet. The company has negative net tangible assets of £40m, which is horrendous. Therefore it should be regarded as extremely high risk, and I wouldn't be at all surprised if this company goes bust in due course, or at least has to do a big equity fundraising to prevent that outcome.

For the moment the Bank seem to be giving them time to try to trade their way out of trouble, but will that continue given the nervousness that accounting problems announced today are bound to cause? This share is pretty much as high risk as you can get, in my opinion.

Laura Ashley Holdings (LON:ALY) issues an IMS today. It's not really much use to me, as it only reports on sales, but says nothing about margins or profitability. Anyway, in the 19 weeks to 7 Dec 2013 the all-important LFL sales figure is down 0.7%. So not a disaster, but remember that retailers really need about 1-2% sales growth to cover their increased overheads each year. Otherwise profits can only be maintained from cost cutting.

Their 1% E-commerce growth is very poor - most retailers are delivering many times that kind of sales growth on the internet, so it looks as if their online strategy isn't working at the moment.

Licensing revenue is also down 16% this year, but they do flag up some "significant new licensing agreements" which will benefit profits next year.

International stores (via franchisees) have grown significantly, with 23 new stores taking the total to 289.

Their shares are down 3% to 26p today. The last three years have seen EPS around 2p, so assuming it's likely to be similar this year, that puts the company on a PER of 13, which is probably about right.

It has also paid out 2p in dividends in recent years, so that gives a huge dividend yield of 7.5%, but clearly there's no wiggle room there, given that dividend cover is effectively one - i.e. their entire earnings is paid out in dividends. That's probably unsustainable unless profits increase, so be prepared for a possible future cut to the dividend here - I would guess that it might be halved to 1p at some point, which would be a sensible move, but would hurt the share price in the short term.

CCTV company Synectics (LON:SNX) has issued an in line with expectations trading update.

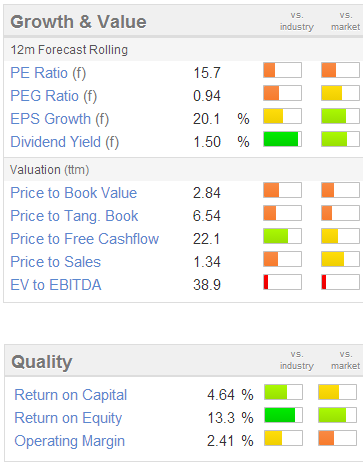

Surprisingly, the shares are down 5% today to 576p. However, as the Stockopedia traffic light graphics on the right show, the valuation is looking pretty much up with events for the time being.

I'm not sure why a relatively poor dividend yield of 1.5% has scored a green (i.e. good) bar there, that doesn't look quite right to me.

These shares have doubled this year, so to my mind the opportunity has been missed now, unless you're very optimistic about the company's future, which would necessitate a lot more research to form that view.

Jolly good, that's today's roundup finished.

Wishing you a pleasant weekend, and see you on Monday as usual.

I'll carry on reporting over the holiday season - so whenever the market is open, expect a report here! It can be quite an interesting time over Xmas, as the thin market volumes can create some interesting buying opportunities occasionally.

Regards, Paul.

(of the companies mentioned today, Paul has a long position in VLK, and no short positions.

A small caps fund to which Paul provides research also has a long position in VLK).

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.