Good morning!

Utilitywise (LON:UTW)

Share price: 207.5p

No. shares: 74.7m

Market Cap: £155.0m

Trading update - today's update relates to H1 of y/e 31 Jul 2015, so it's covering the six months to 31 Jan 2015. It's in line with expecations;

There is then a rather long-winded explanation as to how the company has recently prioritised work to extend existing contracts, and how this has reduced the size of the pipeline. However, since the company states that this doesn't affect revenue, profit or cashflow, then it's not a concern in my opinion (unless the explanation given is obscuring some other problem, but one assumes that the explanation given is truthful, unless there is a specific reason not to believe it).

The Directorspeak today also sounds encouraging;

My opinion - I've been bearish on this share in the past, as I don't like their revenue recognition policy, and I have concerns that the business model may be vulnerable to changes in regulatory policy, or that the energy companies themselves could pull the plug on commission payments to intermediaries.

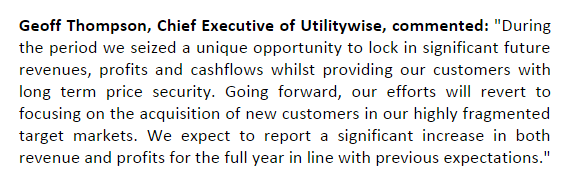

That said, the share price has come down quite a long way, and is now looking sufficiently cheap on valuation metrics to mean that it could be worth considering at this price - i.e. risk:reward is starting to look potentially interesting for a perhaps 20-30% recovery in share price from recent lows? So more of a possible trading idea than a long term investment, is my current thinking on this share.

Note that the key valuation measures (PER and divi yield) are good value, and the Quality scores are very high. So a favourable mix there, if the business model is sustained - and there don't seem to be any immediate threats to it.

I'll have to ask my new charting friends what they think about the chart, but it looks to me as if it's finding support around 200p, which could indicate a turning point perhaps, which is more likely now the company has confirmed current trading & the outlook are fine.

SkyePharma (LON:SKP)

Share price: 299p

No. shares: 104.8m

Market Cap: £313.4m

Debt repaid - this pharmaceutical company looked a basket case a few years ago, laden with debt. However, it's rehabilitation looks complete now, with the company paying off the last of its expensive debt.

I like the comment about strong cash generation in the last twelve months, in this statement today;

The shares have regained their poise after a recent setback due to a delay in royalty receipts;

My opinion - the pharmaceuticals sector is one which I usually completely avoid, as it's too unpredictable for a non-expert such as myself. However, if companies display good value or GARP characteristics, then I will consider them.

This one looks worth a look, and I would certainly be very interested if any readers have sector knowledge, what you think of the company. In terms of drawbacks, it doesn't pay divis, and the Stockopedia computers don't like it particularly, with an average StockRank of 51. That said, with growth companies, the value may not be obvious from the historic figures, since the company has launched new products & gone into new territories, which will only feed into future results.

Hogg Robinson (LON:HRG)

Share price: 49p

No. shares: 324.3m

Market Cap: £158.9m

Trading update - It's a reassuring update, confirming that trading is in line with expectations, the key part says;

Positive noises are made about contract wins & extensions, with e.g. Volkswagen & the UK Govt.

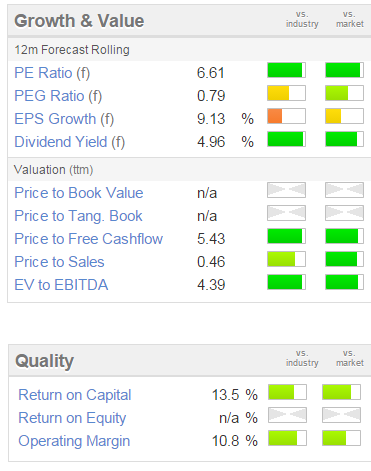

My opinion - in the past I have rejected this share, due to the company failing my balance sheet testing. However, with a solid trading update today, and looking again at the valuation measures (see below), I am wondering if the weak balance sheet is already priced-in?

There's a good dividend yield too, and the company seems to churn out profit every year, which is perhaps why the weak balance sheet is not bothering investors as much as it does me?

We had a great debate here the other night, discussing balance sheet issues. Some argue that the market takes into account weak balance sheets. However, my worry is that a lot of investors simply ignore weak balance sheets, and when you combine that with many investors adopting trend following strategies (on charts mainly), then there is a danger that shares can become wildly mis-priced. That usually ends with a crash in price (as we're seeing with e.g. AO World (LON:AO.) this week).

Overall, putting these factors together, I'm amenable to the idea of picking up a few of these shares as a trade. I'd be interested in readers views on this one too, so do please add comments below.

Shaft Sinkers Holdings (LON:SHFT)

The company name here has turned out to be very appropriate, in terms of what has happened to shareholders, and what the share price has done!

It's game over now, the shares are worthless, as the company says in its statement today. This is what happens when a company runs out of cash, and can't raise enough from existing shareholders to rectify the situation - control then passes from shareholders to creditors. Equity holders are left with nothing.

You wonder why on earth anyone would still be holding this share, as the writing has been on the wall for a while.

It's becoming increasingly clear that some retail punters simply don't understand the processes which kick into play when a company is financially distressed. Such situations are very dangerous, as existing equity holders can so easily be squeezed out of the picture altogether, if they are not able to inject fresh cash. They may not even be asked, if the situation is deteriorating too quickly.

People who inject fresh cash can name their terms, and massive dilution of existing holders is an obvious option for new investors. Cutting them out altogether, by just buying assets on the cheap from the Administrator is usually a better option.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.