Good morning,

Paul is a bit busy at the moment, so you're stuck with me a little longer.

Cheers

Graham

Park (LON:PKG)

- Share price: 78.5p (-4%)

- No. of shares: 184.4 million

- Market Cap: £145 million

Steady progress at Park Group, a major gift voucher/gift card provider.

- "4.6 per cent rise in operating profit to £10.9m (2016 - £10.4m)

- 4.2 per cent growth in profit before tax to £12.4m (2016 - £11.9m)

- 5.1 per cent advance in billings to £404.5m (2016 - £385.0m)"

The dividend is increased, and year-end net cash creeps up to £31.4 million.

I note that that Park's digital reward platform (technology for providing vouchers to customers and employees) has been expanded to for international reach - some decent growth potential, perhaps?

CEO change: a new CEO is needed as the incumbent wishes to retire - after 30 years of service! He will stay for at least one more year.

Outlook is good:

The current year has started well as we have, again, maintained the progress of the previous period. The outlook for our corporate and consumer businesses is positive, with order books ahead of their position at the same time last year.

My opinion

Seems like a decent business, not too exciting but cranking out decent results years after year and moving with the times in terms of the use of technology, e.g:

The cost to us of opening a new account is now close to half that of 2011, while the cost of servicing a retained account has fallen some 70 per cent during the same time frame

The company's Facebook followers are up from 72,000 to 100,000 - sounds great!

Overall, something I'd potentially be interested to purchase. It's not at the same level as Visa or American Express in terms of desirability but perhaps it's not so very far away.

iomart (LON:IOM)

- Share price: 327p (-3.5%)

- No. of shares: 107.7 million

- Market Cap: £352 million

I last covered this cloud computing company at the interim results in December, when revenue was up 16% and adjusted PBT up 23%.

Full-year results are in the same ballpark, revenue up 17% and adjusted PBT going at a slightly slower pace, up 18%.

The final dividend is nearly doubled to 6p.

The statutory numbers are more modest than those above; statutory PBT is up 13% to £14.7 million.

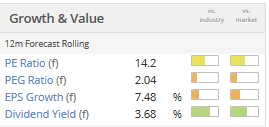

There are more adjustments than I'm comfortable with:

Outlook is for continuation of the positive trends:

This has been another year of strong growth and trading since the year end remains good.

The long term opportunity and runway for success remains large and long. iomart remains well positioned to take advantage of that opportunity and to deliver further significant growth.

My opinion:

I appreciate that this company is profitable, which is more than can be said for plenty of its peers in this space!

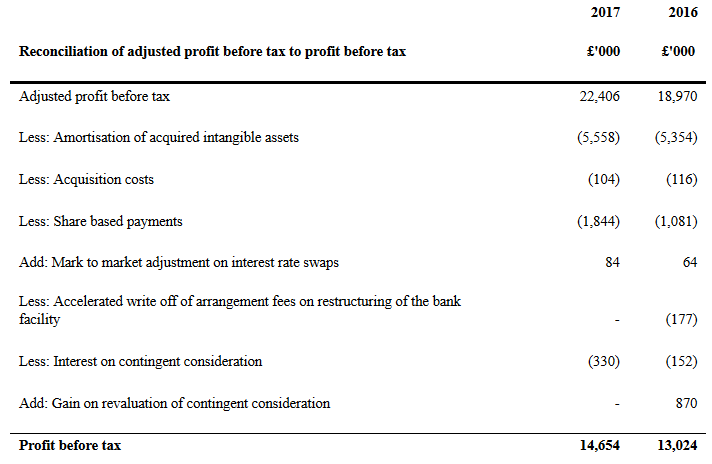

But the sector as a whole looks overvalued to me. The US stock markets are heaving with massive valuations for cloud-based businesses, and I think this has spilled over into valuations for companies such as Iomart.

To be clear: I'm not saying it's wildly overvalued, I just don't see any special attraction to owning it at these sorts of levels.

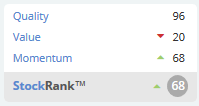

I might simply fail to understand the investment thesis, of course. But Stockopedia algorithms would also suggest that some scepticism is justified, at least in terms of value:

CML Microsystems (LON:CML)

- Share price: 467.5p (-0.5%)

- No. of shares: 16.8 million

- Market cap: £79 million

My first time looking at this semiconductor business, headquartered in Essex.

Its products are used in communications (wireless/wireline) and in data storage, with a roughly 50-50 split between them in terms of revenues. Communications has grown faster both organically and thanks to an acquisition.

Results are great:

· Group revenues increased 22% to £27.74m (2016: £22.83m)

· Gross profit up 22% to £19.82m (2016: £16.25m)

· Profit before tax up 27% to £4.21m (2016: £3.32m)

The final dividend increases to 7.4p from 7p.

That's the seventh year of improving dividends.

The Group MD guides on the outlook:

"Bookings through the latter part of the financial year were good and momentum into the new financial year is encouraging, although we are starting with a higher cost base reflecting further investments made in people and products for sustainable, long term growth. With a strong balance sheet, healthy cash balances and a clear and defined position in the markets in which we operate, we look forward to the year ahead with confidence. Board expectations are for a further advance in profitability to 31 March 2018."

So the confidence and momentum are tempered by higher costs.

That's fair enough, I think. The company talks about having long lead-times between research/development and sales, and how revenues today are the product of investment made several years ago.

In that context, if you trust management, it's fair enough that they are taking on a bigger cost base to take the company to the next stage of its development.

Something that doesn't get enough attention is how important investors are to the capital allocation process: through our influence on Boards, we can determine company strategy, in particular the balance between dividends today and investment for the future.

Obviously, most of us are far too small to make much of an impact, and the larger institutions end up deciding Board composition, but in aggregate we can have an impact.

For CML, basic EPS is 23.1p and the dividend is 7.4p, and it also executed a share buyback during the year. If you include the share-buyback in this year's result, about half of EPS was returned to shareholders.

The return on capital employed and other quality metrics have been consistently good, if unspectacular, so there is a good argument on the basis of the track record that it should continue to reinvest a large portion of its earnings for the future.

My opinion

Although, like Iomart, this is a highly-rated tech stock, I would be a lot more comfortable investing in a designer of tangible products like semiconductors rather than investing in a business which more closely resembles a consultancy.

There is a healthy mix of in-house and out-sourced manufacturing at CML, giving them added manufacturing flexibility.

Also, I agree that there are good long-term underlying growth trends with semiconductors. Nothing is guaranteed to last forever, of course, but it's robust.

I wonder if these quality statistics could be improved a bit - that would make it a really attractive stock.

I need to take a break now. If there is spare time later I will add a little more.

Thanks!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.