Good morning! I was watching CNBC last night and was struck by how upbeat people seem in America, with the markets there hitting new all time highs. This seems a complete contrast to small caps in the UK, where a mood of nervousness and gloom seems to have hit investors, with some big corrections in the prices of many UK small caps having been in evidence in the last two months.

The chart below demonstrates what a sharp divergence there has been between the FTSE 100 IDX (FTSE:UKX) and FTSE AIM ALL SHR (FTSE:AXX) in the last two months;

Sorry that the SMXX and AXX lines are so feint, I can't see any way to alter them - I'll raise a Stockopedia support ticket, and ask them to darken & thicken comparison lines, to make them more legible.

If you're not able to see the lines, the chart above shows that (rebased to the same level as FTSE 100), that the AIM All Share Index has fallen from a peak of about 6,800 in early March, to just 6,100 now. Whilst over that same period the FTSE 100 dipped to 6,500, and has since come back to about 6,850.

Why do I mention this? Because it makes me more inclined to use the current dip to buy good quality small caps - i.e. we're not seeing a general market downturn, just that pockets of over-valued shares in the small caps area are being corrected. That might well throw up some bargains, where people have become nervous and sold things that they shouldn't have.

PuriCore (LON:PURI)

There was a bizarre price movement in this small cap yesterday, which I hold. There was no news from the company, yet the price was suddenly slammed down about 25% for no apparent reason. Later in the day a trade for 1m shares printed at 25p (a huge discount to the opening price of about 40p).

From enquiries I made, this seems to have been a clumsy seller dumping 1m shares with Peel Hunt, who then were happy to offload the stock for a nice profit at around 32p during the day. Most of that stock was cleared yesterday, so I am hoping that (a) there is no more stock from that seller to come, and (b) the seller doesn't know something adverse about the company.

Anyway, I bought some more stock at 32p yesterday, and we'll see what happens. The company's finances look OK to me, and their last results were reasonable, with a perhaps somewhat uninspiring outlook statement. The company should probably put out a statement to clarify if anything has changed on the fundamentals.

Note that a Director spent £700k buying shares in PuriCore last autumn, at between 40-45p per shares, so based on that I would be surprised if the company's prospects turn out to be poor. We shall see, but it's certainly an interesting situation. I wonder if the 1m shares seller was a distressed seller who wasn't bothered about the price - e.g. a Spread Betting company ditching a client's position?

Zytronic (LON:ZYT)

Phew what a relief! Interim results here look good to me. This is a UK-based touch-screen manufacturer, which had a great track record until this time last year, when it all started to go wrong, and they had a nasty profit warning which halved the share price.

That's just an occupational hazard with small caps, and you have to be philosophical about it - it happens, so you have to live with it every now and then. The key thing in my view is not to throw out the baby with the bathwater. If it's a fundamentally good company, which has just hit a bump in the road, then these can be buying opportunities. It all depends whether (a) the company is well-financed, and hence can survive, and (b) whether management have the skill to remedy the situation.

In this case, both of those questions get a "yes" from me, and I originally opened a position at about 172p, on the opening bell of the first positive trading statement in Oct 2013. So it took them almost five months from profit warning to first signs of recovery.

Results for the six months to 31 Mar 2014 are published today, and show a very pleasing 87% increase in profit before tax, to £1.4m. This is mainly driven by a big recovery in the gross margin, from 26% to 33.9% - which occurred due to a better product mix, and improved production efficiencies.

So it's clear the company is on the mend, and the outlook statement reads positively too;

We have a good pipeline of future prospects from both existing and new customers and with current trading continuing at the recently improved levels, we expect to make further progress.

I shall be speaking to management shortly, so will report back, but the shares have bounced this morning on this good news, and are currently up 10p at 239p. In terms of valuation, the interims just reported show diluted EPS of 7.6p, so ignoring any seasonality that doubles to 15.2p for the full year, so a PER of 15.7, which isn't bad value considering the company has net cash of £6.1m (ignoring a £1.4m mortgage), which is about 40p per share. So the Enterprise Value is around the 200p level, which brings the PER down to 13.2, a reasonable level in my opinion.

Good, I've just come off the telephone with the CEO & FD of Zytronic, who whizzed through the key points about how the business is going, and answered a couple of my questions. It all sounds pretty encouraging, with the business clearly now getting back on track. "Last year was a blip", in terms of the profit warning, which reinforces my view that when a fundamentally sounds business has a slip-up, that can be a buying opportunity. People always say don't catch a falling knife, but if you identify profit warnings that will be recovered from, then they can actually give you an excellent value entry point. It's scary to buy after a profit warning, but it can be a good entry point.

Zytronic's pipeline of sales comes from numerous projects with manufacturers who have worked with Zytronic on the design of their bespoke touch screens, for things like ATMs, and gaming machines. So there can be a 2-3 delay between the initial contact, and production starting.

Hence it seems as if last year's profit warning was a delayed impact from customers de-stocking after the Credit Crunch, and a gap opened up in the order book between existing projects finishing, and new projects beginning production. So I think a degree of lumpiness in orders is inherent in this business, and is just something that shareholders will have to live with.

My impression from the tone of the conversation, was that management seem much more confident about the outlook than they have done for over a year - I meet or speak to management every six months, and it's very clear the business has got back its mojo. I like the new sales efforts being made to expand exports into America and China. That should hopefully deliver benefits a couple of years down the line.

Note that the dividend yield here is good - they are forecast to pay out 9.8p in total this year, which is a yield of 4.1% at the current share price of 240p. Note that despite the profit warning last year, the dividend was not cut at any point, but continued to increase.

Cambria Automobiles (LON:CAMB)

This is my favourite car dealer, because it has excellent management, a strong Balance Sheet, and is reasonably priced (in my opinion). Its particular specialism has been buying up under-performing dealerships, and turning them around. The way this sector works is that new car sales are the driver for repeat business on the servicing side of things - because new car buyers tend to take the car back to the dealer that they bought it from, for its servicing, especially during the warranty period. So if good customer service is established, then a relationship with that customer can be created which lasts for years.

Operating profit margins are very low in this sector, but that's because the new car sales are high value, but low margin. This masks better profit margins on the servicing side. We met Mark Lavery at a FinnCap event a few months ago, and he's very impressive - clearly being very shrewd in how he's building this business - he likes to buy freeholds cheaply (which is an excellent strategy - freeholds should be much more popular with investors than they are), and he doesn't usually pay any Goodwill at all on acquisitions.

With small caps it's really all about backing hands-on management, hence why I like to meet them. The main characteristics I look for are: honesty, lack of ego/arrogance, determination, and passion about the business. You can't measure those, so it's just a question of gut feel, and hopefully spotting any warning signs.

What you can measure are things like Directors remuneration (which should not be excessive), importance of paying dividends, and various other factors which build an overall picture about management attitude.

Whereas larger caps have an army of middle management that really run the business in the background, so all you need from senior management is to ensure that they don't destroy the business by borrowing too much money and making stupid acquisitions during economic booms. Although that does happen surprisingly often! Isn't it dumbfounding how many highly paid management seem to be blissfully unaware of the business cycle, so they pay top whack for acquisitions right at the top of the cycle, and almost bankrupt their companies once the next Recession has hit them?

Back to Cambrian, profit before tax for H1 rose from £1.3m to £2.0m. There aren't any accounting funnies that I can see - so the adjusted figures are barely any different from unadjusted. EPS was up from about a penny to 1.56p for the six months.

On outlook it says;

The Group's performance in the all-important month of March was both ahead of our business plan and the previous year. The Board is confident that Cambria will maintain this momentumand continue to deliver improved performances across all its departments. The Company continues to trade in line with market expectations.

Given that H2 is much stronger than H1, they should be on track to make about 4.5p EPS this year, by my back of the envelope workings. Broker consensus is for only 3.75p for this year, which has looked too low to me for some time.

Therefore at 53p the shares are looking pretty sound value on a PER of 11.8 times my guesstimate of EPS (which I've arrived at by just adding on the H1 uplift onto last year's EPS, and assuming H2 sees a similar uplift). Given that CAMB has a net debt-free Balance Sheet, and has freehold property in it too, then a premium PER is justified here, as these factors dramatically reduce investing risk. So personally I would happy to see the PER rise to the mid-teens, and not consider it overvalued.

Management have executed very well so far, and I think this will be a much bigger company in say 5 years' time, so is one that I see as a core long term holding in my portfolio. There's been an overhang of stock in the market, which explains the recent price weakness, which you do find happens from time to time in small caps. If it's a good company, then an overhang is just an opportunity to buy at a good price, and in whatever size you want, in my opinion.

As you can see from the two year chart, the shares have done well, so perhaps it's to be expected that they take a breather for now?!

Lombard Risk Management (LON:LRM)

This is a banking software company. I bought some shares in it last year, as it looked superficially good value. However it was one of the few occasions where a company visit put me off the shares, and I was on the phone to my broker to sell them all whilst in the lift going back down to Reception!

As I've mentioned before, the big problem here is that the company capitalises a whacking great chunk of its payroll into intangible assets. Thus those costs by-pass the P&L (increasing profit temporarily), and are then amortised (i.e. spread over a longer period of time through an annual charge to the P&L).

The trouble is that, at the moment, the company is capitalising much more than it is amortising. So it is reporting profits that have been created almost entirely from deferring the cost of their internal payroll costs on software development.

If you accept that accounting treatment, then the shares look good value. A profit before tax of £4.4m is reported today for the year ended 31 Mar 2014, up 13.4% on the prior year. That sounds a good result for a company with a market cap of about £29m at the current share price of 11.3p.

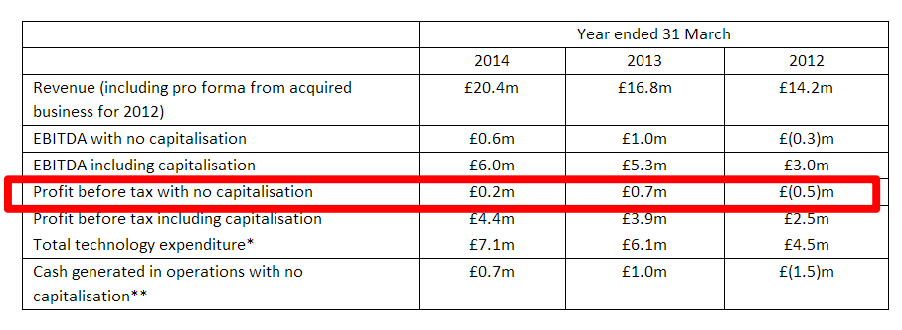

Trouble is, it's not a fair reflection of reality at all, in my opinion. The company is very open about this issue, and provides a table showing that if you expense all the payroll costs (instead of capitlising a big chunk of them), then the company is barely above breakeven (I have ringed the profit figure that I consider the most accurate, and which I understand is used internally to measure performance):

So it's up to each investor to decide whether you like the big profit figure which ignores a ton of payroll costs, or if you want to know what the real world profit of the company is. I'll go for the latter every time.

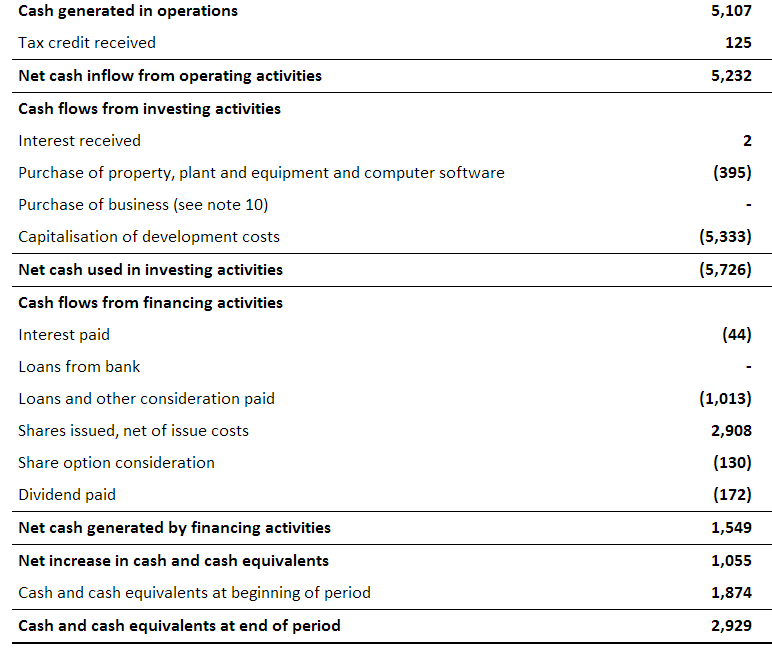

As always, the litmus test is whether it's generating cash & paying decent divis. There is a token dividend of less than 1% yield. As you can see from the cashflow statement below, the cashflow is ALL spent on development costs. Also notice how the cash came from an issue of new equity. So it's not generating cash at all really.

It was a similar picture last year, I clipped the prior year comparatives off to fit it legibly on the page here.

So the key question I would like to ask management, is when are the development costs going to reduce or stop? My impression from visiting the company last year is that these were ongoing payroll costs, not project-based costs.

The upside might come from demand, which is being driven from new EU rules on banking. However, there's no way I'm going to value the business on the adjusted or the EBITDA figures. In reality I think it's probably worth about half to a third of the current share price, as a punt on it generating some real cashflow from the development work that has been undertaken. There hasn't been any significant real cashflow generated so far, that's clear from the figures.

Got to go now, see you again tomorrow morning.

Regards, Paul.

(of the companies mentioned today Paul has long positions in PURI, ZYT, CAMB, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.