Good morning!

After looking at good results from Cambria Automobiles (LON:CAMB) yesterday, another chain of car dealerships has reported today, so let's start with that.

Vertu Motors (LON:VTU)

Share price: 58.6p

No. shares: 340.9m

Market Cap: £199.8m

Final results - for the year ended 28 Feb 2015 are out this morning. In a similar vein to Cambrian, Vertu is growing by acquiring additional dealerships, although it's about four times the size of Cambrian by turnover. The number of sites that Vertu operate rose from 106 to 116 in the year being reported.

Headline figures look good - turnover up 23.2% to £2,074.9m, adjusted profit before tax up 25.7% to £22.0m - as you would expect in this sector, a wafer thin profit margin of only 1.1% here. That is lower than the 1.4% reported yesterday by Cambrian in its interim results - it's a little surprising that the larger chain (Vertu) achieves the lower profit margin.

My main concern with this sector, as mentioned yesterday, is that car dealers are enjoying boom times at the moment, due to ultra low interest rates stimulating demand, recovering consumer confidence, and favourable exchange rate movements recently (making European imports much cheaper). So if these dealerships can only squeeze out just over 1% profit margin in the boom times, where will that leave them once demand slides back to more normal levels? Although each new car sold does carry a tail of decent margin work for the servicing & warranty work. That's what we're told anyway.

Earnings Per Share (EPS) - adjusted earnings per share rose 9.8% from 4.69p to 5.15p. Looking at the adjustments, they seem rather tenuous to me;

- Amortisation of intangible assets of £405k (doesn't seem to be related to goodwill, as the accounting treatment of that seems to have changed to just an impairment review).

- Share based payments charge of £645k - this is part of employee/Director remuneration, so it needs to be factored into the valuation, not ignored.

- Exceptional charges - none this year (good), but £1,180k last year, so I suppose this is acceptable, as it will help give a reasonable comparison year on year.

Therefore I am more inclined to value the shares on the reported 4.87p EPS, and not the adjusted EPS figure of 5.15p, although as with many things that's a personal judgment that each investor is free to make - you don't have to agree with my approach, I just like to be prudent so that there's a greater margin of safety built in.

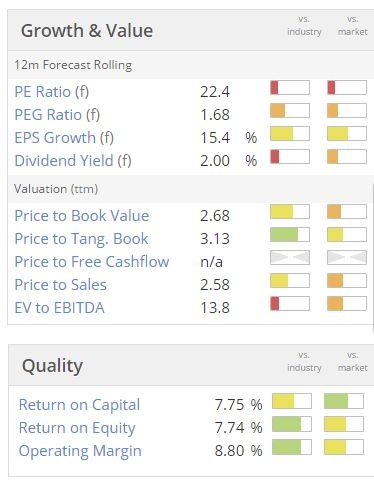

Stockopedia shows broker consensus of 4.94p EPS, which is usually based on adjusted EPS, so it looks like the 5.15p adj EPS achieved was a modest beat against broker forecast.

Valuation - so at 58.6p per share, the PER drops out at 11.4 times adjusted EPS, or 12.0 times unadjusted EPS (my preferred measure in this case). On the face of it that sounds about right, but that depends on what the Balance Sheet looks like.

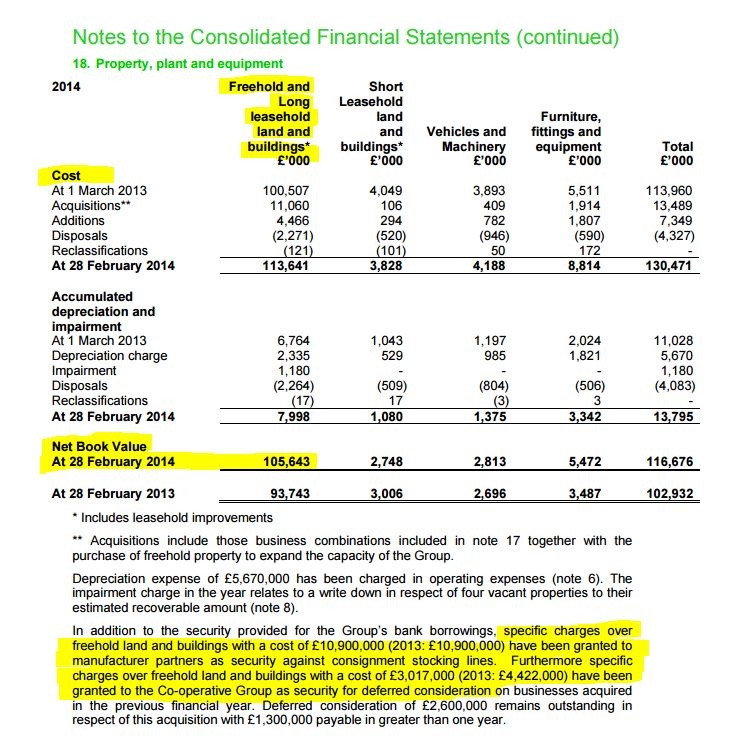

Balance Sheet - I like what I see! In particular there are lots of freeholds - 50% of sites being freehold, according to the narrative, with a net book value of £126.6m (up from £105.6m last year).

The note above is taken from Vertu's 2014 Annual Report, and shows the detail relating to property. So I've highlighted the £105.6m net book value of freeholds & long leases, which ties in with the figure mentioned in today's results.

Note that the freeholds seem to be in the books at cost. Therefore there could be hidden upside value on those properties perhaps? Certainly over the long term this gives shareholders a very nice double benefit - not only is the business a lot safer if it owns freeholds, and will not suffer rent increases (because it owns its own sites), but also eventually shareholders will benefit from the potential sale value of any surplus sites.

So really a company like Vertu should be seen as a car dealership and a property company rolled into one. Some people think that's inefficient, but personally I love it - there's property upside in for free basically, and the whole business is much safer as a result of having property assets.

Note above also that Vertu is able to use its freeholds as security over debt, or other areas of credit risk (e.g. credit facilities from manufacturers for supplying new cars).

The current ratio is 1.0, which in this sector is normal. The inventories are being turned fairly rapidly - inventories at the year end were £394m, and cost of sales from the P&L for the year was £1,786m, so I make that equivalent to stock turning 4.5 times per year, or the company holding about 2.6 months inventories at the year end.

So that level of stock turn ties in with normal payment terms for suppliers (60 to 90 days), therefore working capital overall looks fine to me. Other car dealerships have a similar current ratio of about 1.0, so it's fine.

Long term liabilities are not significant, with the main items being £3.7m of deferred tax (which comes out in the wash, so doesn't concern me), and £5.8m deferred income - which I imagine probably relates to landlord incentives received to enter into new leases (rent-free periods & reverse premiums, the benefit of which has to be booked to the balance sheet as a notional creditor, and then gradually unwinds over the period to the first rent review). So these items can safely be ignored.

That means there is no long term debt. Indeed, Vertu had £15.7m of net cash at the Balance Sheet date. That's a very strong position to be in. When I first started looking at car dealership shares, probably 15 years ago at a guess, they were laden with debt, and often seemed to go bust (or come very close) whenever Recessions struck. It looks as if the sector (and the banks!) have learned the lessons, and now these dealerships are very conservatively funded. So they should have no difficulty at all surviving the next recession.

Dividends - a 31% increase in the divi to 1.05p has been declared, which is ahead of broker forecast of 0.9p divi, but it's still pretty mean - the yield is quite small, at 1.8%. Still, it's worth having, and shareholders I'm sure understand that a bigger divi could be paid, but instead the company is mainly using surplus cash to acquire more sites.

My opinion - sorry this has rambled on a bit, but lots of interesting points to mention. Overall, I really like the Balance Sheet here, and think this company looks reasonably priced.

So which company do I prefer, out of Vertu or Cambrian? It's a very close thing, but I'd say probably Cambrian might offer more upside, as it seems to have more scope to beat broker forecasts.My friend David Stredder ("Carmensfella") appended some interesting figures to yesterday's SCVR here on Cambria Automobiles (LON:CAMB), where he reckons the company is set to considerably beat this year's forecasts. As such, CAMB is probably under-priced, and the catalyst for the shares to go up could be further upward revisions to broker forecasts.

Although given the exceptionally favourable market conditions right now, I think expectations need to stay grounded. For that reason, I think a PER of maybe between 6 and 10 is the maximum anyone should be paying for car dealers right now, to reflect the reality that they're probably enjoying super normal profits right now. I think that's why the share prices haven't been tracking profits upwards - because investors recognise that these good times probably won't last that much longer.

That said, there could also be a takeover premium for either of these two companies. Sooner or later some clever dick might come along with a large credit line, and takeover bids, to buy & build a large chain of dealers, sell off all the freeholds, and then go bust in the next recession! That cycle seems to continue over & over, without mankind never learning from it. Still, if it gives shareholders in Vertu and Cambrian a nice exit at the top of the market, whenever that comes, then they'll rightly be pleased with that outcome.

Centaur Media (LON:CAU)

Share price: 78p (up 4% today)

No. shares: 143.7m

Market Cap: £112.1m

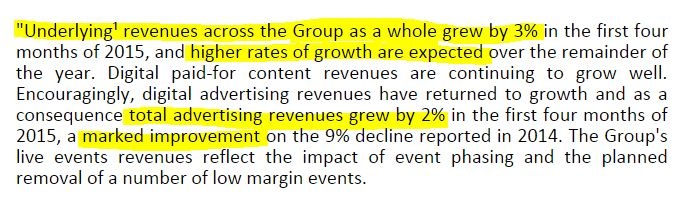

Trading update - at their AGM today. Various details are given, but the most important bit is highlighted below;

Improving trends seem to be emerging, which explains why the share price has been rising this year;

Valuation - it's forecast to do 5.23p EPS this year, and has today confirmed that it's trading in line with that, so the PER for this year is 14.9. I'd say that's looking a bit toppy, given the company's patchy track record, and it's weak Balance Sheet - last reported net tangible assets were negative, at -£23.1m. There was also a very weak current ratio of 0.76.

My opinion - the company seems to be trading well, but personally I would want to see the Balance Sheet repaired before considering an investment here. The 4% divi yield is appealing, but it's questionable whether that is sustainable, given the overall weak financial position.

That said, today's update points to encouraging trends, therefore perhaps balance sheet concerns are not as important as if the company were trading badly? Also, it seems to have a positive working capital profile, with customers paying up-front for some services, so is therefore able to run a lean Balance Sheet easily. It would be good to see the £18.1m long term debt continue to fall though, that's a tad too high for my liking.

Zotefoams (LON:ZTF)

Share price: 295p (up 1% today)

No. shares: 43.8m

Market Cap: £129.2m

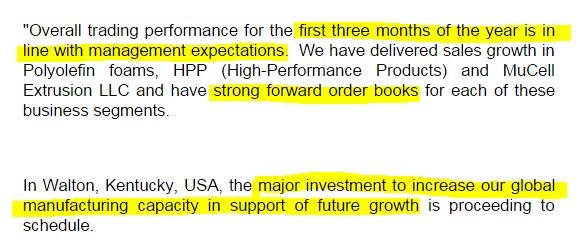

Trading update - there are some interesting comments about future growth in today's AGM update from this manufacturer of foam products;

I've had a look back at their last set of results, which also contain comments about expanding production in the UK and USA.

A Placing was done recently to fund the USA expansion.

It seems to now be in a good growth phase, so the valuation reflects this - looking expensive on forecasts. Although if the upside pans out well, then broker forecasts could end up being too conservative.

So researching this company is all about looking at growth, and new products, and understanding what competitive advantages the company has. That's outside my scope here obviously - part of the problem of trying to cover 500 companies, is that it's difficult to find the time to do more detailed research, even though I come up with plenty of good ideas.

I wouldn't rule it out though - even though the valuation looks high, it's all about future potential rather than the past. As always, reader views are welcomed, especially if you've researched the company in detail.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.