Good morning! The sell-off continued into the close on Fri evening in the USA, and overnight the FTSE100 futures were down c.100 points, so I was braced for a continuation of the selling this morning. Although so far it hasn't been that bad at all, with the FTSE100 down about 30 points at the time of writing.

The state of the markets was one of many issues discussed last night between me and ISA millionaire Leon Boros, in my latest Sunday evening audiocast. For anyone interested, the link is here, and it can be downloaded into iTunes by clicking on the iTunes button. They seem quite popular, so I'll keep recording them each week on Sunday evenings.

Amino Technologies (LON:AMO)

Share price: 82p

No. shares: 55.1m

Market Cap: £45.2m

Trading update - the company is nearing its year end of 30 Nov 2014, so should be in a position to give a fairly accurate view of the year as a whole. Accordingly, its statement today sounds good;

As outlined at the time of the interim results, revenue has returned to the traditional second half weighting and, as such, Amino expects to report revenue for the year ended 30 November 2014 in line with market expectations. However, the Company expects profit before tax to be ahead of market expectations.

Valuation - broker consensus is for 6.9p EPS this year, so if the company is ahead of that, then I suspect we might be looking at (guesstimate!) 7.2p? It's not likely to exceed forecast by a lot, because that would require higher turnover, and turnover is in line.

So if my guesstimate is right, then at 82p the shares are on a PER of 11.4, which looks good value. However, there is a big kicker here, as the company is stuffed full of surplus cash - as of the interims date of 31 May 2014, net cash was £19.7m - which is 36p per share, or 44% of the market cap! That's remarkable, and if you strip out the cash, then the Enterprise Value is only £25.5m, or 46p per share. Hence on a cash neutral basis the PER would drop to only 6.4, which looks very attractive to me.

Dividends - the company doesn't seem to know what to do with the surplus cash, so it's paying higher dividends, with a policy of increasing the divi by 15% each year. Brokers forecast a divi of 4.0p for this year, rising to 4.53p next year. There is a small interim divi (1.15p paid in Sept 2014), but the main divi is paid in April each year, and looks like it should be 2.8p in April 2015 - taking the last final divi of 2.45p and increasing it by 15%. So the broker forecast of 4.0p divis for this year looks correct, giving an excellent yield of 4.9% - so a very attractive share to income seekers. The dividend yield will rise to 5.5% next year.

(EDIT: thank you to "Browner" who pointed out that an earlier draft of this article had picked up incorrect date on the dividends. I have now corrected the figures above, and I apologise for this error).

My opinion - this share looks very interesting, since it's cash-backed, paying excellent divis, and is trading well too. My only reservation is that I presume it's dependent on lumpy orders from TV companies, ordering batches of its set-top boxes? I seem to recall it had an unusual geographic spread in the past too, with possibly some exposure to Russia? So I need to do some more research on this one, but it certainly looks very interesting at an initial review of the figures.

There seems to have been a recent dip in price which looks as if it's just down to negative market sentiment, rather than anything company specific. Which could present a buying opportunity now that we know trading has been good? A drop in share price, followed by strong trading, is the ideal scenario really for value investors brave enough to take the plunge and buy things at the moment! After all, it's when other people are ignoring good news because they're too scared to buy anything, that you get the bargains.

Also the 5p Bid/Offer spread is ridiculous, so it would only be worth considering these shares if your broker can get well inside the spread. Wide spreads really are the curse of the small cap investor, and why it's usually not worth trying to time the ups & downs, because you lose so much in spread every time you transact.

Renold (LON:RNO)

Share price: 51.5p

No. shares: 223.1m

Market Cap: £114.9m

Renold is an engineering company making industrial chains & other power transmission products.

The shares are down about 5% this morning, so the market isn't impressed with today's update. Checking my notes, I commented on 22 Jul 2014 that the shares looked expensive at 64p, once you factored in net debt & the pension deficit.

Trading update - this sounds reasonably good to me;

Good progress continues to be made on the turnaround phase of our strategic plan. Further planned improvements in operating margins in both divisions were successfully delivered during the period. The Board's expectations for the full year adjusted(1) operating profit therefore remain in line with current market forecasts, despite the adverse impact of foreign exchange movements being currently higher than anticipated in our Preliminary Announcement in May.

So it's interesting that the company has shrugged off adverse currency movements.

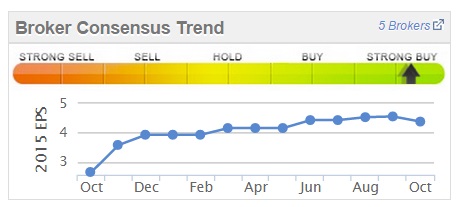

Broker forecasts - I note that there has been a positive trend in broker forecast earnings over the last year, which is usually a good sign, combined with an in line update today that seems positive.

Valuation - the PER looks reasonable, at 11.3 times this year's forecast earnings, but the problem here is the Balance Sheet. As last reported at 31 Mar 2014, net tangible assets were negative by £7.8m, hence the company is dependent on bank lending. Although its working capital position is OK with a current ratio of 1.89, the problem is the £102.8m long term creditors - being bank debt of £30.9m, and the pension deficit of £65.3m. Overpayments of £2.5m are being made into the pension scheme, although that has scope to potentially increase.

The weak Balance Sheet and pension deficit mean that there's no scope here for sensible dividend payments, indeed the company has not paid divs at all since 2005, although a token divi of 0.35% yield is expected this year.

My opinion - the company has pulled off an impressive turnaround in trading, but with no significant shareholder return likely for some time, as the company rebuilds its Balance Sheet, then I can't see any reason to get involved here. The right price is probably a PER of about 5-6, to reflect the poor financial position & considerable pension fund liabilities.

Furthermore, it's not clear what profit growth might be possible? Having stripped out costs to boost profitability, they now need to generate growth.

Overall, it's not of any interest to me, the price would have to be very much lower to adequately reflect the lack of divis, and the poor Balance Sheet. We have so much choice in small caps, why make compromises?

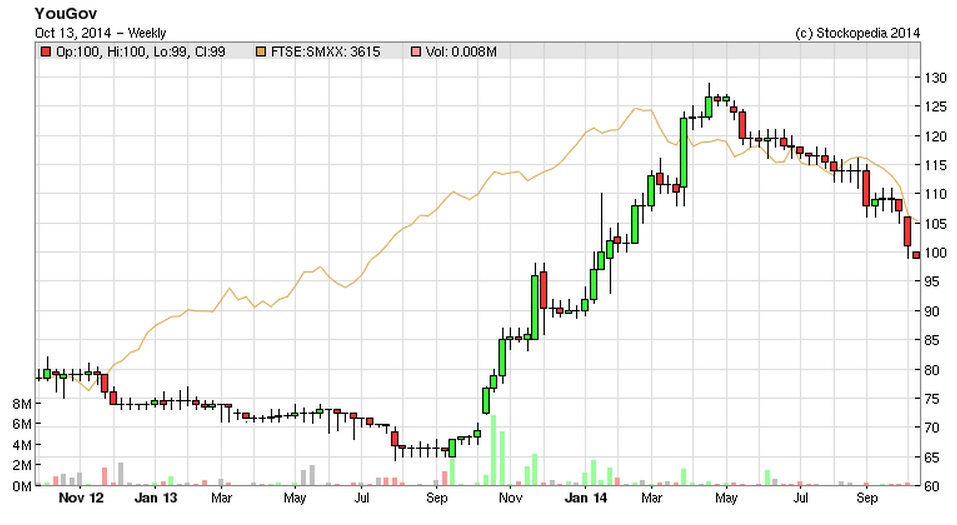

YouGov (LON:YOU)

Share price: 99p

No. shares: 99.3m

Market Cap: £98.3m

As I've mentioned here before, in my view the market cap of YouGov is way too high, because the market is swallowing the company's definition of adjusted earnings. Yet this measure grossly overstates profit in my view, since the company is capitalising large amounts of internal costs. Add those back to the P&L, and it makes very little profit at all.

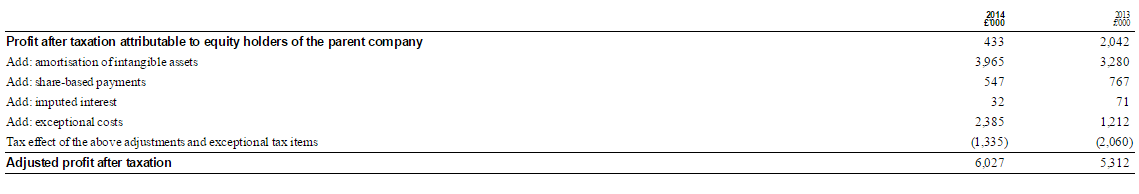

Results - today for the year ended 31 Jul 2014 very much reinforce & confirm my view. It's more of the same - huge adjustments which take an operating profit of only £1m up to adjusted operating profit of £7.4m.

Basic EPS fell from 2.1p last year, to only 0.4p this year! So the PER is 248! So what are the reconciling costs? Here is the reconciliation of statutory operating profit to adjusted operating profit, as set out in note 5 of today's accounts, and sorry for this being small, that's just the way it was published;

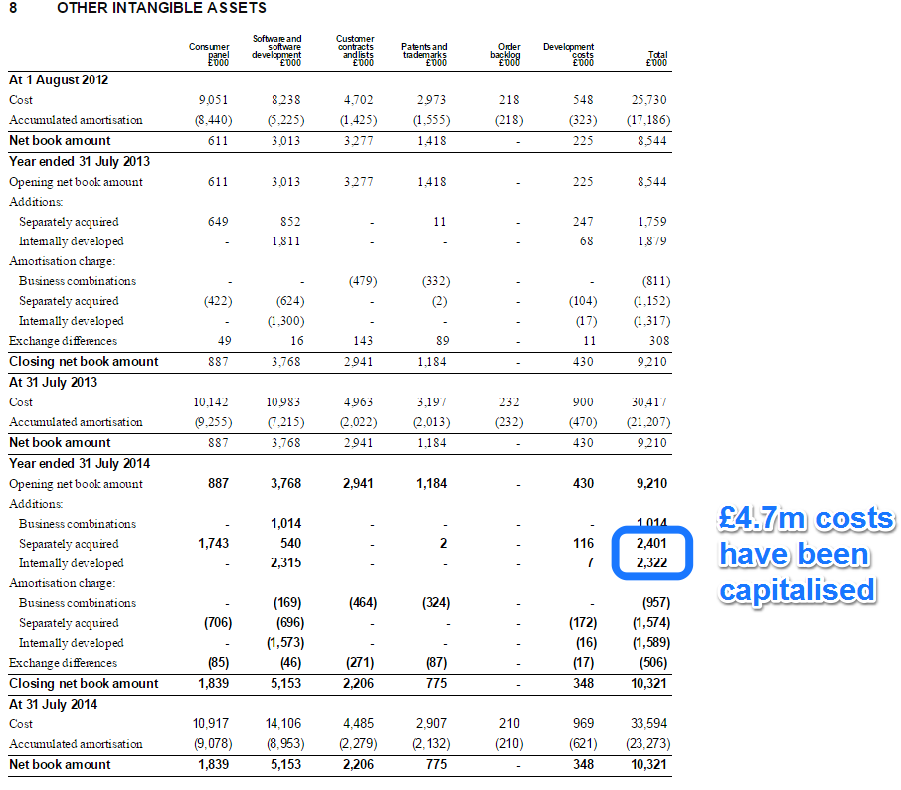

I dispute nearly all the adjustments. The biggest one by far is £3,965k of amortisation of intangibles. This is NOT related to goodwill, because the goodwill on the Balance Sheet is not amortised at all. As you can see from note 7, the only reason goodwill has reduced from £38.8m to £36.3m is due to exchange differences, which seems to have by-passed the P&L and been charged directly to reserves.

So this £3,965k of amortisation of intangibles represents the amortisation of previously incurred costs of running the business. Moreover, as the cashflow statement this year shows, £4.7m of costs were capitalised into intangible assets, as I have highlighted in note 8 below;

Therefore, to realistically measure the company's profit, you need to either include the £4.7m costs, and put them through the P&L, or you need to account for the £3,965k amortisation of previous year's intangible costs. However, what YouGov are trying to persuade us to do, is to focus on their "adjusted" profit figure which completely ignores both the cash cost of intangibles, and the amortisation charge, thus presenting an essentially bogus & heavily inflated profit measure.

The market is then applying a multiple of 16.2 times to this inflated "adjusted" EPS figure of 6.1p, and is therefore wildly over-valuing these shares in my opinion. In my view the company makes very little genuine profit, and should sensibly be valued at perhaps 20-30p per share.

Share based payments of £547k this year, and £767k should not be adjusted out. They are just another form of remuneration, so should be left in place.

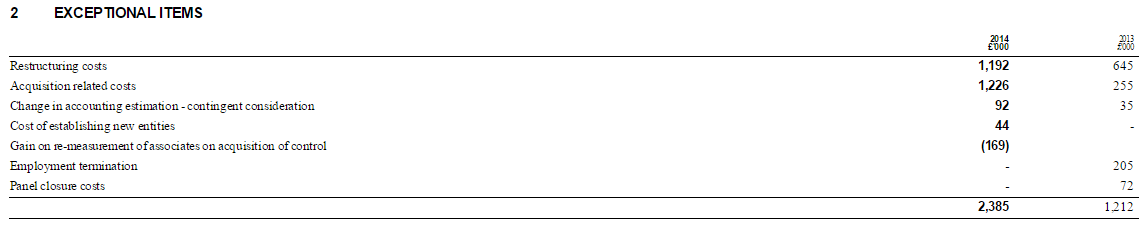

Looking next at exceptional items, these seem to recur every year! So at what point do they stop being exceptional? See the table below;

My problem with companies that report a chunk of restructuring costs every year, is that this can become a soft code within the accounts dept for burying any sundry costs that inconveniently reduce profits.

Balance Sheet - overall this is OK, the working capital position looks fine, with a current ratio of 1.39, and net tangible assets are adequate, at £11.3m. The group has net cash of £7.2m, which looks solid.

Outlook - current trading is in line with expectations.

My opinion - as explained above, this company is not really making much of a profit at all, if you reverse its aggressive adjustments to profit. This is evidenced by the lack of a decent dividend - the yield is only about 0.85%.

Therefore my only interest in this share would be as a potential short, rather than going long.

Tristel (LON:TSTL)

Share price: 76p

No. shares: 40.5m

Market Cap: £30.8m

Tristel is a small company specialising in novel & patented disposable products for disinfecting, used extensively in hospitals. An impressive turnaround has been achieved in the last year, with declining legacy products being replaced with up & coming new products.

Final results - for the year ended 30 Jun 2014 are published today. The numbers look good to me. Turnover is up nearly 28% to £13.5m, which is all organic growth - impressive stuff. As the product is disposable, these are good quality, repeat revenues.

As regards profit, I am impressed to see the company does not attempt to mislead investors with inflated, "adjusted" figures, but simply presents a clean profit before tax figure of £1.8m, which correctly accounts for the amortisation of development spending. Moreover, as the cashflow statement shows, only £479k of development spending was capitalised into intangible assets, which looks to be almost identical to the amortisation charge, as the Balance Sheet total for "intangible assets" has remained almost unchanged (up from £5,629k to £5,637k).

This is a big increase in profitability compared with last year, which was a pre-tax loss of £1.75m, or a profit of £481k once a £2.2m non-recurring cost is stripped out. That's an impressive improvement in performance, especially as it's all organic growth.

The tax charge on the P&L is rather high, at 30.2%, which would need looking into. Looking at note 4 to the accounts today, there is a reconciliation of the tax charge.

Balance Sheet - this passes my simple tests with flying colours. The current ratio is excellent at 2.66, and the company has net cash of £2.6m. There are negligible long term creditors. So a very good little Balance Sheet, so this company is in good financial shape.

Dividends - note that the company has a policy of paying out half its earnings in divis, so there has been a big increase in dividend - it's up four-fold to 1.62p for the full year. That seems to have been a 0.36p interim divi, paid in Apr 2014, and so the balance of 1.26p must be the final divi, not yet paid. I make that a 2.1% yield, which in itself is not particularly impressive, but the rapid growth is impressive, so if that continues then the yield here could become a key attraction of the shares in future possibly?

Outlook - this seems to be overly-cautious in tone, I'm not sure why;

We are delighted with the outcome for 2014 - for the Company and for its shareholders and we remain optimistic for the immediate future. We believe that our Company is very well placed to take advantage of the current trends in the global disinfection market. However, we are realistic in our assessment of Tristel's market reach and recognise that our ambitions must be tempered by our size and that we must be cautious in the way in which we deploy our assets to meet the potential opportunities. We also recognise that in order for Tristel to build upon its position we will need to invest in new products and that innovation must remain at the core of our business. A disciplined and targeted approach to new product development and new market penetration (by segment and country), combined with effective management of our existing product range, will bring the continued successes that our customers, employees and our shareholders deserve.

That all sounds a bit too hesitant for my liking. Maybe it's connected with the fact that the Chairman, Christopher Samler who wrote it (or at least signed off on it) is leaving in two days? Seems a rather abrupt departure, I wonder if there has been a falling-out in the Board Room?

Valuation/My opinion - it's rare that you find companies with strong organic growth, but this seems to be the case with Tristel. The results today are strong, a four-fold increase in the divi is marvellous news, the Balance Sheet is strong, what's not to like?

On valuation the shares do look rather pricey - at 76p that puts them on a multiple of a rather scary 23.4 times. I wouldn't normally pay anything like that price, but in this case you can see operational gearing giving rise to a very positive trend in profitability.

As regards forecasts for this year, broker consensus is 4.32p, and remember that is a proper EPS figure, not an "adjusted" figure. So that brings down the PER to 17.6, and bear in mind the company has a history of repeated upgrades to estimates. So it wouldn't surprise me if the guidance has risen to 5p+ in a few months't time. That would then bring down the PER again to about 15. So in that regard the valuation seems OK to me, providing nothing goes wrong.

Overall, I like it - as usual, not a recommendation, just a personal opinion. Please DYOR as usual!

Having had a very good run in price in the last year, you do wonder if the shares might need to pause for breath before tackling the recent highs again?

That's it for today. See you tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.