Good morning! Today's report is a bit earlier than usual, as I have to be in Reading by noon, for an investor lunch. It's certainly going to be a busy fortnight - on Saturday there is the UK Investor Show, and I'm delighted to have been asked to appear on a small caps/value investing panel with Nigel Wray and Paul Jourdan of Amati. So it's quite something for a humble blogger to be sitting alongside such high profile investors!

Then next week, on Thu & Fri, it's the latest Mello event - where I've been asked to do a talk on Balance Sheets, and I'll also be doing a session explaining in more detail the dangers of spread betting - and what specifically went (disastrously) wrong for me in 2008, which I've mentioned here (and elsewhere) many times before. I think it's important to be open about, and learn from, one's mistakes, as well as the successes, as hopefully other people are then forewarned about what can go wrong once gearing is involved.

My feeling is that with this bull market now looking long in the tooth, and with plenty of over-valuation around, there's an increasing likelihood of another big shock to the system at some point - so hopefully my warnings might help one or two people avoid over-extending themselves in the good times?

Porvair (LON:PRV)

Share price: 303p

No. shares: 44.8m

Market Cap: £135.7m

Trading update - this specialist filters company is just over a third of the way through its current financial year, ending 30 Nov 2015.

I feel the company has managed investor expectations well, in that it has been open about last year's results including some large one-off contracts, which won't recur. Therefore investors were prepared for softer figures this year, and hence have not gone into a panic about that.

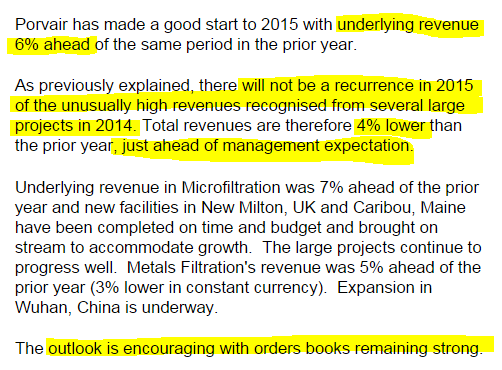

Today's statement says;

I think it's stretching credibility somewhat to strip out the big contacts from last year, and then say that "underlying revenue" is 6% ahead, whilst then saying in the next paragraph that it's actually 4% lower.

There's no mention of whether profitability is in line with expectations or not, but I suppose that since revenues are "just ahead of management expectation" then it's reasonable to assume that profits should be in line with expectations.

The outlook sounds solid too, so there's nothing to panic about here.

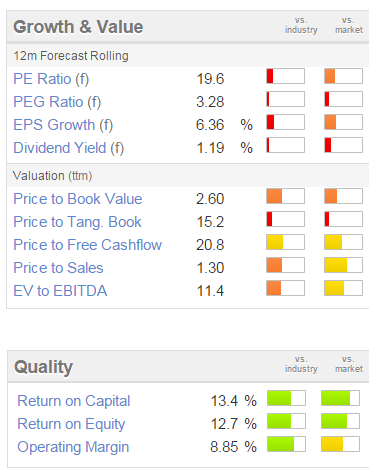

My opinion - this share has looked fully valued for some time, and that remains the case - note that it looks fairly pricey on all valuation metrics;

Earnings growth since 2009 was very good, but appears to be tailing off now. Therefore I question whether a PER of nearly 20 is still appropriate? Personally, I'd be looking for much stronger growth if I was paying that kind of price. There again, maybe bulls think it can exceed broker forecasts? Personally I'd only be interested at a PER of say 12-14, so more like 200p per share, than 303p per share.

Alternative Networks (LON:AN.)

Share price: 462p

No. shares: 48.4m

Market Cap: £223.6m

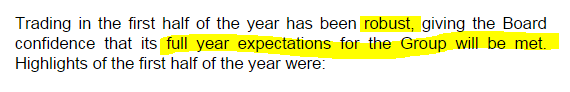

Trading update - for the half year ended 31 Mar 2015. There is a lot of detail given, but the key bit says;

My opinion - the company seems decently profitable, but I've had a quick look at their last Balance Sheet, and it fails my simple tests - with a weak current ratio, and negative net tangible assets.

Given that the company is decently cash generative, then the weak balance sheet probably isn't the end of the world really, but it puts me off. The divis aren't bad though, with a forecast yield of 3.77%.

Flowtech Fluidpower (LON:FLO)

Share price: 123p (down 3.2% today)

No. shares: 42.8m

Market Cap: £52.6m

Final results - for calendar 2014 - these being maiden results for this group in its current form, which listed on AIM in May 2014. It is a distributor of technical fluid power products - e.g. pneumatics, hydraulics, hoses, etc.

The figures look good, with turnover up 17.7% to £37.8m, and underlying operating profit up 15.4% to £6,146k. That's a very high operating profit margin of 16.3%, and my initial reaction is that such a high margin is unlikely to be sustainable for a distributor. Normally distributors only make a very low margin, in low to middle single digits, in my experience.

Pro forma EPS came in at 11.65p, so the PER looks about right, at 10.6. Distributors generally don't command high ratings, as they are only shifting other peoples' products, with little to no IP of their own.

Balance sheet - looks sound to me. The current ratio is very solid at 2.09, and long term liabilities are reasonable at £6.6m, which is only slightly more than one year's underlying profit.

Dividends - the company paid an interim divi of 1.67p, and has declared 3.33p final divi, so 5.0p for the full year. That's a healthy yield of 4.1%.

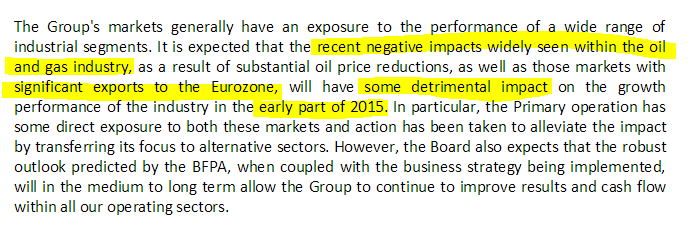

Outlook - this is where it starts to go wrong a bit, with exposure to both the oil & gas sector, and exporters to the Eurozone, both currently having problems;

My opinion - overall, I think it's probably best for me to steer clear of this one. The comapny does have scope to do more acquisitions, so they may be able to offset the problem sectors buy bolting on acquisitions.

You also always have to consider why the previous owner wants to sell, with any recent IPO. Have they foreseen softer market conditions? Do they doubt the growth potential perhaps? Above all, have they taken advantage of a favourable exit price in a buoyant IPO market?

Manx Telecom (LON:MANX)

Share price: 185p

No. shares: 113.0m

Market Cap: £209.1m

Full year results - for calendar 2014. This company operates telecoms services on the Isle of Man, so presumably has a monopoly or near monopoly, which for starters makes me very wary of investing - there's too high a risk of a regulator dropping a bombshell by allowing in competition, or capping prices. I don't generally invest in any regulated industries.

Dividends - the only reason to buy these shares is for the divis. The total divis relating to 2014 are 9.9p, which gives a decent yield of 5.4%.

Balance sheet - this is weak. The company has net tangible assets of only £3.5m. Also it is carrying a lot of debt - which was £53.7m at the year end. The company says this is about 2 times EBITDA, but there is an ongoing capex requirement, which EBITDA ignores.

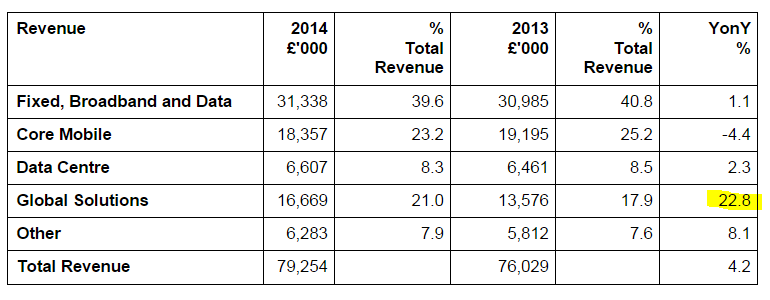

Growth - where's the growth going to come from? Surely this is a mature business? Although I note from the revenue table that one section (highlighted) is showing strong growth;

My opinion - I don't like it, for the reasons given above - lack of growth, too much debt, weak balance sheet, and operating a local monopoly.

It would also be worth checking the pension fund position. It is shown as an asset of £2.2m on the balance sheet, but the cashflow statement shows a £2.1m cash outflow.

In my view it can be a mistake to chase very high dividend yields. I'd rather have a somewhat lower divi, but from a company which is financially strong, and has good growth prospects. That can end up giving you a better long term return, than chasing a very high divi yield from a mature, or even declining company.

Right, gotta dash, see you tomorrow as usual!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions. A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.