Good morning!

In case you haven't seen it, I updated yesterday's report in the evening to look at results from Walker Greenbank (LON:WGB) - an interesting one, as the company was affected by flooding. The insurance payouts look to have comfortably covered all the costs, including business interruption.

I read a fascinating research note from Peel Hunt yesterday, on retailing. Their analysis on that sector in particular is utterly brilliant. Their argument is that there is no such thing as a retailing sector. There are actually diverse businesses at different stages of life. The established businesses are telling us that consumer confidence is weak, demand is low, etc. Yet the economic data says the opposite - consumers are enjoying good increases in disposable income in fact.

So why the disconnect? It's all down to competition - relatively new entrants are eating the lunch of the established players, if they don't keep up with a strong online offering, and constant innovation with products & services.

So you hardly ever see any retailer comment that their products weren't good enough, and that the competition are doing a better job than themselves! Instead they moan about demand being weak, Brexit causing uncertainty (please! How ridiculous), and of course that good old catch all - the weather hasn't been right.

It's all mostly nonsense. The best retailers will do well, regardless of the weather, the economy, or the competition. (e.g. results from Debenhams (LON:DEB) today (at the time of writing, I hold a long position in this share) weren't bad at all - despite them being old school they're just executing well, which is what's needed - "retail is detail").

With living wage set to eat into operating margins as a constant headwind over the next 4 years, it's vital that retailers manage to eke out positive sales momentum, and strong margins. Mind you, over the long-term, rents are likely to absorb some of the pain, but that's a slow process, due to the archaic 5-year upward-only rent review process.

I think there are some stand-out bargains in the sector right now. Being able to buy high quality businesses which generate tons of cash, on PERs of 10-12 is a rare opportunity, in my view. So I reckon the retail sector is a great place to go looking for bargains right now. Although as always, one has to be selective, and put in the hours doing the homework to make sure you pick the right ones.

Norcros (LON:NXR)

Share price: 176.5p (up 3.2% today)

No. shares: 61.0m

Market cap: £107.7m

(at the time of writing, I hold a long position in this share)

Trading update - which covers the year ended 31 Mar 2016.

The key part says:

Group underlying operating profit1 for the year is expected to be marginally ahead of market expectations.

To quantify this, the figure showing on Stockopedia is for normalised EPS of 21.4p - giving a PER of 8.2.

Why so cheap? There are various factors, but the main one seems to be that: it's always been cheap! When a share never seems to gather upward momentum for long, people become bored, and drift away, thus perpetuating the low price with a constant stream of bored sellers.

Net debt really isn't a problem. It has risen to £33m (from £14.2m a year ago), due to acquisition-related payments. I don't see this as an issue, given that it's a relatively modest multiple of EBITDA. Also, Norcros has freehold property, which personally I net off against debt, since if needs be, debt can be de-risked & shunted off balance sheet (for now) by doing a sale & leaseback on freeholds.

South Africa - some shareholders were worried about Norcros's S.African operations, which are material to the group overall. However, today's statement shows them in good health - with LFL sales growth of 15%. This is offset by an equivalent drop in currency, so flat in sterling terms. That's fine, and much better than it could have been.

UK - this is the biggest part of the business, and seems to be struggling a little still - with LFL sales down 2.2% for the year, that's not great.

Acquisitions - several excellent acquisitions have been made - in each case I have checked out the company accounts at Companies House, which now offers this service free.

Norcros has a buy & build strategy, to acquire complementary bathroom fittings companies, then drive sales through its existing international distribution network. This seems to be working well, e.g.

Croydex continued to perform strongly in line with the Board's expectations.

Pension deficit - one of the reasons that Norcros shares remain cheap on a PER basis, is probably due to investor aversion to large pension deficits.

In this case, the pension schemes' gross assets and liabilities are very large - something like 4 times the market cap of the group. So even minor changes in actuarial assumptions can cause big movements in the deficit.

My main worry with this share, was that the pension fund trustees would demand unrealistically high over-payments, thus draining cashflow, and stunting the growth of the host company.

Therefore today's news of a 10-year agreement with the trustees as follows, is reassuring:

The March 2015 triennial actuarial valuation process for the Group's UK defined benefit pension scheme has now been agreed with the Scheme Trustee, and shows a deficit of £73.5m (2012: £61.9m) representing an 84% funding level (2012: 85%). The increased deficit is driven predominantly by historically low gilt yields.

A revised deficit recovery plan has been agreed with the Scheme Trustee, with a cash contribution of £2.5m per annum starting in April 2016, and increasing with CPI, payable over the next 10 years. This compares to a deficit recovery payment of £2.1m in the year to 31 March 2016 under the previous plan.

So a relatively modest increase in payments (up by £0.4m), then inflation increases. That's well within the company's ability to pay, from profits. It should not interfere with dividend payments, nor expansion either. So a good balance looks to have been struck, and we can stop worrying about the pension schemes for the time being.

Actuarial deficits look scary, but they're worked out more conservatively than the usually smaller accounting deficit. The key figure is the cash overpayment, the way I look at things - that's money going out of the door that could otherwise have been paid in divis. So it's c.£2.5m p.a. + CPI here, which is annoying, but not a deal-breaker.

Dividends - nothing is said about divis today, but given that earnings are marginally ahead of expectations, and the pension fund agreement is satisfactory, then the dividend yield of about 3.8% looks safe, and is nice to have whilst we wait seemingly an eternity for the shares to re-rate.

My opinion - if I had known it was going to take so long for this share to go anywhere, then I'd have deployed the funds elsewhere. That said, it's impossible to second-guess these things. Everything seems on track overall, and the buy & build strategy seems to be going well. Therefore EPS will rise, even without any organic growth. This should drag the share price up eventually.

Two worries are removed today - over S.African performance (which we now know is going well), and the pension deficit, where agreement has been reached. So I shall sleep a little sounder knowing this.

Mothercare (LON:MTC)

Share price: 154.5p (down 18.0% today)

No. shares: 170.9m

Market cap: £264.0m

Q4 trading update - the commentary from the CEO doesn't sound too bad at first glance:

"Overall Group underlying profit for FY2016 is within the range of current market expectations. The UK is responding well to our strategy with continued sales growth and improved margins. International continues to be impacted by adverse currency and weakening consumer confidence in some key markets as economic headwinds persist."

The trouble is that Q4 sales in the problematic (and historically most profitable) division seem to have fallen off a cliff, although up against what looks like the last quarter of strong comparatives in the prior year.

Some geographies, e.g. China & Middle East seem to be struggling. The trouble is, this now throws into question the turnaround strategy. In particular, analysts currently forecast a 54% increase in EPS from 2015/16 to 2016/17, which looks questionable now.

Therefore if forecasts are going to be lowered for the new year, then the valuation comes into question - it gets de-rated, hence the 18% fall today.

My Achilles Heel is buying too soon after profit warnings. I had lunch this week with an old friend who pointed out some academic research on profit warnings. It said that you should always sell after a profit warning, because statistically the shares are far more likely to continue falling after the initial fall (notwithstanding a short-term bounce).

The research suggested that we should wait at least 2 weeks before considering a purchase after a profit warning. That rings true to me. So I'm going to take my time on MTC, and do some more detailed work on it over the next few weeks, if I can find the time.

One broker has reduced their FY2017 forecast by 12%, but is saying they see today's weakness as a buying opportunity.

UK trading is doing alright, and it's striking that 35% of UK business is now online.

A few snippets now, as I have to nip back to Hove from London, as I forgot my passport (am off to Warsaw first thing in the morning)

Lavendon (LON:LVD)

(at the time of writing, I hold a long position in this share)

A solid update today. Although note that the hire fleet was increased last year, so increased revenue is to be expected. Lots of detail is given, but overall this is key section:

"Building on the momentum established towards the end of 2015, we have seen an encouraging start to the year with our continued focus on revenue growth delivering results. This growth reflects the benefits of the strategic investment programme we undertook in 2015, to strengthen our market positions across all our regions. Whilst recognising some uncertainty in the economic outlook, the Board remains confident of making further progress during the year and delivering on its expectations for 2016."

That sounds fine to me, especially considering what a low rating this share is on.

It's good to see that the M.East division is holding up - with other countries making up for softening trading in the high margin Saudi Arabian market. Worries about the M.East are probably the main reason that this share is on such a low rating.

It has a very solid balance sheet too - vastly better than say HSS Hire (LON:HSS) .

Matchtech (LON:MTEC)

(at the time of writing, I hold a long position in this share)

I've not had time to go through all the detail, but when time is short, all you really need to do is check that the company says its trading in line with expectations. That's the crux of it all:

Whilst the Board is mindful of the increased caution in economic forecasts in recent months, based on opportunities won, trading in the two months since the half year and continued close cost management the Board anticipates the Group's operational results for the year to 31 July 2016 will be in line with management's expectations.

A bit annoying that they say "management's" instead of "market". I cannot see the reason for this, given that there are market forecasts out there.

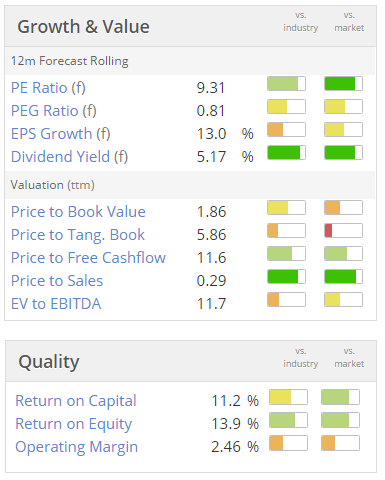

This share looks terrific value in my view:

Balance sheet - I was expecting this to look stretched, after taking on debt to acquire Networkers Intl. So what a pleasant surprise to see that it's actually fine - no issues there at all, for me.

The current ratio is strong, and long-term debt looks perfectly manageable.

This share is arguably similar to Norcros - in that it always looks great value, but sellers snuff out any decent rise in share price. Mind you, who cares, if we're collecting in a 5% dividend income whilst we wait for the overhang to clear?

Renold (LON:RNO)

(at the time of writing, I hold a long position in this share)

I reported here on 10 Feb 2016 about Renold's profit warning, concluding that the shares looked good value at 30p.

An update today has given things a boost, with the company seemingly coping well with lower demand:

As a result of the slightly better than expected sales and ongoing cost reductions, the Board now expects that the Group's underlying Adjusted2 Return on Sales3 will be maintained at 8.6%, the same level as the prior year. Adjusted operating profit will therefore be ahead of current market expectations of £13.5m. The benefit to Adjusted Earnings Per Share will be further enhanced by savings in financing costs and the estimated tax rate applicable in the year.

I've commented before how this company seems good at managing investor expectations. So rather than dribbling out bad news, it seems to have cleared the decks in Feb 2016, and is now out-performing against lowered expectations.

I particularly like that the company has maintained profit margins, despite lower sales.

Epwin (LON:EPWN)

Results for 2015, out today, look solid.

Big increase in the divi, up 50%.

It's on a PER of about 12 times 2015 earnings - probably about the right price, I'd say.

Current trading - in line, so that's fine.

Balance sheet - OK-ish. There's a bit more gross debt than I'd like to see, but this seems to be funding quite large fixed assets.

EDIT: an adviser to Epwin has just emailed me to say that debt is high because they made 2 acquisitions late last year for £24m cash.

Sorry, I've run out of time for today, have to jump on a train now to grab my passport from home.

My flight to Poland is first thing tomorrow morning, so my plan is to write tomorrow's report from my hotel room, so you shouldn't notice any difference from usual, assuming my flight is not delayed.

Regards, Paul.

(usual disclaimers apply)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.