Good morning!

Fridays are usually fairly quiet, but exceptionally so today - there's literally nothing of interest to me on the RNS today, so I had a lie-in this morning after doing my usual initial review of the news on my iPad, in bed. Working from home is so efficient - no time wasted ironing clothes, taking suits to the dry cleaners, or the unpleasant & frustrating commute. I heartily recommend it.

I've noticed that a lot of small cap shares are slipping backwards at the moment, on profit-taking, especially things that have had big recent moves upwards. This is presenting some good buying opportunities, for people who missed the initial move upwards. I'm looking at topping up a few shareholdings that have done well recently, but slipped back in recent days.

Also I'm finding other buying opportunities, with mini panics on other illiquid small caps, as there aren't many buyers around with people being on holiday. So this can be a very profitable time of the year, to pick up small cap bargains which are irrationally oversold in thin trading, hence why I keep my eyes peeled throughout the summer - the more illiquid the market, and the fewer market participants, then the more pricing anomalies arise, to be taken advantage of.

If you've already done your detailed research, then you're primed and ready to pounce when the right (lower) price is presented to you by Mr Market! Although there's always the risk that a profit warning might be on the way, when a share plummets unexpectedly. Hence why I tend to prefer buying within a relatively short time after a trading update, which reduces the risk of something unexpected happening.

Satellite Solutions Worldwide (LON:SAT)

Share price: 4.26p (down 2.1% today)

No. shares: 308.1m

Market cap: £13.1m

Interim results to 31 May 2015 - this is a new company to me. It floated on AIM in Dec 2014, reversing into a shell called Cleeve Capital. The company describes itself as a, "global communications company specialising in rural, last-mile satellite broadband". This has already confused me! If it's satellite broadband, how can it be "last mile"? Surely it would be many miles, from earth to the satellite? If any reader can explain this, please do so in the comments below.

It's interesting to note that the founders of the cash shell, Rodger Sargent, and Simon McGivern, achieved good Institutional backing for their creation of the cash shell in Dec 2014. Their CVs look interesting, and include (McGivern) being CEO of Litebulb (LON:LBB), and a former fund manager at Panmure Gordon. Sargent also has an interesting CV as follows;

Rodger Sargent has been the founder and finance director of a number of quoted and private companies over the past fifteen years, including Sports Internet Group Plc, Hydrodec Group Plc, Audio Boom Group Plc and Litebulb Group Limited. He previously ran the family office of Betfair founder, Andrew Black. He qualified as a chartered accountant with PriceWaterhouse Cooper, London in 1996.

Turnover was £3.2m, and pre-exceptional profit before tax was a loss of £231k.

This appears to be six months trading, even though the acquisition only occurred in the last 3 weeks of the period, but reading the notes it seems to have been treated as a reverse transaction, so I think the figures are a full six months trading.

Balance sheet - looks fine at the period end, but more acquisitions have been made since. The company has the stated aim of "rolling up" small satellite broadband companies.

Outlook - this sounds potentially interesting;

Since the period end, the underlying business has continued to grow organically adding on average 450 gross new customers per month. The loss of customers, known as "churn", has started to fall and now represents approximately 15% of the base on an annualised basis (c25% lower than telecoms industry average).

Average Revenue Per User "ARPU" has continued to grow and with the forthcoming launch of a pan European VOIP offering we would expect this to grow further as our customer base adopts this value added service.

The enlarged group's strategy is very clear - to grow subscriber numbers, through organic means and through carefully selected acquisitions, in a controlled, low-risk manner with a focus on enhancing earnings and cash generation...

...If we are successful in the execution of our strategy, the Company intends to become the largest satellite ISP in Europe by the end of 2017 with over 100,000 customers.

My opinion - for speculative investors, this share looks potentially interesting, albeit early stage. There are some big hitters on the >3% shareholder list, which presumably means management are well-regarded.

The trouble is, there will have to be repeated Placings to fund lots of acquisitions, the planned strategy, which could result in PIs being diluted, especially if Placings are done at a discount.

It's not something that I would take an interest in at this stage, but it's useful to have had a quick look, so that some notes are in the archive for future reference.

Powerflute Oyj (LON:POWR)

Share price: 78.2p (up 2.7% today)

No. shares: 284.1m

Market cap: £222.2m

Trading update - this is a Finland-based paper & packaging group, whose shares listed on AIM in 2007, so it's been around a while.

The company comments on H1 performance (to 30 Jun 2015) as follows;

Consistent with the trends described in the Trading Statement provided on 15 May 2015, the Group has performed strongly during the first half of the year in both its Coreboard and Cores and Packaging Papers activities and the outlook for the second half of the year remains positive.

Outlook - more detailed outlook comments are given, and it started to sound as if they were warning on profits, but it comes to a happy conclusion;

The second half will be impacted by planned annual maintenance shutdowns in a number of the paper and coreboard mills during which we will complete several complex projects and upgrades that are not without operational risk. However, in the absence of any material production challenges or any significant change in market conditions, we currently expect that the outcome for the full year will be ahead of previous expectations.

My opinion - it sounds from the above as if they are preparing the ground for something possibly going wrong, but saying that they will do well if nothing does go wrong! A fair bit of risk that there could be a profit warning later this year, i would say.

I don't normally touch overseas companies listed on AIM, but in this case, it's long-established, a reasonable size, profitable, and pays divis. So it's probably OK.

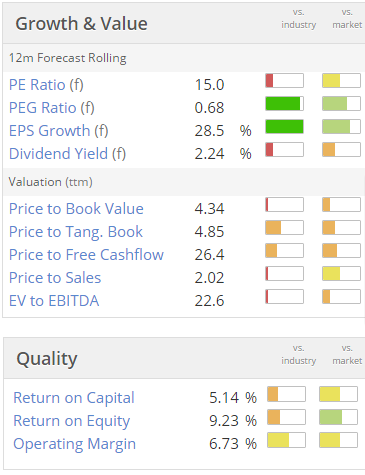

The valuation metrics don't look attractive though, see below;

Note that turnover is forecast to more than double this year, and profits up substantially too, so they must have done a big acquisition. The narrative today mentions the acquisition of Corenso, and that integration is progressing well.

I can't see anything to get excited about with this share.

Nothing else to report today, so have a lovely weekend, and I'll see you back here on Monday morning.

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions.

A fund management company with which Paul is associated may hold positions in companies mentioned.

NB. These reports are Paul's personal opinions only)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.