Good morning. Last night was interesting in the US markets (which the UK closely follows the next day), as there was a roughly 1% correction - which doesn't sound much, but you could really feel the tone change on CNBC for example - everyone now talking about taking profits, and valuations being too high, the need for a 10% correction to blow off the froth, etc. I think that's absolutely right - markets have gone up too far, too fast, to borrow a phrase (!), and in my opinion a correction is needed and would be a healthy thing, especially in the most speculative stocks, which have gone well into euphoria territory in some cases. So it will be interesting to see which stocks wobble today, as that will give clues as to what would really nosedive in a more serious downturn perhaps?

On this type of day, being a value investor, of course one can just sit back & relax. Value/GARP shares don't have any speculative froth in them, so holders don't tend to panic sell on a down day. Famous last words ...!

There are an unusual number of positive trading updates today, reflecting the undeniably strengthening economy. In terms of strategy this is something to keep at the front of our minds. Companies which are now trading well could end up beating market forecasts by a long way - due to the operational gearing which means that in many cases only a small rise in turnover can generate a big rise in profit. So an apparently high valuation can quickly become reasonable, or even cheap, if earnings forecasts are blown out of the water - and remember that in an economic recovery brokers tend to be too cautious, so forecasts are in some cases likely to be too conservative.

I like the trading update from Moss Bros (LON:MOSB). They had a remarkably good Christmas, with LFL sales for the five weeks to 11 Jan 2014 up a whopping 12.9%! That's amazing, given how tough economic conditions have been, and the terrible weather too. LFL sales for the 24 weeeks of H2 (it's a January year-end) were up 7.3%, so you can see that Christmas saw an accelerating sales trend.

Margins are down slightly, as the cash gross profit (the best performance measure, other than overall profitability, since it takes into account both sales and margins) was 5.6% ahead of last year. That's more than enough to absorb overhead increases, and should be good for the bottom line. Indeed, the most important sentence in today's statement says;

The improved sales performance over Christmas and continued tight cost control has meant that profit expectations for the 2013/14 financial year will exceed market expectations.

The other very interesting section of Moss Bros's update today concerns dividends. The company has had a strong Balance Sheet, with surplus cash for a while now, and they have now decided to give some of it back to shareholders. Therefore a target level of cash has been set of £15m at the year end (well down on the £25.7m reported at the last year end of 26 Jan 2013. This is what they say today about future dividends;

Subject to any other strategic opportunities arising, therefore, the Board intends to announce with its full year results for the year ended 25 January 2014 a recommended final dividend of 4.7 pence per share, being a total dividend of 5.0 pence per share for the year. This compares with 0.9 pence per share for the year ended 26 January 2013. The Board expects to increase this dividend payout progressively thereafter.

That's pretty dramatic news! The dividend being hiked by a factor of more than five should have put a big smile on all shareholders faces. Although the company does caution that this year the dividend will not be fully covered by earnings, although they sound pretty confident about the outlook (as always, my bolding below);

Whilst the dividend for the year ended 25 January 2014 will be partly uncovered by earnings, given the strength of the Company's balance sheet and the cash generative nature of the business, the Board believes that this level of growing dividend payment is sustainable and leaves sufficient working capital flexibility going forwards.

So this means they have a pretty exciting dividend yield going forwards, and the share price has already shot up this morning to adjust for that. It's up 24% to 92p, which still generates a generous dividend yield of 5.4%. Although as it's not fully covered by earnings, personally I wouldn't set too much store on that - a setback in trading would necessitate a dividend cut.

Well done to shareholders here - you wouldn't have bought these shares on the historic numbers, as it looked expensive (or if you did, then you just got lucky!). But for people who got under the bonnet, and worked out that the business was coming into a sweet spot for trading, then very well done on spotting a winner.

Broker W H Ireland has this morning increased their price target from 85p to 110p, and they have also raised earnings forecasts by 26.1% for the year that's about to end in two weeks' time, and by 6.5% next year. So it strikes me that there could be good upside on the 2014/15 forecast, if this strong trading continues?

As an aside, I bought a black tie type of suit from Moss Bros last year, and noticed that the hire operation seems to be designed to steer people towards actually buying a suit - i.e. it wasn't much dearer to buy, than to hire. Although the quality of the suit I bought was poor - it really did feel cheap & nasty, but served its purpose for the Small Cap Awards ceremony where I was amazed to be in the final shortlist of 3 for "Analyst of the Year" last year.

(as another aside, that event was held at the BAFTA building on Piccadilly, so having just got a new iPhone I tried out "Siri" using voice recogniton to give me directions to BAFTA. Anyway, Siri misheard, and hilariously directed me to the nearest bathroom fittings store - she thought I had said "bath tub!")

Moving on, I've been looking through today's interim results from Ideagen (LON:IDEA), a small niche software company that provides compliance software to highly regulated sectors, such as healthcare. The figures look very good - turnover for the six months is up 43% to £3.7m (of which organic growth was 16%, the rest has come from acquisitions).

Adjusted profit before tax was up 58% to £1.1m, although adjusted EPS was only up 11% to 0.7p, which suggests either a very high tax charge this year versus next year, or that there have been a lot of new shares issued (or both). Checking the Stockopedia StockReport, there is a handy line (second row from the bottom of the large "Financial Summary" box) which shows the average number of shares in issue for each of the last six years. In the case of Ideagen, that has risen significantly every year, and the compound annual increase in number of shares in issue seems very high to me at 43.8%. So my concern here is that EPS has been constantly dragged down by large numbers of new shares being issued, which has offset a lot of the gains in headline profitability.

On the other hand, with a decent amount of cash now, on a strong Balance Sheet, hopefully the company won't need to issue any more shares from now on? This is an important point - the best shareholder returns generally tend to come from a company growing, but the number of shares not growing, in my opinion. That said, it's acceptable for a company to issue new shares for an acquisition, if the deal struck is a bargain for the buyer!

In this case, a group of us met the CEO of Ideagen at a Mello investor evening, and my impression was that whilst an affable chap, he is clearly also pretty shrewd, and knows both how to turn around companies, and buy them at favourable prices. Ideagen also has a very high profit margin, so clearly has products with pricing power - usually a good sign.

They report net cash of £5.3m at 31 Oct 2013, and my quick Balance Sheet testing is passed with flying colours, with current assets being 233% of current liabilities (anything over 150% is very strong, and generally I look for at least 120%), and the only long-term creditors are £911k in deferred tax, the least worrysome type of creditor, as it's just an accounting book entry to adjust for timing differences on tax.

I have also reviewed their treatment of intangibles, and note that they capitalised £238k of intangibles (presumably development spend, but it's not specified on the cashflow statement) in the six month period, which seems to be ahead of the roughly £110k of amortisation of development spending. The adjusted EPS figure of 0.7p seems to be a fair number, as it includes amortisation of development spending, which is OK. So annualise that (assuming no H1/H2 seasonality), and you're at 1.4p EPS. So at the current price of 30.6p (down 9% on the day), that rates the company on a PER of almost 22 times, which strikes me as a pretty rich rating for such a small company.

The dividend yield is negligible, at about 0.5% - hardly worth bothering, although perhaps they want to get on the dividend list, and report a huge % increase in divis in the next couple of years?! (by starting very low).

Overall then, it looks a good company, and is consolidating in a fragmented sector, but the valuation is too high to get me interested. I'd want an entry point much lower than 30p to get me interested.

Edit: The outlook statement sounds intriguing though, especially this bit, hinting at further organic growth (my bolding below). There are a lot of positive phrases in there, and coming from a management that have delivered well so far, I would be inclined to take this at face value;

...our successful entry into and immediate growth within the UK healthcare sector is particularly exciting and provides the Group with a significant market opportunity in which to grow profitably over the near to medium term.

The Group has an increasing pipeline of new business sales which combined with our growing recurring revenues provides validation that we are pursuing a sound business strategy that underpins our confidence in the outlook for the rest of the year.

Just one additional point that I've only just spotted. They spent most of the surplus cash on an acquisition after the period end - £3.4m being paid as the initial cash consideration for Pentana, which itself had £1.175m of cash, so net cash consideration of £2.25m. Another £0.8m of contingent consideration could be payable after 12 months. It is good to see no new shares being issued for this acquisition. In an ideal world, this company should probably adopt the highly successful model used by David Cicurel at Judges Scientific (LON:JDG), where he used the cashflow from companies acquired to pay for their own deferred consideration, topped up with a bit of bank debt. If managed well, that is far preferable to issuing shares all the time.

Checking the archive, I don't seem to have mentioned Carrs Milling Industries (LON:CRM) before - probably because it looks a fairly boring, low margin business with various activities around agriculture, food, and engineering. The shares have done well in the last year though, being up about 60%. So boring can be lucrative.

It has issued an in line with expectations trading update this morning for the 19 weeks to 11 Jan 2014, being most of their H1 period (it's a 31 August year end). It reports net debt has risen to £28.2m at 30 Nov 2013 - it's not clear why they are reporting up to date sales, but the net debt position from seven weeks ago - seems odd.

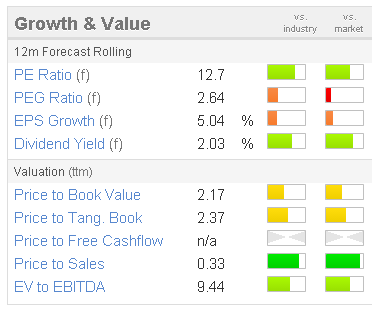

The dividend yield is an unexciting 2.0% (forecast), and the forward PER is 12.7, so it looks priced about right in my opinion, based on the most cursory of glances at the figures. Although it's worth noting that the dividend is about four times covered, so if I were a shareholder I'd be pushing for a more generous dividend. Surely they could double that to give a 4% yield, and still be twice covered? That's what mature businesses should do - pay out their earnings to shareholders, as demonstrated today by Moss Bros.

We're in a bull market, so I can't imagine investors generally will get very excited about this share, which doesn't seem to have any attractive growth planned, although management do say today that they are exploring growth opportunities, so maybe they'll come up with something?

A couple more comments to round off this morning's report. Alliance Pharma (LON:APH) has issued a trading update for the year ended 31 Dec 2013. This is a speciality pharmaceuticals company which buys up the rights to small scale, old drugs or treatments which are not of any interest to the major pharmas any more. It's an attractive business model, as they make good profits from these niche products, and then keep rolling by using a mixture of cashflow and bank debt to buy up more such products.

Their statement today says that turnover for 2013 is expected to be £45.5m (up just 1.3% on 2012), and pre-tax profits should be in line with market expectations. Broker consensus was for £46.9m turnover, so they've fallen a bit short there, but it's profit which matters, and that is forecast at £9.9m, for 3.68p EPS.

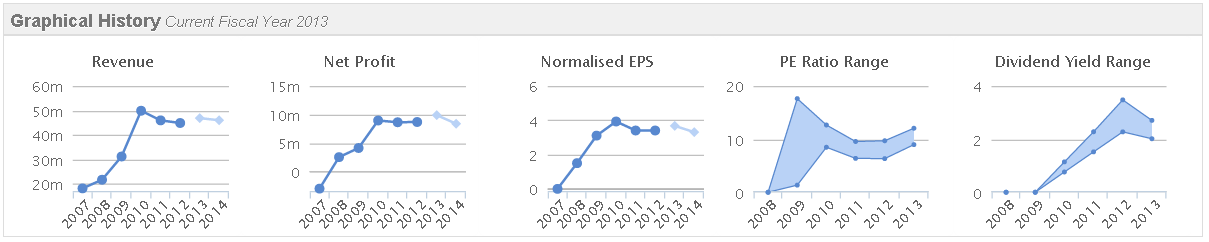

Therefore at the current price of 37p the shares are on a fairly modest PER of 10. The forecast dividend yield is 2.6%, although note that the net debt of £25.5m at 31 Dec 2013 is nearly 10p per share, so it's quite material. Adjusting for that takes the PER up to about 13, which is probably about right for a business that has not generated any growth in recent years, as the Stockopedia Graphical History shows below;

I think this company needs to deliver some growth if it wants to attract a higher rating. I could see some upside on the current price if they announce some decent new acquisitions at favourable prices, but it's not getting me excited at the moment. Or it might have a run up in price just on the basis of it looking overlooked, and everything else having moved up in price? That's not a good enough reason to buy any for my book - there are better opportunities elsewhere I think.

My Charity Fundraising for Spring 2014

That's it for today, it's lunchtime now & I need to go for a jog, to train (rather belatedly) for my next Half Marathon, on Feb 16th. I'm fundraising mainly for MacMillan cancer support, an absolutely wonderful charity I'm sure you agree, and also for a local charity, Sussex Beacon.

Also, I've made this a double challenge, by combining this charity run with abstinance from alcohol for not one, but three months! So far so good, it's been a dry, and boring January so far! So if you would like to sponsor me for charity, my latest fundraising page is here. I appreciated you were very generous for my last Half Marathon in October, so don't feel obliged to donate again, only if you wish to - or look on it as a fee to ensure Thu morning reports are on time for three months! ;-)

Best Wishes, Paul.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.