Hi everyone,

There's not much in terms of results today but there are some trading updates on some familiar stocks, so that's what I'll be covering.

Cheers

Graham

DX (Group) (LON:DX.)

- Share price: 9.5p (suspended)

- No. of shares: 200 million

- Market cap: £19 million

These shares remain suspended due to ongoing procedures related to a potential reverse takeover by Menzies Distribution.

That doesn't stop the news flow and today we learn that the CEO and CFO are both stepping down from the company.

Perhaps given the destruction of the share price, there are few platitudes given in the statement with respect to these changes.

We further learn that the company's bank remains supportive in relation to net debt at end-June of £19 million.

If the bank wasn't supportive, the consequences would likely be dire for equity value, so this is certainly not a positive - just the absence for now of a serious negative.

But perhaps the outcome isn't going to be so bad for shareholders after all, if the Menzies deal goes through. The Group is being reorganised into two divisions, Express and Freight, whose managers will report to the Board. Is that in preparation for the Menzies deal going through, I wonder?

Adjusted PBT is set to be in line with market forecasts. Overall, combined with the personnel changes and the restructuring, I'd see this as a soothing update for long-suffering shareholders.

Character (LON:CCT)

- Share price: 490p (+1.6%)

- No. of shares: 21.1 million

- Market cap: £103 million

Character renews license for Teletubbies

Again, I see this as less of a positive than the absence of a negative!

Character, through its subsidiary Character Options, designs and distributes a wide range of toys under some of the most well-known brands.

The relationships with the licensors are critical, and Character has done a really good job over the years of impressing IP-holders with what it can do.

Today's statement confirms that Character is still impressing DHX, the owner of the Teletubbies brand. Another happy customer:

"As we continue to grow the overall licensing programme for Teletubbies, it is imperative that we build on strong sales and marketing in core categories. Character Options has done a sterling job with the toy lines and we are excited about the new product to come that will complement the current broadcast season. We are confident that our continued relationship will see Teletubbies toys go from strength to strength at retail."

So if you're a Character shareholder, there is basically no change - the Teletubbies range will remain for at least another three years.

Despite not owning much of the IP behind its products, the lucrative nature of the industry and the strong execution of its strategy have nevertheless resulted in Character enjoying exceptionally strong returns on capital.

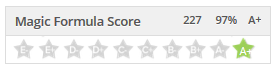

This is reflected in the Magic Formula score, showing a combination of both value and quality characteristics:

Ramsdens Holdings (LON:RFX)

- Share price: 140p (-5%)

- No. of shares: 30.8 million

- Market cap: £43 million

Unauthorised access to IT Systems and Trading Update

An unusual little update from this pawnbroking/financial services chain.

There was "unauthorised access" to its systems, but with anticipated "minimal disruption" to business, just some new IT costs. I wonder if the potential impacted stakeholders were customers or employees or both?

Anyway, I'm not sure why the shares are off 5% because apart from that, we also get an accompanying trading update which states that strong trading has continue across all core segments.

I'm a fan of this share and perhaps should be buying some to diversify a little bit away from my H & T (LON:HAT) holding.

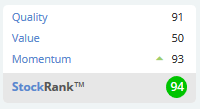

Stockopedia algorithms agree and reward it with an excellent StockRank:

Hays (LON:HAS)

- Share price: 167.6p (unch.)

- No. of shares: 1443 million

- Market cap: £2,420 million

This is well outside our market cap range but it's useful to keep an eye it with respect to the recruitment sector and I suppose the job market in general!

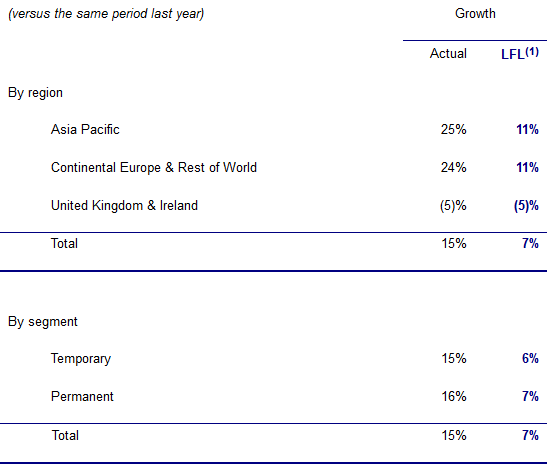

The LFL (like-for-like) numbers are more useful, because they strip out the effect of currency movements against sterling.

The aggregate movement is fine, +7%, led by international growth. Operating profit for the year ended June 2017 is expected to be marginally ahead of consensus expectations, which were £209.5 million.

Within the UK (-5%), London net fees were down 9%. Conditions are said to be sequentially stable (i.e. flat against Q3), even though they're down against a year ago.

It's worth keeping an eye on the giant recruiters such as this one if you own shares in the likes of Harvey Nash (LON:HVN), Empresaria (LON:EMR) and Gattaca (LON:GATC).

For what it's worth, the rating on these shares is quite a bit too high for my liking, at a PE ratio of 16x. The PEG is 2.0x, which as a useful piece of shorthand tells you that the PE is twice the growth rate. It's a well-diversified and highly credible, mature business, but I'd generally want a good bit more value than this.

I think that's it from me. Have a good weekend and I'll see you next week!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.