Good morning.

PuriCore (LON:PURI)

This company has been discussed a lot lately, as it's the one where the share price suddenly dropped 25% due to a clumsy seller of 1m shares, who appeared to dump them through Peel Hunt at 25p a couple of days ago. That block of shares seemed to have cleared by yesterday, as I was told by several people that they had tried to buy in size, but couldn't get filled.

The company has issued an IMS this morning, but it's nothing to do with the share price movement, it's following the same timing as last year, when an IMS was issued on 17 May 2013, also covering the company's Q1 performance.

The key part of today's IMS says;

Revenue for the Group decreased 2.9% to $10.6 million (6.4% at constant currency) in the first quarter of 2014 (Q1 2013: $10.9 million), as higher recurring revenues were offset by delays in capital orders. Cash and cash equivalents were $3.9 million as at 31 March 2014 (as at 31 December 2013: $3.4 million).

It's good to see that the cash balance has increased by $0.5m since the year end. Note that this is a net cash balance, as there is no debt here - the Balance Sheet was restructured in early 2013, and debt was eliminated.

A small reduction in turnover for Q1 sounds consistent with the outlook statement published with their calendar 2013 results published on 24 Apr 2014, which said;

Consistent with market expectations, revenue is expected to soften in the short term as we balance declining revenue from capital equipment and grow consumables and other recurring revenue.

On their endoscopy product, the commentary sounds positive to me;

The (6%) decrease (in turnover) was due to delays in capital orders and planned heavier sales in the second half of the year in anticipation of the launch of the new state-of-the-art endoscope washer disinfector, RapidAER®. During the quarter, the Endoscopy business completed final testing of and received CE marking for the new product. Market acceptance of RapidAER has been favourable, and sales orders are already in hand with shipments planned to commence in June.

The statement overall is rather unsatisfactory, in that it doesn't comment on profitability at all, nor about market expectations. So one assumes that the company must be trading approximately in line with market expectations, or they would have said otherwise.

The summary says;

For the remainder of 2014, we will invest strategically in our Supermarket Retail business to drive growth and aim to increase revenue in the UK Endoscopy business driven through new product launches and ancillary recurring revenue streams. The new Middle Eastern partnership, plus other international partnerships being pursued in all business areas, offers opportunities to leverage marketing resources whilst delivering growth.

That's a bit mixed - the market generally recoils from additional investment, which means increasing costs, to drive sales. On the other hand, how else can you increase sales?!

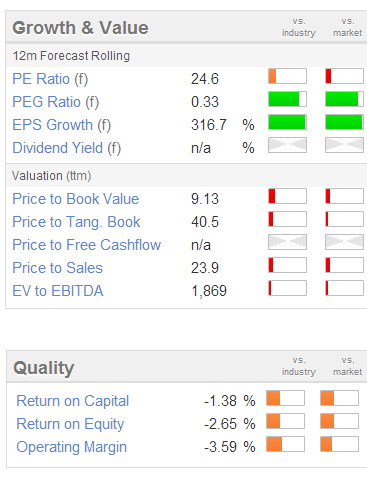

My view is that the market is being far too pessimistic about this company. It seems to be operating profitably, or at least cashflow positively now, and has decent products with big name customers, buying consumables from them on a recurring basis. It has net cash, and no debt.

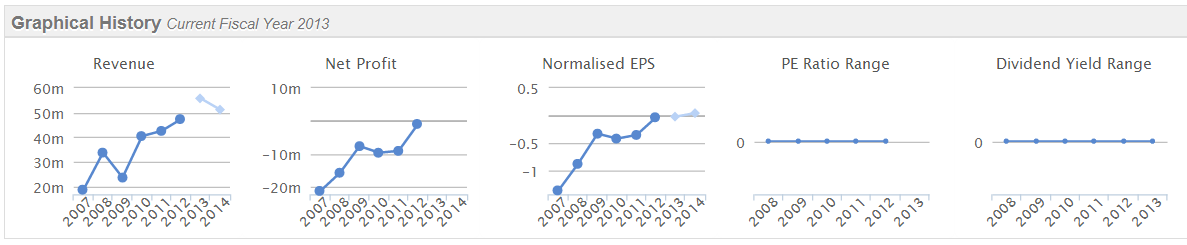

So to my mind valuing it at only £15.8m at the current share price of 31.5p seems very pessimistic. Part of the reason is that a lot of investors have been burned on this stock in the past - it generated heavy losses for years, and doesn't pay a dividend. However, the reason it interests me is because performance has improved to a point where it is no longer loss-making, so if you look forwards a couple of years this could be a decently profitable business. If that happens, then the valuation would probably be several times the current share price. See the Stockopedia graphics below which demonstrate the poor historical performance;

My best investments have nearly always been where investors view a share extremely negatively, but where there are early signs of a turnaround. Sometimes you have to wait a year or two, but suddenly the stock can re-rate, often spectacularly so. I think Puricore could do exactly that, but it's dependent on management execution of course. Not literally, but on them executing well I mean. That needs a further sales push.

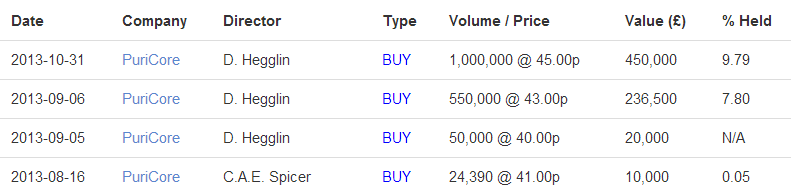

Director share buying:

There was a strong steer from management that they see things positively when a Director spent c. £700k buying stock last year - that is a big sign of confidence at a micro cap like this, and doesn't happen on a whim, or very often. Clearly he must see a bright future for the company.

So whilst I accept fully that market sentiment is very negative towards this company at the moment, I like situations like that because it can throw you an irrationally cheap bargain. If this company executes well, then there could be considerable upside from the current price, in my opinion. It certainly looks a much better bet than a lot of the over-priced blue sky stuff that you find on AIM, often at a much higher market cap than this, which have yet to generate any significant sales at all! In this case it's a proper business already, but needs to grow further to generate significant profitability.

Note that PuriCore has a Full Listing, which is very unusual for a micro cap such as this. It would surely make sense on cost grounds for them to move to AIM?

Broker consensus is $51.2m sales, and $0.044 EPS for calendar 2014, which puts the shares on a forecast PER of about 12-13.

See from the long term chart how early expectations have not happened, so this company is seen as a serial disappointer, which is why the shares are cheap for a company of its size & activities.

However, a chart like this also gives an idea of the opportunity if the company's performance does improve - investors have got very excited about its valuation in the past, so who is to say that cannot happen again?

The average number of shares has roughly doubled over this period, so there's plenty of upside scope if they start delivering good news.

Coms (LON:COMS)

I've been asked to look at a trading statement from this company today, which says;

The Board is very pleased to state that as the audit process nears completion, it is now apparent that whilst revenue numbers for the year will be approximately £14 million, as previously indicated, EBITDA and Profit Before Tax will be, in each case, significantly greater than the £0.75 million and £0.45 million respectively, that was announced previously.

Nobody likes audit adjustments, but if you're going to have them, then increasing profit (as in this case) is very much better than decreasing profit! Although I am curious as to what figures the finance dept got wrong which led to profits being increased?

As you can see from the usual Stockopedia valuation graphic on the right, this share is very highly priced, based on broker consensus forecasts, which are themselves heavily reliant on a large increase in profits to £2.4m in the current year (ending 31 Jan 2015).

So I'd need to know a lot more about this business before I could even entertain paying a £60m market cap (at 6.3p per share). It seems to be a cloud telephony company. Growth companies like this need a lot more research, as you have to assess their potential to continue growing, what competitors are doing, etc. So there's not a lot more I can add really. The trouble is that growth companies often disappoint, because the shares often get hyped up beyond reasonable expectations, in order to get the share price up and see less dilution for existing holders at fund raising time. So I would just urge caution, and that people really do their homework properly on this type of share, and be prepared for a heavy loss if the growth does not live up to expectations.

Nothing much else has caught my eye this morning, so I'll sign off. See you tomorrow!

Regards, Paul.

(of the companies mentioned today Paul has a long position in PURI, and no short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.