Good morning!

Castings (LON:CGS)

Share price: 402p

No. shares: 43.6m

Market Cap: £175.3m

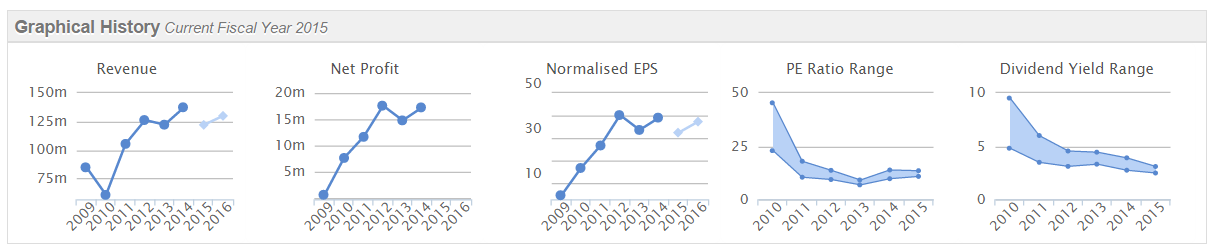

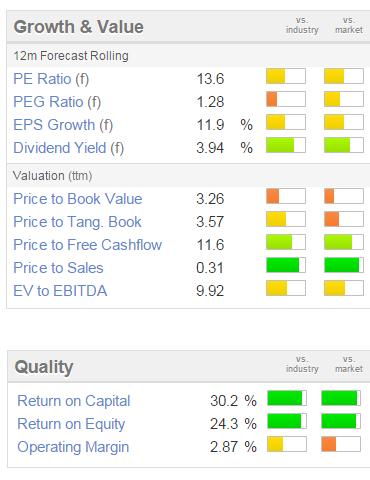

This company is an iron castings & machinery business. It's track record in recent years has been really excellent, and overall it looks a smashing business, with a strong Balance Sheet. It scores highly on Stockopedia, with a StockRank of 95, and high quality scores too. The valuation appears reasonable too. So that's a good starting point.

The problem is that the company has repeatedly stated that it has an uncertain outlook. Top marks for being open & honest, but it's clearly a worry that if profits are unsustainable, and/or totally unpredictable, then how on earth do you value the company?

Interim results - for the six months to 30 Sep 2014 are issued this morning, at 9am. Annoyingly, this company ignores market convention of putting out results at 7am (so that everyone has an hour to read them before the market opens) and instead inconveniences investors by issuing its results at 9am, when the market is already open. This causes unnecessary stress to investors, and gives a potential advantage to people who happen to be looking at their screen at 9am on results day. It's just bad practice. Results should always be issued at 7am, to give everyone a fair chance to read the figures before making any decision on whether they want to buy or sell when the market opens at 8am. Almost everyone else report figures at 7am, so why is this company different?

Profitability & Outlook - profit has fallen 12.9% from £9.6m in H1 of 2013, to £8.3m in H1 of this year. Although it looks as if the company has correctly guided down market expectations in the past, as they comment today;

It was reported at our Annual General Meeting in August that sales were below our expectations. Market forecasts of an increase in volumes in the third quarter of 2014 did not materialise. Forward schedules suggest a reduction in demand.

With the increasing concern over the strength of the recovery in Europe it is difficult to forecast the outcome for the remainder of the year. However, the directors anticipate that the year end results will be in-line with current market expectations.

Valuation - broker estimates (confirmed above) for this year ending 31 Mar 2015, are for 32.4p EPS (down from 39.1p last year). So at the current share price of 402p that puts the shares on a PER of 12.4.

Broker consensus is for an increase in EPS next year to 37.3p, which looks too ambitious to me, given the uncertain outlook mentioned above, and the comments on demand reducing. I suspect that figure might be revised downwards. It might be safer to assume that a range of perhaps 25-30p EPS is more prudent to value the company on. Put that on a PER of about 12, and you come up with a share price of 300-360p. Therefore there's possibly 10-25% downside on the current share price, to bring it down to a level that I would be comfortable with, where downside risk is factored in.

Balance Sheet - perhaps I'm being too conservative valuing it on a PER of 12, as that doesn't allow for the excellent Balance Sheet here. It's fantastic actually! The current ratio is 3.3, with hardly any long-term creditors on top of that. The company could pay off all its creditors just from its existing cash pile, of £24.7m.

So this is evidence of conservative management, and also consider that they have scope to make acquisitions, so I think you could add at least 10% to the valuation to take into account the reduced risk, and scope for acquisitions using existing cash. Therefore I'd probably be willing to go with a PER of 13-14, which raises my theoretical valuation of the company to 325-420p per share. Given that the share price is actually 402p, then it looks reasonable - within my range. I'd be looking to buy if it came down to the bottom of that range.

Dividends - the company has been increasing its divis by 5-10% each year since 2010. 13.5p divis is forecast for this year, giving a useful but not exceptional yield of 3.4%.

My opinion - the interim report gives very little narrative - just 4 paragraphs. I've had a look at the company's website & last Annual Report, and it seems to focus heavily on using the latest technology (robotics, etc) to give it a competitive advantage. I still have a worry that it might be vulnerable to losing business to low-cost countries, but on the other hand maybe its technological advantage is enough to secure business for here in the UK? Exchange rates are probably very important too, if a lot of business is exported, as is suggested.

Every time I've looked at this company, it ticks so many boxes that I like, but it's the uncertain outlook that worries me. What drove the big increase in turnover & profit over the last 6 years? Could that go into reverse? More research is needed, but it's certainly a stock that looks interesting & worth doing more work on.

The company mentioned soft demand from Europe, so it might at some point be a good recovery stock if/when the Eurozone starts to recover.

The chart looks grim, so that makes me wonder whether holding fire might be the best option for the time being?

Matchtech (LON:MTEC)

Share price: 550p

No. shares: 25.0m

Market Cap: £137.5m

AGM trading update - this sounds OK to me. Net fee income is up 3% in Q1 of the company's year (being Aug-Oct). The key bit says;

"The Board is confident that the outlook for FY2015 remains in line with its previous expectations."

My opinion - I like this company, as it has a niche - specialising in engineers, which seems to be a good place to be. The valuation looks about right to me at 550p. Could be attractive for both future growth & a good divi;

CPPGroup (LON:CPP)

Share price: 6p

No. shares: 171.6m

Market Cap: £10.3m

Trading update & strategic review - It was only a matter of time before this lot ran into problems again.

I last reported on it here on 22 Aug 2014. The company mis-sold worthless insurance policies for mobile phones, etc, and are now having to pay compensation. It's run out of money now & is trying to refinance.

This part of today's announcement should have sent anyone with some common sense running for the exit;

Financial position

In view of discussions with its stakeholders, the Board believes that there is a reasonable prospect that a satisfactory agreement can be reached with the Group's creditors as a result of the Group raising new equity capital. The Group has received indications of interest to subscribe for £9.0 million of new equity. The Group is engaged in supportive and constructive dialogue with its creditors and the Board anticipates that it will finalise negotiations with its creditors in the coming weeks.

It is expected that any new equity raised would be at a significant discount to the prevailing share price of 10.75p as at the close of business on 13 November 2014, with expressions of interest received to date at an indicative issue price in the region of 3.0p per share. The final issue price and quantum of placing will be determined by the Board following discussions with potential investors. Any potential equity fundraising would be subject to shareholder approval in General Meeting. Certain consents will also be required from the Group's secured and unsecured creditors.

So as the shares are now 6p, but new ones (presumably a large number) likely to be raised at 3p (or maybe less, who knows?), the why on earth would anyone not sell immediately?

I normally say that I hope businesses survive & recover when they get into financial trouble. In this case however, I hope CPP goes bust, due to the unethical way it has operated in the past, and that the people concerned do something more useful with their lives.

The company says today it may also be sold. Why would anyone buy this can of worms? Better to put it into pre-pack administration, and start again with a clean slate, rather than taking on a big pile of actual & potential liabilities for previous mis-selling.

It was an oversight on my part not to add this to my Bargepole List back in August, so belatedly have done so today.

Not one to short though - look at the intra-day spikes on the chart, when any shorters would have been incinerated!

(am still updating this article, so pls refresh from time to time, if you wish)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.