Good morning!

Victoria (LON:VCP)

I'm kicking myself for not buying any of these shares. Looking back at my previous notes here, on 31 Jul 2013 I noted the company's rather poor results for 2012/13, and had some concerns about the level of debt. However on 6 Nov 2013 I reported on the big reduction in net debt, and also the attractions of the asset and dividend backing, and came close to buying some shares but unfortunately didn't. They were 245p at the time.

That was a pity because Victoria shares are now 355p to buy, and are decidedly illiquid, so it's difficult to buy (or sell) in any size - there are only three Market Makers here, and two of them are only up in 500 shares (i.e. £1,775), which is hopeless.

There is a positive trading update issued this morning, with the key part saying;

The Board are pleased to announce that the Group's profits before tax and exceptional items are likely to be ahead of market expectations for the full year to 29 March 2014, as a result of continued improvements in like-for-like group profitability and including the impact of the acquisition of the Globesign group.

Somehow I'd missed this acquisition of Globesign Ltd (maker of "Westex" carpets) in Nov 2013, so have been looking back at the RNSs and it was a major deal (for the size of company), being for £16m initial cash consideration, plus further deferred consideration of £8m based on performance targets being met (being that Globesign has to achieve an average of £4.2m EBITDA over three years). So the acquisition will dramatically improve profitability by the looks of it. Globesign made £3.7m profit in the year ended 2 Mar 2013.

I couldn't see how the acquisition was funded (there were no shares issued), so have just rung the company's advisers, who told me it was financed by debt - from existng facilities, plus a new £12m acquisition facility provided by Barclays, which is repayable by quarterly instalments. That must make the group quite highly geared now, although a property sale & leaseback (on apparently rather unattractive terms) was announced in Mar 2014 to raise £5.8m (in return for an initial rental yield of 8.5% + annual RPI uplifts of 0-4%. That looks an unattractively expensive deal to me, but was obviously done to raise cash).

So this carpet making company has been very busy, and things seem to be going well for them. I've missed the boat on the shares though, so am not going to chase it higher. I'm taken aback by a comment in a broker note saying that there might be a provision for a £1m incentive payment to the Chairman, Geoff Wilding! Surely that cannot be right? If I were a shareholder I'd be absolutely livid at bonuses of that size being paid at such a small company.

Although the shares have gone up a lot, it's a very much better business now, following the acquisition of Globesign. So I might be tempted to buy a few on any pullback in future?

Today's announcement notes that Globesign made £4.5m profit before tax (unaudited) for the year to 1 Mar 2014 on £18.7m turnover, but emphasises that it was only part of the Victoria group from 13 Dec 2013 onwards, hence only 3.5 months of its results will fall into the financial year ended 30 Mar 2014. Although of course from that point onwards Globesign profits will be 100% included in the group figures. If that level of profitability is sustainable, then we should see dramatically better overall group results from Victoria in the current financial year (ending 30 Mar 2015) - so the interims in late 2014 could be the catalyst for another re-rating possibly?

Sweett (LON:CSG)

This is the property consultancy that recently shocked the market with the revelation that previous problems with alleged dodgy dealings by former employee(s) have resurfaced, with the Serious Fraud Office and the US Dept of Justice now investigating the matter. I ran for the exit on the opening bell when that announcement was issued on 2 Apr 2014, and now regard this share as uninvestable until this matter is fully resolved.

Hence for my purposes the trading update today is irrelevant, but I include it here for readers who are prepared to give the company the benefit of the doubt. The key part says;

The Group traded well through the fourth quarter of its financial year and it expects to report results for the year ended 31 March 2014 slightly ahead of market expectations.

Net debt at 31 Mar 2014 was slightly down, to £6.2m (cf. £7.1m a year previously).

This section from today's announcement, about a number of exceptional charges for different matters, but also a couple of exceptional profits (my bolding below);

The preliminary results for the year ended 31 March 2014 are expected to include material charges for exceptional administrative expenses, including the costs associated with investigating the Wall Street Journal allegations and restructuring costs incurred largely in Australia.

The Group will also be taking a full year charge for the Performance Share Plan (PSP) for the first time of approximately £0.6m. Due to the unpredictable nature of this charge, this will be disclosed separately going forward.

Other material non-recurring items included within the preliminary results will be the profit on the unwinding of the Australian dollar derivative contract (£1.0m) and the profit on the financial close of the Leeds Social Housing project (£1.1m).

Good luck to holders, but it's too high risk for me until the legal matter is fully resolved. The company had previously inferred that it was done & dusted, when it wasn't. So I'd want hard evidence that the matter is closed next time, not just soothing noises from the company.

Trifast (LON:TRI)

It always seems to be good news from this industrial fastenings group, and today is no exception, with an update that says;

The Directors are pleased to report that the business is continuing to benefit from the improving macro-economics and demand from manufacturing output across TR's customer base, in particular automotive; these trends are reflected across most of the Group's operations. As a result the Group is expected to report that the financial results for the year ended 31 March 2014 will exceed market expectation.

Unusual to see the singular used, i.e. "expectation". Usually it's "expectations". Dunno if there is any significance in that, maybe there is only one broker note in issue?

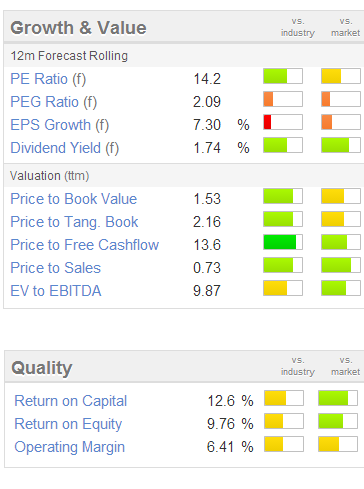

The Balance Sheet here is indeed strong, and net debt has been paid off. They sounds confident about the future. Based on the usual Stockopedia valuation graphics, these shares look priced about right to me. Although of course if they continue out-performing, then forecasts will be increased again, and the PER will fall.

Well done to holders here, I missed this opportunity. Although it's so difficult to know in advance which companies will execute well, and which ones won't.

Punch Taverns (LON:PUB)

Be careful with this one. The situation is effectively controlled by the debt holders, so the equity could turn out to be worth nothing if they play hardball.

Be careful with this one. The situation is effectively controlled by the debt holders, so the equity could turn out to be worth nothing if they play hardball.

The problem is that debt is excessive, at over £2bn, and the company is in breach of its loan covenants. Temporary waivers of the covenants appear to be in place.

Note also from the P&L that operating profit is largely consumed by debt interest cost (similar to £JPR). The problem with that, is the company cannot then escape from the mountain of debt, since even though it generates positive cashflow, the debt holders are paid interest out of it, leaving little to nothing to reduce the debt capital amounts. Usually the only way out is some form of insolvency, or a debt for equity swap.

The going concern note in today's results says;

...the Directors are making full disclosure, as required by accounting standards, to indicate the existence of a material uncertainty that casts significant doubt on the ability of a significant part or substantially all of the Group to continue as a going concern.

So anyone punting on these shares should be aware that a 100% loss is a high likelihood. Or at the very least, probably heavy dilution through a debt for equity swap perhaps? So you have been warned!

Manx Telecom (LON:MANX)

This is a recently floated company which seems to have a monopoly on telecoms services on the Isle of Man. Results today for calendar 2013 pre-date the IPO, so the Balance Sheet reflects the ravages of Private Equity - i.e. it's loaded up to the roof with debt, which they use to gear up their returns. That debt was partly repaid in the IPO by the looks of it, and there is a note that net debt after admission to AIM was still quite high at £65m.

I'm a bit nervous about getting into anything directly regulated by Governments, as there is always the risk that some vote-hungry politician might do something that harms the commercial interests of the companies concerned.

It could be an interesting dividend play though, as the forecast yield for next year is 6.1% (for a 10p payout).

Right, gotta dash as off to London for meetings.

See you tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has no long or short positions)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.