Good morning! Plenty of news announcements today, and we also have the ongoing issue of the plummeting oil price, and general market volatility to contend with - the US markets seem to be going a little wobbly again, and that always spills over into UK markets too. The FTSE 100 Futures are indicating an open down 60 points to 6,235. No doubt the heavy weighting of oil & resource stocks distorts the FTSE 100 - personally it's not an index that I find useful, so I tend to follow FTSE Intl-aim All Share Index (FTSE:AXX) and FTSE Smallcap Ex Investment Trusts Index (FTSE:SMXX) more closely, which are much more relevant to small caps.

Small caps indices are rapidly approaching the year's lows, hit in mid-Oct 2014, so not a happy time to be a small caps investor. Still, that's when the buying opportunities crop up!

MySale (LON:MYSL)

Share price: 173p

No. shares: 150.6m

Market Cap: £260.5m

This is a Philip Green -backed fashion company, which has a very interesting business model of doing flash sales online of surplus stock. Another interesting twist on that idea is to swap out of season stock from Australasia to Europe, thus in theory clearing surplus summer stock at the end of one hemisphere's summer, in the other hemisphere's start of summer.

I've kept my distance from this share so far, as the valuation looked far too ambitious for something that isn't really commercially established as consistently profitable yet.

Profit warning - today indicates that sales in the 5-months to 30 Nov 2014 are only up 4% year-on-year. That's terrible for a supposedly fast-growth internet retailer! The problems seems to be Australia, which is the main established market that MySale currently has. Others, such as UK &USA are recent start-ups.

On profits, the company says;

I expect MySale shares are likely to take quite a hefty hit today. Although as we've seen recently with both Ocado (LON:OCDO) and ASOS (LON:ASC) shares, the market seems very forgiving of poor trading statements. I suspect that the days of looking at online retailers through rose-tinted spectacles could well be close to an end. That's one of my main investing themes for 2015 - the likelihood for many very highly-rated growth stocks coming down to earth with a bump.

Although MySale does benefit from the sparkle of Philip Green & Mike Ashley both being involved in this company, so that star factor might well keep the shares at an irrationally high valuation for some time to come, who knows?

There are a lot of very bad reviews for MySale if you Google it - customers complaining about poor service, and very long delays to product arriving, etc. That's not a good sign.

Update 8:08am: MySale shares have been pole-axed, down 64p to 109p at the time of writing. That still values it at £164.2m, which still seems a lot for an unproven business model.

A couple more interesting snippet's from today's trading update, re the strong cash holding, and the low risk method of taking consignment stock (i.e. selling stock on a sale or return basis, stock which is owned by someone else);

The company cites both a weaker economy, but also "competition has increased noticeably", for flat sales in Aus/NZ. It's very difficult to get excited about this concept, if its original markets have already peaked & are now flat. People forget about competition, but there's a lot of it in online fashion retailing now. So companies like this probably don't deserve a premium rating.

Entu (UK) (LON:ENTU)

Share price: 103.5p

No. shares: 65.6m

Market Cap: £67.9m

This is a recently-floated home improvements company, with an emphasis on environmentally-friendly products. So it's double glazing, boilers, solar panels, etc. You might recognise two of their brands - Zenith & Weatherseal, which have been around for years.

I like the business model here, with both production and sales out-sourced. So theoretically the company should be able to scale up & down with the economic cycle.

After reading the Admission Document, I bought some shares recently, because the valuation seems modest, and at an attractive discount to a similar rival, Safestyle UK (LON:SFE) . Hence I suspect their might be scope for ENTU to re-rate perhaps.

It's also worth noting that section 15 of the Admission Document indicates that the dividend yield is set to be a whopping 8%;

Interestingly, the Directors seem to have used the company, pre-IPO as a slush fund for various interesting items of expenditure! Note that the company lent, and subsequently wrote off, £8.9m to Manchester Sale Rugby Club!! Of course, the shareholders can do what they want before the IPO, but that type of thing will have had to stop now, and all the related party loans seem to have been cleared away just before the company Listed.

But that level of extravagance suggests that the existing shareholders (who still own about half the company) might want big dividends to continue, to maintain extravagant lifestyles perhaps? Just conjecture on my part, and not necessarily a bad thing if Directors are motivated to pay out big divis, since outside shareholders receive them too.

Trading update - this sounds alright to me, published today;

Valuation - Stockopedia doesn't show any forecasts, but digging around elsewhere I've found forecast EPS for this year of 12.0p, rising to 13.3p next year. So at 103.5p the shares seem good value on a PER of only 8.6, falling to 7.8.

Divis - An 8p dividend is forecast for calendar 2015, which ties in with the stated dividend yield of 8% at the Placing price of 100p. There seems no issue with debt either, so it's not an artificially low PER for a highly indebted company.

My opinion - this looks good value to me. An 8% dividend yield is not to be sniffed at! Although a home improvements group is bound to be cyclical, and may not appeal to everyone.

Michelmersh Brick Holdings (LON:MBH)

Share price: 62p

No. shares: 80.8m

Market Cap: £50.1m

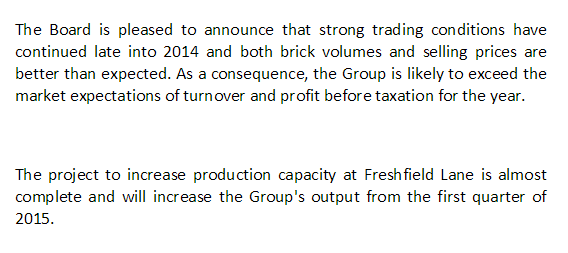

Trading update - very positive, exceeding expectations;

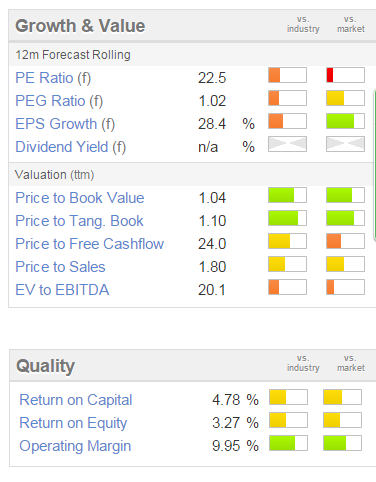

That's great, but looking at the Stockopedia valuation graphics, the price looks to be well up with, or even ahead of events?

My opinion - it doesn't scream value to me. But there again, I don't know the business or the sector well enough to make a judgment on how things might progress if the housebuilding upturn continues for some time to come.

So this is very much a situation where investors would need to get into detail of how the business might grow, what operational gearing there is ,etc.

This certainly seems the right point in the cycle to be buying a brick maker, given the urgent need for more housing, and the relaxation of planning laws. Whether the upside is already baked into the share price or not, is the big question - given that it has already tripled in price in the last two years. Still, existing holders will be pleased with the positive update given today.

Cohort (LON:CHRT)

Share price: 238p

No. shares: 41.0m

Market Cap: £97.6m

Cohort is a group of defence-related companies. As its market cap is approaching £100m, it might start to attract more Institutional buyers, as the £100m level is often the cut-off point, below which many Instis won't look, as things are too small.

Interim results for the six months to 31 Oct 2014 are out today, and look alright to me. Although there seems to be a heavy H2 bias to results, hence there's little point in analysing H1 results, as they make up a relatively small part of the overall year's profit.

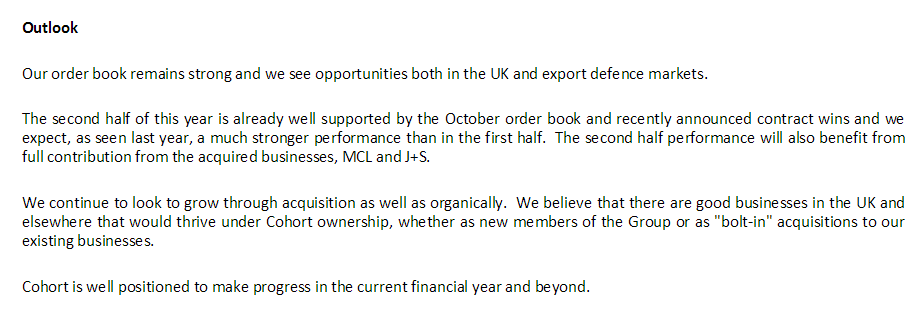

Outlook - the company comes extremely close to, but can't seem to bring itself to confirm full year expectations. So that says to me they are close, but not quite certain, so have given themselves some wiggle room with this form of wording;

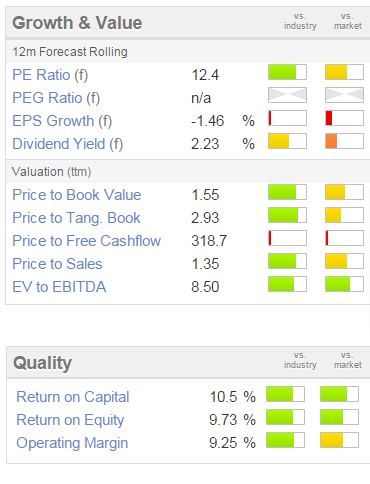

Valuation - it looks reasonably-priced, although given the contract nature of its work, these shares never get onto a high rating - since it's the type of business where a profit warning could happen every now and then if gaps appear in the order book.

My opinion - Overall that valuation looks about right to me - a PER of just over 12. Note that the company has puts some of its cash pile to work by making a couple of acquisitions. So that should help grow earnings.

Providing nothing goes wrong, then Cohort seems to be developing well as an aggregator of small defence contractors. The trouble is, as with so many smaller companies, they have to constantly win new contracts to keep busy. Defence must be difficult area, given Govt cuts, so I'm reluctant to buy any shares here due to that ever-present risk of them having a bad year, and wake up one morning to see my investment has just plunged by 30-40%. In a way, I like to keep companies like this on my watchlist, and buy them cheaply after the profit warnings, or at least once the dust has settled, as sound companies recover from passing problems.

Nice enough company, but I can't see any reason to get excited about the shares.

That's it for today. See you tomorrow!

Regards, Paul.

(of the companies mentioned today, Paul has a long position in ENTU, and no short positions.

A fund management company with which Paul is associated may hold positions in companies mentioned)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.