Good morning!

Last call for Mello Beckenham tonight - with an unusually large company giving a presentation over dinner - Photo-Me International (LON:PHTM) .

A pleasant start to the day for me, with news of a special divi at one of my favourite micro caps:

Best Of Best (LON:BOTB)

Share price: 195p (up 10.8% today)

No. shares: 9.7m

Market cap: £18.9m

(at the time of writing, I hold a long position in this share)

Special dividend - and quite a decent one too, at 19.5p has been declared today. This company operates the supercar competitions which have been a prominent feature in UK airports for about 15 years - although these days most of their business is now online - making it a much more attractive investment proposition in my view (more scaleable, and without capex).

The Company continues to be both profitable and cash generative and benefits from a strong balance sheet with significant cash reserves. As a result of this, the Company has a cash balance surplus to the operational requirements of its continuing activities and deems it appropriate to declare the Special Interim Dividend.

After the Special Interim Dividend the Company will retain cash balances in excess of £1.0 million, which the Directors consider to be sufficient working capital to fund its activities over the next 12 month period.

This is a good illustration of why I like investing in companies with net cash on the balance sheet. Not only are they much safer investments usually (as cash in the bank means the company cannot usually go bust, and can ride out difficult patches), but also every now and then you get a pleasant surprise - e.g. a special divi, or an earnings-enhancing acquisition. So cash is really latent value, that some investors overlook - people often just look at the PER, and ignore the cash or debt position.

A nice pattern is emerging here, as BOTB also paid a 14.5p special divi in late 2014. I very much like management that distribute surplus cash to shareholders, it's a great discipline, and shows a very good mindset in my view. Management and outside shareholders are well aligned here, with management drawing (in my view) reasonable salaries, and having large personal shareholdings, so we all benefit from the special divi.

Illiquidity - this share is horribly iliquid, so is one of the toughest shares out there to buy/sell. I found that the only way to accumulate a position was to spend several months just buying small scraps of shares on down days. The risk then is that you're locked in, and can't get out if anything goes wrong.

Stockopedia shows the free float as only 14%. This was one of many issues that I discussed with the company's refreshingly open, and enthusiastic CEO, William Hindmarch, in my interview with him a month ago.

My opinion - I see considerable potential here, if the company is able to move up a gear or two, and really drive serious additional traffic to its existing website. The figures could then become very interesting. At the moment it's perhaps not quite exploiting the full growth potential from what is now a well-known, trusted (and fun) weekly competition?

Hornby (LON:HRN)

Share price: 31.6p (up 29% today)

No. shares: 55.0m

Market cap: £17.4m

CEO departure - this had to happen I think, after last week's disastrous profit warning;

The Board of Hornby Plc ("Hornby"), the international hobby products group, today announces that Richard Ames is stepping down as Chief Executive and is leaving the business with immediate effect.

Roger Canham the current Chairman will move to take over as Executive Chairman and will lead the Group for the foreseeable future.

I suspect that the very strong rebound in share price might be because investors are betting on existing major shareholders being prepared to refinance the group again. They haven't got much choice really, so the CEO leaving probably clears the way for another refinancing.

The big question is what price the next equity fundraising will be at? Last time shareholders clearly overpaid, presumably in order to prop up the value of their existing shares? It will be interesting to see what happens this time.

There's definitely some value at Hornby, with its iconic brands, and if supply chain issues can finally be fixed, there should be a decently profitable business afterwards. Personally I can't really see that risk:reward is currently attractive, until the next refinancing has been done & dusted.

The other possibility is that a predator might want so snap up the group, for its IP, and then put in place their own reliable supply chain? As things stand right now however, the shares are not much more than a wild punt, as there's so much uncertainty.

I see that Hargreave Hale have sold about 460k shares, taking them below 5%. So perhaps one large shareholder there which may not be enamoured with the idea of stumping up more cash for the next refinancing? It's always worth looking at what the major shareholders are doing after a profit warning.

Proactis Holdings (LON:PHD)

Share price: 116p (up 1.3% today)

No. shares: 39.6m

Market cap: £45.9m

(at the time of writing, I hold a long position in this share)

Trading update - this announcement was issued last Thursday, but I missed it at the time. Everything's fine basically, with the main bit saying;

The Group confirms that results are expected to be in line with expectations, with revenues for the six months ended 31 January 2016 of approximately £8.7m (2015: £8.4m). The Group signed 23 new logos (2015: 20) delivering £3.7m (2015: £2.6m) of initial contract value. Both the order book and the pipeline for new deals remain strong.

More detail is given, but there's nothing new in it, just a recap on previous items.

Share options - another announcement today, details more share options granted to 3 Directors/PDMRs. Whilst the strike price is fine, at 114.5p, I am a bit concerned that the total share options in issue is now becoming excessive:

The Company now has 4,565,557 Options outstanding, representing 11.5% of the issued share capital of the Company.

To my mind, anything over 5% dilution is getting on the warm side, and an absolute maximum of 10% is the informal rule. So at 11.5%, the total share options here now looks too much to me, so I definitely wouldn't want any more to be issued, even though I like management here a lot.

Opinions differ on share options. Some investors don't mind management getting an extra reward for creating long-term shareholder value. Whereas others see options as basically paying Directors twice, just for doing their job well. Also share options can introduce incentives to take too much risk, especially with gearing & acquisitions, which can end up destroying shareholder value. I'm probably somewhere in the middle, and would like to see more structure, and best practice rules over this kind of thing, so that it's less of a free-for-all.

All Leisure (LON:ALLG)

Share price: 2.7p (down 51% today)

No. shares: 61.7m

Market cap: £1.7m

Results & possible delisting - the writing's been on the wall here for some time - the last time I reported here on this company (a year ago), I concluded that, "I don't know what the end game is likely to be for this company, but I suspect it won't be good".

Results today are improved against last year, but still loss-making at the operating level (before a favourable derivative movement).

It's the balance sheet that is the main problem though. Consider this: currents assets are £19.0m, but current liabilities are £50.5m, so that's one of the worst deficits on working capital that I've ever seen - a current ratio of just 0.38 (I usually look for at least 1.2).

The business is financed by customer deposits, which are shown within trade creditors. If I booked a cruise, I would assume that my money was segregated safely, but it isn't. You could view it as being not that far from a ponzi scheme - where deposits from future customers are used to provide services to current customers. If the business stopped operating for any reason, there wouldn't be enough cash to repay customer deposits, not by a long shot. I'm very uncomfortable with that business model, but it's very common in the travel sector, certainly not unique to All Leisure.

I presume customer deposits are protected by ABTA, and note that All Leisure has an ABTA logo & number on its website.

Possible delisting - this is why the shares are down 50% today;

"The board is actively considering delisting from the AIM market. It is mindful of the on-going costs of remaining as a publicly quoted company and the limited current and potential benefits available to the company. A further announcement will be made in due course."

With the market cap now so small, and probably no market appetite to refinance the company, then I agree there is no point in the shares remaining listed. A nightmare for existing holders, but there we go - that's the risk of holding shares in a small, poorly performing, technically insolvent (once intangibles are written off) company. What do people expect?

Plastics Capital (LON:PLA)

Share price: 92p (up 1.1% today)

No. shares: 35.3m

Market cap: £32.5m

Trading update - updates always seem to be slightly disappointing from this niche plastic products group, and today is no exception.

"Trading conditions remain somewhat variable reflecting global economic conditions, but I am pleased to say that financial performance is improving and the Group is making very good progress on the key strategic initiatives that will drive its targeted growth. Overall, we anticipate that performance over the second half of the financial year will be broadly in line with market expectations."

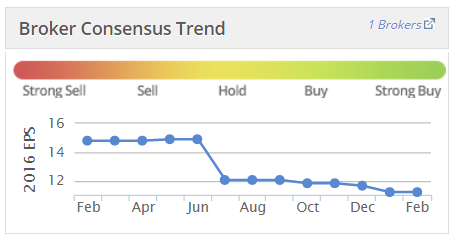

Valuation - as you can see from the Stockopedia graphic below, broker consensus forecast has already dropped quite a lot in the last 12 months, and the company is today saying that it's going to be slightly below the revised figures. So maybe we're heading for 10-11p adjusted EPS this year?

Given that the company is carrying a fair bit of debt, then the shares really don't look particularly cheap to me.

Dividends - the yield now looks very good - forecast at 5.4%, however I question how much this can be relied upon, given that arguably divis are being paid out of borrowings?

Net debt - the group had £15.9m of gross interest-bearing debt when last reported, at 30 Sep 2015. I think that's too high, for a not particularly profitable group. Sure, there was £4.0m of cash to come off that on the balance sheet date, but I find it more revealing to look at the gross debt position (since year end cash can be boosted to an untypical high).

My opinion - I can't get excited about this share. The outlook sounds a bit uncertain, macro conditions aren't great, and it has too much debt (in my view). Therefore the divi yield may not be as secure as people think - I could see it being cut swiftly on any deterioration in trade.

Overall, this group seems to rather plod along, and hasn't really gone anywhere much for quite a few years now. If it didn't exist, would you invent thing group? Probably not. I don't see how the (significant) central overheads add any value.

Note that the StockRank is low, at 32.

Time is running out now, so some quick remarks on other news:

Safestay (LON:SSTY) - an "in line with market expectations" trading update for 2015 is issued today.

My view - nice concept, but upside for shareholders gets knocked back with discounted placings to fund expansion. So difficult to see much upside, with that constant headwind. Too capital-intensive.

Coms (LON:COMS) - might be worth a fresh look, as the trading update today sounds positive. This group almost went bust last year, but seems to be sorting itself out, following the disposal of the problematic telecoms division;

Coms plc (AIM:COMS) the leading provider of Infrastructure and Smart Building solutions is pleased to announce that Group EBITDA (after central costs) from continuing operations for the financial year ended January 2016 is positive and will be ahead of management expectations. This has primarily been driven by continued robust trading within the core operating division, Redstone, where both revenue and operating profit have been significantly ahead of the prior year

As reported on 27 January 2016, the Group has resolved the vast majority of legacy issues that were inherited by the Board and has focused its efforts on developing the Group's core Redstone business, which has market-leading product offerings in Infrastructure and Smart Buildings. Since the disposal of the Telecoms business, Redstone has benefited significantly from the Board's focus and the Group's increased financial stability. The Group enters the new financial year with a new and experienced executive management team in place and with a sales pipeline at its highest for 6 months.

The Company finished the year with a net cash balance of c.£1.0 million, which has been achieved through stronger than expected cash generation within Redstone.

I haven't really got enough to go on yet, but will look at the results when they are published.

Amino Technologies (LON:AMO) - the market seems to be ambivalent about results today, with the share price up slightly (on a day when most things are up).

Sorry to be a let-down, but Amino goes in my "too difficult" tray. I don't understand the sector they operate in, and TV is changing so fast (e.g. with the advent of streaming services like NetFlix, and Amazon Fire/Prime, etc), that I have no idea who will be the winners & losers. Making OTT set-top boxes strikes me as an area that might become old hat fairly quickly?

NATURE (LON:NGR) - unbelievable. It's another profit warning! This company is just a disaster area.

Nature Group PLC (AIM:NGR), the provider of port reception facilities and waste treatment solutions for the oil, marine and process industries, provides the following update on trading in the year ended 31 December 2015. Owing to challenging and industry wide trading conditions and adjustments relating to certain receivables from prior periods, the Company expects that sales will be broadly in line with market expectations but that profit before tax will be substantially below market expectations and the Group will post a trading loss for the year. In addition, the Company will incur non-trading write downs and restructuring costs in relation to its operations in Norway and Gibraltar.

What can I say? This share can only really be regarded as a special situation, where there might be some hidden value. I think it's lost all credibility as a listed company though, so not something I would ever consider investing in.

All done for today, see you tomorrow!

Regards, Paul.

(of the companies mentioned today, I have long positions as disclosed above, and no short positions. These reports are my personal opinions only, and are never advice or recommendations)

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.