Good Morning,

Today, I intend to cover:

- Tracsis (LON:TRCS)

- Animalcare (LON:ANCR)

- Hargreaves Services (LON:HSP)

- Qinetiq (LON:QQ.)

- Koovs (LON:KOOV)

Cheers,

Graham

Tracsis (LON:TRCS)

Share price: 402.5p (-13%)

No. shares: 27.8m

Market cap: £112m

This is a profit warning that's not a profit warning - an announcement that there might be a profit miss, depending on H2, after a tricky H1.

But the market's reaction tells us that plenty of investors think that the risk of a H2 miss is now pretty big!

Overview:

Group revenues for the six months to 31 January 2017 were c. £15.5m (2016: £13.1m*), and EBITDA is expected to be slightly ahead of the previous period (2016: £3.2m*) as is Adjusted Pre Tax Profit (2016: £2.9m*).

Rail Tech & Services

The key warning is as follows:

Due to longer sales cycles associated with higher value products combined with changes in the Department for Transport's franchise bid timetable, some sales anticipated to take place in H1 are now expected to take place in H2 which is supported by our current pipeline.

Traffic & Data Services

We are reminded that the SEP business is busiest in the summer months, and also:

...the Traffic & Data Services division is trading well albeit within competitive market conditions, which has led to increased price competition and associated gross margin pressure.

I always applaud companies which admit that competition is tough, but of course the question of competitive advantage is critical to the investment case.

The Traffic & Data Services Division (follow link) operates in the following sectors: Traffic Survey, Passenger Surveys, Data Capture and Event Traffic Management.

The technologies involved there are Bluetooth Sensors, Number Plate Recognition, Anonymised Mobile Network Data and Automatic Traffic Counting.

Given the steady rate at which these technologies are improving, it must be tricky to stay one step ahead of the competition - not impossible, but requiring constant innovation.

Summary

H2 "is expected to be significantly stronger" than H1.

And here is the confirmation that it's just a semi-profit warning:

The outcome for the full year remains subject to the timely conversion of new sales for our various software products and services, supported by the improvement in gross margin initiatives that commenced at the start of the financial year. Delivery of these goals will result in revenues and profits being in line with current expectations and we will provide a further update with our Interim Results.

My opinion:

Unfortunately, I'd still be rather nervous about the share price here. That said, I tend to be biased against acquisitive growth strategies, and it's possible that this one has been executed better than I am giving it credit for.

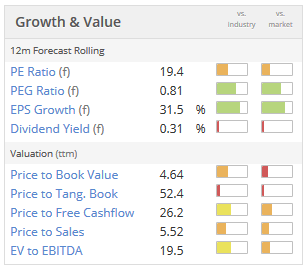

Stockopedia stats confirm that there was not a lot of value at yesterday's share price (Value Rank of only 12). Pending more insight into the nature of the company's competitive advantages, I'd be minded to remain cautious here.

Animalcare (LON:ANCR)

Share price: 316p (+3%)

No. shares: 21.2m

Market cap: £67m

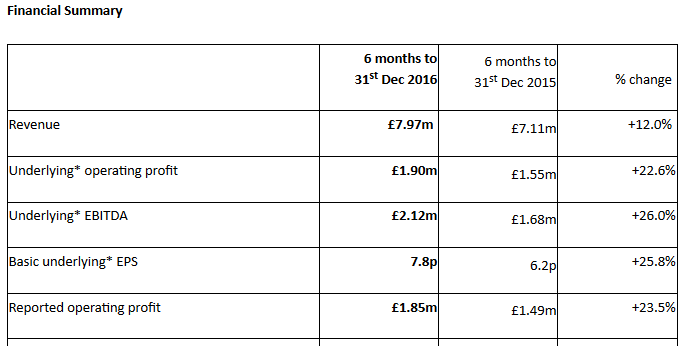

I've been writing in glowing terms about this company recently - and am unlikely to change my perspective today, after a "very strong" H1, which was ahead of the BoD's expectations.

(If you can't see all of this graphic, you can right click and then try to download or view the image, or else find it in the Half-Year report itself).

The disclosures at AnimalCare tend to be nice and clear: the 17.2% growth in licensed medicines is broken down into 13% like-for-like growth and 4.2% contribution from new products (medicines are 60%+ of annual sales).

Exports have only been c. 8% of total sales - but increased at a rate of nearly 38% in this period! I'm pretty interested in what the growth runway might be there.

Dividend: interim divi up by 11% - I've not seen any problems with cash conversion at AnimalCare.

Capex: We already knew that the level of investment in the product pipeline had surged here. The Chairman gives an update:

Given the strong performance of the Group, the Board took the decision in 2016 to increase the investment in new product development to around £2.0m during the current financial year (FY16: £1.6m). We made good progress in our product development pipeline in the half year with many projects moving forward to the later stages of development as well as starting several more.

My opinion:

I still think this is an exciting growth stock.

Note the potential export growth: "New distribution contracts and letters of understanding have been agreed with 14 distribution partners in new markets across Europe, Asia, Australasia and North America."

And the company's major offering, Aquapharm, has seen two of its products registered in 11 additional EU countries.

The sales growth and cash generation is real. And it has excellent quality metrics. So it's definitely worthy of a premium rating, in my book.

Hargreaves Services (LON:HSP)

Share price: 273.25p (-1%)

No. shares: 32m

Market cap: £87m

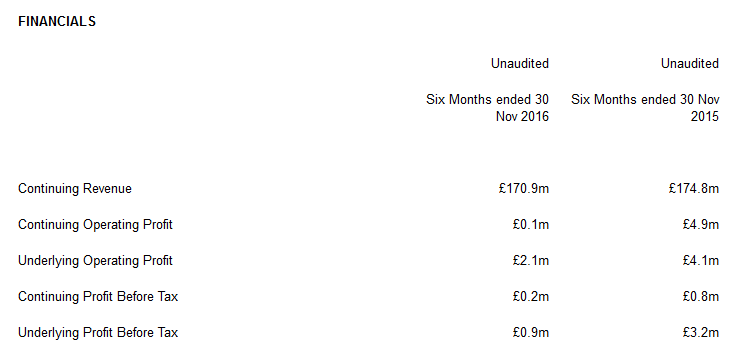

I covered these in December when the market cap was at £74 million, and expressed the view that there were both balance sheet and earnings-related reasons for optimism - after all, it had tangible net asset value of £120 million, and was targeting operating earnings of £10-£15 million per annum in the Industrial Division (and the Coal Division was still profitable).

So I'm cheered to see that the share price has improved since then, although today's results are not pretty from an earnings point of view, with a 98% fall in continuing operating profit.

It was effectively just a breakeven six months, which was in line with management expectations:

In December, the company said it was targeting to close the year with net debt of less than £5 million.

Unfortunately, net debt has increased to £37 million during H1, although the company says that cash performance was in line with expectations:

Net debt expected to fall materially during the second half, with the final outcome dependent on the timing of material property disposals;

Reading further down the statement, the company says that despite timing risk of disposals, "management expects that year end net debt will not exceed £10 million".

So it sounds to me as if there is a probable miss on the sub-£5 million target. Hopefully they will get close to it at least.

Overall, it sounds as if most goals are on track.

"...earnings from the continuing Distribution & Services operations are well set to deliver operating profit within the target range that we set. Second, good progress is being made in creating and then delivering the targeted £35m-£50m uplift in value from our Property & Energy portfolio."

Segment Results

As a slightly odd conglomerate of related divisions, it's important to check the segments here.

Sadly, the numbers for this period don't appear to stack up well yet versus future hopes.

Industrial Services produced very little operating profit for the period (£200k). On the bright side, we have an expected H2 improvement:

Given the overall profile of contracts and planned site outages, our expectation for the Division continues to be that operating profit will be weighted to the second half and a strong second half profit performance is expected.

In the Outlook section, the company describes Industrial's position as follows:

A delay in the commencement of a major project in Hong Kong will mean that, although the operation will grow year on year, it is likely to under-perform against internal profit targets.

Outlook summary:

The Board is pleased with the performance and re-positioning of the business and is confident that the business will continue to demonstrate excellent progress towards realising the intrinsic value of the Group's operations and the value inherent in the Group's balance sheet. As debt levels reduce through the second half of the year careful consideration will be given to the application of cash to create shareholder value.

My opinion:

I wonder if that final sentence quoted above is a hint to potential special dividends or share buybacks?

Hargreaves has just raised its interim dividend by nearly 60%, so if it starts to feel too flush with cash, perhaps it will come up with some kind of special measure to deal with that?

The earnings-related reasons for optimism haven't materialised yet and look as if they will probably be delayed in the Industrial Division, but the balance-sheet reasons remain. Despite the discount to TNAV having closed a little, I'd still be quite positive on this.

Qinetiq (LON:QQ.)

Share price: 276.4p (unch.)

No. shares: 572.8m

Market cap: £1,583m

I'm not sure how many of you follow the defence sector?

I won't dwell on this for too long, anyway, since underlying trading was "as expected" in Q3, the outlook is unchanged, and the share price is close to unchanged - it doesn't get less exciting than that!

It is massively cash-rich, however, after a couple of strong years - £271 million in net cash at September 2016. It has deployed some of that in the acquisition of an unmanned target business from Meggitt for £57.5 million, and is completing a £50 million buyback, as well as continuing a modestly rising dividend policy.

Just might be worth a look.

Koovs (LON:KOOV)

Share price: 44.5p (+2%)

No. shares: 175.4m

Market cap: £78m

KOOVS wins most popular fashion portal

Paul emailed me about this, this morning, so I thought I'd mention it in passing.

Koovs plc, (AIM: KOOV),the London listed fashion-forward online business for the twenty-something Indian consumer, has been named Most Popular Fashion Portal Preferred by Youth at India's largest gathering of youth marketing experts, cool hunters and brand specialists at the annual Global Youth Marketing Forum in Mumbai.

According to the press release, other companies which have won awards at this event in the past include Coca-Cola, Facebook, MTV and Cadbury Dairy Milk! So Koovs has something in common with all of these brands.

And also:

The youth market in India is probably the most attractive globally with the number of affluent young urbanites expected to reach 60m this year 2017 (Technopak 2016), while the market for lifestyle fashion in India is expected to reach $30bn by 2020. The Koovs.com portal focuses totally on western fashion for this rapidly expanding demographic.

I'm no Warren Buffett but I do know that investing in companies simply because they are trying to target large addressable markets in developing (or "lower-middle-income") countries, is a pretty bad strategy.

£RFX (New ticker)

Share price: 98p

No. shares: 30.8m

Market cap: £30m

Admission to AIM and first day of dealings

Prompted by a reader comment, I note the fresh IPO of Middlesborough-based pawnbroker Ramsdens.

Like larger rival H & T (LON:HAT) (in which I hold a long position), Ramsdens operates a range of pawnbroking-related services: FX, gold dealing and jewellery retail.

It's a decent-sized operation, with 127 stores (H&T and Albemarle Bond have 181 and 114, respectively).

The IPO has been launched by a placing a 86p, with 12.3 million shares being sold by prior shareholders, and 5.8 million new shares being issued.

This means gross proceeds for selling shareholders of £10.6 million, and £3.9 million net proceeds to the company.

I'll be keeping an eye on this as useful comparator against H&T, and perhaps as an interesting investment in its own right.

It does look as if the management have sold quite a lot of equity at 86p, so I'll probably exercise my usual caution and see how things play out for at least a year.

That's all I've got for today - cheers!

Graham

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.