Good morning! Busy for trading updates this morning. I see Home Retail (LON:HOME) has reported profits in line with expectations, but LFL sales at Argos are only up 0.1%, which is very surprisingly low (I was expecting a much higher figure). Asian markets did well overnight, so we should see a strong bounce in the UK first thing today.

Avesco (LON:AVS)

Share price: 121.5p

No. shares: 18.9m

Market Cap: £23.0m

Preliminary results - for the year ended 30 Sep 2014 are out today. My first impressions are positive. Here are the highlight points from today's results, with my comments below.

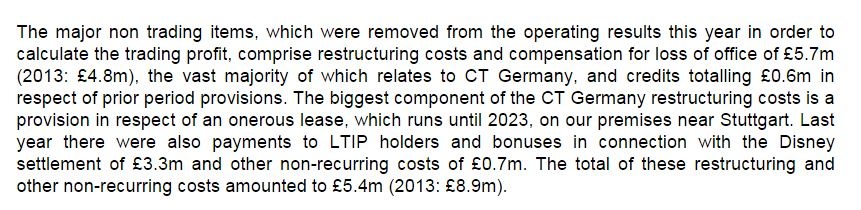

Trading profit - this is £6.3m, which looks excellent for a company with a market cap of only £23.0m. Why is it so different from operating profit of £0.9m? The difference is £5.4m in exceptional costs. I can't see a breakdown of those exceptionals, but the narrative reassures me that they do indeed seem bona fide exceptionals;

EBITDA - it's not often that you see an EBITDA figure that is higher than the company's entire market cap, but it is here! Before getting too excited though, one needs to bear in mind that the equipment that Avesco buys & hires out, has quite a short life, so is depreciated rapidly. Therefore you can't ignore the depreciation charge by measuring performance on EBITDA.

However, having such high EBITDA does mean that if the bank ever goes wobbly on the company, then it could just switch off capex, and would then throw off tons of cash, which could be used to settle the bank debt quickly. That cash generative nature of the business makes me more relaxed about:

Net debt - I'm not madly keen on the Balance Sheet at Avesco, which has rather more debt than I would like. However, in relation to the cashflows, it's probably alright. After all, debt is only a problem if the bank thinks you can't pay it back!

Net debt reduced in 2013/14, to £21.4m. That is only 0.86 times EBITDA, so doesn't look a problem. Note that the company has plenty of headroom on its bank and HP facilities, which total £48.6m. Facilities are in place until June 2018, so this all looks OK to me.

Turnaround - the most interesting thing about Avesco, is that the company has restructured, and is now demonstrating much improved profitability. The company is off most investors radar, and I suspect, with patience, this share has the potential to re-rate somewhat.

Seasonality - Avesco has an unusual two year cycle of profitability - i.e. good years and bad years alternate, due to the timing of major sporting events, such as the World Cup, where a lot of the company's equipment is hired out.

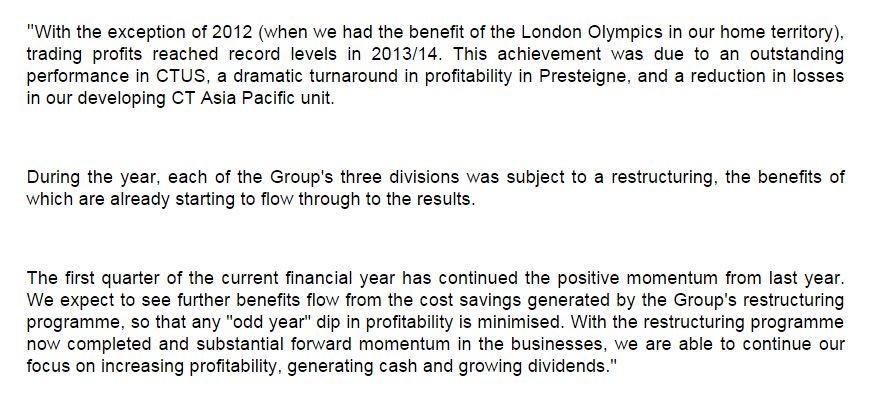

Today's statement gives comfort that seasonality is being reduced, as commented on in the:

Outlook statement;

That all sounds good to me.

Valuation - due to having on-off years, the best way to value this company, in my view, is to take the average profits for two years. Broker consensus is for only just above breakeven in the current year to 30 Sep 2015, which to my mind seems too pessimistic, and I expect to see upward revisions as the year progresses - because the Directorspeak today clearly indicates that there should be less pronounced seasonality post restructuring.

Taking the adjusted EPS of 23.4p reported today, I'll guesstimate that the current year might be about half that, say 12p. Average the two years, and you get to 17.7p. Put that on a PER of say 10, and it gets me to a personal share price target of 177p, or a useful 46% above the current price.

Some might query that a PER of 10 is appropriate, given the high levels of debt. However, the debt is just asset financing, as there are £57.8m in tangible fixed assets. Note that overall net tangible assets is high, at £32.0m, well above* the market cap. So you could argue that the shares should be on a P/NTAV of about 1, which would imply a share price of 169p. So on this measure too, I'm getting to a similar share price target as on a PER of 10.

(* = this is now correct. An earlier draft said "below" in error. Apologies for this error).

Dividends - best of all, we're paid to wait for the possible re-rating! Avesco pays very generous dividends. A final divi of 4.5p (up from 4.0p last time) is announced today. On top of the interim divi of 1.5p, that gives 6.0p for the full year (5.0p last year). That is a strong divi yield of 4.9%, and it's unusual to see a yield that high also rising strongly. The divis look sustainable to me, and are a very attractive feature of this share.

My opinion - as you have probably gathered by now, I like this share, and think it represents good value at the current price. However, on a note of caution, it is very illiquid, and I have found it extremely difficult to buy, and the bid/offer spread is so wide, that it can easily absorb a whole year's divis. So it's the type of share that could spike down when an existing holder is trying to exit, which might present a better buying opportunity than trying to chase it on a good news day?

Cambria Automobiles (LON:CAMB)

Share price: 52p

No. shares: 100.0m

Market Cap: £52.0m

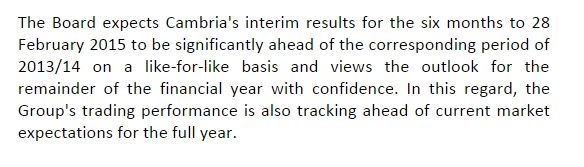

Trading update - this chain of car dealerships reports on the four months to 31 Dec 2014 (since it has a 31 Aug year end). There are impressive sales growth figures, but personally I'm only really interested in profits, and the company has delivered here too, saying;

Valuation - Stockopedia is showing broker consensus EPS forecast as being 4.9p for this year. The company is now saying that it's tracking ahead of that, so if they are say 10% ahead, then that would bring us to 5.4p EPS for this year, and would put the shares on a PER of about 10.

That certainly looks a reasonable valuation to me, especially as Cambrian has a super Balance Sheet, with lots of freehold property, so you have the security of that asset backing too. Plus of course long term capital appreciation on the freeholds too. I absolutely love freehold property, it dramatically de-risks investments, and is greatly under-appreciated by many investors.

My opinion - new car sales have been booming (due to ultra-low interest rates giving very attractive financing options) for a while now, and there's little doubt that we are probably at or very near the top of the cycle. It's true that dealers also make money from aftersales, warranty work, and used car sales.

However, it's difficult to see any immediate catalyst to send the rating higher than 10. Who knows though? The share price growth might however come from expansion. So even if the PER stays at 10, the earnings figure should grow as Cambrian bolt on more dealerships.

Management came across very well at a Mello investor event last year. So overall, I think this company looks solid, and the shares seem good value. Therefore it gets a firm thumbs up from me. There's been a selling overhang for a while, so once that is cleared, there could be scope for another say 10-20% rise, at a guess. Really nice company though - this is probably the best of the smaller car dealership shares, in my view.

UPDATE: Mr Contrarian has pointed out an important fact in the comments section below - namely that the Director pay at Cambrian looks excessive, which certainly dents the bull case for the shares.

Bonmarche Holdings (LON:BON)

Share price: 308.7p

No. shares: 50.0m

Market Cap: £154.4m

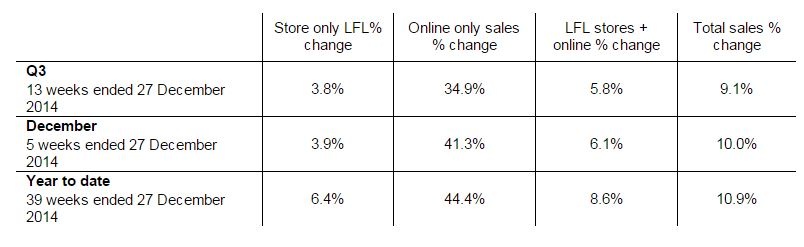

Trading update - this looks very good. A useful table is presented, and as you can see these are strong growth figures. I would say this is the ideal scenario actually - i.e. strong store sales, combined with even stronger internet sales. That proves their business works well in both sales channels;

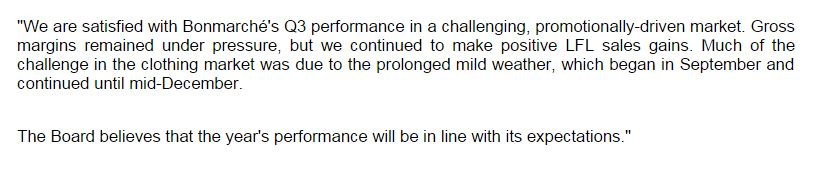

However, this is tempered by caution over gross margins;

The all-important in line with expectations line appears at the end, hence these figures are reassuring, rather than justifying any further increase in the share price.

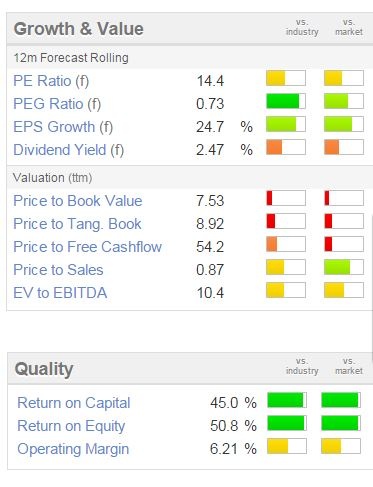

Valuation - this looks priced about right to me;

My opinion - this looks a fairly good business. It is expanding with new store openings, and the shares look priced about right, possibly with a little more upside, but I think the main gain since IPO at 200p has now been had, for the time being anyway.

So many small cap IPOs go badly wrong, it's becoming unusual to see a successful one!

Note that 52.4% of the shares are held by BM Holdings SARL, so the issue of a controlling shareholder is present here. One would need to find out who they are, and whether you feel comfortable taking a minority investment in a company they control. About another 22% is held by >3% Institutional shareholders, so that doesn't leave a lot of free float for the rest of us. Hence this makes the share less liquid, and bid/offer spread wider than normal for the size of company, not ideal really.

Braemar Shipping Services (LON:BMS)

Share price: 423p

No. shares: 29.8m

Market Cap: £126.1m

Trading update - it's an IMS actually, but same thing for my purposes. Marben100 (who is a sensible chap!) has flagged up this trading update in the comments section below, so thought I would have a quick look.

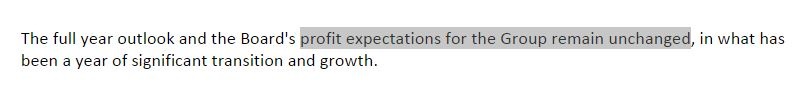

Today's statement sounds positive, although it looks as if this positive trading was already factored into broker forecasts, as the last sentence of today's announcement states;

Dividends - certainly the yield looks extremely generous, but bear in mind that is just a policy decision by management, which can be changed. It's the dividend generating potential that matters more, in my view. So in this case the divi is only covered just over 1.1 times, so there's very little room for error there.

Another aspect of generous divis, is that the company needed to issue more shares in order to make a recent acquisition. Whereas if it had retained cash in the business instead of paying big divis, there would have been less dilution.

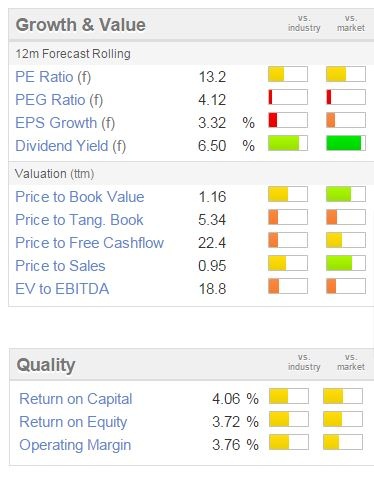

My opinion - I've only given this the most cursory look, but from what I've seen it looks potentially interesting. Marben100 makes the very interesting point that shipping rates could rise, thus boosting future profits. So it could end up looking cheap if that does happen. Worth having a deeper look anyway, from my initial review.

The above are the main things that interest me today, but here are a couple of bonus comments on other company news, that don't particularly interest me;

Lavendon (LON:LVD)

Supplies rental of powered access equipment in Europe & M.East. Results for calendar 2014 are expected to be "at the top end of its expectations for 2014".

Net debt was slightly down, at £95m in constant currency, but benefited from a favourable move, so reduced to £90m in reported net debt at 31 Dec 2014.

Outlook - a non-committal "making further progress" type of statement.

Valuation - looks reasonable, fwd PER of just under 10. Divi yield of 2.8%.

My opinion - Might be worth a look, as eventual recovery in Europe could give the company a boost in future perhaps?

Bioquell (LON:BQE)

Trading update - the company says 2014 was in line with expectations.

Impairment charges are detailed, but these are non-cash, so don't concern me.

My opinion - the shares don't look cheap on 2014 forecasts (PER of 19.0), but if it can meet 2015 forecasts then the PER would drop to 13.2. Pays quite good divis, and has small net cash. It sometimes comes up on my radar, but profits have been somewhat erratic in recent years, so it's a difficult one to gain any conviction on, without properly delving into the business model, meeting management, etc.

That's it for today, back tomorrow morning as usual!

Regards, Paul.

Of the companies mentioned today, Paul has a long position in AVS, and no short positions.

A fund management company with which Paul is associated may hold positions in shares mentioned.

See what our investor community has to say

Enjoying the free article? Unlock access to all subscriber comments and dive deeper into discussions from our experienced community of private investors. Don't miss out on valuable insights. Start your free trial today!

Start your free trialWe require a payment card to verify your account, but you can cancel anytime with a single click and won’t be charged.